XM Trading is our #7 ranked forex broker in South Africa. We like XM's fast execution (no-requotes policy), low spread, negative balance protection, and zero fees on deposits/withdrawals. Read our full XM broker review to find where XM shines & where they lack!

XM Trading is popular forex broker in South Africa & they are a market maker broker. They were founded in 2009 & are one of the largest forex brokers in world in terms of daily trading volume, and have close to 2.5 million clients globally.

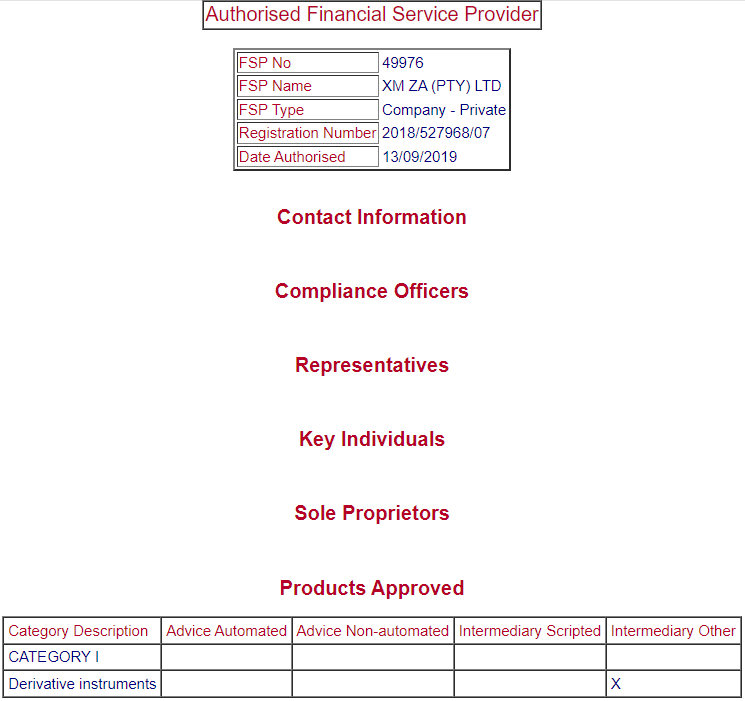

We consider XM to be a moderate risk forex broker for South African traders are they are not regulated by FSCA in South Africa, and are regulated with ASIC (Australia) & CySEC.

XM broker offers a wide array of trading instruments: 55+ currencies, CFDs on equity indices, precious metals, commodities & energies. Their support is good, and they have local payment options like EFT for South African traders.

Also, XM has ZAR base currency accounts. But their overall trading fees is not the lowest, and is generally quite high with Micro & Standard Accounts.

We signed up with XM broker’s Ultra Low Account for this review. Read our below in-depth breakdown of all the pros & cons of XM broker, plus the user reviews.

XM Pros

XM Cons

Table of Contents

| 🏦 Broker Name | XM ZA (Pty) Ltd |

| 📅 Year Founded | 2009 |

| 🌐 Website | www.xm.com |

| Address | No. 5 Cork Street, Belize City, Belize, Central America. |

| 💰 XM Minimum Deposit | $5 |

| ⚙️ Maximum Leverage | 1:888 |

| ⚖️ Regulation | ASIC (Australia), IFSC (Belize), CySEC (Cyprus) |

| 🛍️ Trading Instruments | Forex, CFDs on 1000+ Commodities, Stocks, Equity Indices, Precious Metals, Energies |

| 📱 Trading Platforms | MT4 and MT5 for PC, Mac, Web, Android |

XM Trading is a reputed forex broker that is regulated by 2 top-tier regulatory bodies CySEC & ASIC. But they are not regulated with FSCA in South Africa.

Below is an overview of all the important XM’s regulations:

We have found XM to be moderate risk in terms of being regulated even though they are regulated with FSCA in South Africa because their offshore entity ‘XM Global Limited’ which is registered in Belize is the product provider.

Although XM ZA is an authorized FSP, you must note that XM is not an approved ODP. This means, their local entity XM ZA (Pty) Ltd is not authorized to be the issuer of derivative products.

They claim on their website that XM Global Limited (IFSC) is the product provider, meaning this entity is the market maker, and their local entity is only an intermediary. Their foreign entity takes the opposing sides of all your trades (they are a market maker).

This could indicate conflict of interest for some traders since you are trading with a market maker.

The commissions and fees depends on account type at XM. They are a spread only Forex broker, they Ultra Low, Standard and Micro Accounts have variable spread without any extra commission.

The good thing that we like is XM’s zero fees on deposits & withdrawals, while some other brokers charge high fees during funding & withdrawals.

Here is the breakdown of all fees and charges at XM broker:

They don’t have the lowest spread (with Micro & Standard Accounts) when compared with other regulated brokers that we have listed, but it is competitive with Ultra Low account.

XM has moderate overall fees of all best South African forex brokers that we have compared. Their spread with their Micro & Standard accounts is quite high, but it is moderate with the Zero account.

Besides the spread, XM does not charge any other extra commissions on any trade. Overall, XM’s fees is considered moderately competitive with Ultra Low account but high with Standard & Micro Accounts.

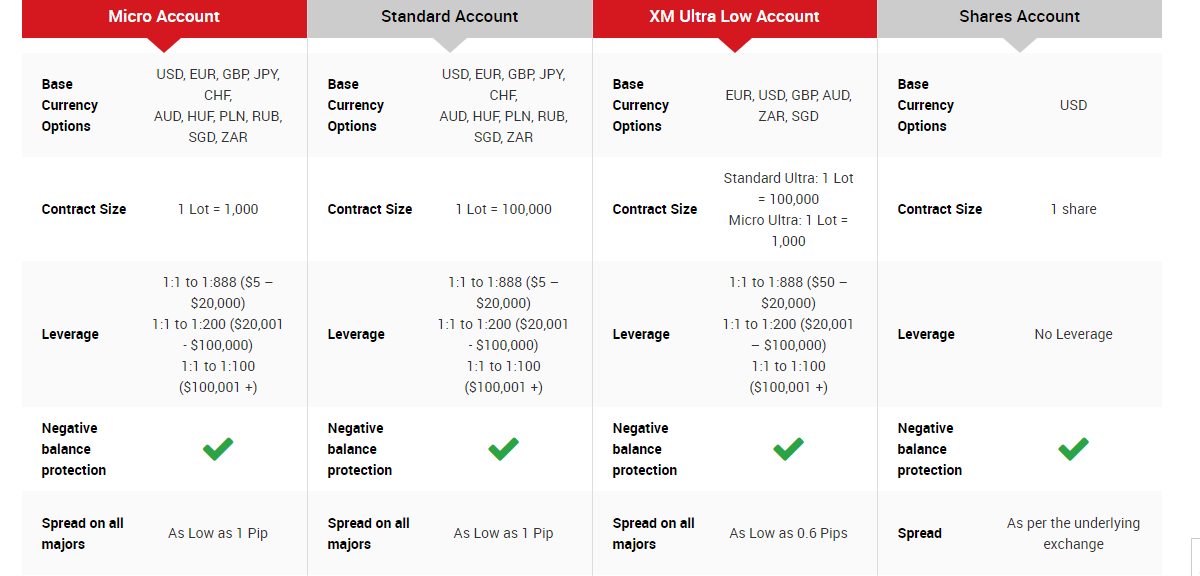

XM offers 3 different accounts namely a Micro account, a Standard account and a recently launched Ultra-Low account along with the free-demo account. XM also offers Islamic swap-free accounts.

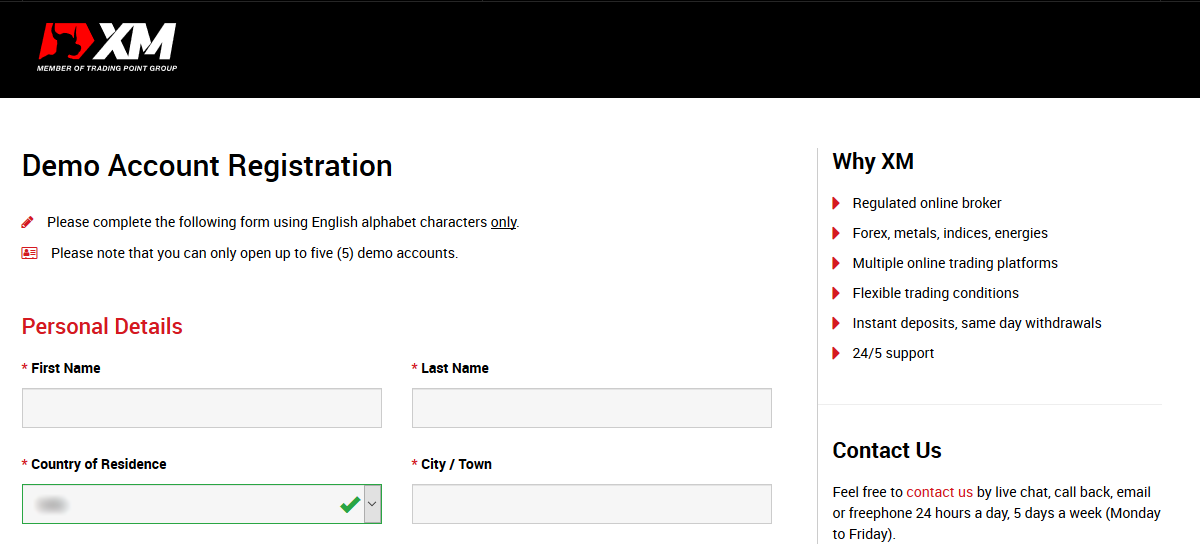

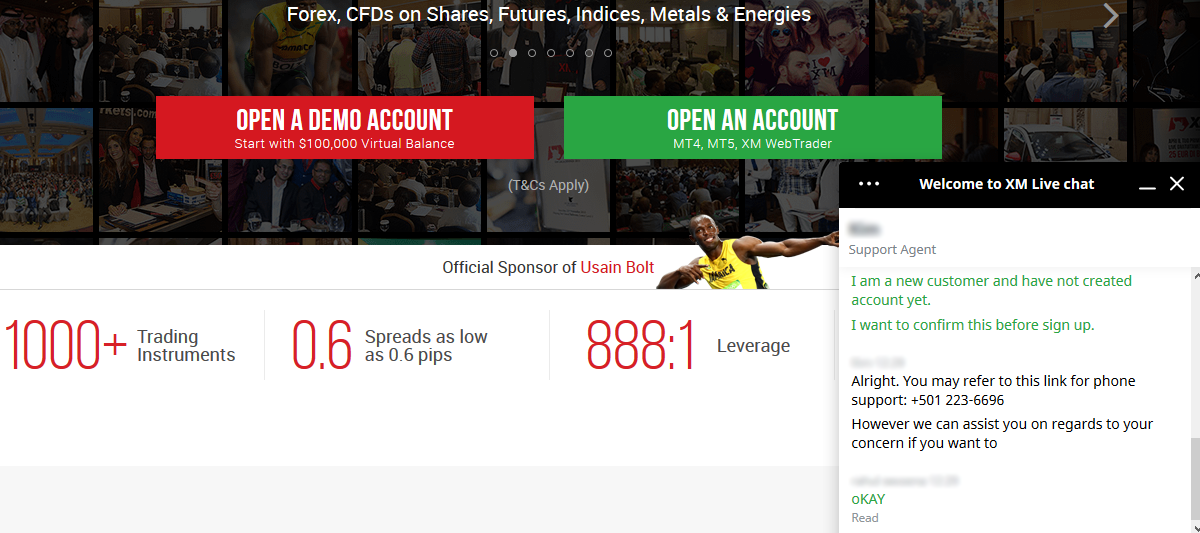

XM offers free demo account for South African traders.

Demo account-holders traders receive US $100,000 as virtual cash for trading. The only benefit of this is they can also access real-time data or analytic tools offered on the XM trading platform.

Demo traders at XM can also use the site’s resources and educational materials besides support.

Note: Demo accounts not functional for more than 120 days from the previous login attempts will be shut. However, new ones can be started at any time.

XM Broker has ZAR Account currency option with all 3 account types. The minimum deposit in ZAR at XM is R85 ($5) approx. for Micro, Standard & Ultra Low Accounts.

You have the option to select ZAR at some stage of account opening process. You cannot change your trading currency once you have selected it on XM. You can open a new trading account with different currency if you want to hold multiple currency accounts at XM.

The minimum required deposit at XM is R85 to open ZAR account. This deposit is the same for Micro Account, Standard Account & Ultra Low Account.

You can make deposits via your bank account in South Africa to XM’s bank account or via EFT, credit card in ZAR. They do accept local deposits in ZAR.

XM offers 3 different live accounts to its customers, all of them with different deposit requirements & trading conditions.

All of the XM’s Live trading accounts have the 3 following features in common:

Here are the Live trading Accounts available at XM broker:

1) XM Ultra Low Account: $5 deposit (Recommended)

This account type has highly competitive spread of as low as 0.8 for EUR/USD. The minimum deposit for this account is is 730 South African Rand/ZAR.

On the positive side, the spread is very low with this account. You can only claim XM’s welcome bonus if you choose this account, but on negative side, you cannot claim any other bonus like Loyalty Rewards.

But still, we recommend South African traders to start with this account, due to its very low fees.

2) Micro Account: $5 deposit

Micro account type has a very low $5 minimum deposit condition. This account is suited for new traders learning the forex markets as the deposit requirements are very low.

As the name suggests, you can only trade micro lots with this account. This is an account type comes with XM’s standard 1:888 leverage.

On this plus side, you can get XM’s bonus & offers with this account. In negative, you can only trade micro lots (1000 units or its multiples), and the average spread with this account is also higher, around 1.6 pips on average for EUR/USD.

3) Standard Account: $5 deposit

For this account, the minimum deposit is USD 5. The standard account allows you to trade upto standard lots.

Everything else is the same as Micro lot (even the spread), the only difference is that you can trade standard, mini & micro lots.

4) Zero Account (discontinued)

Note: XM no longer offers the Zero Account, but instead offer Ultra Low Account.

XM’s Zero Account offered spreads of 0 pips. The leverage was up to 1:500. For a market maker model brokerage.

Further, a USD 100 minimum deposit condition was required for this account. XM charged a flat $7 as total commission for every $100,000 traded on the Zero Account. This account was for high volume traders.

Now, XM’s Ultra Low account is the perfect replacement, with very low spread on majors & minors.

5) Forex Islamic Accounts (Optional)

These are swap-free accounts. This means no swap and/or rollover interest is charged or gained on overnight positions. These Islamic accounts can be opened with micro or standard or Ultra Low account. It is for those wishing to trade under Sharia laws.

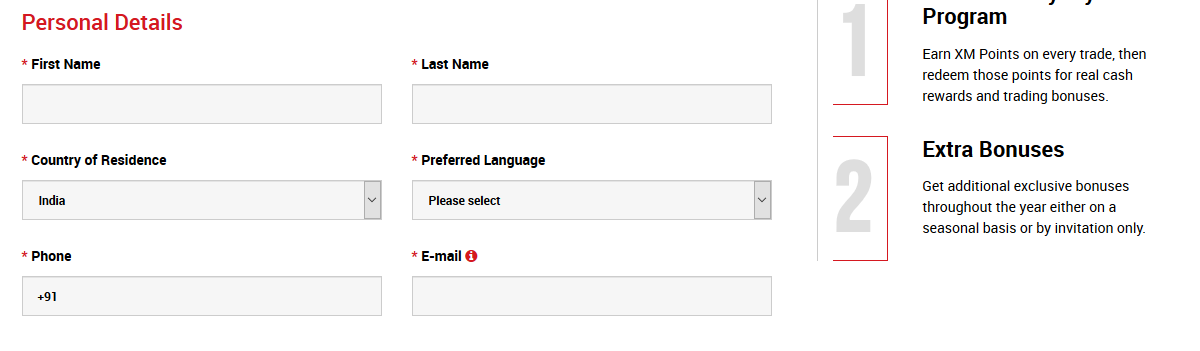

Step 1) Signup with XM: Open the home page of XM.com’s website on your browser. At the top right side of the screen, click on the Opening an Account tab. This will direct you to the real account registration where you need to complete personal data using alphabet characters.

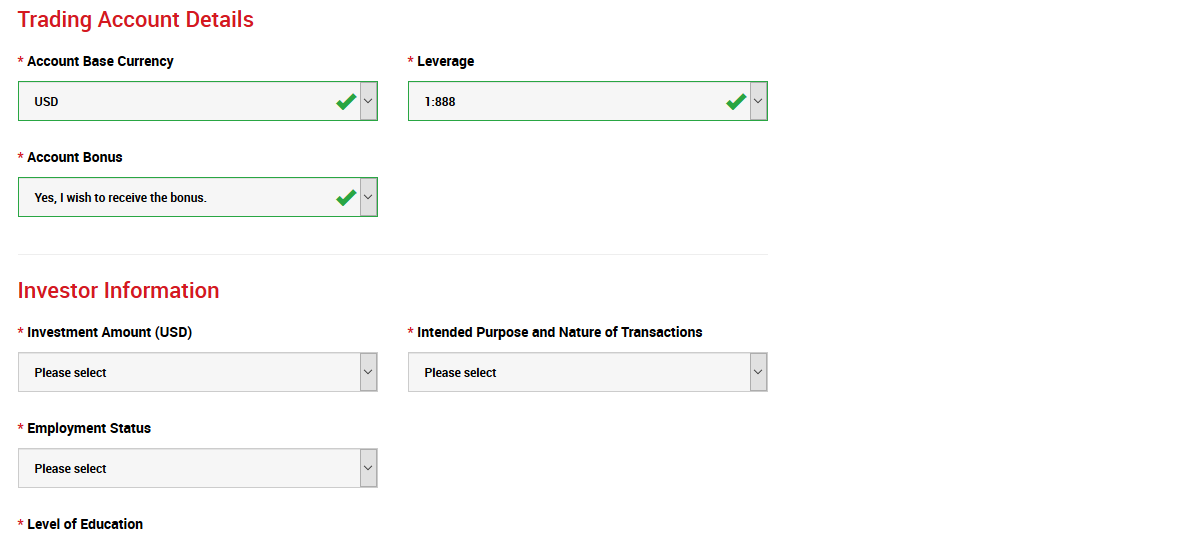

Step 2) Select Account Type: In this step, you need to finalize trading account details by choosing the Trading Platform type and Trading Account type.

Now in Real Account Registration 2/2 section you need to confirm the following:

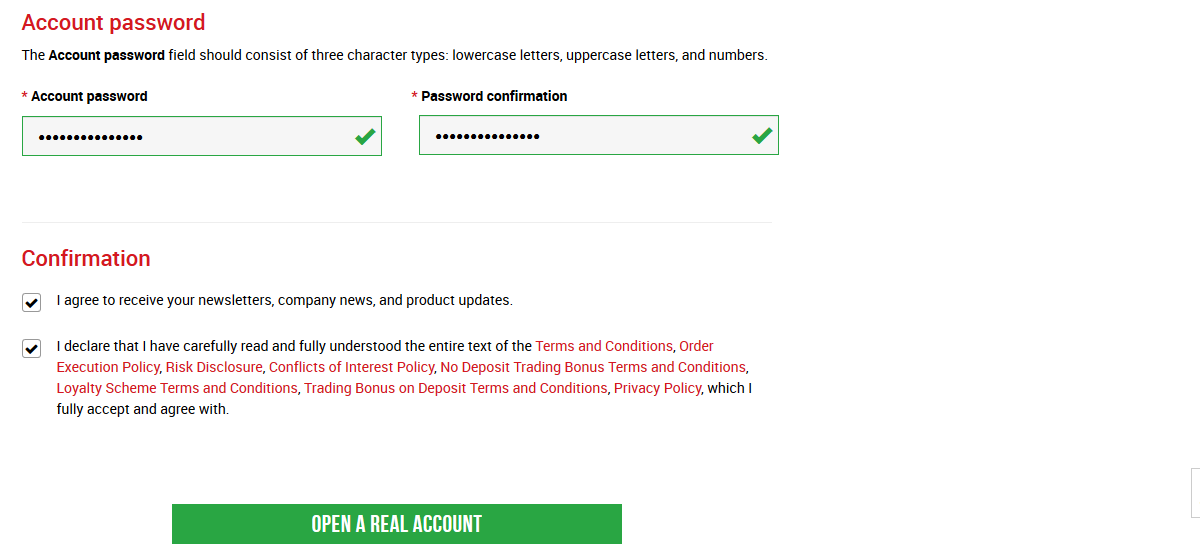

Step 3) Set login Password of account: At last, you need to secure your account by setting a strong password and then click on Open a real Account button as shown in the below screenshot.

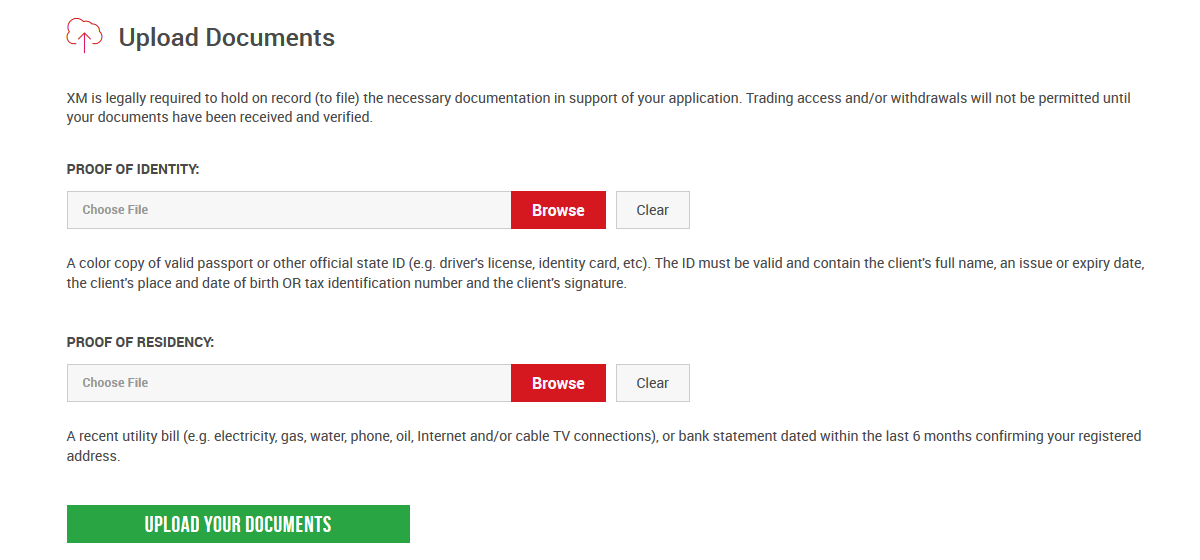

Step 4) Verify your account: Once done with setting password of your account, you need to verify your account that required before funds and withdrawal of your funds from your account.

Identification documents include:

Step 5) Funding Your Account: At last after the complete setup of the account you need to deposit cash by logging into the XM Client Portal.

Over 1000 financial instruments are on offer at XM for forex traders in 7 asset classes.

Here are the most important instruments that you can trade at XM:

1) Forex Trading:

XM offers 57 currency pairs including the majors, minors & exotics, making their forex offerings really wide. Some of the major currency pairs traded on XM include: GBP/USD, USD/EUR and USD/JPY. XM does not charge any extra fees on forex trading, except for their variable spread.

Their spreads are generally higher (with Micro & Standard accounts) than other CFD brokers, and their Swap fees for most currency pairs is also higher compared to HotForex, Tickmill & Exness.

For lower spreads, you should open Ultra Low account, as there is not much different in deposit requirements, but a large different in the typical spreads for trading currencies with these different account types.

For example, the typical spreads for EUR/USD is 1.7 pips with Micro & Standard Accounts, but for the same instrument, the spread is on average 0.7 pips with Ultra Low account. So, there is a wide different in fees for each instrument.

2) Stock CFDs:

XM platforms let traders trade in stock CFDs/Contract for Difference. They offer 1209 global stocks from 17 different countries including: US, UK, Germany & Australia.

3) CFDs on Commodities:

XM forex traders can opt to trade 8 of the most popular commodity including Corn, Wheat, Cocoa etc. Traders can benefit from no commissions and moderate spread.

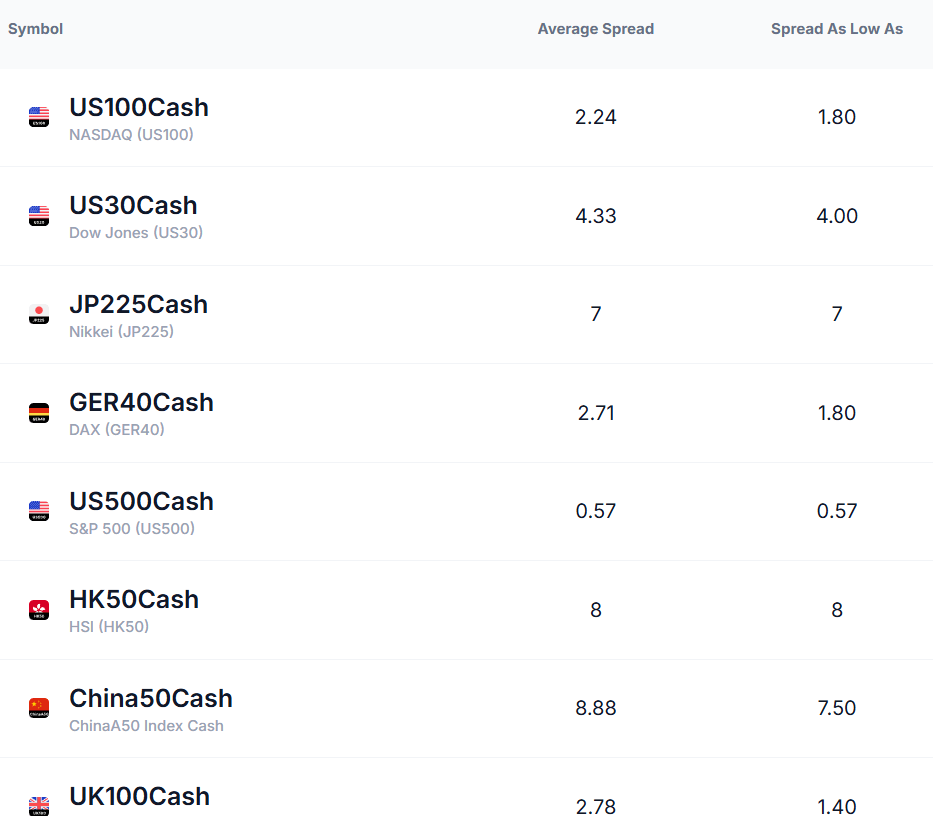

4) CFDs on Equity Indices:

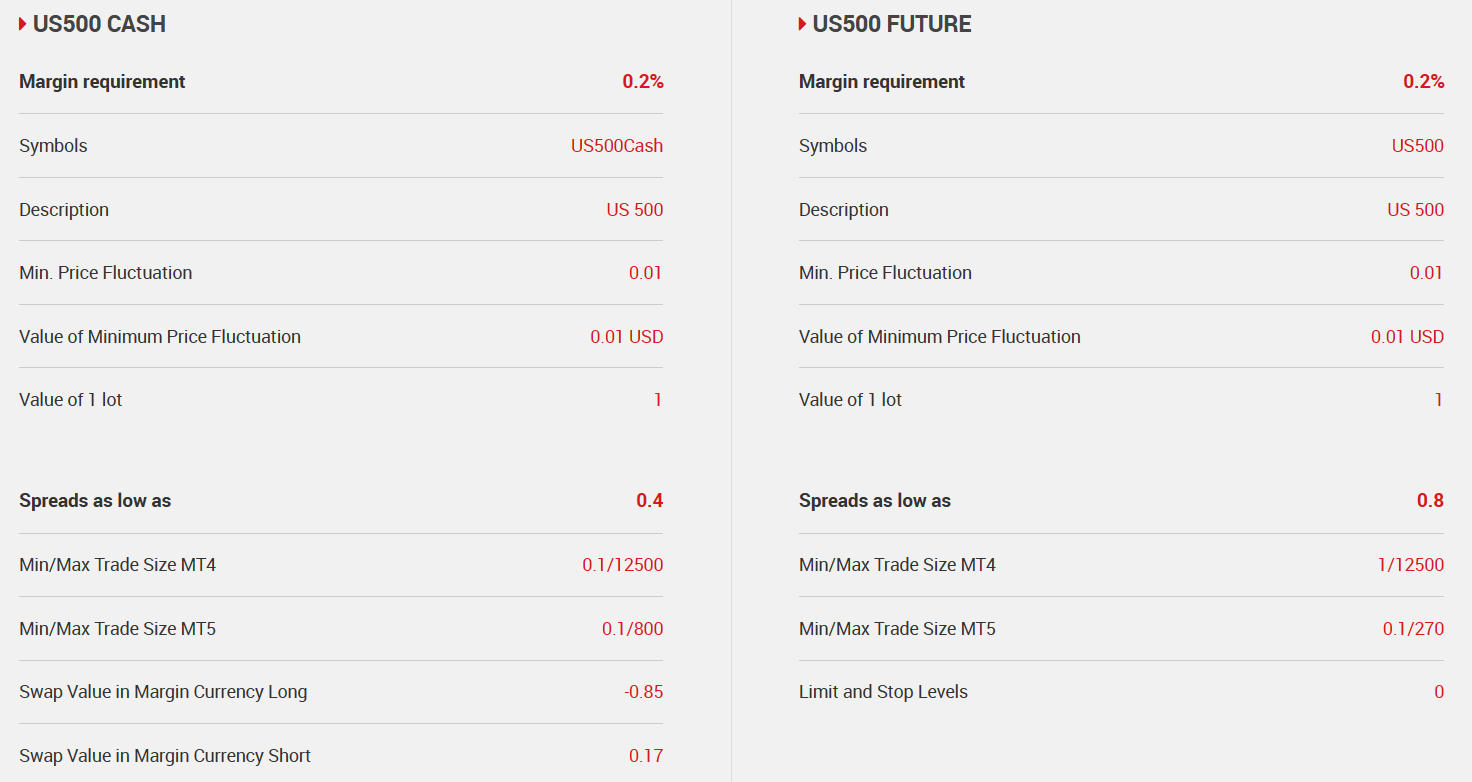

The XM trading platform offers trading in all the major equity indices. This includes leading indices such as S&P 500, ASX200, Nasdaq (NAS100), VIX, Dow Jones, FTSE100, DAX, CAC40, Nikkei225 and Euro Stoxx 50. No extra fees are charged, and 18 cash indices CFDs on offer are among the biggest stock indices in the global financial industry.

You can trade CFDs on Cash/Spot Indices or their futures. For example, you can trade CFD on US500 Cash or US500 Futures contract. Depending on the instrument, the contract conditions vary, as well as their total fees, margin requirements, trading hours etc.

Their typical fees for trading CFDs on major indices is moderate compared to other CFD brokers.

5) CFDs on Precious Metals & Energy:

XM forex trading platforms offer precious metal trading in gold and silver. Moreover, you can trade Oil, Natural gas at low spread on XM.

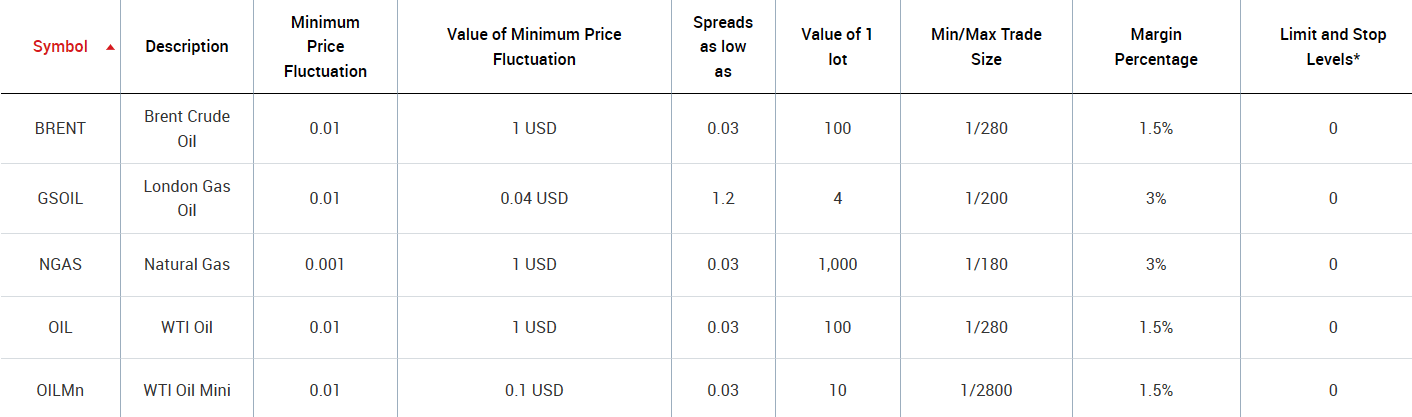

XM offers CFD trading on Futures of 5 Energies Instruments including Brent, WTI Oil, NatGas. Their typical spread for trading CFD on Brent Oil Futures Contract is 0.03 pips, which is comparatively low. The exact margin requirements vary according to the instrument & below is the table of the contract specifications & trading conditions.

6) No Cryptocurrency CFDs

XM does not offer any Crypto CFDs currently. There are other major brokers that offer CFD trading on Bitcoin & other cryptos, if you are looking to trade Bitcoin, other cryptos & their crosses specifically.

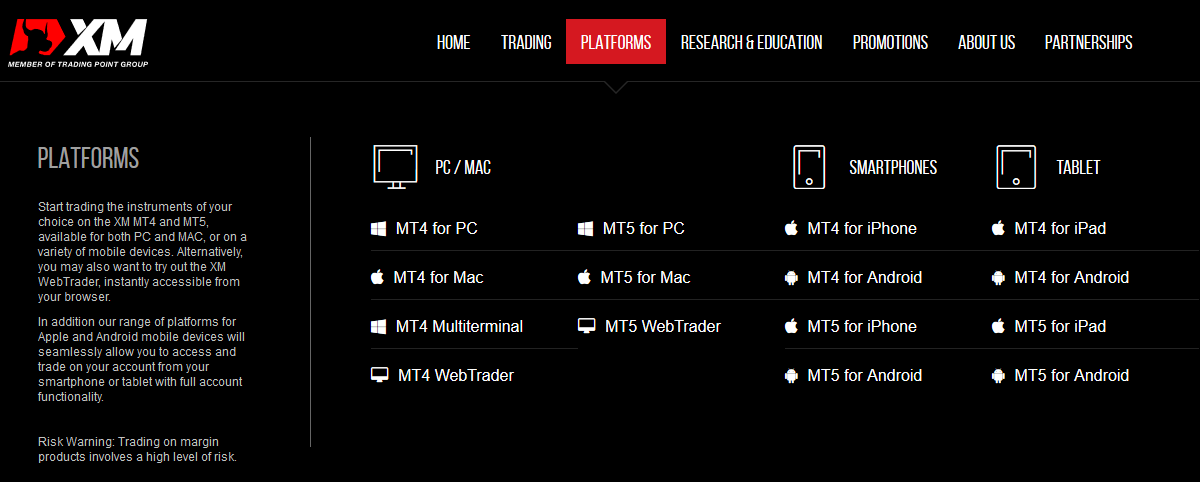

XM Broker offers standard MetaTrader platform for mobile as well as for desktop.

XM has mobile trading app for both Android and iOS.

Both MT4 and MT5 offer quality online trading. With no re-quotes or rejections, leverages are competitive from 1:1 to 1:888 on these platforms. You can install both MT software on your Android or Mac device.

Full functionality is available through MT4 and MT5 mobile XM trading platforms.

MT4 is internally acclaimed, with EAs, 50 in-built technical indicators, and ready-made robo-trading. It is available for all devices – mobile, web and desktop. Multiterminal MT4 offers PAMM or management of multiple accounts from single interfaces.

The 2 platforms differ in terms of trading spreads and commissions, trade execution, and other features.

The choice is between the industry-standard MT4 platform and next-gen trading platforms like MT5.

XM forex broker offers rapid market execution along with a no re-quotes/rejection system on both platforms. The only difference? The MT5 platform offers over 300 more stock CFDs.

XM offers Metatrader platform for desktop, including PCs or Laptops. We recommended using desktop MT4 for most traders. MT4 and MT5 are on offer for Windows and Mac OS devices both.

XM’s Metatrader for desktop includes:

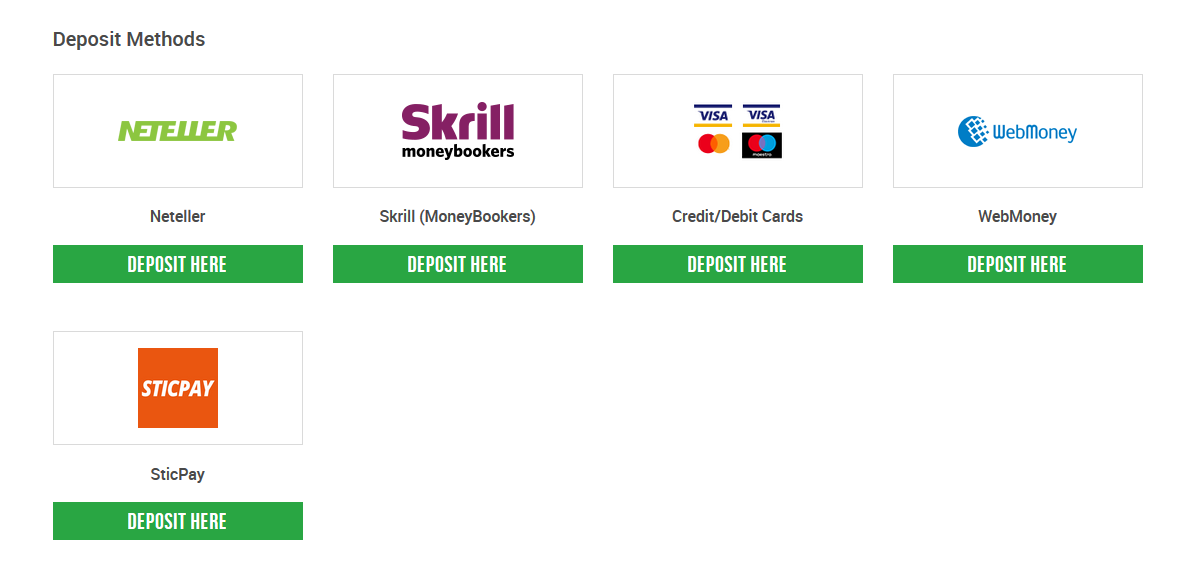

XM offers very good deposit & withdrawal options.

First of all, XM covers all withdrawal and deposit transfer fees for payments through Neteller, Moneybookers or major credit cards (including VISA Electron, VISA, Maestro, MasterCard, and China UnionPay). Even in case of wire, all deposits and withdrawals above US$200 USD processed by wire transfer are part of the zero fees policy.

Moreover, Local bank transfer option is available for South African traders for easy funding. You will need to login to your XM account to check the options available for you.

Let’s get into more detail on their funding & withdrawal methods.

XM Brokers allows their customers to make deposit using EFT, Cards and using various electronics payment gateways.

You can withdraw your funds with XM using multiple methods such as Major Credit Cards & other popular Electronic payments. They also offer withdrawals via EFT in South Africa.

How long does the withdrawal takes at XM? Except for bank wire transfers which can take a maximum of 5 business days, all other methods of withdrawal are processed in 24 hours.

Rules for Withdrawal at XM:

1) Account must be verified: Using valid ID plus supporting document (such as proof of address) must be submitted to request fund withdrawal.

2) Withdrawal time depends on your procedure of methods like a credit card, e-wallet bitcoin, a bank transfer is followed by XM.

3) Same Source Withdrawal: Like every other regulated broker, at XM you can only withdraw to your funding source. If you did your first deposit via card, then your first withdrawal will be your funding source.

For example: If you deposited $400 via your card, then the first $400 during withdrawal would be made to your card, and you can then select other alternate methods for the subsequent withdrawals.

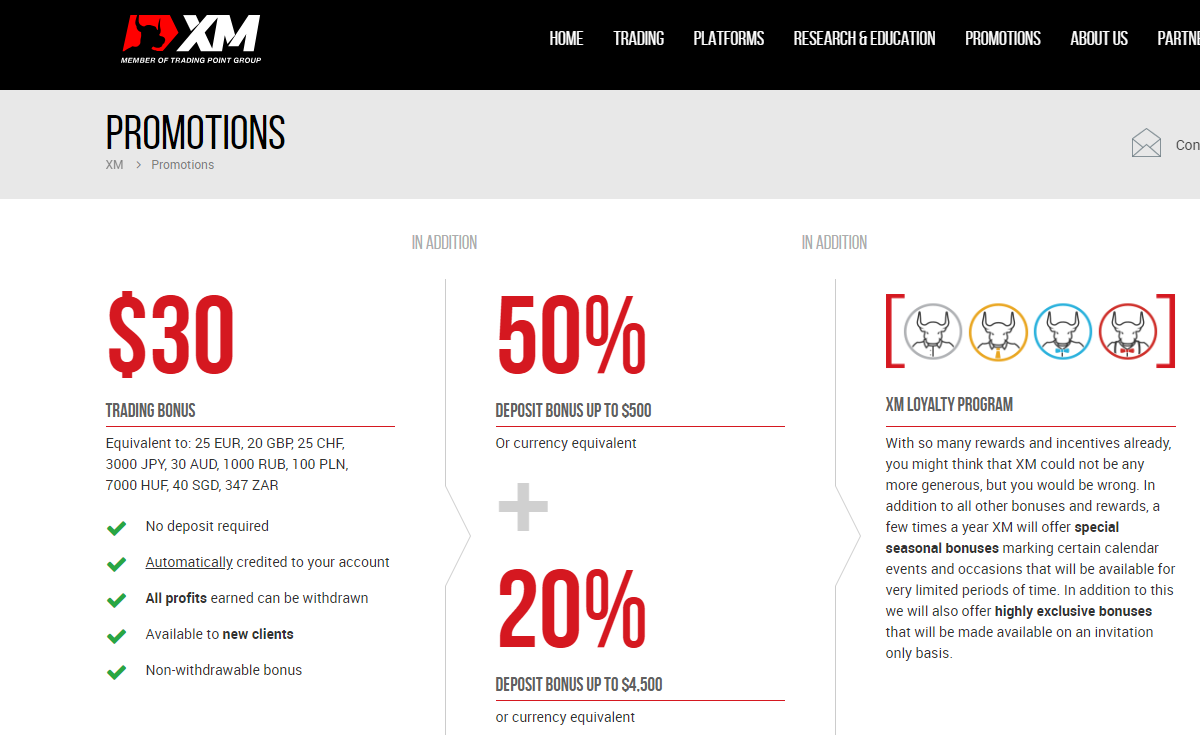

For South African traders, sign-up bonuses are allowed at XM (unlike EU traders following MiFID).

The following bonuses are available at XM broker:

XM trading has a really good customer support for South African traders. We tested their Chat & email support & we found them to be really helpful.

Here is a quick breakdown of XM’s support:

Chat Support: The XM customer chat support desk is available 24*5 hours a day. Their live chat support is very quick in answering most questions.

Email Support: XM’s email support normally replies within few hours hours. You can reach them via support[at]xmza[dot]com. Their email support is not the fastest though.

Phone support: We have checked that XM does not have any local phone number in South Africa. If you want to contact them via phone then you can call at their international phone number.

Local Address in South Africa: XMZA have a local office in Cape Town, South Africa. This is also the listed address under their ‘Contact Information’ under FSCA.

Research and Education: This includes daily resources for customers: the latest news, fundamental analyses, technical analysis by XM.com’s research team. Moreover, XM offers free forex webinars, forex seminars, and video tutorials.

Yes, we do recommend XM & consider them a good forex broker.

Well regulated including with ASIC & CySEC, very competitive trading fees, zero deposit/withdrawal fess, negative balance protection, instant order execution, all of this makes XM Trading an exceptional forex broker in terms of trading environment.

Their bonus offerings are also good for SA traders. Plus, their customer support, especially their live chat is quite solid!

XM trading’s platforms are also very good with multi-device support. Other than forex trading, their instruments on offer include cryptocurrencies & stocks, which makes them even better option for traders looking to trade multiple instruments.

But XM is a market maker forex broker. And they don’t have a local phone number in South Africa for getting local support.

Still, choosing XM broker to trade forex & other CFDs is a no-brainer considering the fact that they are a reputed broker that have been around for over a decade.

The minimum deposit at XM is $5 with Micro & Standard Account Types. The deposit is $50 with Ultra Low Account. So the deposit depends on your account types that you open.

Yes, XM does offer the ZAR as one of the Base Currency Options. You can open ZAR account with all 3 account types i.e. Micro, Standard & Ultra Low.

XM has NASDAQ or NAS100 CFD instrument which is listed as US100 on their platform. The typical spread for trading NASDAQ on XM is 2 pips.

XM is considered a moderate to high risk broker for traders in South Africa because of the fact that they are not locally regulated. Their parent is regulated with CySEC, but traders from SA are registered under XM Global (FSC) in Belize.

No, XM does not have VIX or Volatility 75 Index on their platform at this moment. Traders looking to trade VIX can trade with Hotforex SA broker.

No, XM is not regulated with FSCA. They are regulated with 2 Top-tier regulators ASIC & CySEC.

"Do you have experience with XM Broker? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

XM is by far the best broker. Overall deposits, withdrawals, spreads, executions are awesome compared to other brokers. Haven’t had any negative experience since I used XM. I personally can confidently say XM is great .