IronFX is a regulated forex broker in South Africa. They are regulated with top-tier regulators i.e. FSCA, CySec & FCA in UK & ASIC. They have zero deposit charges but no ZAR accounts. Read our unbiased review to decide if you should choose them or not!

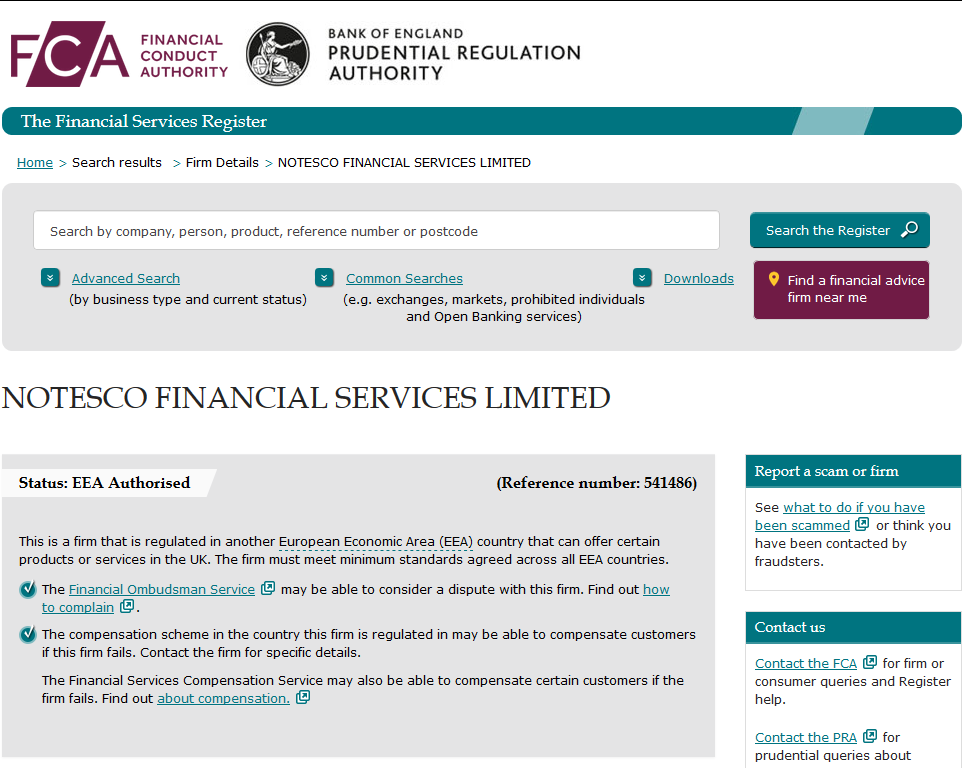

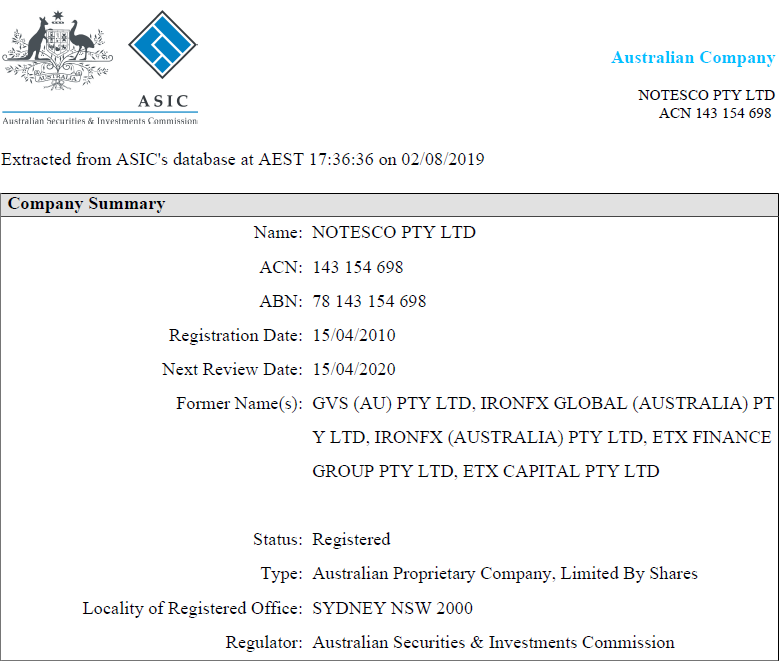

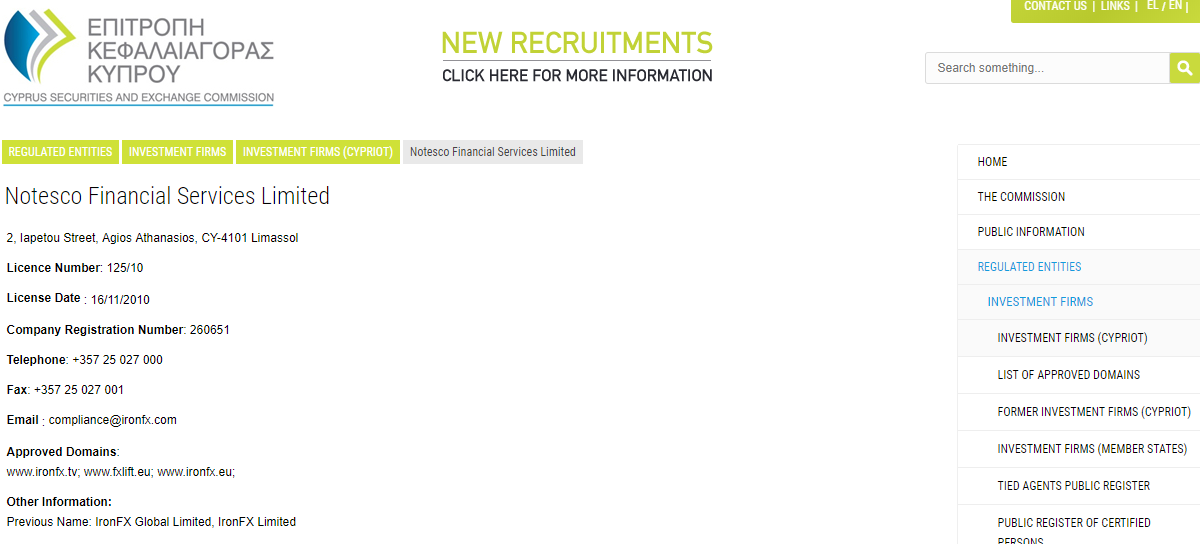

IronFx was established in 2010 and they are regulated with various regulatory bodies including FSCA, FCA, CySEC, ASIC. IronFx is a brand of Notesco and have a wide range of CFD trading instruments.

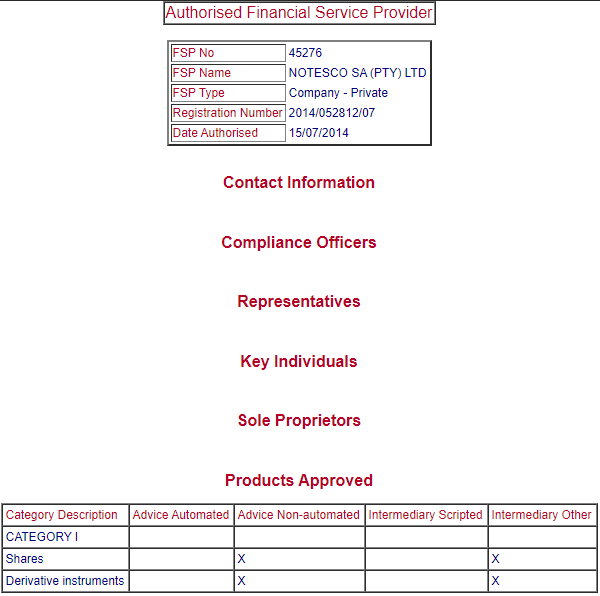

We consider IronFX to be a safe CFD broker as they are regulated with FSCA under FSP no. 45276. They have variable as well as fixed spread account types, and well explained commissions and fees structure on their website.

Read our full review based on comparison of IronFX’s trading fees, spread, support promptness and 7 other factors which are important to decide whether to trade with them or not.

IronFx Pros

IronFx Cons

Table of Contents

| 🏦 Broker Name | IronFX |

| 📅 Year Founded | 2010 |

| 🌐 Website | www.ironfx.com/en |

| Registered Address | 28 Irish Town, GX11 1AA, Gibraltar |

| 💰 IronFX Minimum Deposit | $100 |

| ⚙️ Maximum Leverage | 1:1000 |

| 🗺️ Major Regulations | Regulated by ASIC, CySEC, FCA. |

| 🛍️ Trading Instruments | Currencies, CFDs on Commodities, Indices, Stocks, Crypto |

| 📱 Trading Platforms | MT4 |

As per our research, IronFX is a well regulated forex broker that is authorized under 4 Top-tier regulations. Below is a breakdown of IronFX’s regulations.

Overall, IronFX is considered safe for SA based traders due to their regulation with FSCA & multiple other top-tier regulators.

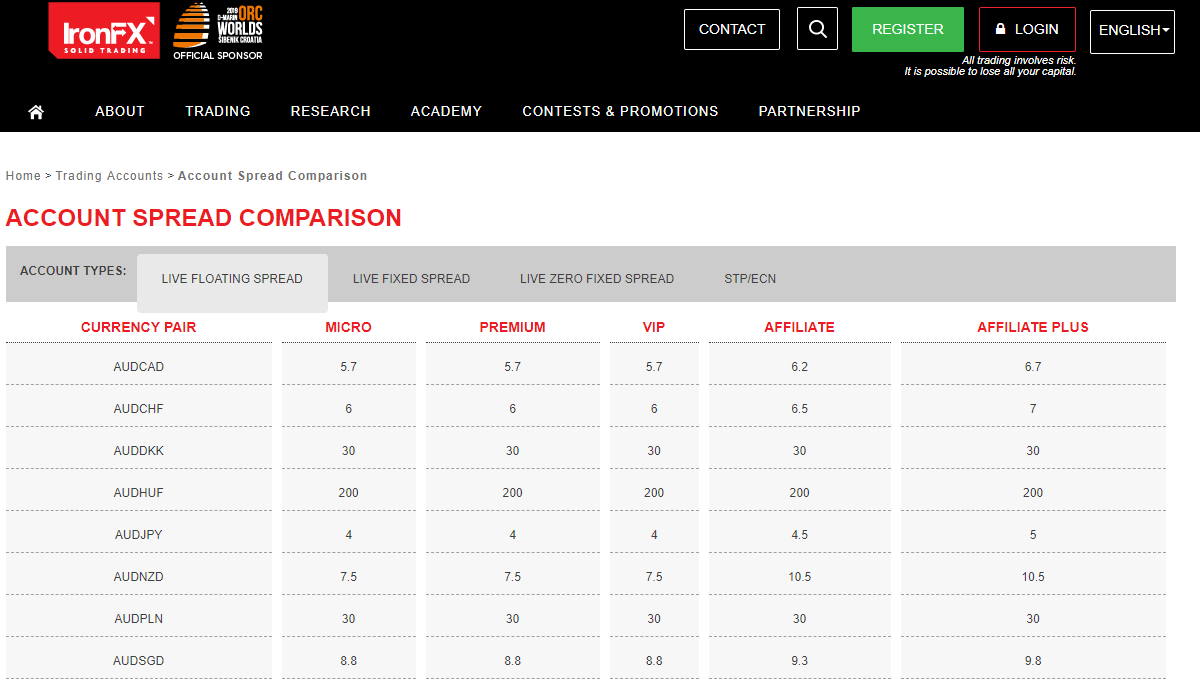

IronFX charges higher fees when compared to other brokers. We breakdown their fees into 4 categories explained below.

IronFx categorizes trading accounts into 2 types based on the spread types and commissions. We are explained and listed below:

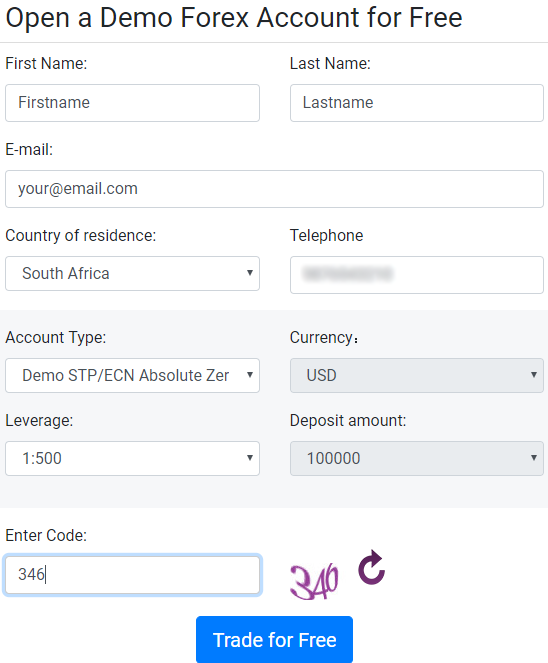

They are offering demo account for the customers who are interest in trying the various Forex trading strategies.

This demo account can be used for unlimited times and all trading platforms can be used in demo account.

They are offering 4 types of demo accounts which are STP/ECN Absolute Zero, Floating Spread, STP/ECN No Commission & STP/ECN Zero Spread.

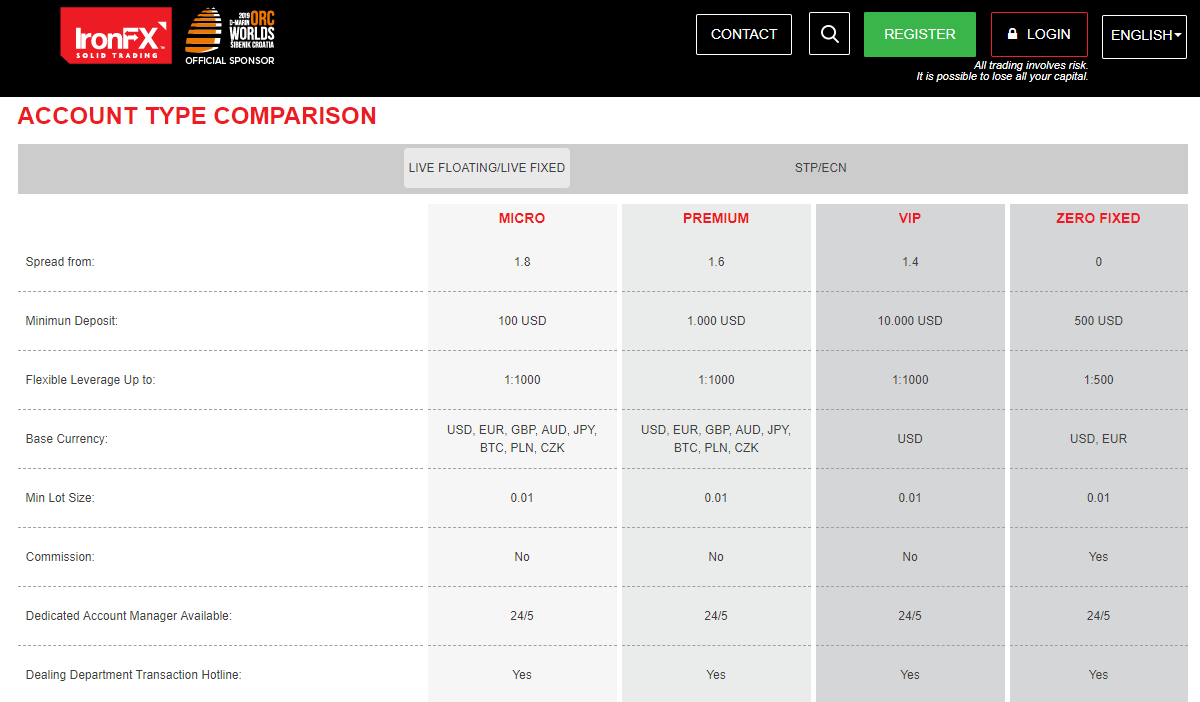

There are 4 types of accounts under this category. We have listed them below with their features:

1) Micro Account: This account is a basic account with minimum deposit of $100. You can trade micro lots under this account. And it comes with both fixed and variable spreads. Moreover the option to assign dedicated account manager is also available in this account.

2) Premium Account: The minimum deposit for this account is $2500. And the fixed spread 1.8 pips and floating spread is 0.7 pips in this account. As this account is premium account so a dedicated account manager option is also available.

3) VIP Account: In VIP account spread start from 1.4 pips spread. The minimum account deposit is $20000 in this account. Dedicated account manager is available and also department hotline is available for this account.

4) Zero Fixed Account: Spread start from zero in this account. The minimum deposit for this account is $500. You can trade micro lots and dedicated account manager can assign in this account. There is low commission in this account.

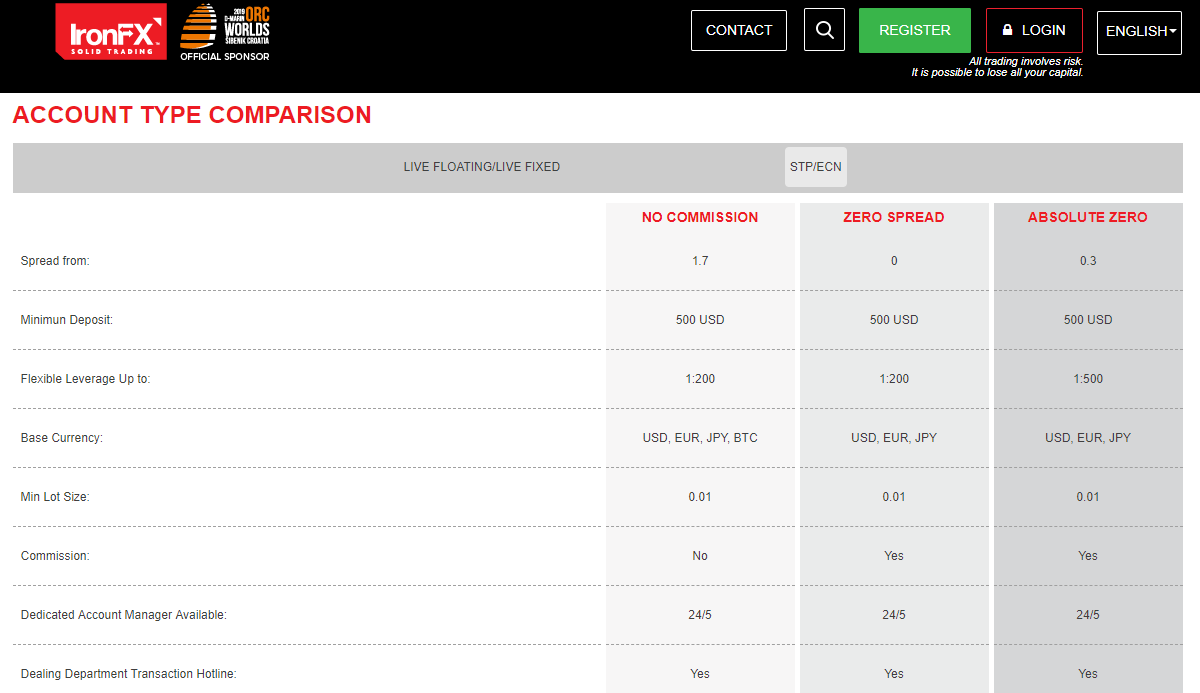

There are 3 accounts under this category as described below:

1) No Commission Account: This comes with market execution and there is no commission in this account. But the spread in this account start from 1.7 pips.

2) Zero Spread Account: The flexible leverage in this account is 1:200. And the spread start from zero in this account but the commission is charged in the traded lots in this account.

3) Absolute Zero Account: The minimum account balance is $500 and the Flexible Leverage is up to 1:500 in this account. The spread start from this account is from 0.3 pips.

In order to open an account with them you need to follow the below simple steps:

1) Click on Register button: First of all you need to open the home page of IronFx and click on Register button at the top of the screen.

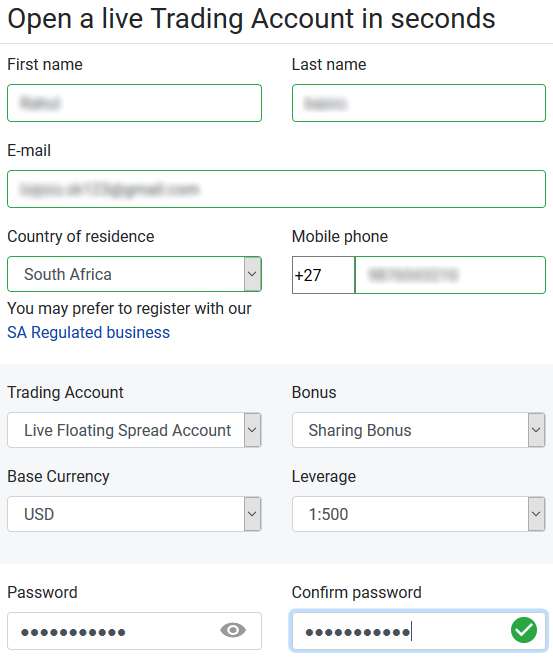

2) Open a live Trading Account in seconds: In this page you need to fill your basic information like name, email, country. You also need to select the trading account types and leverage in this page. Once done with filling the details you need to click on Open your Trading Account button at the bottom of the page.

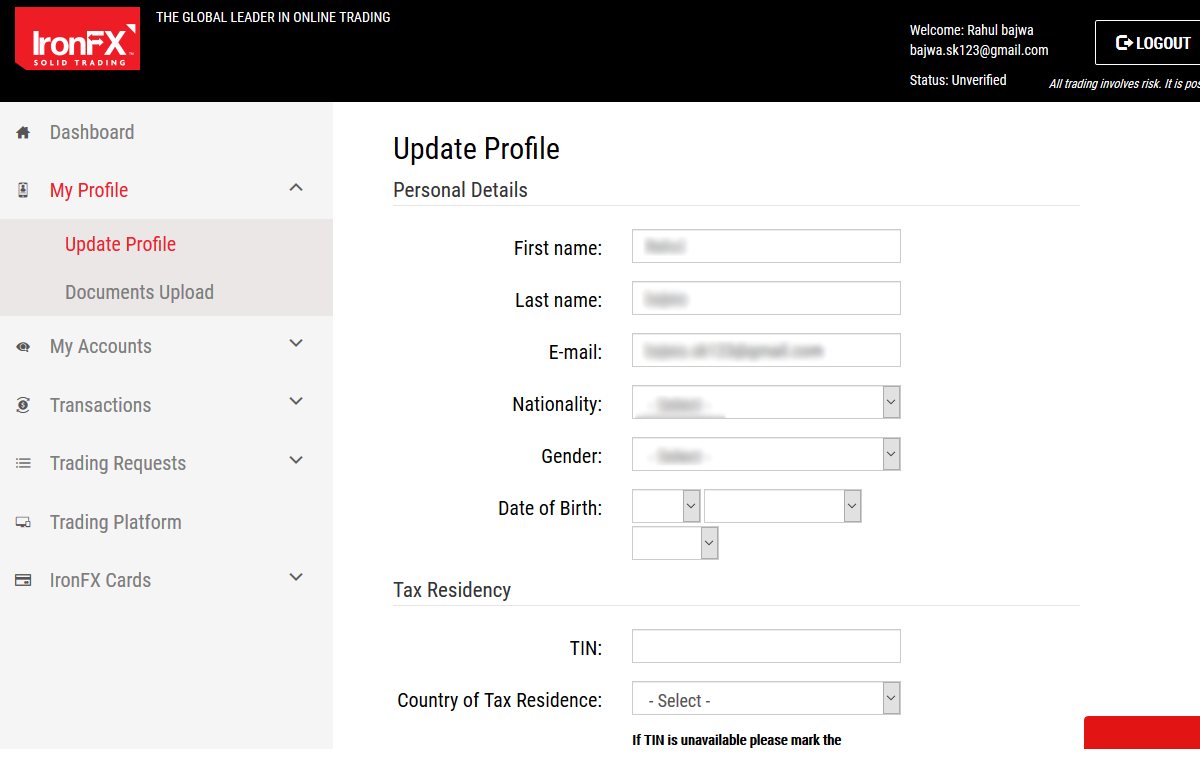

3) Update Profile: After login using your email and password, you need to update your profile by filling your address and other financial details by following the on screen instructions.

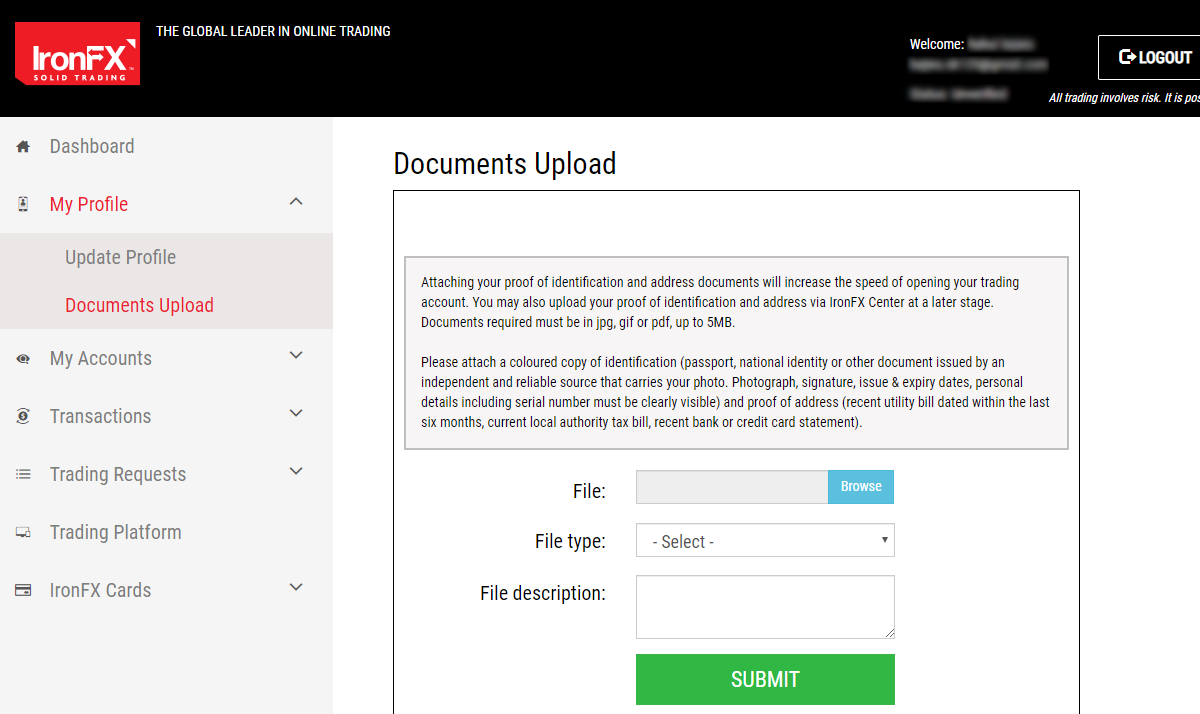

4) Document Upload: You need to upload your documents to complete the verification. You can upload your ID proof like passport, driving license and Address Proof like Electricity bill, Post-paid mobile connection bill etc.

Once done with uploading your documents, you need to wait for few hours as verification can take maximum upto 24 hours. When they verified your documents, you will receive a mail regarding account verification completion and all the details of your account will be attached in that mail.

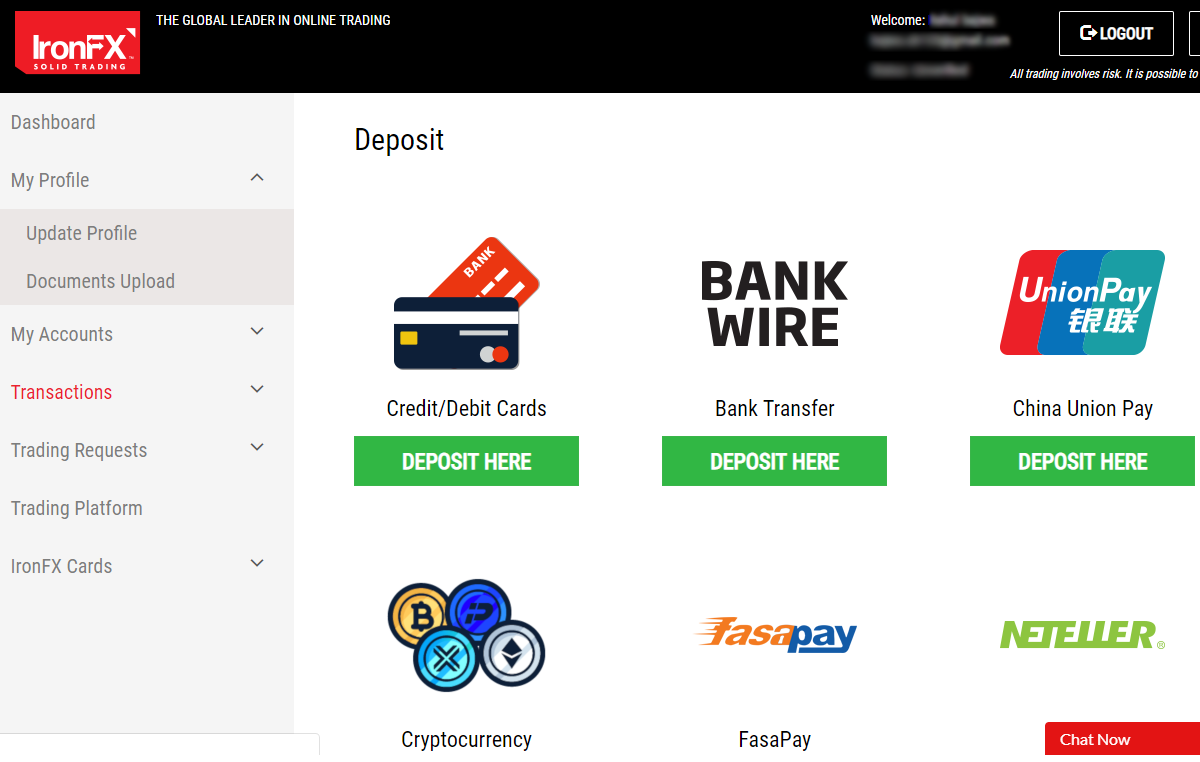

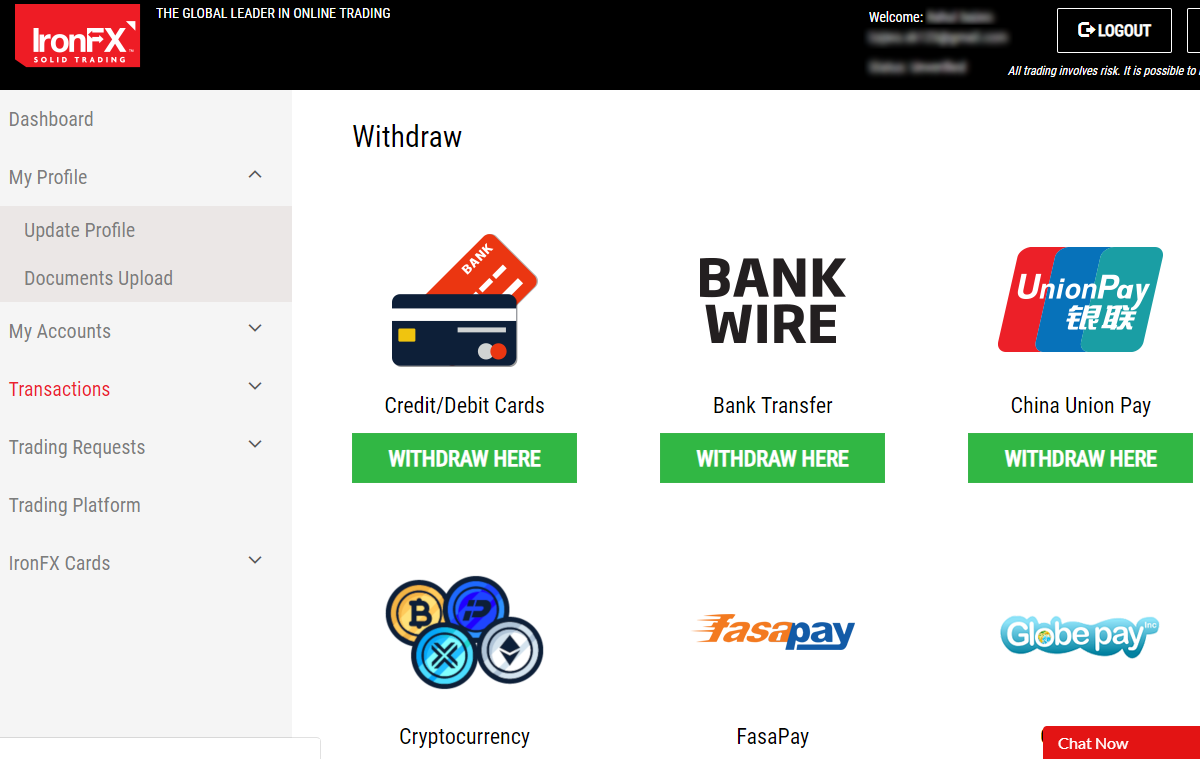

IronFX offers various deposit and withdrawal methods for their clients. There is no deposit fee by IronFx but the withdrawal fee vary depending upon the payment method that you will use.

Deposit can be made using any of the below methods:

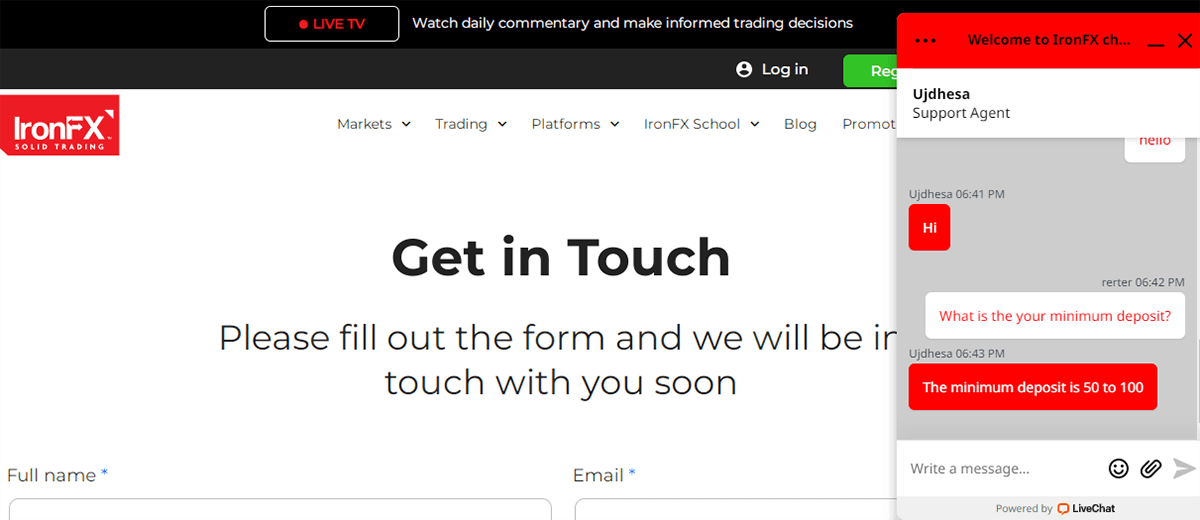

IronFx customer support is available for 24 hours during 5 days in a week i.e. from Sunday to Friday. You can contact them anytime using any of the below medium:

We appreciate them for their good customer support which is always available 24 hours from Monday to Friday. They always help every clients whether he is beginner or experienced trader.

They also have variety of trading platforms which can used after downloading and even have some platform which can be used without downloading. Moreover you can also synchronized it with your downloaded version.

Apart from this, good and easy to use trading platforms and demo account options are the boost for the beginners.

No, IronFX currently does not offer ZAR base currency trading accounts for its South African clients. But trader from South Africa can make deposit in ZAR which will be converted to account base currency like USD.

Traders can start from the Micro Account which has $100 minimum deposit. And this account has option between variable or fixed spread as trading fees.

Yes, IronFx is regulated as NOTESCO SA (PTY) LTD with South African regulator FSCA with FSP number 45276. Moreover they are also regulated with ASIC, CySEC, FCA.

Clients at IronFX SA can request withdrawal from their client panel by navigating to ‘Transactions > Withdrawals’. The funds or balance can be withdrawn via Bank transfer/ewallet or BTC and it can take 24-48 hours maximum depending on your withdrawal method.

"Do you have experience with IronFx? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review