Tickmill is a NDD (No Dealing Desk) forex and CFD broker. They are regulated with top-tier regulators i.e. FSCA, FCA (UK) & CySEC. They offer instant internet banking deposit method & quick bank transfer withdrawals in SA. Traders can open live account with minimum deposit of $100. Read our Tickmill review to find if they are good for South African traders.

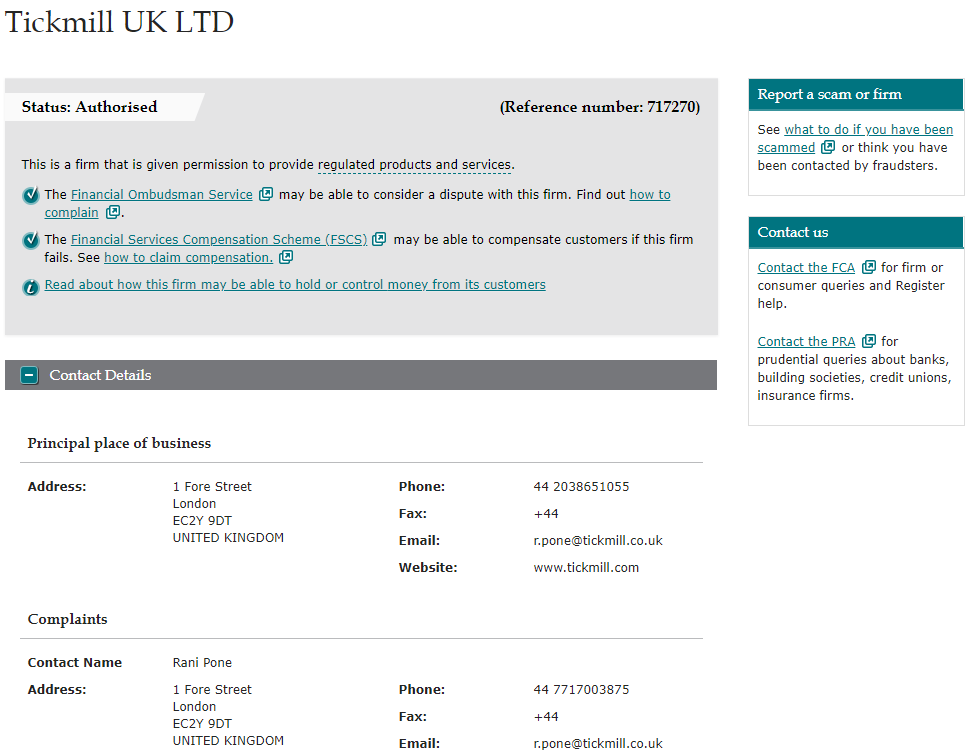

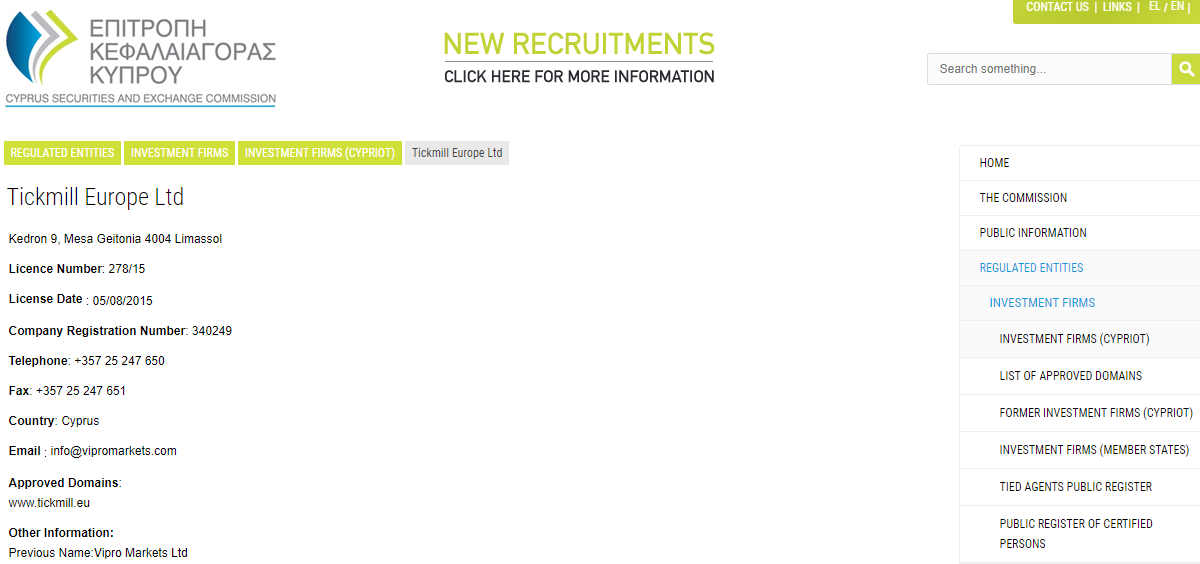

Tickmill is a reputed & well regulated UK based forex & CFD broker established in 2014. Tickmill South Africa Pty. Ltd. is regulated with FSCA, and Tckmill UK Ltd. with FCA in UK, and Tickmill Europe Ltd with CySEC in Cyprus.

Tickmill is a No Dealing Desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that Tickmill have no conflict of interest with the traders using their platform.

They offer instant internet bank transfer option for funding in South Africa & their withdrawals via bank transfers are very fast too. They offer MetaTrader 4 as trading platform to their clients, and they have recently started to offer the latest MT5 platform as well. Moreover Tickmill have 24/5 support via email, chat, international phone support.

Read our in-depth review on Tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

Tickmill Pros

Tickmill Cons

Table of Contents

| 🏦 Broker Name | Tickmill Ltd |

| 📅 Year Founded | 2014 |

| 🌐 Website | www.tickmill.com |

| 🏢 Registered Address | 3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles |

| 💰 Tickmill Minimum Deposit | $100 |

| ⚙️ Maximum Leverage | 1:1000 |

| ⚖️ Tickmill Regulations | FSCA, CySEC, FCA, FSA SC. |

| 🛍️ Trading Instruments | 62 Currency pairs, CFDs on 10 Commodities (including Metals & Crude Oil), 20 Stock Indices, 9 Cryptos & 4 Bonds |

| 📱 Trading Platforms | MT4 (MetaTrader4), MT5, WebTrader |

We consider Tickmill to be a safe forex broker for South African traders based on their regulation with FSCA & Tier 1 regulator FCA.

Tickmill is regulated with 3 Top Tier regulators:

We consider Tickmill to be low risk CFD platform considering the fact that they are regulated with FSCA & also have regulatory licenses from a number of other Top-Tier regulators.

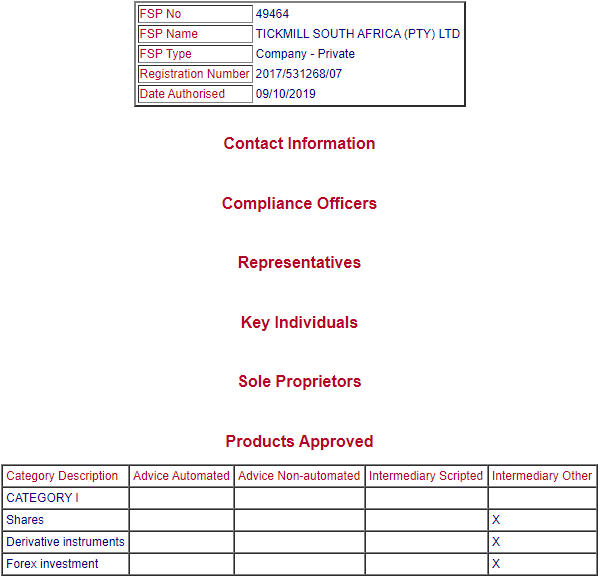

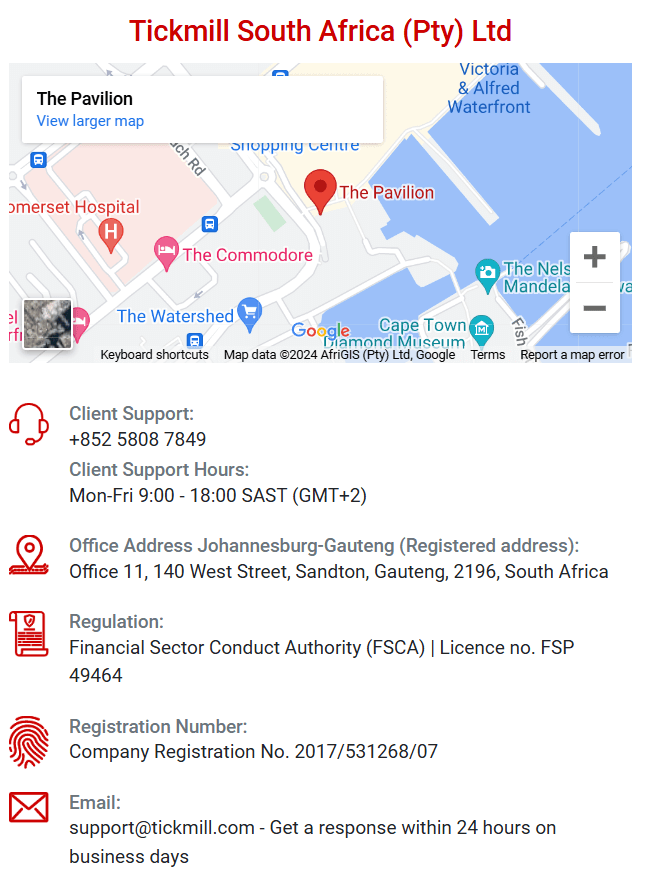

Yes, Tickmill is authorized as an ODP with FSCA as per the latest search. Their local entity ‘Tickmill Ltd.’ is registered in Cape Town & they have a valid licensed to operate as an Over the Counter Derivative Provider.

The below is the information about their ODP status listed in FSCA’s website. Please make sure to check the recent status, as this may have been updated from the time of this review.

Yes, Tickmill is a legal CFD broker because they are licensed with FSCA under FSP no. 49464, and they are also an approved ODP.

It is important to note that their local entity ‘Tickmill Ltd’ is the licensed entity, so when opening your account, ensure that you are being registered under this entity in order to get the investor protection of your funds.

Tickmill’s fees depends on your account type with them but overall we found it to be very competitive. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

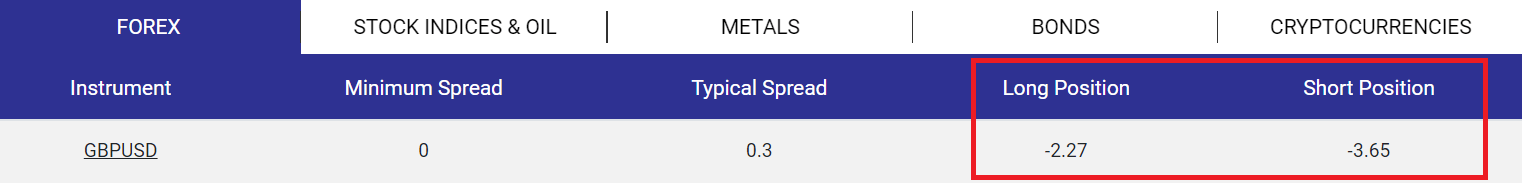

Their typical Swap charges are moderate to low compared to other CFD brokers. For example, EUR/USD their Swap fees are -3.78 USD for Long & USD 0.65 for Short. For GBPUSD it is -2.27 USD for Long & -3.65 for short.

Depending on the currency pair you are trading, rollover fees would be credited or debited from your account at the end of the forex day i.e. 5 PM. For some currency pairs it is low, but for some it is moderate. There is no rollover fees only for Islamic accounts.

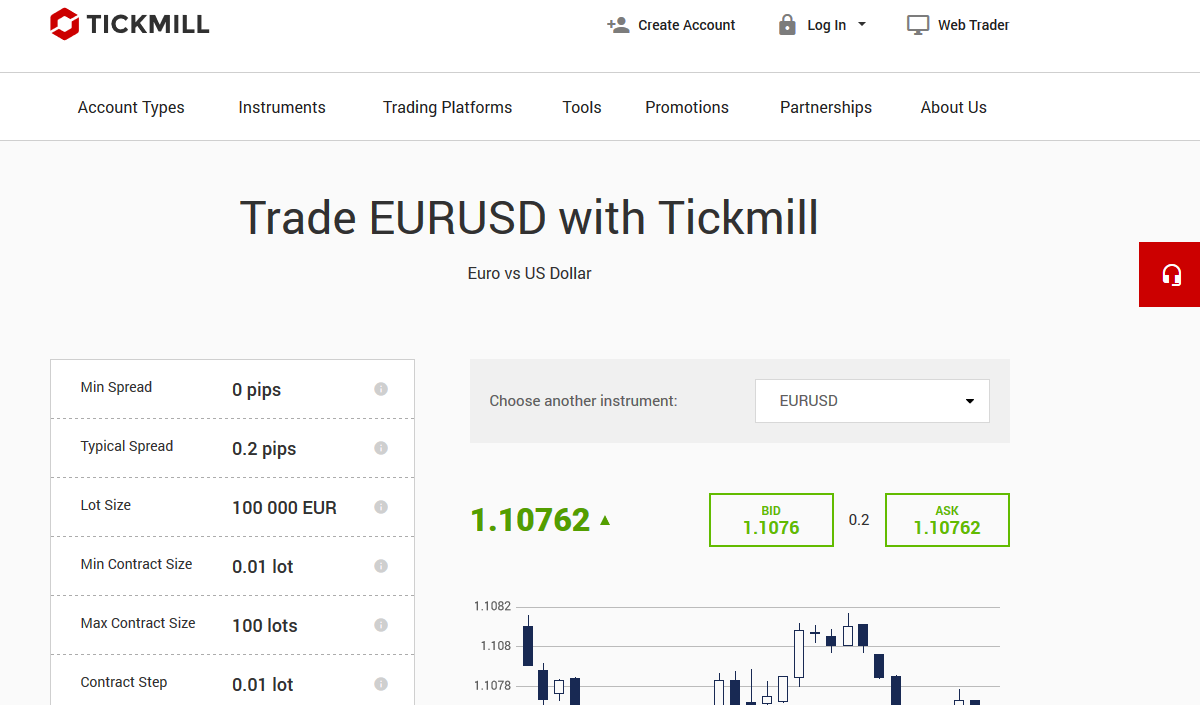

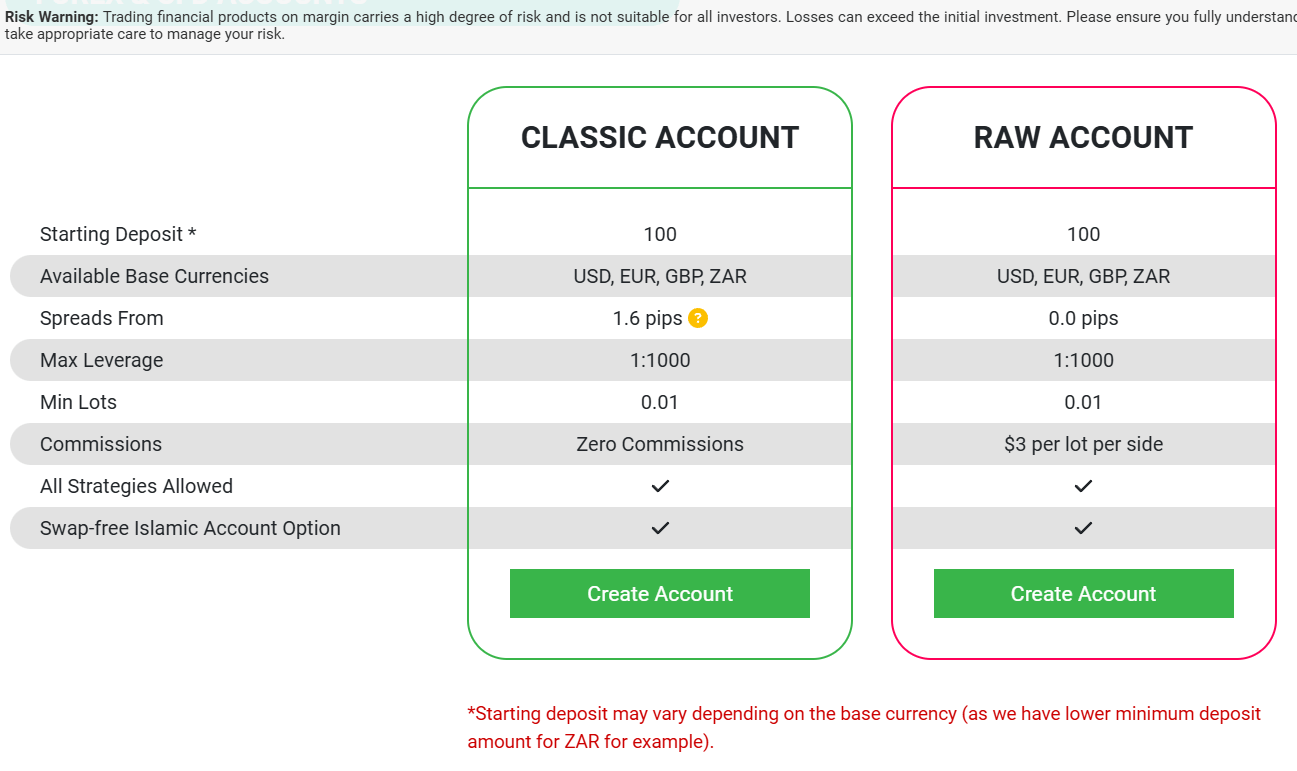

Their spread with Classic account is bit high, but if you choose Raw account then the spread is Raw i.e. as low as 0 pips. The commission with Raw account is also low at $6/lot Round turn, which is lower (or almost equal to) than other ECN Type brokers that offer raw spreads. Their non-trading charges are also low.

Below table is breakdown of their typical spread for major currency pairs.

| Instrument | Average/Typical Spread (Raw Account) |

|---|---|

| EUR/USD | 0.1 pips |

| AUD/USD | 0.1 pips |

| GBP/USD | 0.3 pips |

| EUR/GBP | 0.4 pips |

So, overall Tickmill’s fees is very competitive for most of the instruments. The trading charges are low, and the non-trading charges are also quite low & transparent.

It is also important to note that Tickmill charges a currency markup fees. The exact fees is not mentioned on their website, but if you are trading an instrument which is not in your base currency, then you will be charged a conversion fees when your losses or profits are calculated.

For example, if your account is in ZAR, and you are trading XAUUSD (gold, which is quoted in USD), your ZAR is first converted to USD in this example. If the broker charges a fees on this, it means you will pay for conversion of your ZAR to USD, for trading gold.

Demo account is provided by the Tickmill for free to all traders. You can use the demo account to practice and learn forex trading.

You can signup with Tickmill & create a demo account on their website. With this account you can start testing your trading strategies in real market like conditions. Once you are experienced, you can at anytime open a Live account.

In Demo account MT4 trading platform is offered by Tickmill. You can download it on your PC and Laptop and start your trading in just one click.

Tickmill South Africa has a minimum deposit of $100 for Classic & Raw Accounts. Note that if you are opening your trading account in ZAR, the account minimum deposit is lower.

Overall, the Account types at Tickmill are very clear. You can choose Classic Account if you want to trade on spreads only account. But if you want lower cost, then you should open Raw account.

The max. leverage at Tickmill South Africa is 1:1000 for forex with all their 2 account types. For CFDs like Indices, the leverage is lower at 1:100. For stock CFDs, the leverage is not the same for every stock, it varies between 1:5 to 1:20. For Crypto CFDs, the max. leverage is 1:200.

Traders have to adjust to a lower leverage.

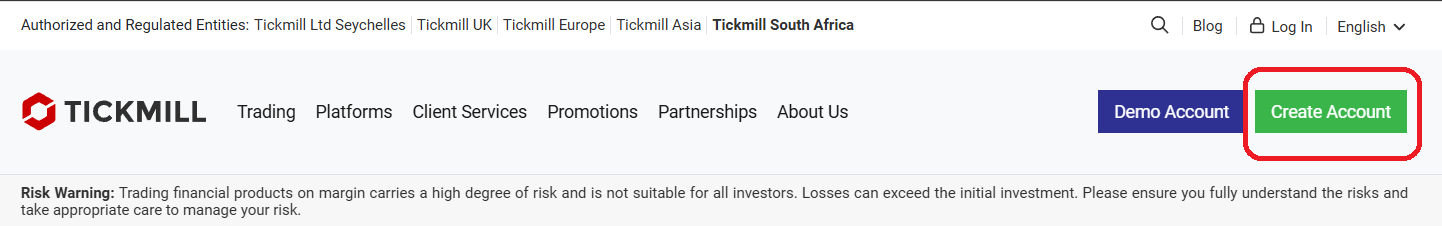

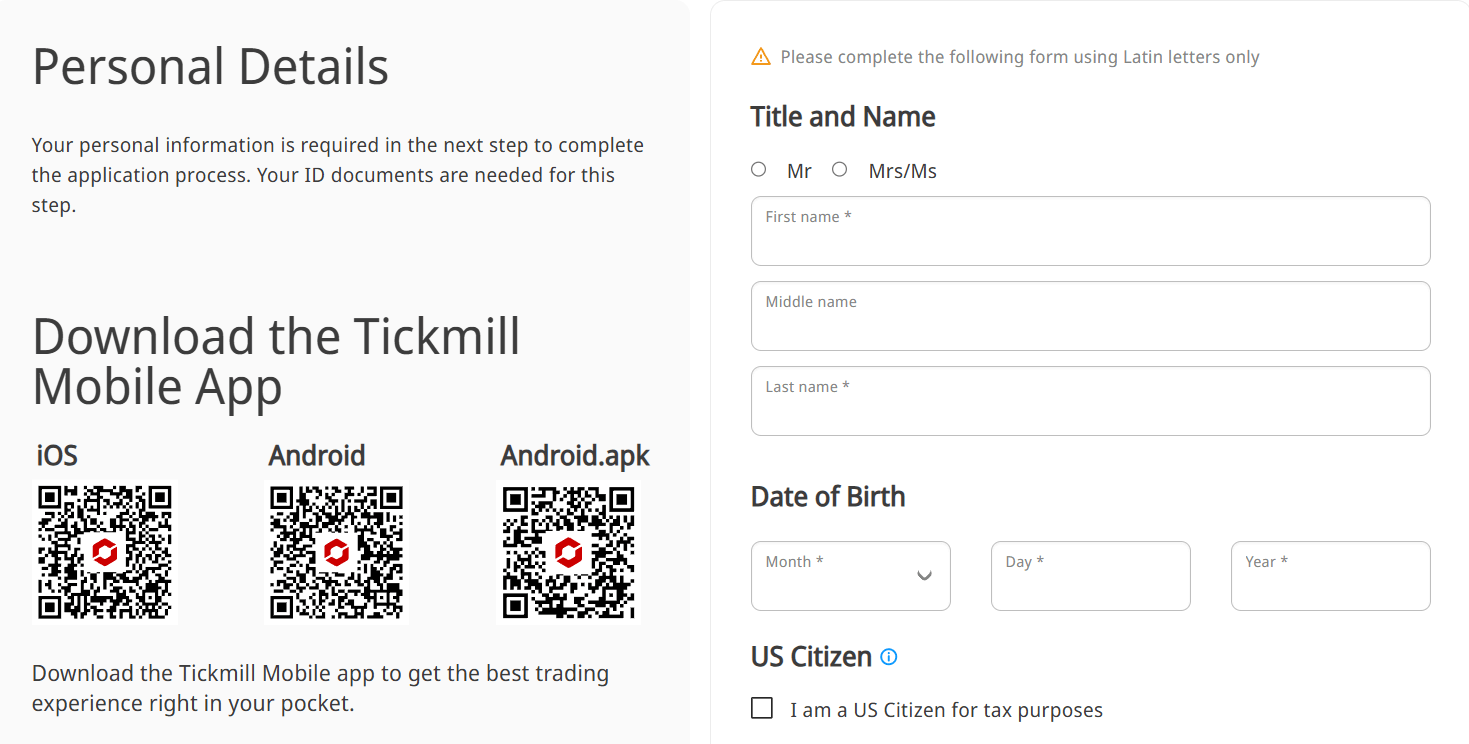

Step 1) Click on Create Account: Open the home page of the Tickmill and click on Create Account link at the top of the page.

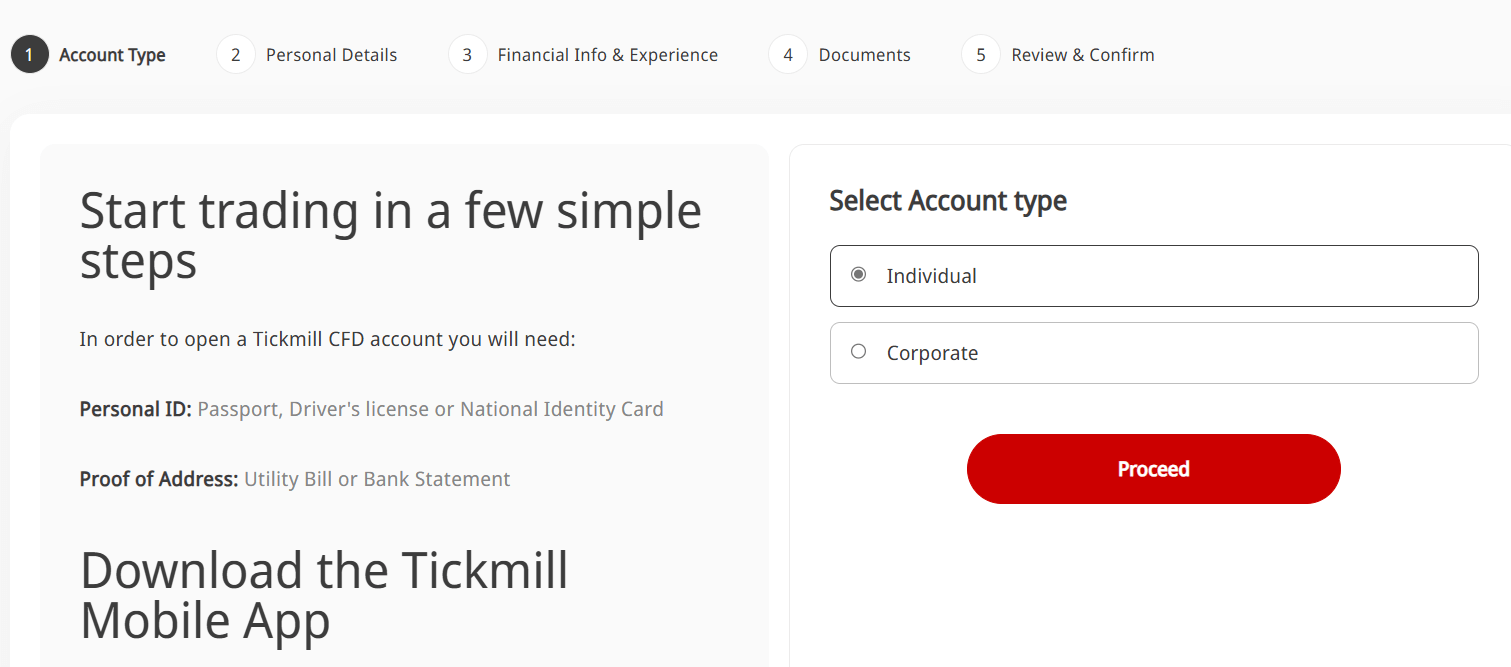

Step 2) Account Type Select: Now you will be redirected to page where you need to select your account type. For retail traders it will be ‘Individual’ Account, and you choose ‘Corporate’ if you are opening the account for your company.

Note that if you choose Corporate Account, one more document will be required during KYC i.e. your ‘Corporate Certificates’.

Step 3) Enter your Personal Details (there are 6 steps involved here): Here you need to fill in your personal details (Full Name & Date of Birth). Note that all the details should match the details on the ID that you are going to submit in the later step.

After entering your name & DOB, you are required to select your country & the Tickmill entity under which you are opening your account. You also need to confirm that you are not a US Citizen.

After that you will be required to enter your Phone Number & Email.

Step 4) Validate your e-mail address: Now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) Complete Account Verification: At last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like Passport, Driving Licence etc. and Address proof like Post Paid Phone Bill, Electricity bill etc.

That All! Your account has been created now. You can check your email to check all the details to start trading with them.

The number of CFD trading instruments available at Tickmill are lesser than other brokers that we have compared.

1) 62 Forex Pairs: Tickmill offers a 62 Forex trading pairs, which is comparatively higher or similar to other forex brokers like Hotforex (53), FXTM (62) but lower than Exness (107).

2) Range of CFDs: Trading instruments other than forex are not the highest, but most of the commonly traded CFDs are available on their platform.

Tickmill have trading available on 15 Commodity CFDs, 20 CFDs on Stock Indices & Commodities & 4 CFDs on Bonds. This is very limited as many other brokers offer higher number of CFD instruments other than forex.

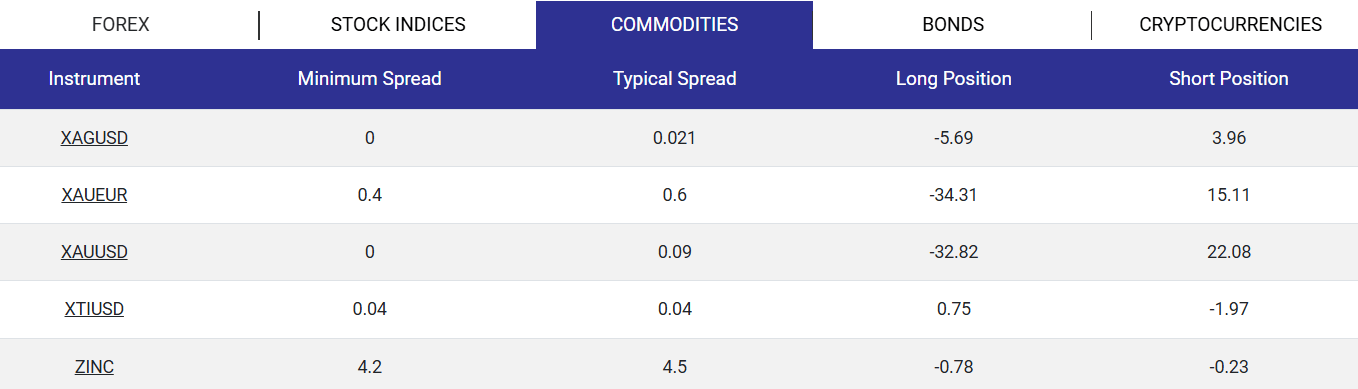

But they have major instruments like XAU/USD, USTEC (NASDAQ) & other popular CFD instruments. For example, below is the screenshot of their Commodity CFDs, which includes CFDs on metals like Gold & Silver as well.

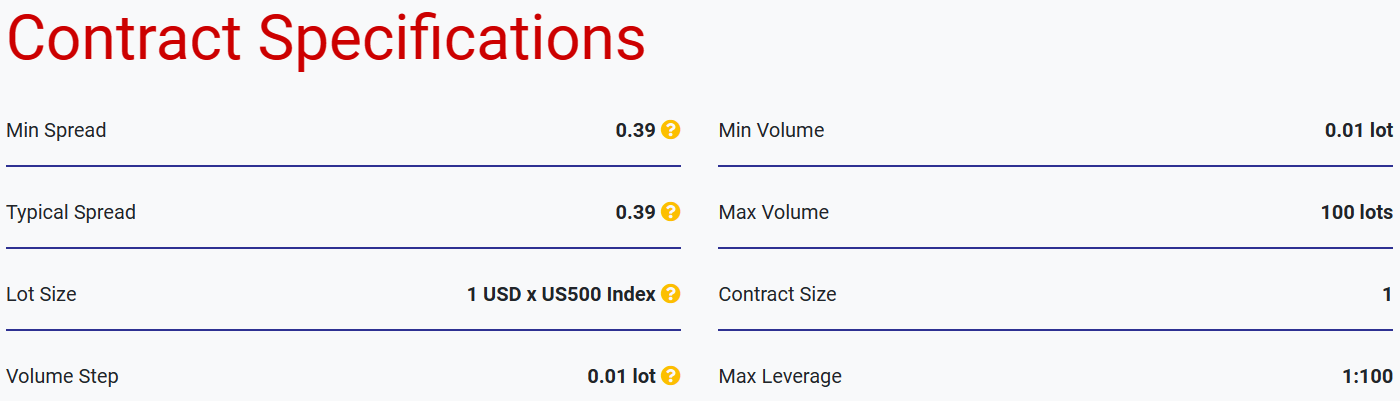

It is important to note that Tickmill does offer CFD trading on major global indices including DJI (US30), S&P500 (US500), NASDAQ 100 (USTEC), DAX (DE40), NIFTY50. Almost all of the major global indices are available for CFD trading on their platform & the fees for trading these instruments is moderate.

For example, the typical spread for trading US500 is US500 0.39 pips. So, if you are trading 1 Contract of 1 Lot size, with the S&P500 at 4000 (for example), then your notional exposure is $4000. The max. leverage for this instrument at Tickmill is 1:100 (and it is similar for other major indices).

3) 9 Crypto CFDs: Tickmill offers crypto CFD trading on Bitcoin, Ethereum & Litecoin against the US Dollar. BTCUSD, ETHUSD & LTCUSD are available for trading with typical spreads of 85, 1.5 & 5 respectively for each of these crypto CFDs.

Most other major CFD brokers like XM & don’t offer crypto CFDs. So, this is a positive if you are looking to trade crypto CFDs.

The typical spread for major like BTCUSD is 24.9, for exposure of 1 lot, if the BTCUSD is trading at $24,000, then the fees would around 0.1%. This makes the spread moderate.

Overall, the total number for currency pairs at Tickmill are good. Major CFDs like NAS100, Gold etc. are available at Tickmill & the trading fees is low for these instruments.

Yes, you can trade CFDs on gold on Tickmill’s MT4, MT5 & other platforms. They offer trading on commodity CFDs, but their swap charges are high for overnight positions.

It is -20.43 i.e. you will have to pay $20.43 per lot of XAUUSD per night for holding that position overnight. So, if you are a swing trader, and you want to trade XAUUSD on the short side, you will have to consider this holding cost at Tickmill.

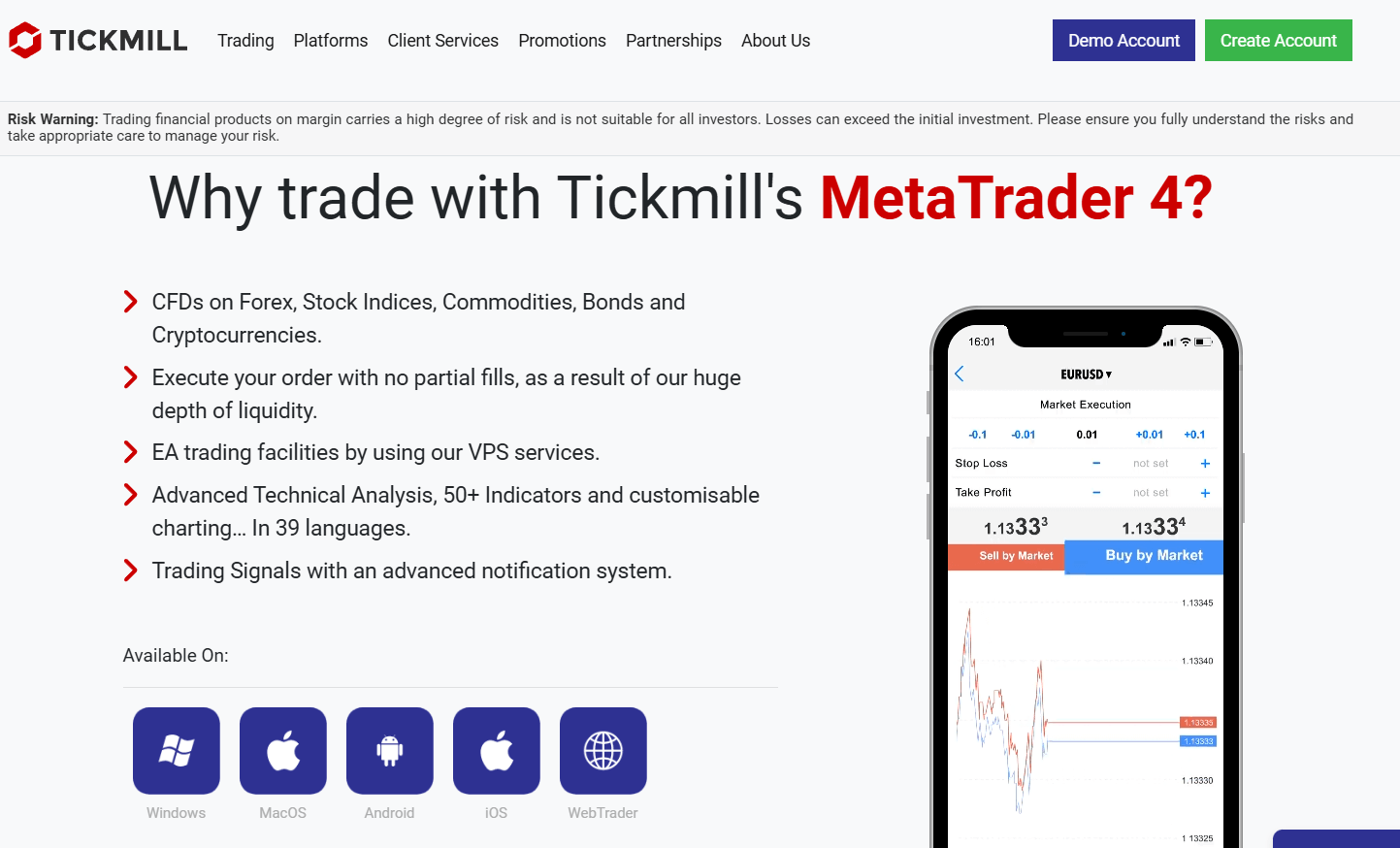

Tickmill is a Metatrader based forex broker & they offer both MT4 & MT5 trading platforms (on web, mobile & desktop). They also have their mobile app.

Tickmill is a standard Metatrader based CFD broker. They offer both MT4 & MT5, and these are available on all the devices.

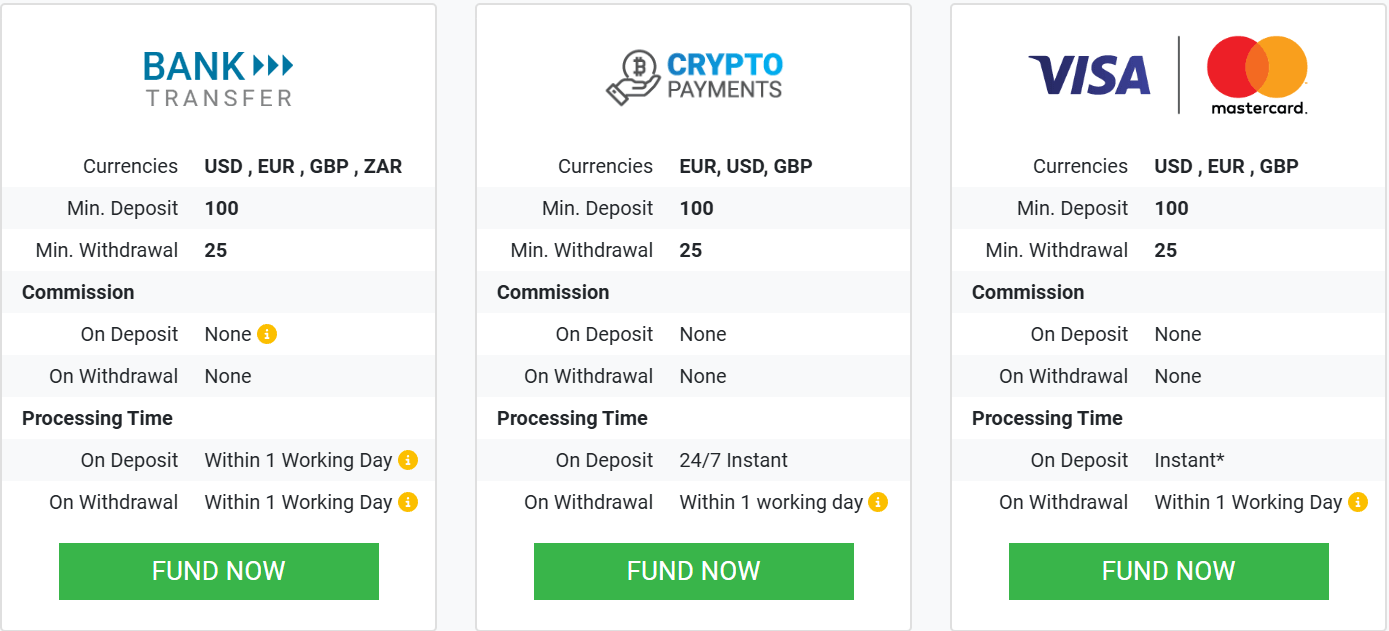

Tickmill offers various deposit & withdrawal methods. The most important is the fact that they support local bank transfer payments in Rand (you can also withdraw in your local bank account).

Let’s first look into their deposit methods.

Tickmill offers multiple methods with instant deposit options in South Africa.

Withdrawals at Tickmill are fast for traders in South Africa. They also offer Internet Bank transfer withdrawals.

The withdrawals at Tickmill would normally be credited in your bank account within 24 hours. This is if you are using EFT transfer option on your withdrawals.

Note that the EFT withdrawals at Tickmill are made in ZAR, so if you have USD as your account currency, the conversion charges would apply on your withdrawal amount.

Overall, the deposit & withdrawal options available at Tickmill are good.

To sum up, Tickmill offer local bank transfer for deposits & withdrawals, which is considered good. And the withdrawals via Internet banking are proceeded within 1 day, which is faster than many other CFD brokers.

Tickmill does not have any bonus offers in South Africa currently.

They have a $30 welcome bonus offer with no deposit, but it is not available to South African traders for now.

Tickmill currently have an ongoing rebate promotion that is available for the traders in South Africa. You can earn cash rebates based on your monthly trading volume.

The minimum deposit required to take part in this rebate promotion is $200. The exact rebate depends on the number of lots traded & it is divided into 3 tiers.

For upto 1000 Standard lots traded, you would get $0.25 per/lot. For 1000-3000 lots, the rebate is $0.50 per Standard lot. And for over 3000 lots the rebate is $0.75 per standard lot.’

For eg: If you trade 100 lots, then the cash rebate that you would earn is $25.

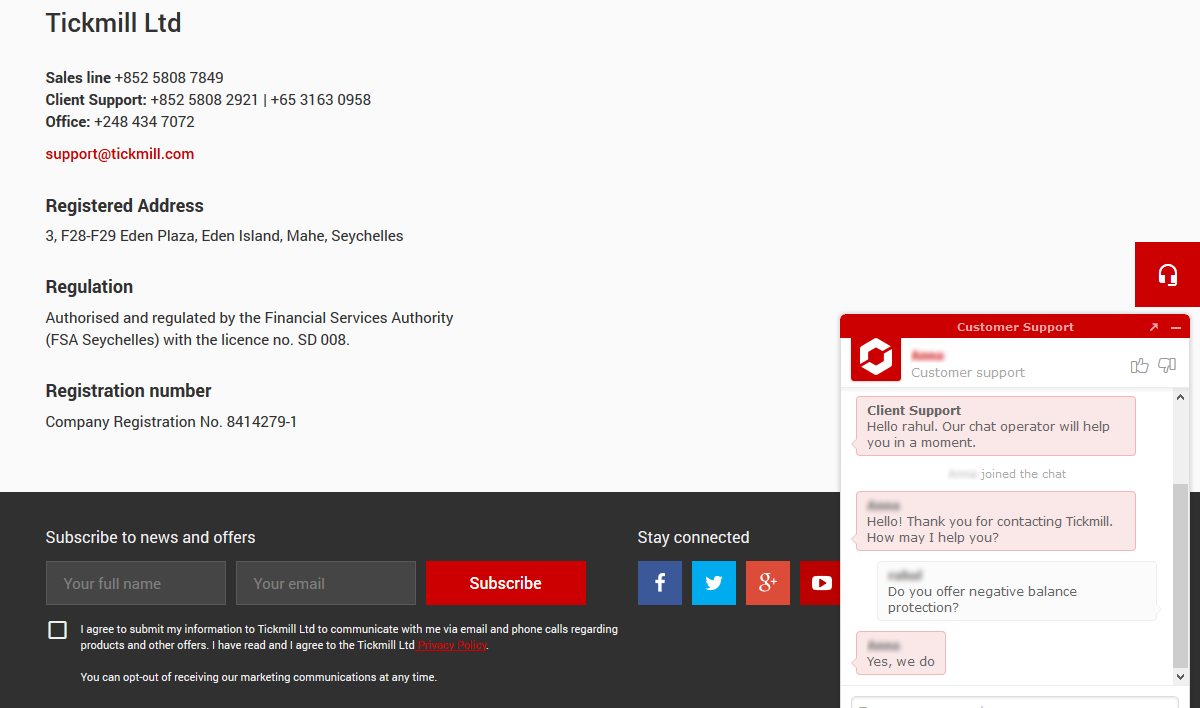

We found Tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

Note that Tickmill does have a local address & office in South Africa. But there lack of local phone number & the English live chat is not 24/5.

Yes, we do recommend Tickmill South Africa as they are a good & reputed broker with low trading fees.

On the good side, they are a 100% NDD broker that is regulated with FSCA & FCA. Their overall trading fees is very competitive with Raw account. Also, they do not charge any deposit and withdraw fees.

Plus, they offer local bank transfer option in SA with quick withdrawals, plus ZAR account. Their support is also not bad.

And they offer MT4 & MT5 platforms. But, their total no. of CFD instruments other than forex are somewhat limited.

Overall, there are one of our recommended brokers that South African traders can choose to trade.

Tickmill had a minimum deposit of $100. South African traders can signup with their Raw & Classic Accounts, both have the same minimum deposit of $100. But if your account is in ZAR, the minimum required deposit is lower.

Tickmill is authorized by FSCA under FSP no. 49464. They are also licensed with FCA & CySEC, so as per our research we consider them as a low risk forex & CFD broker for traders based in South Africa.

Tickmill offers withdrawals via local transfer to South African bank accounts at zero fees, wallets like Skrill, Neteller & via Debit/credit cards. There is no fees with any of these methods & the withdrawal time is also fast. It would vary between few hours to 24 hours depending on the withdrawal method that you choose.

Tickmill has NAS100 or NASDAQ instrument as a CFD on their platform. USTEC CFD index instrument is available on their Metatrader platform with a typical spread of 1.93 pips.

Yes, Tickmill does offer ZAR base currency trading accounts & the deposit is also lower if you choose ZAR as your base currency. Traders also have the option to choose between USD, EUR & GBP base currencies during account opening process.

"Do you have experience with Tickmill South Africa? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review