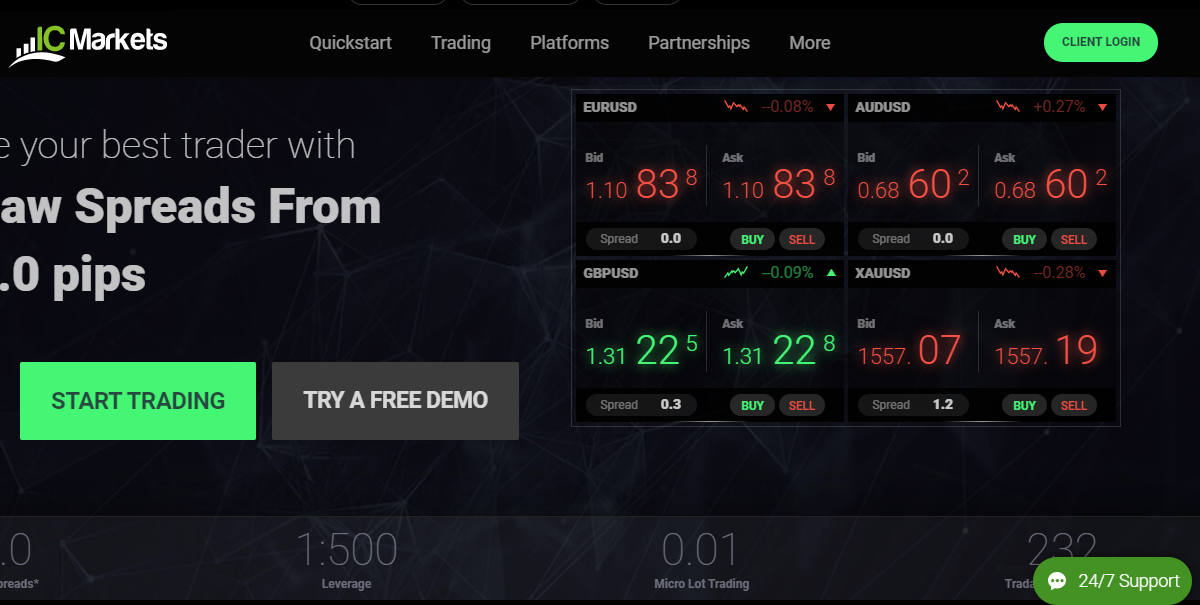

IC Markets is a reputed Raw spread forex broker that also accepts traders from South Africa. They have account with spreads from 0 pips & moderate commission of $7 per lot. But are they good?

IC Markets is a reputed global forex broker & one of the largest forex & CFD broker in terms of daily trading volume.

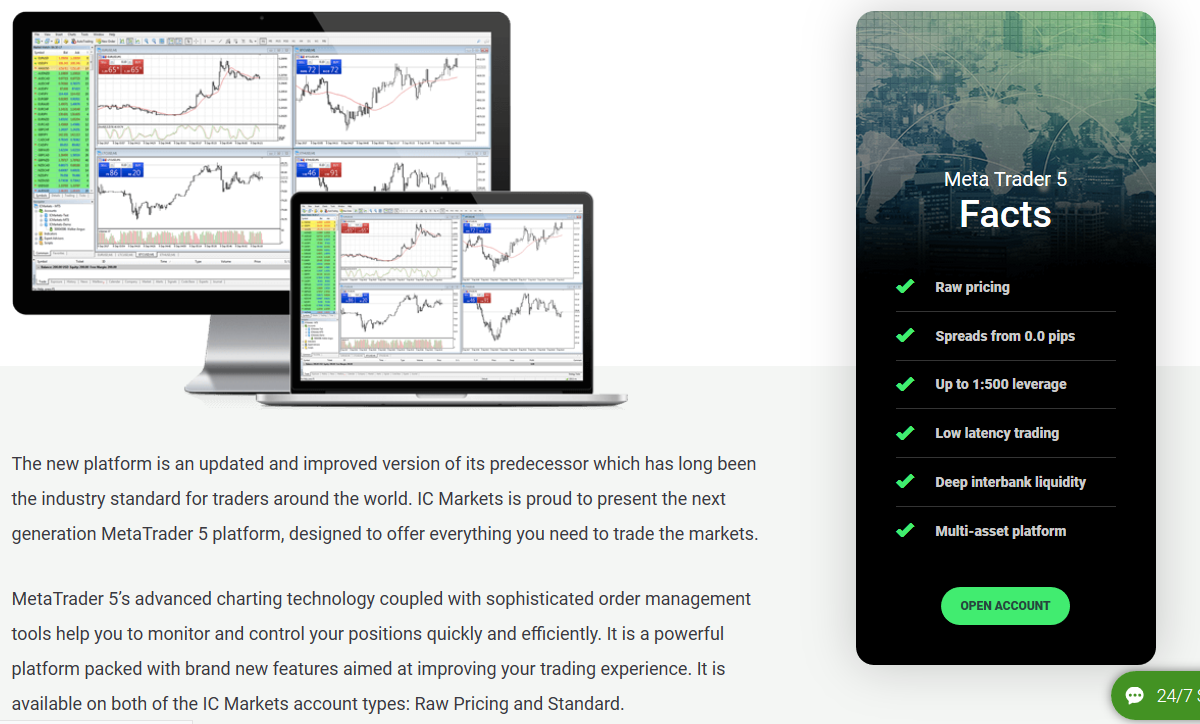

IC Markets are quite known for their simple Metatrader based low spread trading accounts. Their trading conditions are good overall, with multiple CFD trading instruments & high number of forex pairs.

Their support too is good. We tested their platform, fees, support, ease of deposit & withdrawals, and many other factors for this review.

Here is a quick review of IC Market’s pros & cons.

IC Markets Pros

IC Markets Cons

Table of Contents

| 🏦 Broker Name | IC Markets Ltd |

| 📅 Year Founded | 2007 |

| 🌐 Website | www.icmarkets.com |

| Registered Address | International Capital Markets Pty Ltd Level 6 309 Kent Street Sydney NSW 2000, Australia |

| 💰 IC Markets Minimum Deposit | $200 |

| ⚙️ Maximum Leverage | 1:500 |

| 🗺️ Major Regulations | ASIC, FSA. |

| 🛍️ Trading Instruments | Stocks, Currencies, Indices, Bonds, Commodities and Crypto |

| 📱 Trading Platforms | MT5 (MetaTrader5), cTrader, Zulutrade |

We consider IC Markets to be a safe broker for traders in South Africa. They are regulated with FSCA, and also with multiple regulators & are a well known forex broker.

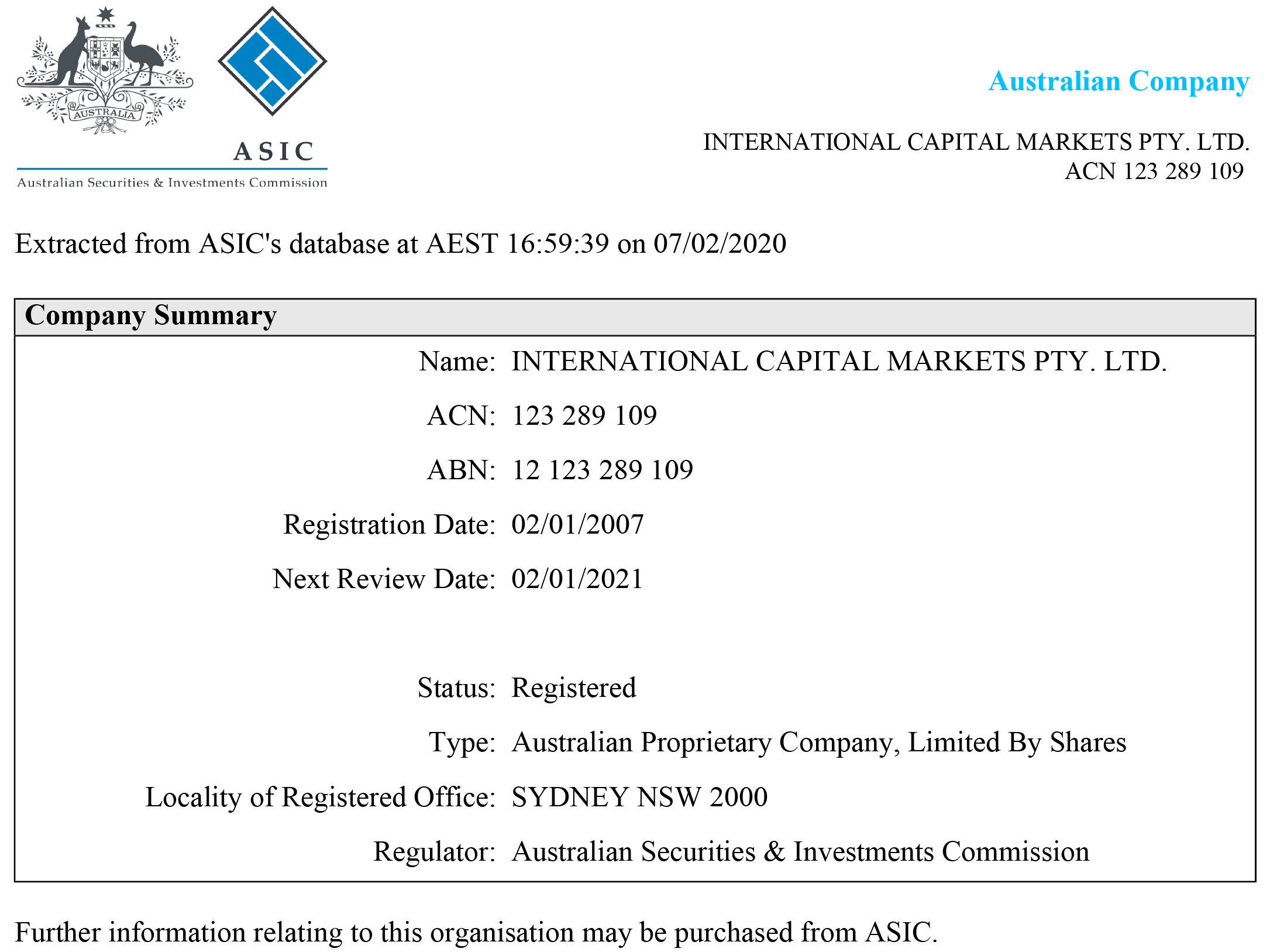

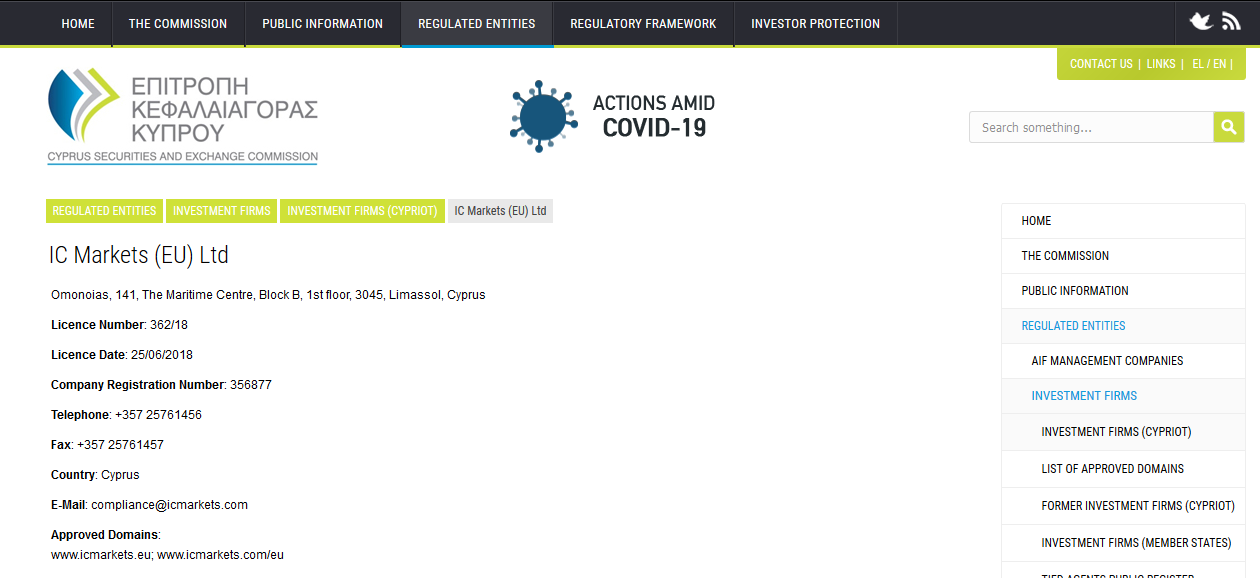

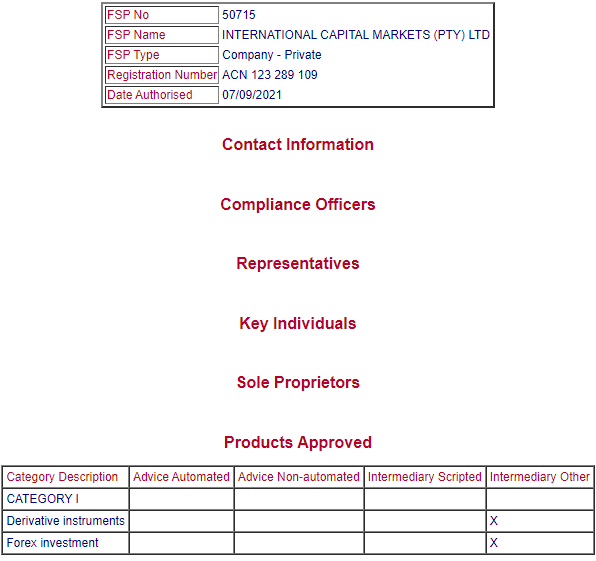

Here is a breakdown of their important regulations:

Overall, IC Markets is a low risk forex broker as they are regulated under multiple regulations.

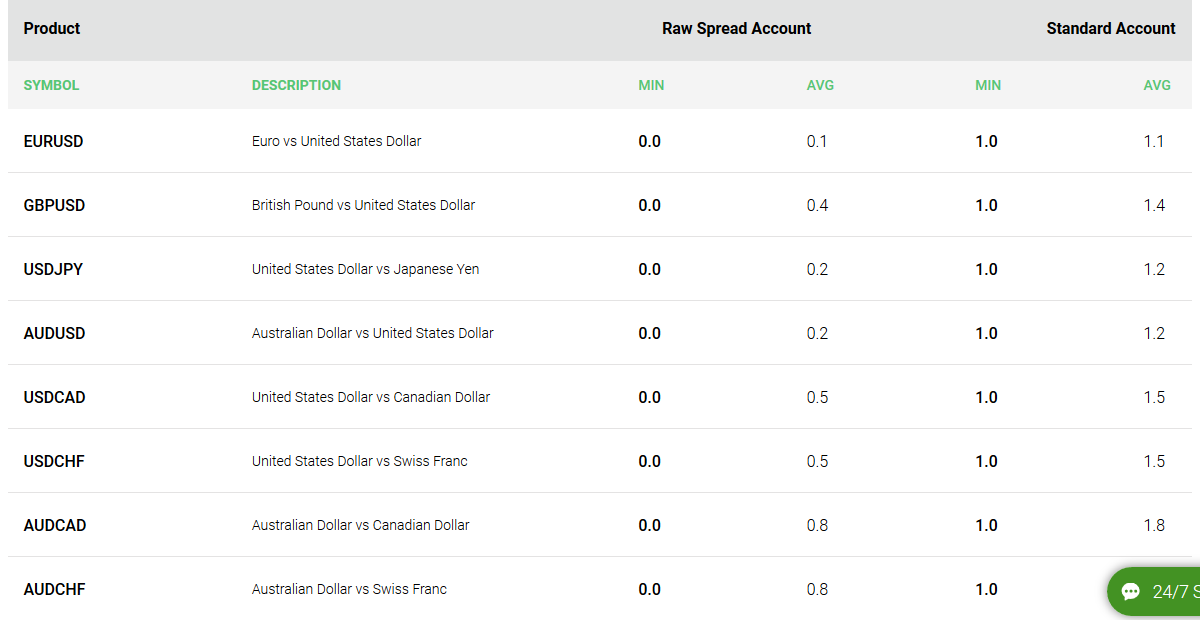

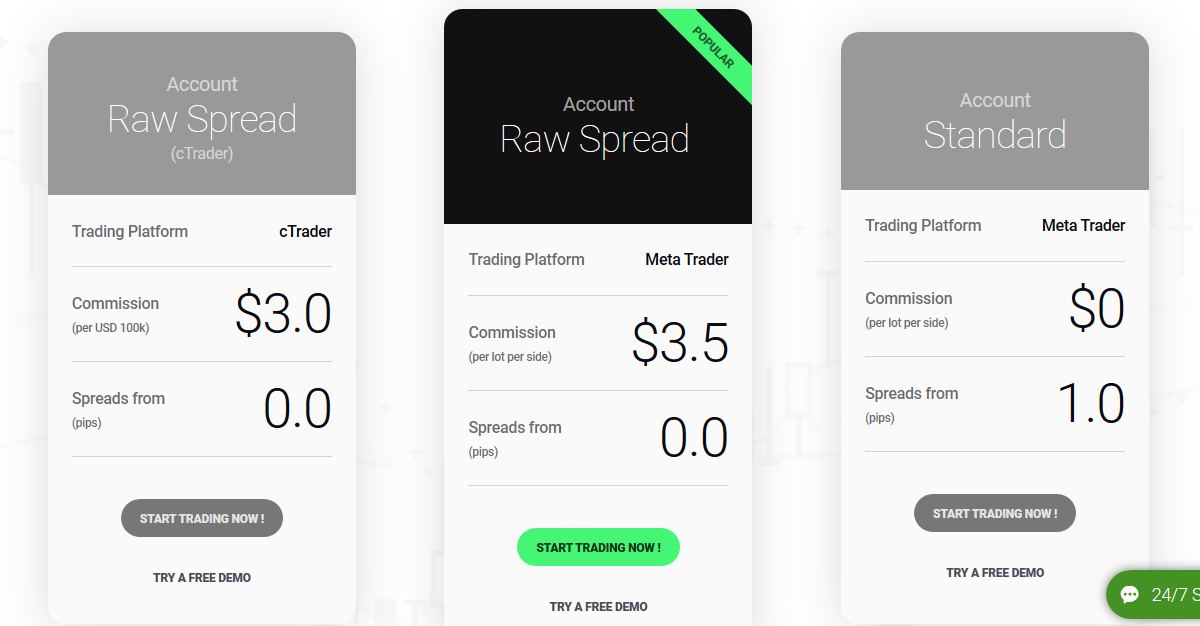

The fees structure & spread at IC Markets is quite straightforward & low overall compared to other forex brokers. Their spread is variable depending on the account type & CFD instrument that you are trading.

Here is what we noticed regarding their fees.

Their Commission per lot with MT4 platform is higher than some other ECN type brokers like Tickmill & FXTM, but comparable to HotForex.

Overall, the trading & non-trading fees at IC Markets are moderately low compared to other brokers during our tests. They have Raw spread account which has low spreads & moderate commission per lot.

The spreads with their Standard Accounts are low & there is no extra commission with that account type.

Like all other brokers, IC Markets to offer demo account & Standard accounts.

They offer Free demo account, and South Africa traders can easily sign up on their website for opening this account within few minutes.

Note: While IC Markets demo accounts reflect as accurately as possible the conditions of the real account. But it will never be possible to guarantee they will be identical to Real account market conditions.

The demo accounts are good for familiarizing yourself with the functions of their platform only. They should not be compared to Live market conditions.

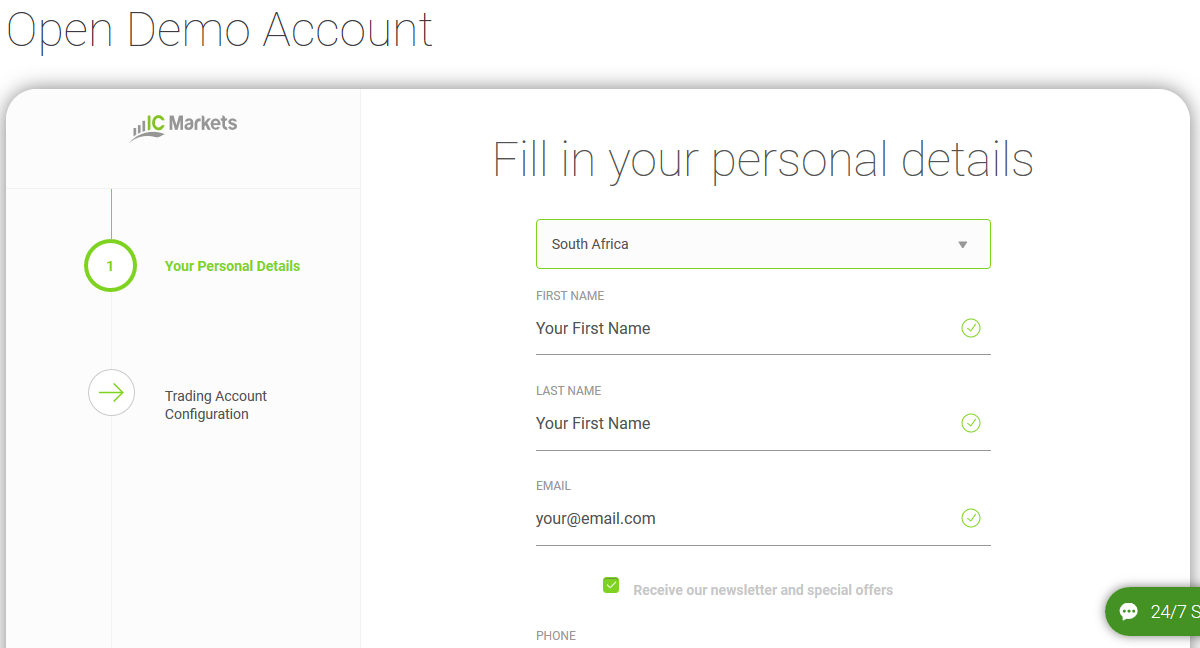

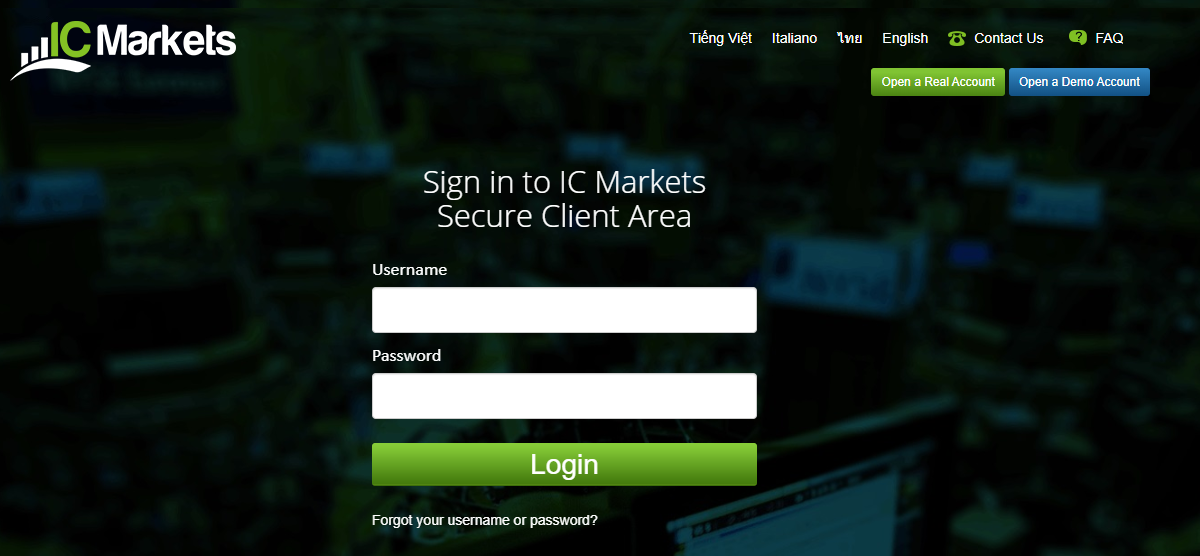

It is very easy to open account with IC Markets. You simple need to follow the below steps to open account with them.

Step 1) Click on Client Login: First of all at home page of IC Markets, you need to click on Client Login button which is showing at the top right side of the screen.

Step 2) Open a Real Account: Now you will be redirected to a page where you need to select Demo or Live account. To open account with them for trading you need to click on Open a Real Account button.

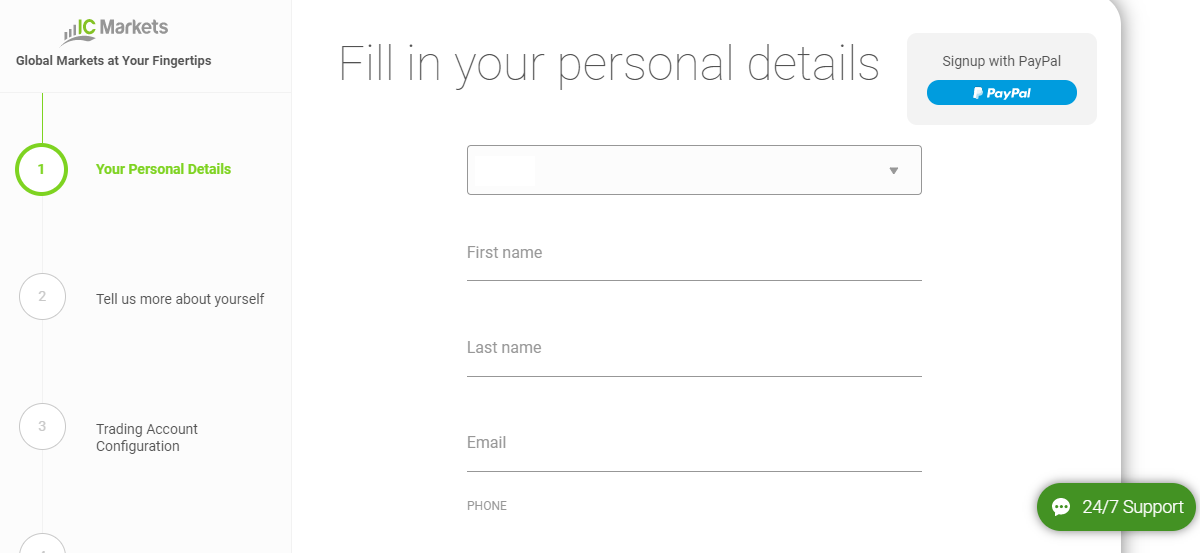

Step 3) Fill in your personal details: In this page you need to fill your all personal details like name, email, phone number and then click NEXT button.

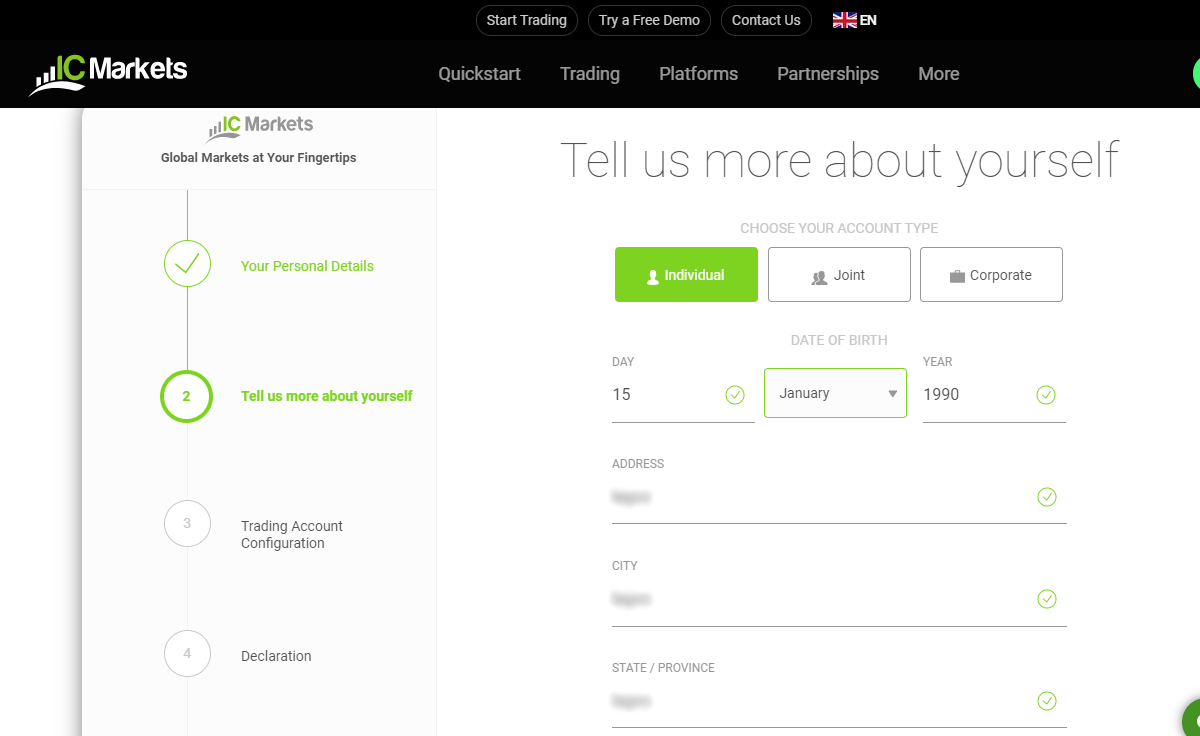

Step 4) Tell us more about yourself: At this page you need to provide more information about you like your date of birth, address, state, city, etc.

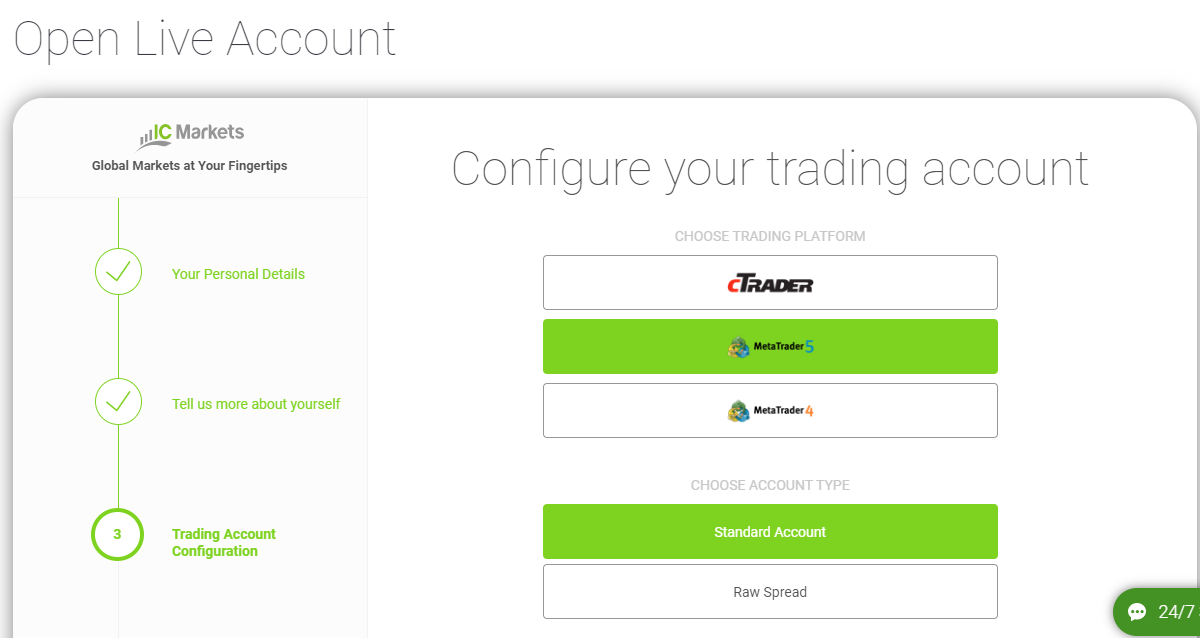

Step 5) Trading Account Configuration: Now you need to select the account type, base currency and trading platform before proceeding to next step.

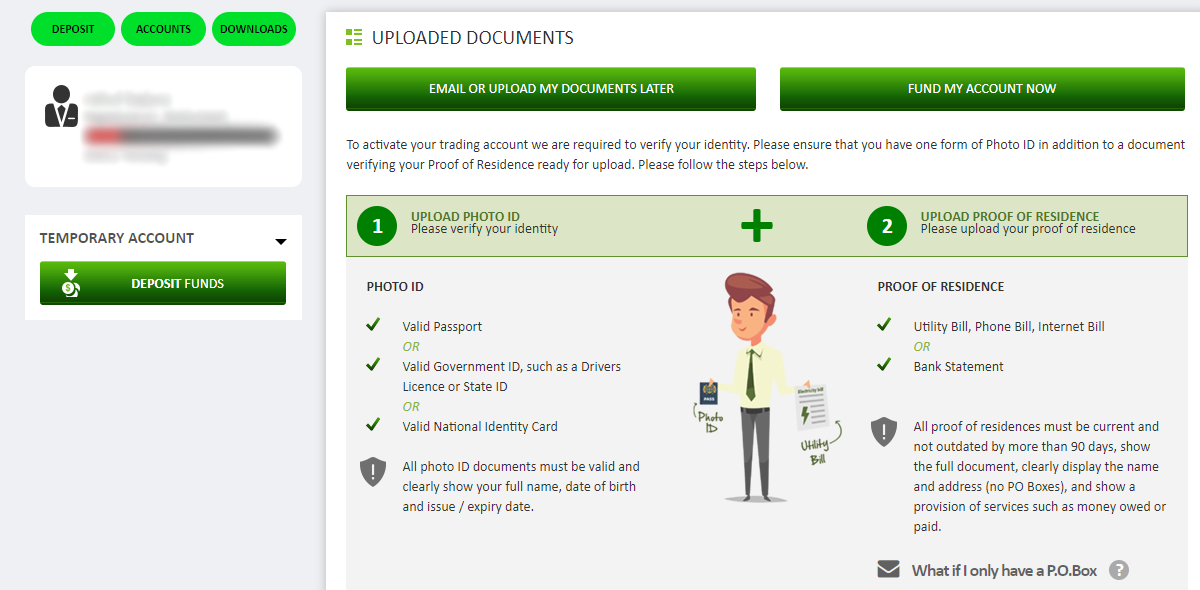

Step 6) Upload Documents: This step is very important to verify your account with them. You need to upload your documents like Valid Passport, Valid Government ID, such as a Drivers Licence or State ID, Valid National Identity Card. And the details in your documents should match with your details used while signup.

Step 7) FUND MY ACCOUNT NOW: At last you need to add funds to your account using your preferred method to start trading with them.

Congratulations! Account setup process has been completed. You can now check your email for confirmation email and the details of your account that required to start trading.

IC Markets offer Metatrader & cTrader platforms depending on your account type. You can choose this during account opening.

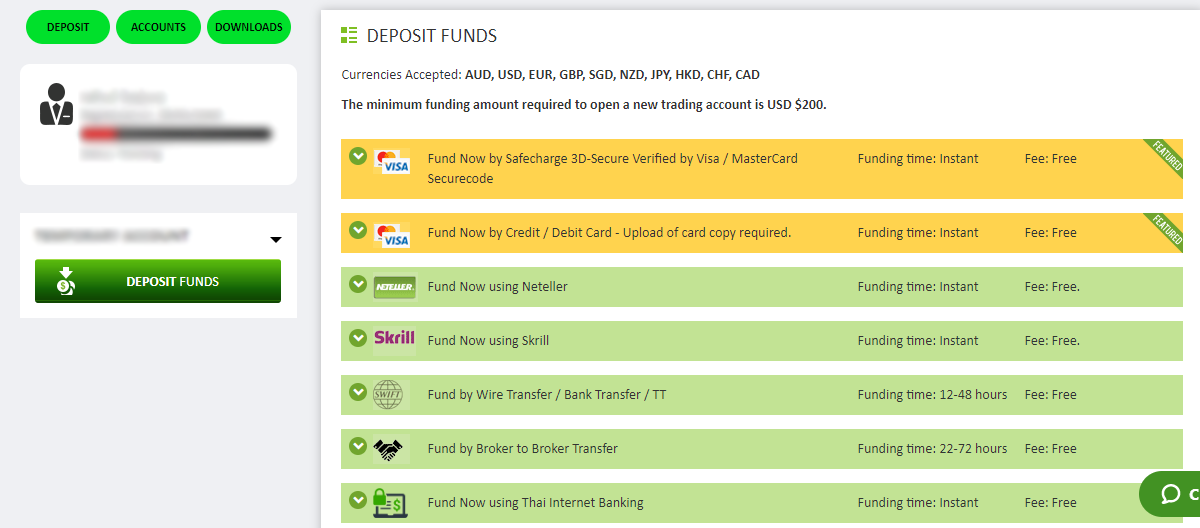

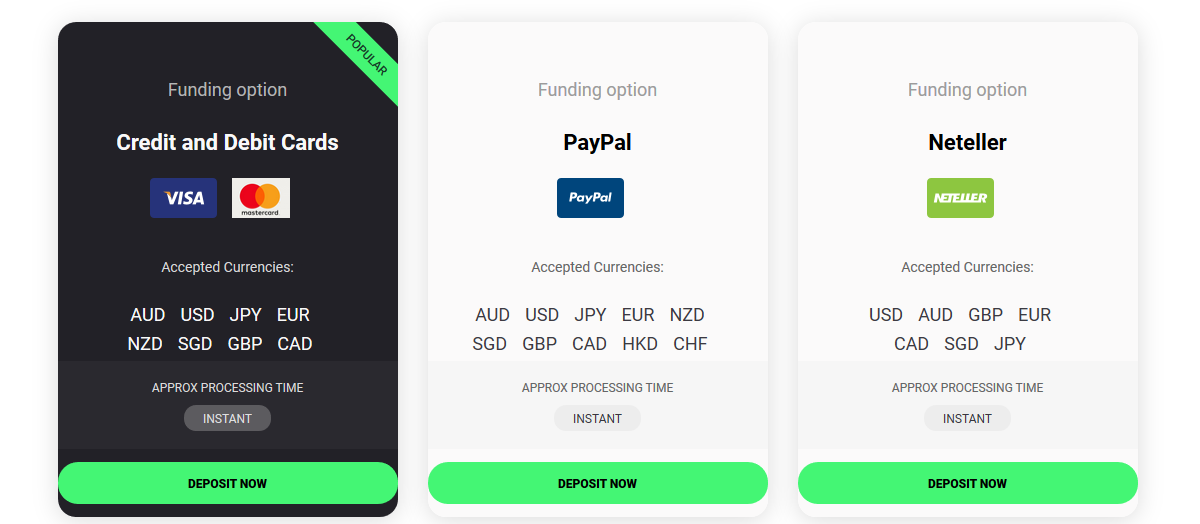

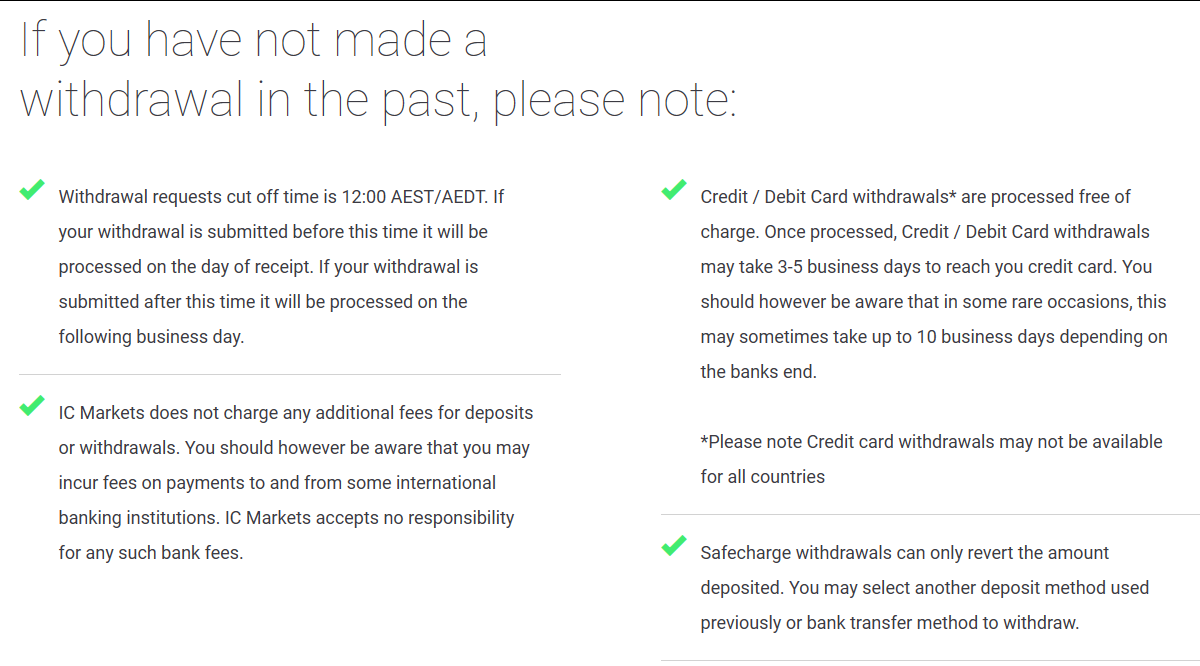

Funding & Withdrawals ate IC Markers are quite easy & fairly fast. IC Markets have a minimum deposit requirement of $200.

IC Markets does not offer bonuses or such promotions to their clients.

We asked their support regarding bonus & this was their response “As a fully regulated Forex CFD provider, we believe that those are not best practices for new clients.” And we agree with it.

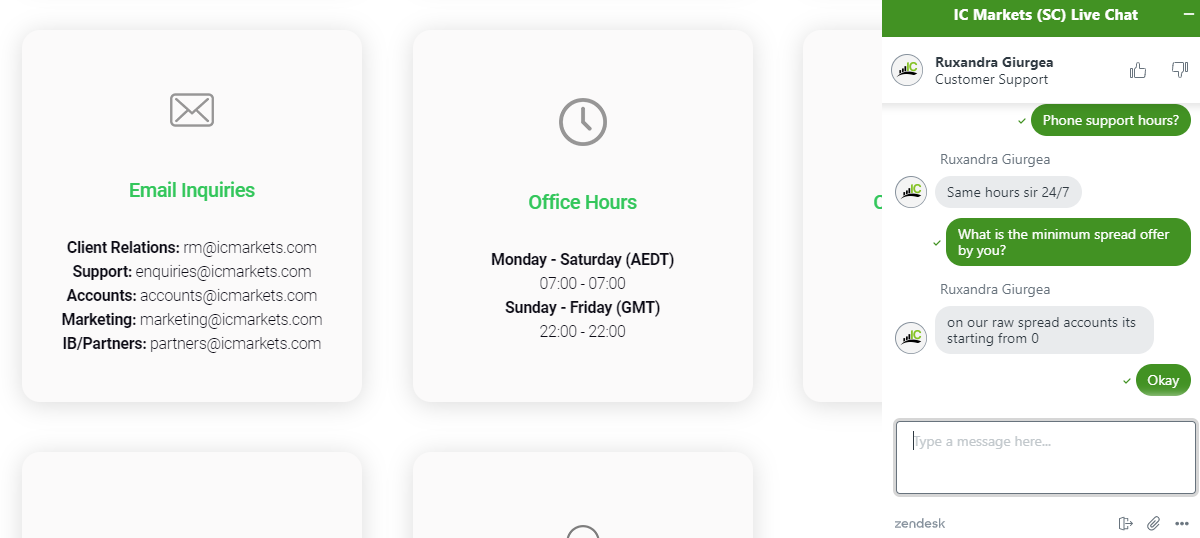

IC Markets offers support via 3 channels. We tested their support & here is what we experienced.

Yes. if you are looking for a reputed broker that offers Raw spread accounts & doesn’t charge for withdrawals.

IC Markets is regulated with ASIC, which is a reputed regulator. The broker also has authorized FSP no. They have very low spread with their trading accounts. Their execution policy & speed is quite good too, and we did not experience any issues with their platform.

Their Customer support is responsive & knowledgeable. Overall, we do recommend IC Markets if you are looking for a low cost ECN Type broker. You should choose their Raw Spread account for spreads from 0 pips & moderate commission per lot.

IC Markets has a minimum deposit of $200 with all 3 account types (cTrader, Raw Spread & Standard) available for traders in South Africa.

No, IC Markets does not offer ZAR base currency accounts at the moment. They support 10 base currency accounts: USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, CAD currently & traders from SA can open their trading account in any of these currencies. There could be high extra currency conversion charges if you deposit in ZAR.

IC Markets is regulated by 3 regulatory authorities i.e CySEC, FSA and ASIC. They currently are regulated with FSCA. We checked & IC Markets had applied for regulation with FSCA in 2021 & currently it shows as ‘authorized’ status, with FSP no. 50715. The registered company with FSCA is their Australian company.

The withdrawal method will depends on the method that you choose, and the method used for funding your account initially. Traders can submit request of withdrawal from the IC Markets client panel, and the time taken can vary from few hours when withdrawing via wallet to 2-10 business days in case of wire transfers.

"Do you have experience with IC Markets? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review