HFM is our recommended regulated forex broker. They are regulated with top regulators including FSCA (South Africa) & FCA in UK. We like their very low trading fee, zero deposit/withdrawal charges & 100% Bonus. Read our HFM Review to know more on why you should choose them or not!

HFM (HotForex) is a reputed forex and CFD broker that was established in 2010. It is the brand name of “HF Markets Group” which serves clients from around 200 countries. It is a popular broker, with more than 2.5 million live accounts registered.

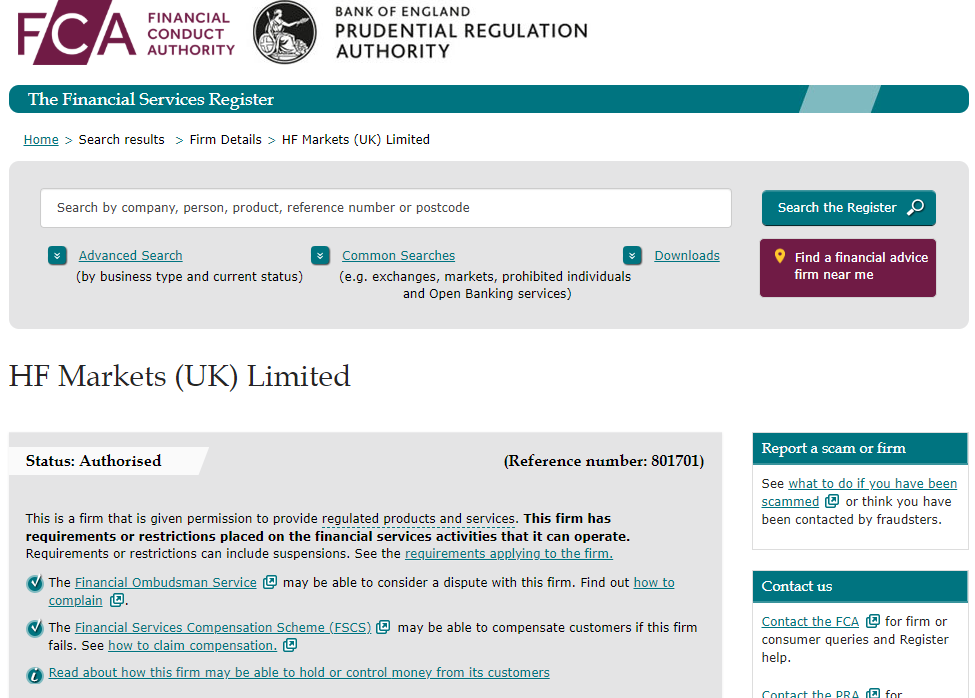

HFM South Africa is licensed by regulatory authority Financial Sector Conduct Authority (FSCA) with FSP Name HF Markets SA (PTY) Ltd since 2015. Plus, HFM Group is regulated by globally reputed Top Tier Regulators including FCA, CySEC. So we consider HFM as a safe broker for traders in South Africa.

HFM also offers ZAR Trading accounts, and very low spread for trading with Zero account. They have online bank trasfer option available for funding & withdrawals in SA. They also have local phone number for support.

The platform at HFM allows to trade a medium range of trading instruments including 49 Forex pairs, 100+ CFDs, and they have a reliably quick execution rate.

We compare the HFM South Africa’s fees, platforms, account types bonus & more!

HFM Pros

HFM Cons

Table of Contents

| 🏦 Broker Name | HF Markets SA (PTY) Ltd |

| 📅 Year Founded | 2010 |

| 🌐 Website | www.hfm.com/za |

| 🏛️ Address | KATHERINE & WEST, SUITE 18, SECOND FLOOR, 114 WEST STREET, SANDTON, 2021. |

| 💰 HFM Minimum Deposit | $5 (70 ZAR) |

| ⚙️ Maximum Leverage | 1:1000 |

| 🗺️ Regulations | FSCA in South Africa, FCA in UK, CySEC in Cyprus, FSC in Mauritius, DFSA in Dubai & FSA in Seychelles |

| 🛍️ Trading Instruments | 53 Currencies, 100+ CFDs on Spot Metals, Commodities, Energies, Stocks, Cryptos, Indices, ETFs & Bonds |

| 📱 Trading Platforms | MT4 and MT5 for PC, Mac, Web, Android, iOS |

HFM is a FSCA regulated forex broker in South Africa, so we consider it a safe broker for forex trading.

HF Markets is authorized and regulated under various jurisdictions:

‘HFM Investments Limited’ is licensed as a non-dealing forex broker under license no. 155 with CMA.

Being regulated by FSCA & with multiple globally reputed financial institutions, we believe that it is relatively safe to trade with HFM.

No, HF Markets is not approved as an ODP in South Africa. They had applied for ODP license but the current application status on FSCA’s search is ‘Application Withdrawn’. Refer to the below screenshot from FSCA’s website.

From the application, we can see that they had applied for ODP approval for their foreign entity ‘HF MARKETS LTD’.

Also, what it means is that HFM can only act as an intermediary to your trades under their FSCA license, they cannot act as the counter party or market maker for the instruments you are trading with them.

There are a few more things which we believe makes HFM a standout with regards to the safety of funds:

1. Insurance backed: Errors, omissions, negligence, fraud and various other risks which may lead to financial loss are covered by an insurance program for a limit of €5,000,000.

2. Segregation of funds: In the unlikely event of default of the HFM, the company cannot use the clients’ funds as they are segregated from the operational expenses of the company.

3. Accounts with major banks: HFM brand is international and its connections with global banks enables the company to provide high liquidity.

Also, HFM offer negative balance protection with all their trading accounts. So, you cannot lose more than your deposits in case the price goes against you by a lot in extremely volatile conditions.

We think HFM is okay with regard to the safety of funds. They are regulated in South Africa, 3 other Tier-1 & Tier-2 regulations, so the security of your funds is backed by these top-tier regulators.

Fee is important as it is something you pay to the broker every time you place an order. It is therefore helpful to go into the details before your signup with any broker.

We break down the fees into trading & non-trading charges. We’ve compared the fees at HFM with other brokers.

Let’s explore different charges at HFM South Africa:

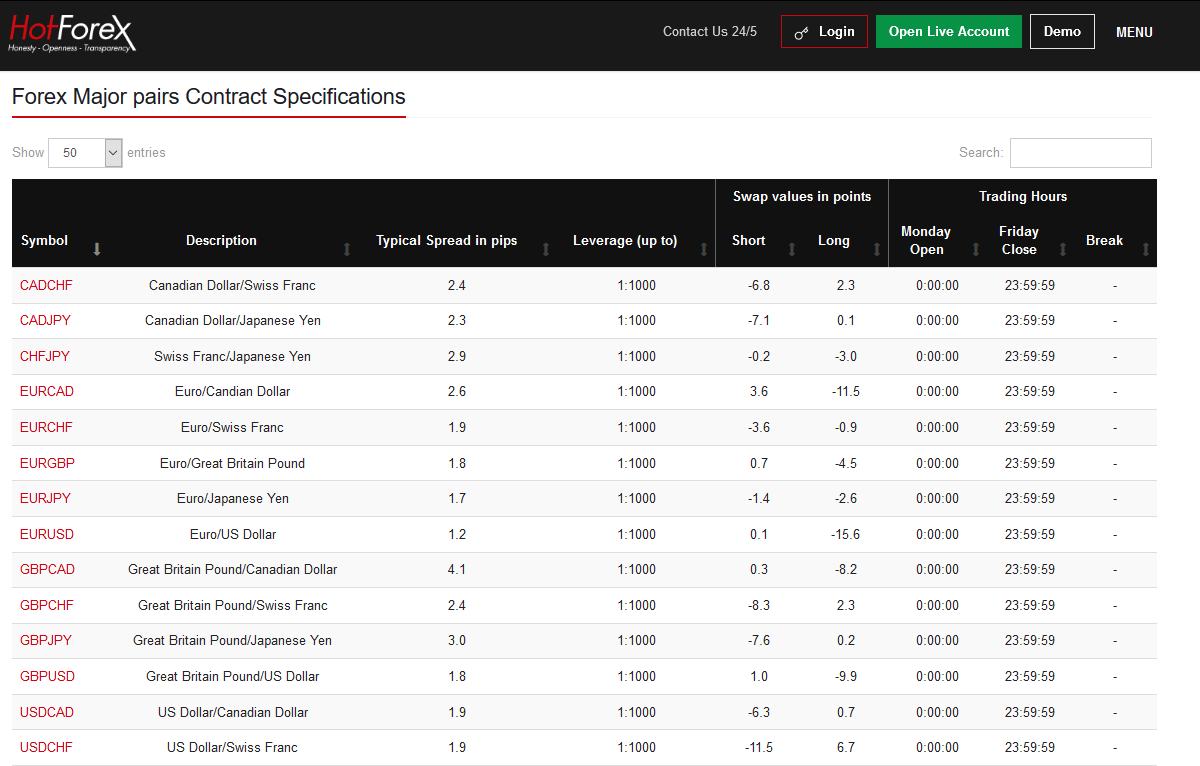

HFM offers the low typical spread for major instruments, in comparison with other regulated brokers like FXTM, Tickmill; but it is higher than Exness.

For CFD instrument like XAU/USD, their typical spread is 29 pips with all their 3 account types, and the spread is comparatively similar to other low cost CFD brokers XM, Exness & Tickmill for this instrument.

For a major pair like EUR/USD, the benchmark typical spread is around 0.1 pips for a Zero account and 1.3 pips for both Premium & Micro accounts, as per their spread comparison table.

For major pairs, the commission fee is $6 per standard Lot i.e. $3 to open the trade & $3 to close it. For other pairs, the commission fee is $7 per standard lot. This commission is similar to Exness’s Raw spread account, butbit higher than FXTM ($4.88 commission with Advantage account). Both these brokers offer similar Raw spreads & commission based ECN type accounts.

In Forex, the rollover calculation involves the difference in the interest rates of both currencies. Although rollover is medium, long-term traders like Swing traders need to consider the interest differential as rollover charges may build up.

For example,, for EUR/USD their Swap Short is 3.2 USD & Long is -10.2 USD for 1 Standard Lot. This data is as of February last year.

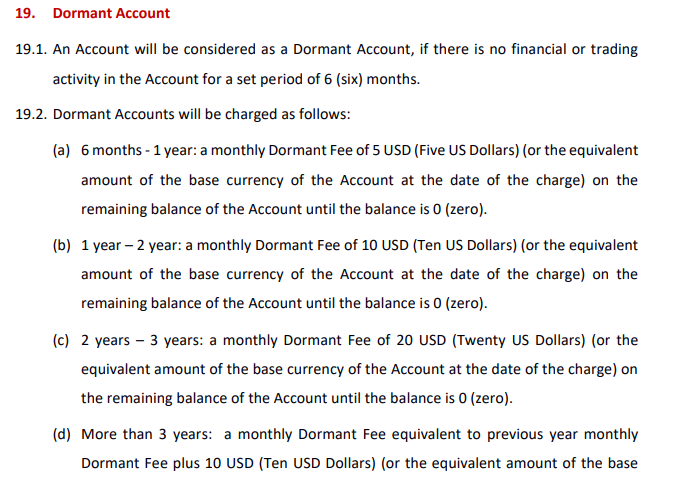

A live trading account at HFM SA is archived after 90-days of Inactivity in the account.

There is no account currency conversion charges at HFM South Africa if you hold the account in same currency as your deposit/withdrawal currency. Let’s say your account currency is USD, but you make deposits in Rand from your bank account, they you may see currency markup on the current conversion rates.

But if you deposit in Rand to your ZAR account at HFM, there is no markup or conversion losses for SA traders using HFM’s platform.

Overall, HFM’s fee structure is very transparent (you can easily scan all the spreads & there are no major widening of spreads during most active trading sessions), and we didn’t find to many hidden charges. Also, we noticed that HFM offers one of the lowest typical spreads for EUR/USD in the market even with Zero Account.

HFM offers different types of Accounts to its clients to suit a wide range of trading strategies. The currency accepted is either the USD or EUR or ZAR. HFM is a 100% STP broker, all the trades are executed as Market orders which means there won’t be any requotes.

HFM South Africa has a minimum deposit of $5 or 70 ZAR. This is the deposot required with their Micro Account.

HFM does offer 4 ZAR base currency accounts for traders in South Africa. These are Micro account with the lowest minimum deposit of R70, Premium account with R1400 deposit, Zero Spread account with R2800 deposit & the Auto Account.

HFM is one of the only few forex brokers that offers ZAR accounts to SA traders. The other brokers are XM, Plus500 & a few others.

HFM Demo account is designed to closely resemble the Live account thereby offering a seamless transition to the Live account for anybody new and test the market before putting their real money.

You will receive a $100,000 virtual money when you open a Demo account where you can test your trading strategies under the close to real market conditions.

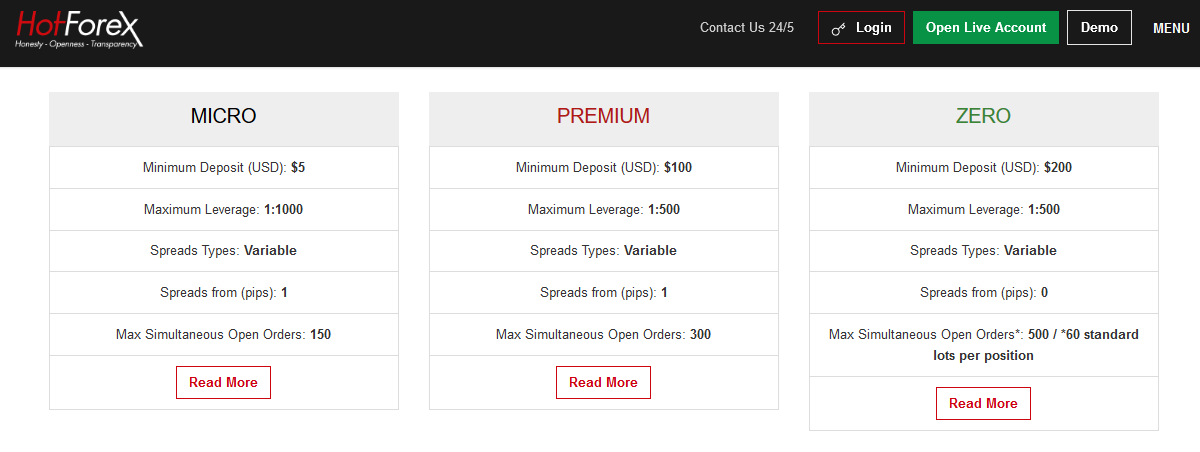

There are 5 different types of HFM Live Trading accounts.

The following features are offered with all accounts at HFM:

1. Negative balance protection: During the events of high volatility, sudden price movements may occur and margin calls or stop loss may not function correctly, which could lead to negative balance in the account. Under HFM policies, client is not liable to pay back a negative balance.

The minimum deposit required to open Live trading account at HFM South Africa is $5 or ZAR 85 approx. The minimum deposit depends on the account type that you sign up for.

Here are the Live trading accounts at HFM:

1) Micro Account ($5 Minimum deposit)

Micro Account has a minimum deposit of $5 (70 ZAR), a maximum leverage of 1:1000 & access to all trading instruments on HFM. You can trade micro lots with this account, at 40% Margin call level and 10% stop out level. No commission involved but you have to account for the variable spread (a benchmark figure of 1.3 pips). You can trade a maximum of 7 Lots per trade upto a maximum number of 150 orders.

2) Premium Account ($100 Minimum deposit)

Premium Account has a minimum deposit of $100 (1400 ZAR), a maximum leverage of 1:500 & access to all trading instruments on HFM. You can trade micro lots with this account, at 50% Margin call level and 20% stop out level. No commission involved but you have to account for the variable spread (a benchmark figure of 1.2 pips). You can trade a maximum of 60 Lots per trade upto a maximum number of 300 orders .

3) Zero Account (Recommended account for low fees & has $200 minimum deposit)

Zero Account has a minimum deposit of $200 (2800 ZAR), a maximum leverage of 1:500 & access to all trading instruments on HFM. You can trade micro lots with this account, at 50% Margin call level and 20% stop out level.

This account is more suitable if you are a day-trader who places a lot of trades, as you get very low spreads (a benchmark figure of 0.3 pips), but you need to pay commission based on the volume of the trade. The overall fee in the end is much lower. You can trade a maximum of 60 Lots per trade up to a maximum number of 500 orders.

The commission-based structure is transparent and is based on the currency pair type. This account has very low spreads hence we highly recommend HFM Zero account.

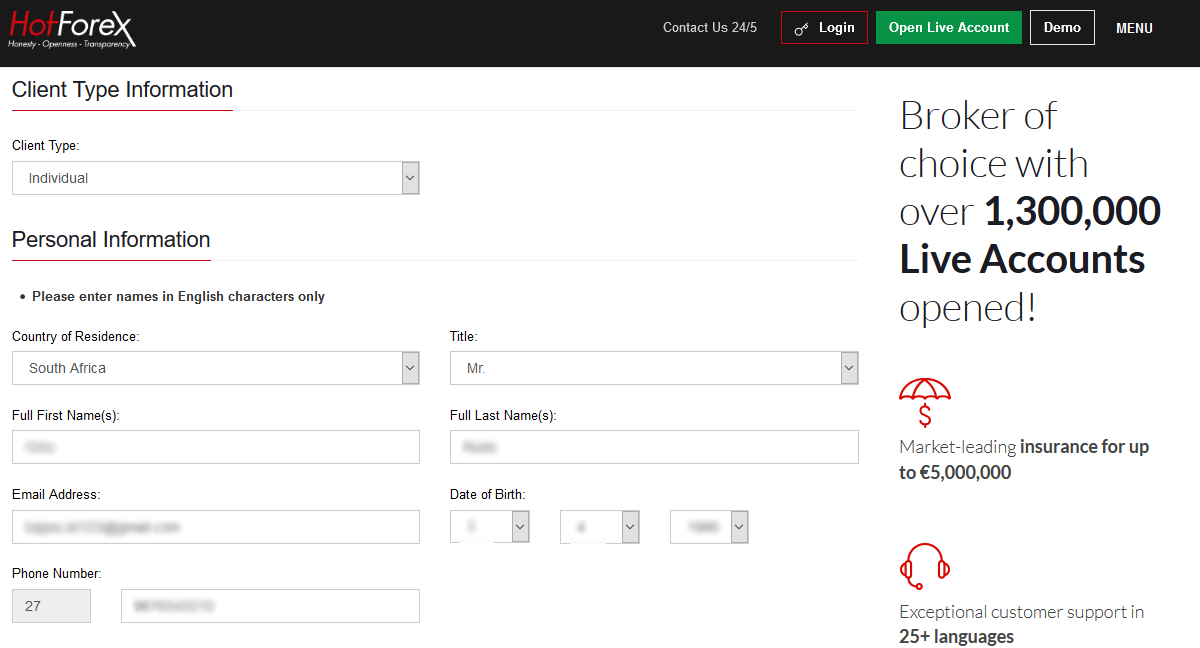

Opening account with HFM South Africa is very simple and does not take much time. You simply need to follow the below steps to open an account with them to start trading.

Here are some detailed and explained steps that you can follow to open and account with HFM:

Step 1) Open the home page: First of all you need to open the homepage of HotForex.co.za and after that you need to click on Open Live Account on the top right side of the screen.

Step 2) Open Live Account: Now you will be redirected to Open Live Account where you need to fill some Information as shown in this below screenshot.

Step 3) Click on Register button: After entering the required information while signup you need to agree terms and conditions and then click on Register button at the bottom of the page.

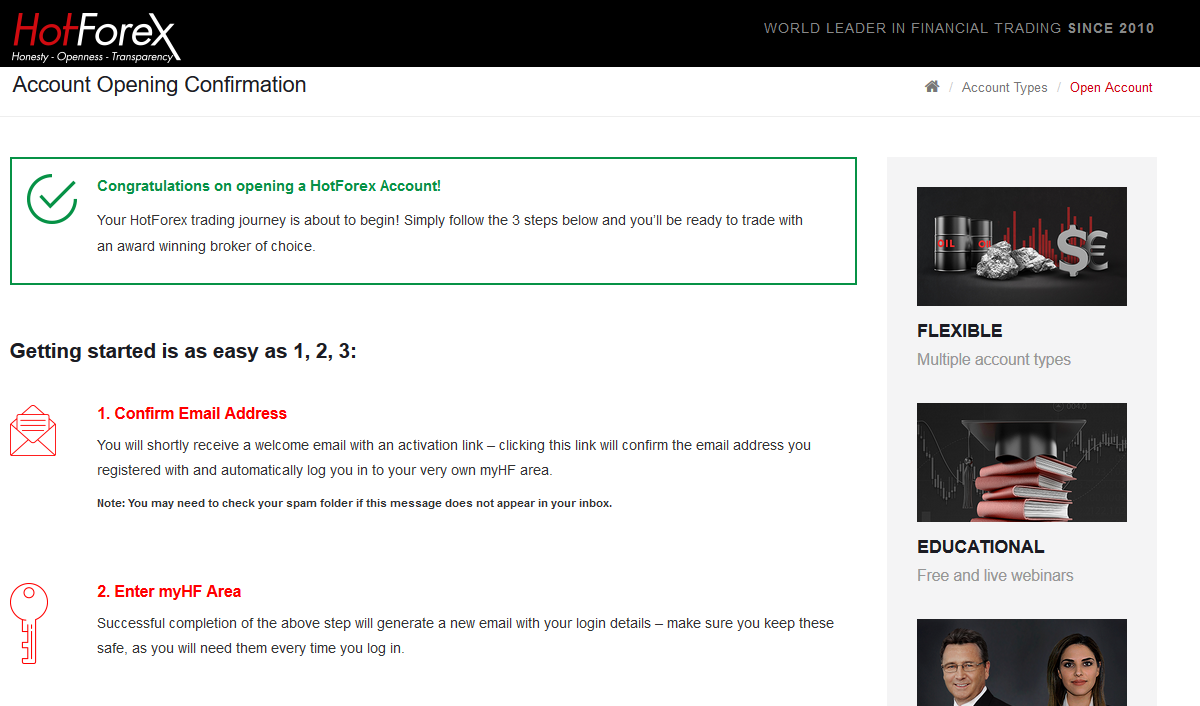

Step 4) Account Opening Confirmation: At last you need to verify the details and email used by you by clicking on the verification link sent to your email.

Step 5) Select Trading account & fill basic KYC details: After verifying your email you need to selecting the trading account type and then fill some basic information to complete the KYC details.

NOTE: We recommend you to start with Premium or Zero account as it comes with lower spread and very low commission fees.

Step 6) Account Verification: Once done with filling the KYC form you need to upload your ID proof and Address proof for the verification.

You can upload your any national ID proof like Driver’s license, Passport, etc. and for Address proof you can upload your Utility bill like telephone bill or electricity bill.

That’s All! After you have submitted your documents, HFM will normally verify your account in 24-48 business hours and revert to you on your email with account verified message. In case you don’t receive confirmation within this time, you should contact their support for an update.

HFM allows trading under 7 asset classes (the same as most other brokers). But their currency offerings are lesser than other South African regulated brokers.

Moreover, execution desk is available for all open orders, which means the clients can close or manage all their open positions over the phone. It is not available for Market orders or to open new positions.

Here are the instruments you can trade with HFM SA:

But the spreads are competitive for all the pairs they offer. You can have access to trade on 7 Major pairs and other Minor, Exotic currency pairs. You can even trade South African Rand against the USD/GBP/EUR.

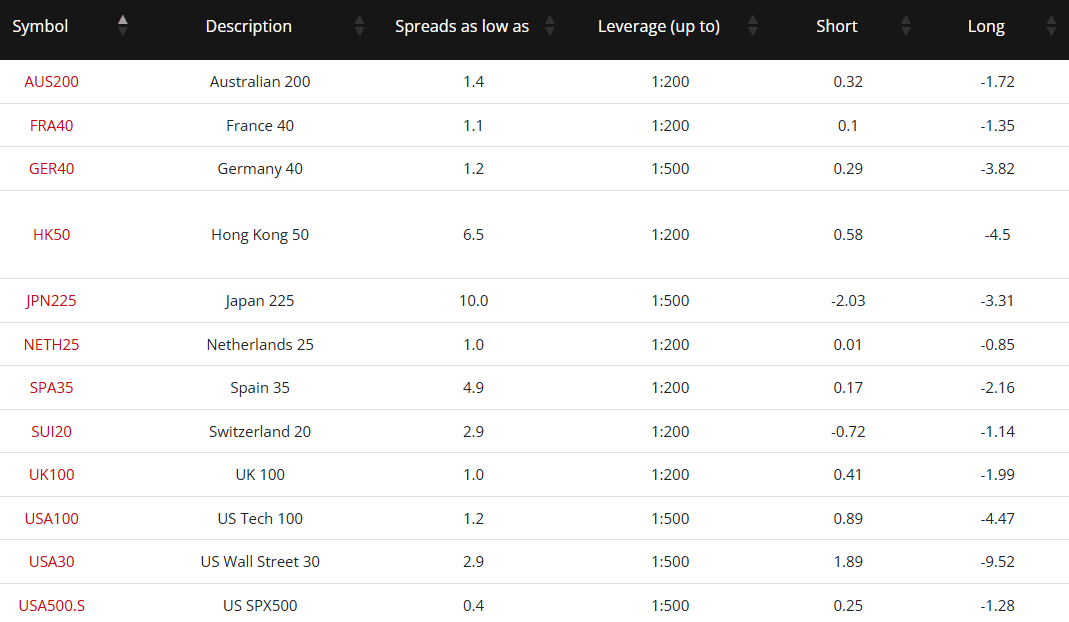

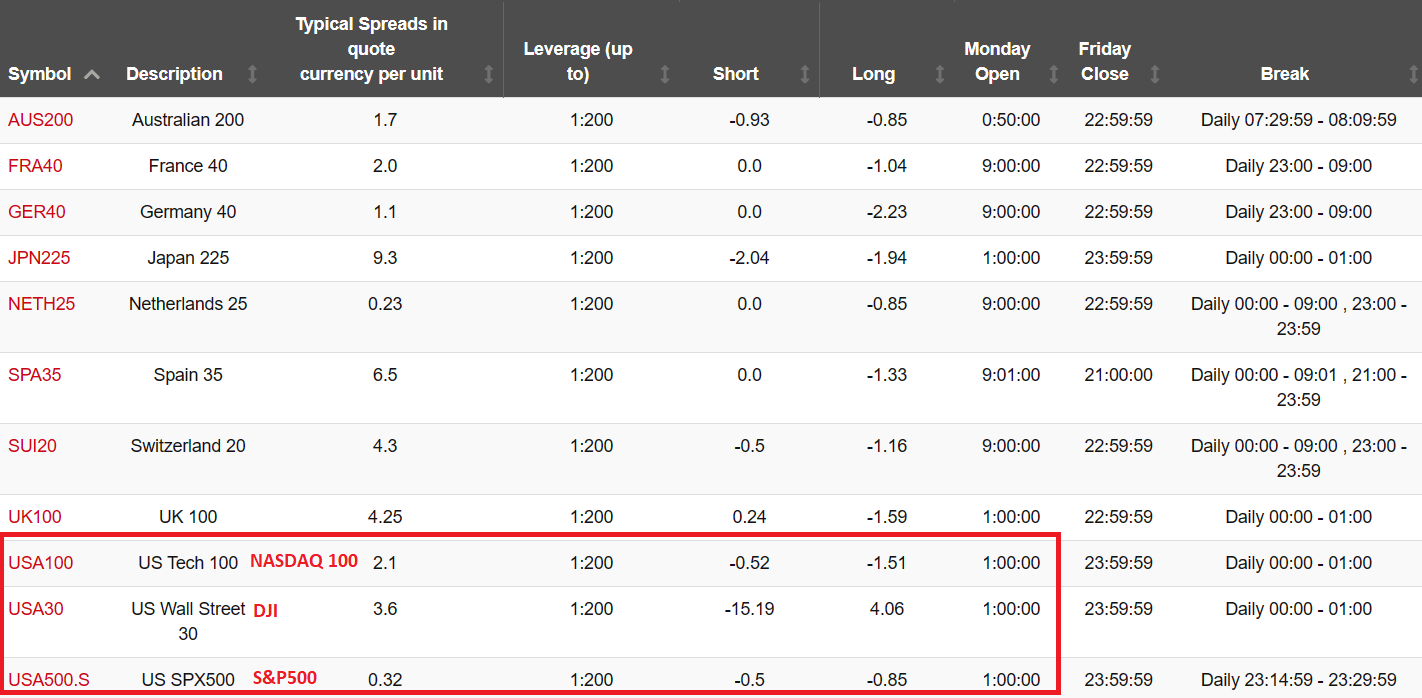

You can trade CFDs on major indices at HFM. You can either short sell or long the index. Depending on the market movement, there is potential for profits (or losses). You can trade both Spot market Indices (plural for Index) as well as Futures market (example futures of S&P500 or NASDAQ). Examples of Indices include NASDAQ, SPX, Australia 200, France 40, US Wall Street 30 etc. You can refer to their instruments page for the full details on various Indices on offer on HotForex.

They have advantages like low margin requirements, low transaction fee etc. but have a downside in high spreads where profits become less in case of low volatility. As many as 56 share contracts of reputed companies can be traded on HFM by the time of this writing.

You should check the exact margin requirements & the fees for every instrument at HFM. First, you must know the symbol for the index that you want to trade. For example, if you are to trade DJI (Dow Jones Industrial Average), which is a basket of 30 major stocks in the US, the symbol for that is USA30 at HFM.

Below is the screenshot of the major indices at HFM, for example.

Check the exact specifications like the Swap fees, trading hours, max. leverage, spreads & the overall fees. Click on that instrument for the exact specifications of the overall fees & other important points to know if you are trading an instrument on HFM’s platform.

Overall, we have found HFM’s list of instruments to be okay, and their fees is moderate for most of the instruments. The availability of multiple asset classes (including trading on major indices) is a plus. They also, support trading CFDs on 19 cryptocurrency crosses.

HFM has trading platforms for all kinds of trading needs, whether it be Desktop or on-the-go using mobile.

They offer MetaTrader4 (MT4)and Meta Trader5 (MT5) trading terminals which are as good a platform as any other (maybe the best). Their platform is perfect for forex and futures trading, and is developed by MetaQuotes Software Company. It comes with versions for PC/Mac, Android/iOS.

We discuss the mobile and web terminal in more detail in this review below:

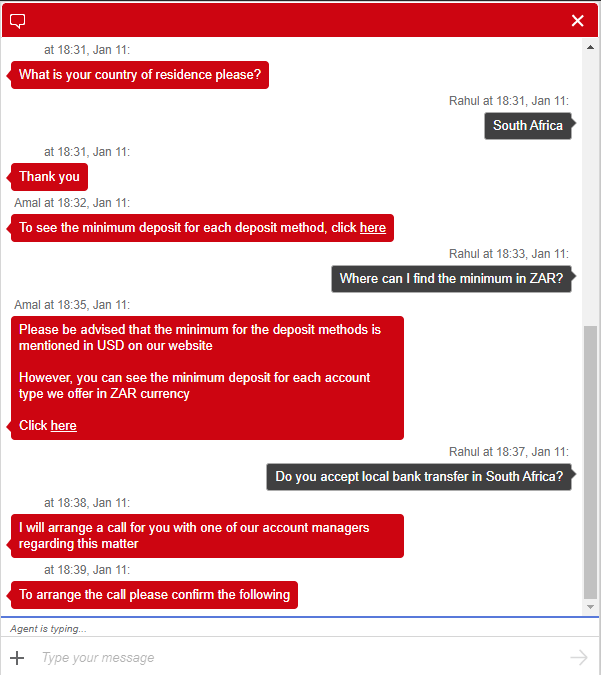

Deposit & Withdrawals of your funds at HFM is easy with multiple options available for traders in SA. Local bank transfer is the easiest option available.

Online Bank Transfer: HFM offers deposit via Online Bank transfers in South Africa. Most of the major banks are supported including FNB, Investec, NedBank, Standard Bank, Capitec Bank, Bidvest Bank & TymeBank. There is no fees with this method & funding is almost instant.

Visa/Mastercard and EWallets: You can also fund your account via your credit card, or using Skrill. The minimum amount is 5 USD, and the funds are reflected in your HF account within a few minutes.

Bank Transfer: SA traders can withdraw funds via Online transfer in bank account. The withdrawal time is up to 48 hours, but there is no extra fees with this method.

HFM is one of the few forex brokers that have local bank transfer option for funding & withdrawals. This makes them a better option than any foreign brokers, as you can deposit & withdraw funds in ZAR quickly without any extra fees.

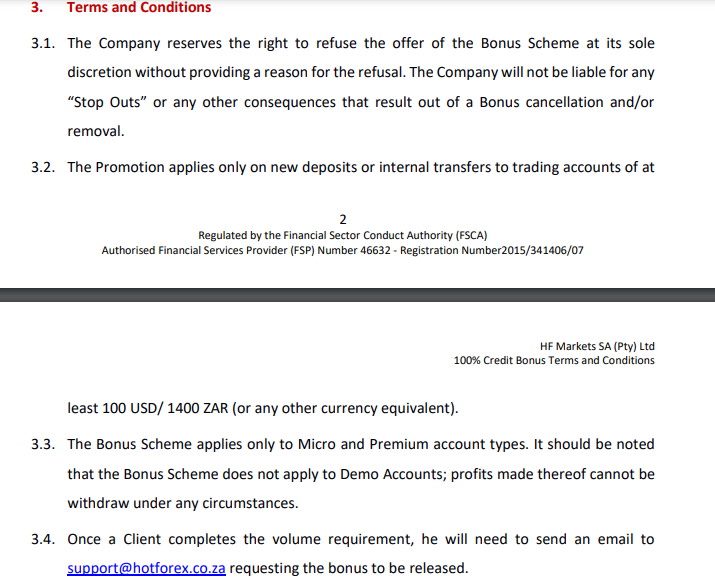

HFM has bonus available for South African traders including 30% rescue Bonus with $50 deposits, credit bonus with $100 deposit and a Super charged bonus with $250 deposit.

There are currently 3 active HFM Bonus offers available:

1) 100% Super Charged Bonus: HFM is currently offering 100% bonus for South African traders. The bonus is applies to every deposit of of at-least $250 or higher..

2) 30% Rescue Bonus: This is available for deposits higher than $50. This applies as a ‘Stop Out Bonus’ & cannot be withdrawn..

3) 100% Credit Bonus: This applies only to new deposits or Internal account transfers to Live Trading accounts. The minimum deposit required for this bonus is $100 or ZAR equivalent. The bonus can be withdrawn, provided certain trading volume conditions are met as specified in their terms..

Overall the bonus at HFM is good. We advise to contact their support at [email protected] if you have any questions regarding their bonus.

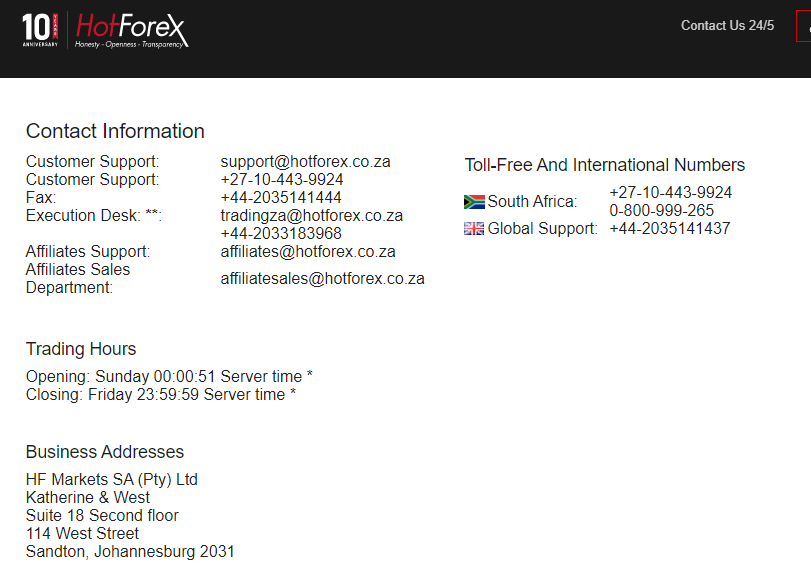

HFM customer support staff is very helpful and can be contacted easily via Live Chat Support, Email or by calling at their local South African phone number.

You can contact them any time i.e 24 hours in a day with the HFM Customer Support. But during the weekend Saturday & Sunday customer support is not available.

Helpful Live Chat Support (Recommended method for contact): Live Chat Support is available on their website which is very quick responsive. We did not experience about a minute of hold time to connect with Live Chat Support at HFM SA during our tests. The chat is available to visitors as well, but they normally ask for Country of Residence before answering the questions. We found the responses to be quite helpful.

Fair Email Support: You can send a mail to HFM at [email protected] to contact them regarding any query or issue. There are also different emails for various departments, all of which are mentioned in the Contact Us page of HFM. Normally they reply back within 12 hours via email.

HFM South Africa Contact Form: You can also submit your request to HotForex.co.za by filling the contact us form on their website. It is similar to email and their response time is also same.

Local Phone Support is available: The South African office of HFM have a local support line which is 0100207764, and toll-free numbers +27-104439924 and +27-800999265. You can also submit a call back request to their chat or email.

Social Media: You can also drop a message to them at their different social accounts like Facebook, Instagram, Twitter, LinkedIn, etc.

We found HFM South Africa customer support to be very helpful & available across multiple channels. Their support is quite good compared to many other CFD brokers in SA, plus they also have local phone support available.

They have local support & office in South Africa.

Yes, we do recommend HFM to South African traders.

On the plus side, HFM is regulated by Top-Tier regulators FSCA in South Africa, FCA in UK, CySEC in Cyprus, DFSA, so it is safe to trade with them.

Moreover, HFM is offers one of the lowest spread with their trading accounts out of all the brokers that we have tested so far. For a Zero Account, the benchmark average spread for a major pair like USD/EUR is 0.1 pips, which is the quite low when compared to other brokers, but it is not the lowest though in overall fees which includes $6 commission per lot.

The rollover and commission fees are also very clear and transparent, unlike some others who don’t advertise them publicly. Their fees is low to moderate, depending on the account type.

Plus, they also have a 100% deposit bonus for new customers! Their support is also very reliable as per our tests. They also have a local phone number for support in South Africa.

But, the support is not available during the weekends. Also, the number of trading instruments could be higher.

To sum up, HFM offers an end-to-end solution from on-boarding, to execution and settlement of payments. Anybody who wants to signup with HFM for trading forex & CFDs should consider it a safe & low risk broker.

HFM South Africa has a lowest minimum deposit of $5 or ZAR 70 with Micro Account. The exact minimum deposit depends on the account type that you choose. It is $100 or R1400 with Premium account & $200 or R2800 with Zero Account.

Yes, HFM does offer ZAR account currency option with account their trading accounts for traders in South Africa. The lowest deposit is R70 with Micro account. You can make deposit via EFT or local bank transfer.

Yes, HFM have NAS100 indices as a CFD instrument on their platform for traders in South Africa. The typical spread for trading NASDAQ CFD on HFM is 2.03 with all account types. The instrument is listed as US Tech 100 on their platform.

HFM is licensed by FSCA in South Africa. HF Markets SA (PTY) Ltd with FSP No. 46632 is an authorized Financial Service Provider since ’09/02/2016′ for offering ‘Derivative instruments’ as Intermediary Other under Category I.

You can withdraw funds via bank transfer in ZAR, and the minimum amount is R70. There are other methods as well like Skrill & Cryptos (only available if you have deposited funds via these methods). Also, the bank transfer can take 24-72 hours.

HFM charges traders spread & commissions, depending on your account type. Their fees is quite competitive, with their spread of 1.3 on average for EUR/USD, 1.7 for GBP/USD 0.29 for Gold/US Dollar CFD, 26 for BTC/USD CFD with Premium account type (no commissions with this account type). They have Zero Account which has Raw Spreads from 0 pips & upto $7/lot commission. Also, HFM doesn’t charge any extra fees for deposits or withdrawals from traders in South Africa.

"Do you have experience with HFM SA? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Comments are closed.

The support staff is great at their services i had found out they are humble enough replying my queries and on the quicker notes resolving them too.

Very popular over all in South East Asia, many of my trading buddies do trade with Hotforex due to ease of access and stability. no slippage experienced so far which is always a good sign, I’ve made a couple of withdrawal so far with no hick ups. Great broker.

Last withdrawal made was July 6th, total amount of 560 usd, received in Skrill account on July 7th. This is my 3 withdrawal since joining last April 2020. This broker is really good.

HotForex is manipulating the market. When you make a small deposit, they manipulate the market till you blow your account. I started well but since first blow they’re manipulating the market, almost like they red flagged my account. Really disappointed.