IG Markets is among the oldest Forex brokers in the world. It is well regulated and offers tight spread across a plethora of trading instruments. The broker has a local office in SA but does not offer ZAR based trading Account. Read our detailed review before choosing the broker in SA.

IG Markets is a renowned global forex and CFD broker based in London. It is a subsidiary of the IG Group which was incorporated in 1974. IG Market is regulated by multiple top-tier regulatory authorities including FSCA in South Africa.

We liked the number of capital markets and trading instruments available at IG markets. It is a trustworthy broker for South African traders, but traders might have to pay a slightly higher fee to trade at IG Markets.

We have reviewed every attribute of IG Markets for traders in South Africa. Read the pros and cons of each segment before opening your account at IG Markets.

IG Markets Pros

IG Markets Cons

| 👌 Our verdict on IG Markets | #17 Forex Broker in South Africa |

| 🏦 Broker Name | IG Markets |

| 💵 Typical EURUSD Spread | 1.1 pips (with Standard Account) |

| 📅 Year Founded | 1974 |

| 🌐 Website | www.ig.com/za |

| 💰 IG Markets Minimum Deposit | R4000 |

| ⚙️ Maximum Leverage | 1:30 |

| ⚖️ IG Markets Regulation | FSCA, FCA, ASIC |

| 🛍️ Trading Instruments | 90+ currency pairs, 17,000 CFDs on Stocks Indices, Cryptos, Metals, etc |

| 📱 Trading Platforms | MT4 & MT5 for desktop, web & mobile |

IG Markets is regulated by multiple top-tier regulatory authorities including IFSC which makes it fairly safe for the South African traders. The broker has firm roots in international capital market services and has 17 offices in 14 countries of the world including Johannesburg, SA.

IG Group is the parent company of IG Markets which has a prolonged history in the financial capital market services. IG Group was instigated in 1974 and is publicly listed on the London Stock Exchange. The stock is named IG Group Holdings plc (IGG) and is also a constituent of the FTSE 250 index with a market capitalization of nearly 3 billion GBP.

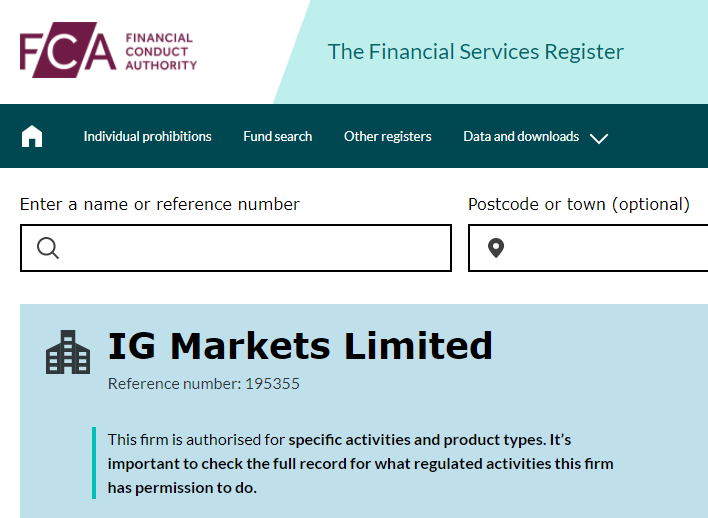

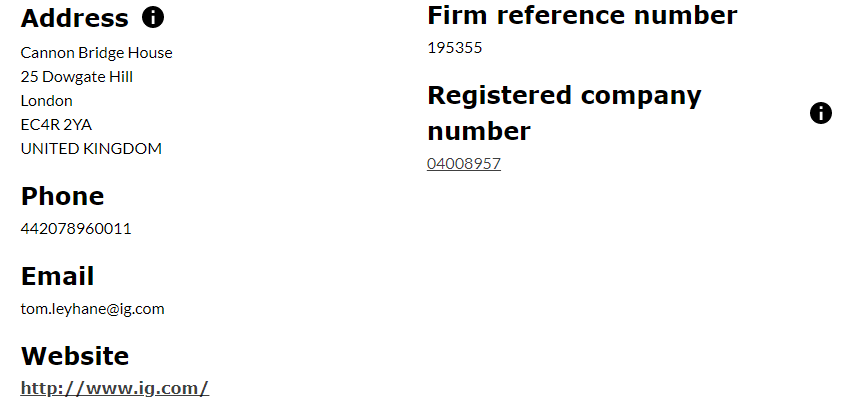

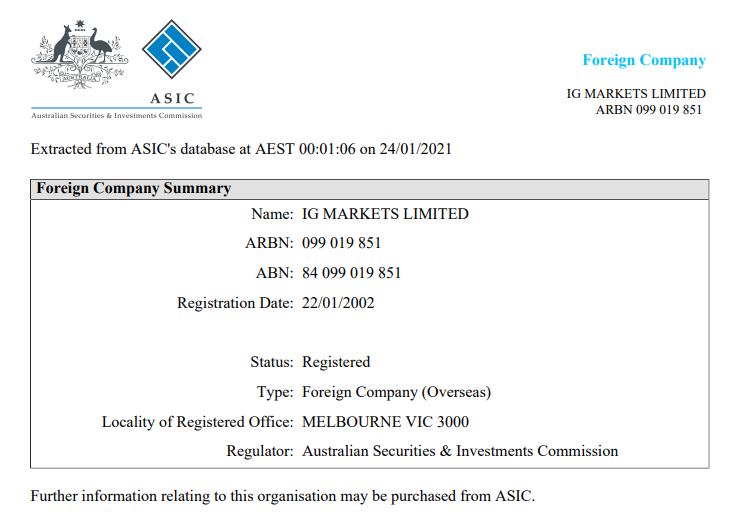

IG Markets is regulated by following regulatory authorities to ensure the safety and welfare of the traders. These regulatory authorities ensure compliance of broker’s activities in accordance with regulations of their respective jurisdiction.

FSCA (SA), FCA (UK), and ASIC (Australia) are the top-tier financial regulatory authorities. Apart from them, IG Markets is also regulated by DFSA, BMA, BaFIN, JFSA, MAS, etc.

The incorporation of IG Markets dates before many regulatory authorities. The broker withstood various financial crises and is reputed among the forex and CFD traders globally.

The only flaw we could find in the safety segment is that IG markets do not have a banking license or a parent banking firm. Clients’ funds are kept in a segregated bank account and we found the broker to be fairly transparent with its financial statements.

Compared to other regulated brokers in South Africa, IG Markets can be considered very safe.

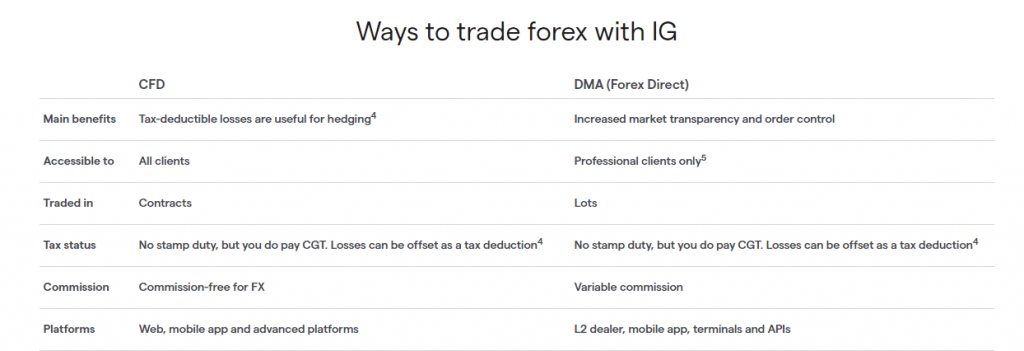

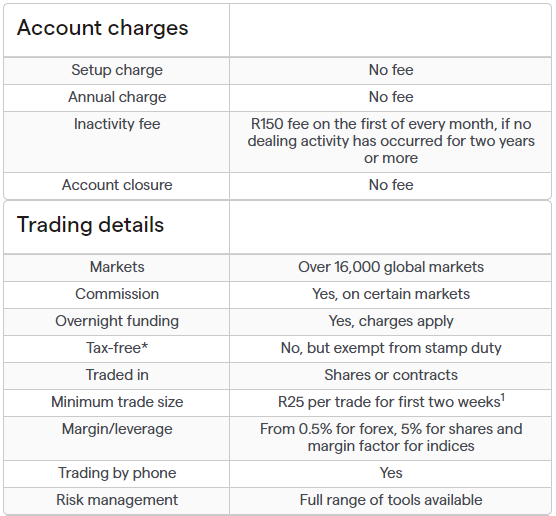

The fee structure at IG markets differs based on the instrument chosen by the trader. No commission is involved for forex trading but CFDs on stocks incur additional commission for opening a position.

For a better analysis of the fee structure, we have divided the charges into trading and non-trading fees.

Trading Fees at IG Markets

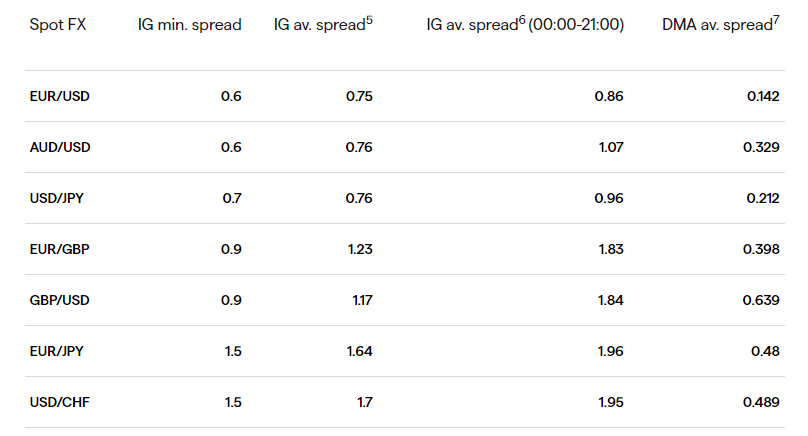

The spreads and commission at IG markets are decent as the commission is only charged while trading CFDs on stocks. Spread is the major component of trading fees at IG Markets which starts from 0.6 pips per lot for the currency pairs. For EUR/USD, we found the average typical spread to be 1 pip per lot. It does not offer fixed spreads for currency pairs as the spreads depend upon the liquidity in the market.

IG markets also provide an optional feature of ‘guaranteed stop’ to avoid slippage in the opened position. A commission is charged for the same. The guaranteed stop premium for EUR/USD is 1.2 pips per lot.

Traders who wish to trade with CFDs on stocks need to pay a commission which depends on the size of the contract. If the amount of commission is lesser than the fixed minimum limit, then the stated minimum commission will be charged to the traders.

IG Markets Non Trading Fees

The non-trading fees include all the charges that are incurred without executing trade orders. The account opening, deposits, and withdrawals are free at IG Markets.

However, traders in South Africa need to pay a currency conversion fee (0.5%) for trading with CFDs as ZAR trading account is not available at IG Markets. The broker also charges an inactivity fee of 12$ per month if no trades are executed on an active account for more than 2 years.

The non-trading fees at IG Markets are minimal as the currency conversion fee is the only major applicable fee. Although, trading with CFDs on stocks with a DMA accounts needs to pay a monthly fee to access live DMA prices.

Overall, trading, as well as non-trading fees at IG markets, are decent. It can be slightly higher than some of the regulated brokers in South Africa but is better than a majority of competitors.

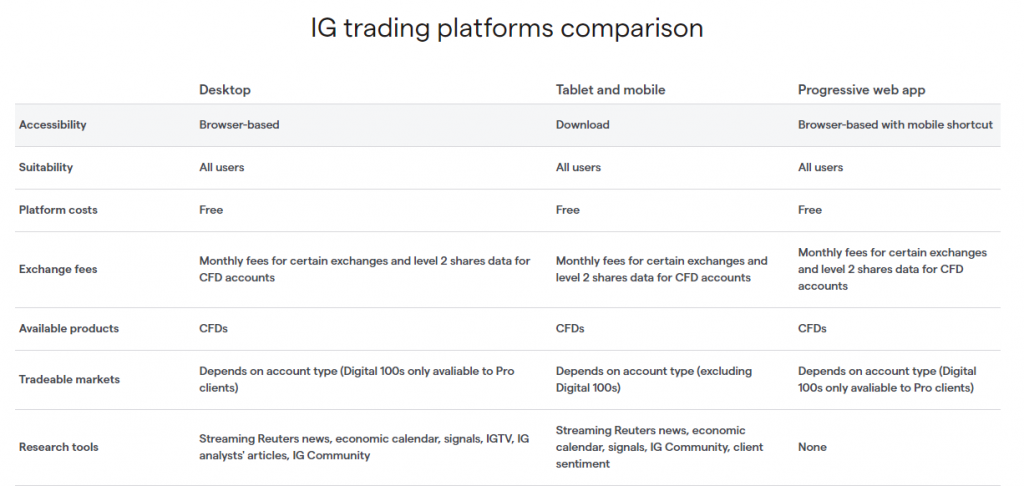

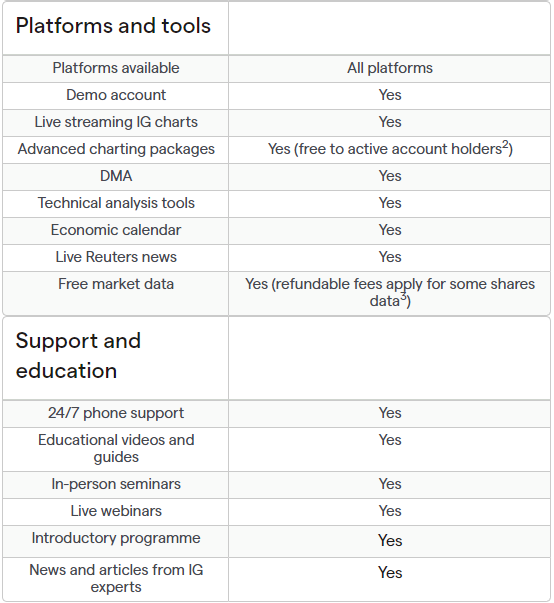

IG Markets offers a range of trading platforms for multiple devices. Traders have the option to choose the most convenient and productive trading platform from the following list:

IG Markets allow traders to choose from multiple trading platforms according to their suitability.

The customer support service at IG Markets is decent as no support executives are available on Saturdays and Sundays. Following is the review of each method to connect with support executives at IG Markets:

The customer support service at IG Markets is decent as the staff is friendly but connectivity can be difficult at times.

The account opening process at IG Markets is simple as they only offer a single standard account type. The broker does not allow ZAR-based trading accounts and the account can only be opened with USD, GBP, AUD, EUR, SGD, and HKD as a base currency.

The live trading account can be upgraded to a DMA account which is ideal for professional traders and incurs commission on forex currency pairs too. The DMA account type greatly reduces the spreads on each trading instrument. IG Markets also offers a corporate account in which trading can be done on behalf of a corporate or a group of people.

The account opening process is simple but can take more than 24 hours due to slower KYC processing. A demo account is also available that can assist the traders in gaining pre-requisite experience and learning basic trading strategies.

IG Markets has a single account type and unlike most of the brokers in South Africa, it does not offer a fixed spread, Zero spread, or ECN account types.

IG Markets allows traders in South Africa to choose from a broad variety of capital markets with a large number of trading instruments. All the following available instruments can be traded by opening the standard live account at IG Markets:

IG Markets provide a total of more than 17,000 trading instruments which is marginally higher than most of the forex and CFD brokers in South Africa. The maximum leverage is comparably lower but a large number of trading instruments is a major advantage of choosing IG Markets over others.

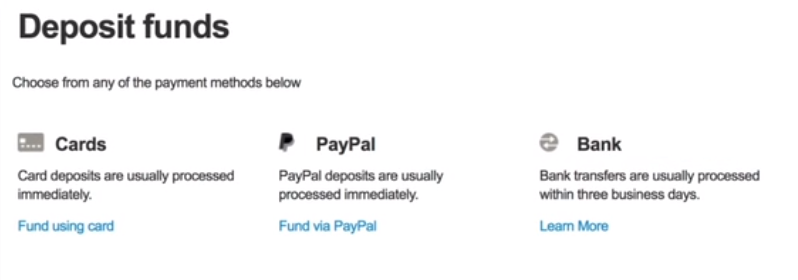

The deposits and withdrawals are convenient and free for most of the methods. Traders can use credit/debit cards, electronic payment gateways, or bank transfers to withdraw as well as deposit in IG Markets.

There is no lower cap on the deposit and withdrawal amount if you are using cards or electronic gateways for transactions. Traders depositing in ZAR will need to pay 0.5% of the amount as currency conversion fees.

The number of methods for deposits and withdrawals is limited while additional charges are applicable on transactions. Some of the regulated brokers in South Africa allow completely free deposits and withdrawals which puts IG Markets on the back foot.

At the time of the review, we couldn’t find any bonus programs for the traders in South Africa at IG Markets. However, they do have a referral program in which existing clients, as well as the newly-referred client, are rewarded when the new client executes a fixed number of trades. The referral program includes a lot of restrictions.

IG Markets isn’t an ideal choice if you are seeking bonuses like welcome bonus, deposit bonus, etc.

Yes, IG Markets is one of the oldest forex and CFD brokers in the world and is regulated by 3 top-tier regulatory authorities. The spreads are decent, and the higher number of available instruments and multiple trading platforms is another pro.

Professional Traders who wish to trade with safe and trustworthy forex and CFD broker will find IG Markets fairly suitable for themselves.

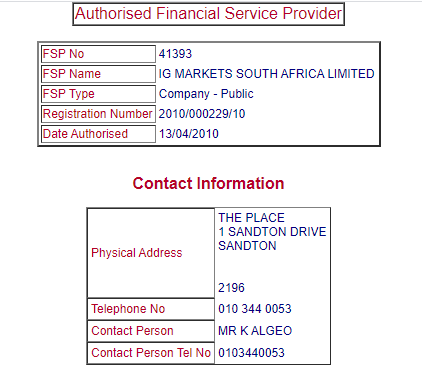

Yes, IG Markets is authorised and regulated as IG Markets South Africa Limited by the Financial Sector Conduct Authority (FSCA) in South Africa under the FSP number 41393.

No, IG Markets is not offering ZAR base currency account to South African Traders. So you need to pay the currency conversion rate which is around 0.5%.

The minimum deposit at IG Markets is $1 (16 ZAR) in case of bank transfer. But in case of card payment or Paypal the minimum deposit is $300 (4800 ZAR).

"Do you have experience with IG Markets? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review