Forex.com is a well regulated forex and CFD broker. They offer wide variety of trading instruments through multiple account types. The broker might not serve well to traders in South Africa as they do not accept ZAR deposits and don't have a ZAR based trading account. Read our honest review of Forex.com before opening your account.

Forex.com is a US-based international forex and CFD broker launched in 2001. It is a market maker broker but also has a separate STP pro account in which trades are sourced from global banks and top tier liquidity providers.

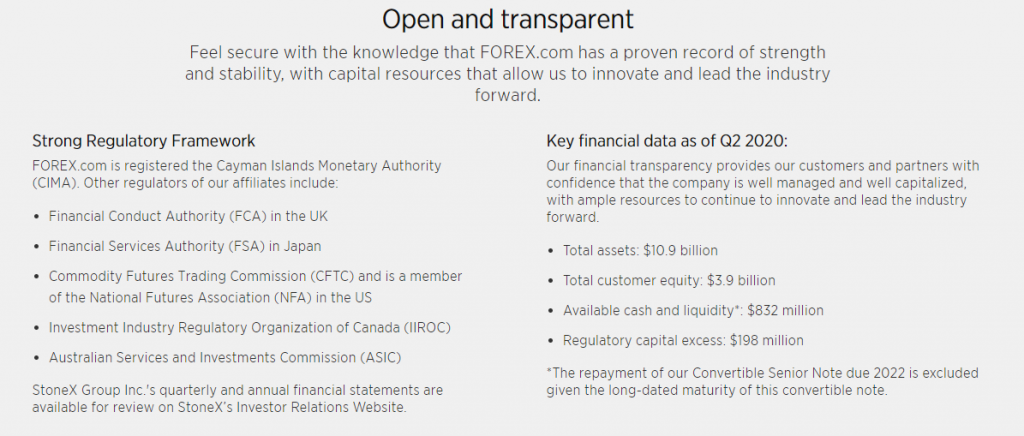

Forex.com is a subsidiary of Stonex Group Inc, which provides financial services networks and is also listed publicly on NASDAQ.

The trading fees at Forex.com is variable and slightly lower on average, but are variable. They offer STP and ECN account types and allows trading on a decent number of trading instruments.

The unavailability of FSCA regulatory license, ZAR based account, and ZAR deposit/withdrawal are the major drawbacks of Forex.com for South African traders.

Read our detailed and data backed review of Forex.com for South African traders. We have covered all the pros and cons of the broker to assist traders in having the best forex and CFD trading experience.

Forex.com Pros

Forex.com Cons

| 👌 Our verdict on Forex.com | #4 Forex Broker in South Africa |

| 🏦 Broker Name | Forex.com South Africa |

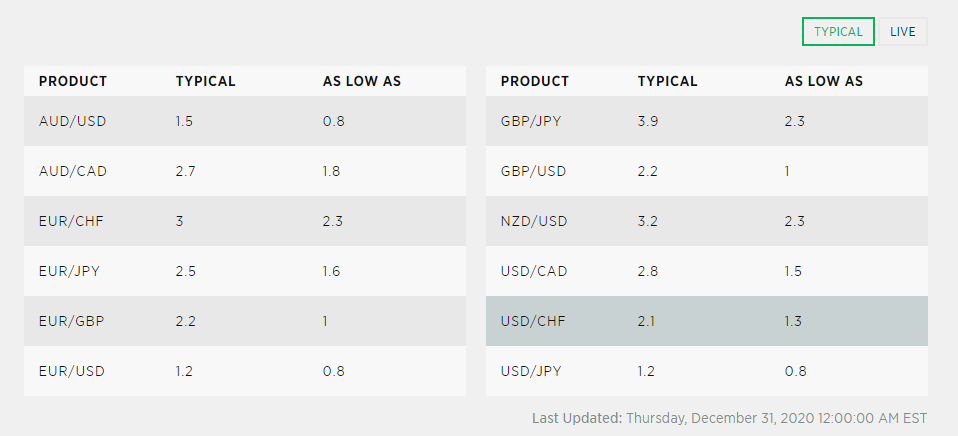

| 💵 Average EURUSD Spread | 1.2 pips (with Standard MT4 Account) |

| 📅 Year Founded | 2001 |

| 🌐 Website | www.forex.com |

| 💰 Forex.com Minimum Deposit | $100 |

| ⚙️ Maximum Leverage | 1:300 |

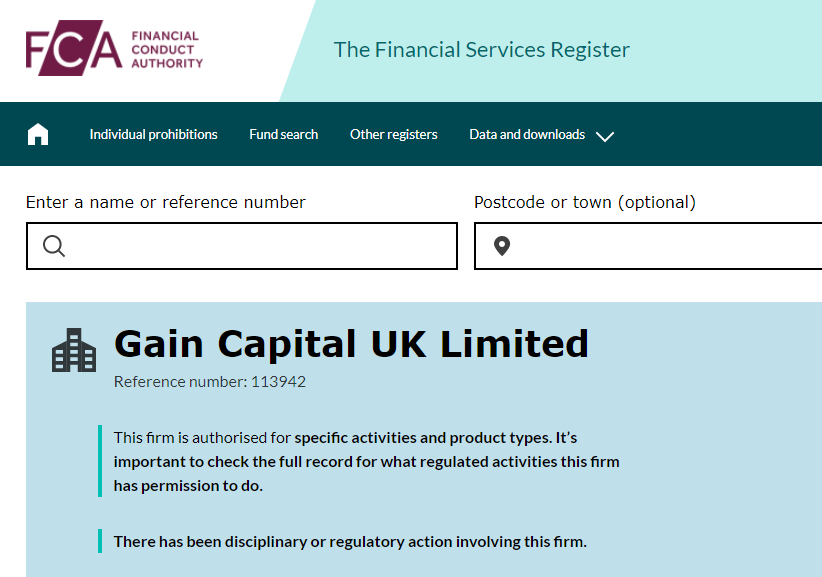

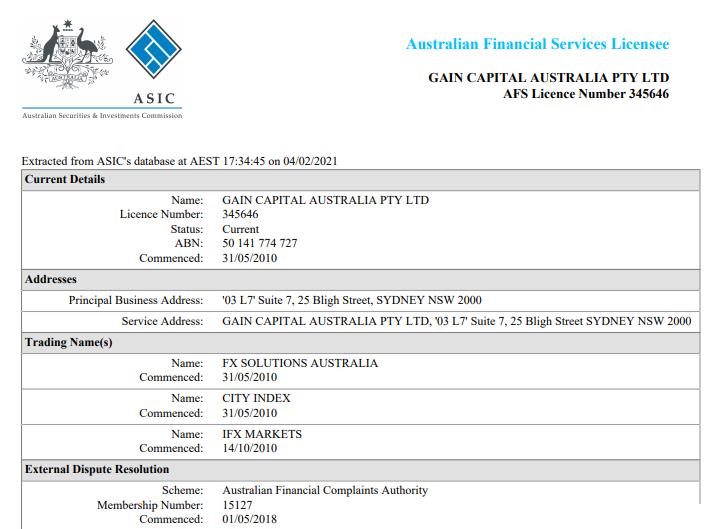

| ⚖️ Forex.com Regulation(s) | FCA, ASIC, NFA |

| 🛍️ Trading Instruments | 80+ currency pairs, 4500+ CFDs on Indices, Cryptos, Metals, etc |

| 📱 Trading Platforms | MT4 & MT5 for desktop, web & mobile |

Forex.com is a reliable and safe broker for traders in South Africa although it may not be the safest. Details of the regulatory licenses owned by Forex.com are described below:

It is fully owned by StoneX Group which is an institutional-grade financial services network connecting different participants to multiple global markets. StoneX is a publicly listed firm on NASDAQ with ticker SNEX. The support of a prominent financial service provider as a parent company further enhances the safety ratings of Forex.com.

Forex.com is very transparent with their financial earnings and statements and details are published every on their official website. The details of the owners are also available along with reparations in the past.

We couldn’t find any cons in the safety section except for the fact that it is not regulated by FSCA (SA) or any other regulatory authority in the South African jurisdiction.

Compared to regulated brokers in South Africa, Forex.com is safer than many but the brokers with FSCA regulatory license will always have an upper hand over others in terms of safety in South Africa.

The fee structure at Forex.com is divided into account types as they offer 3 different types of accounts. We found the fee structure to be slightly complicated compared to other forex and CFD brokers in South Africa.

Although, the cost-effectiveness is decent on the comparison. We have divided fees charged at Forex.com into trading and non-trading fees.

Forex.com Trading Fees

The trading fees at Forex.com involve spreads and commission which add up differently for each account type.

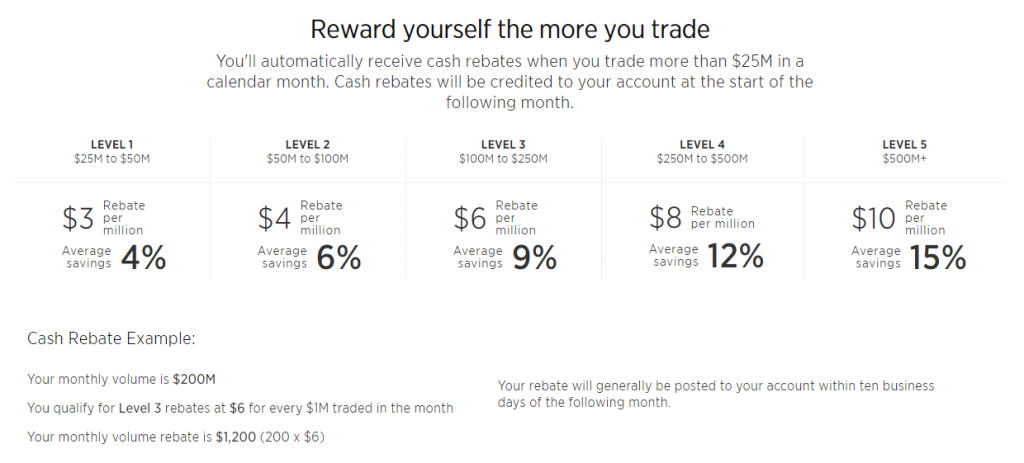

Forex.com provides an Active trader program in which the rebates are rewarded to traders if the trading volume fits into predefined slabs. The minimum requirement to claim benefits of the program is $25M. The minimum benefit is a 4% rebate on spreads while the maximum benefit is a 15% rebate on spreads but the trading volume requirement is $500M+ for the same.

Forex.com Non-Trading Fees

Forex.com offers 3 trading account currency namely USD, EUR, and GBP. For any deposit made apart from these currencies, they do charge a currency conversion fee i.e. 0.5% of the transaction amount. Traders in South Africa cannot deposit in ZAR as Forex.com does not accept payments in ZAR.

Overall, we found the trading as well as non-trading fees to be slightly higher than many of the forex and CFD brokers in South Africa. The cost incurred to new traders and small volume traders is high but for the high volume traders, the active trader program makes the fees decent at Forex.com.

Forex.com provides the most widely used MetaTrader 4 and MetaTrader 5 trading application for web, Windows, macOS, Android, and iOS devices. The complete suite of MetaTrader trading application grants access to 100+ indicators, and 80+ charting and analytical tools that can enhance the trading experience.

A large number of forex and CFD brokers in South Africa provide MT4 and MT5 trading platform. While a few of them also allow trading through the cTrader platform which is not available at Forex.com.

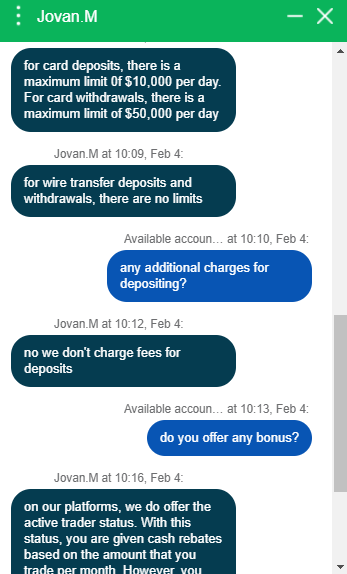

The support staff at Forex.com is very helpful but the connectivity with the support executives can be challenging during peak trading hours. We tried reaching them through all the available methods and our experience wasn’t satisfactory.

The customer support service is decent through the live chat window. Although, the unavailability of email support and local phone support can be a major disadvantage to traders in South Africa.

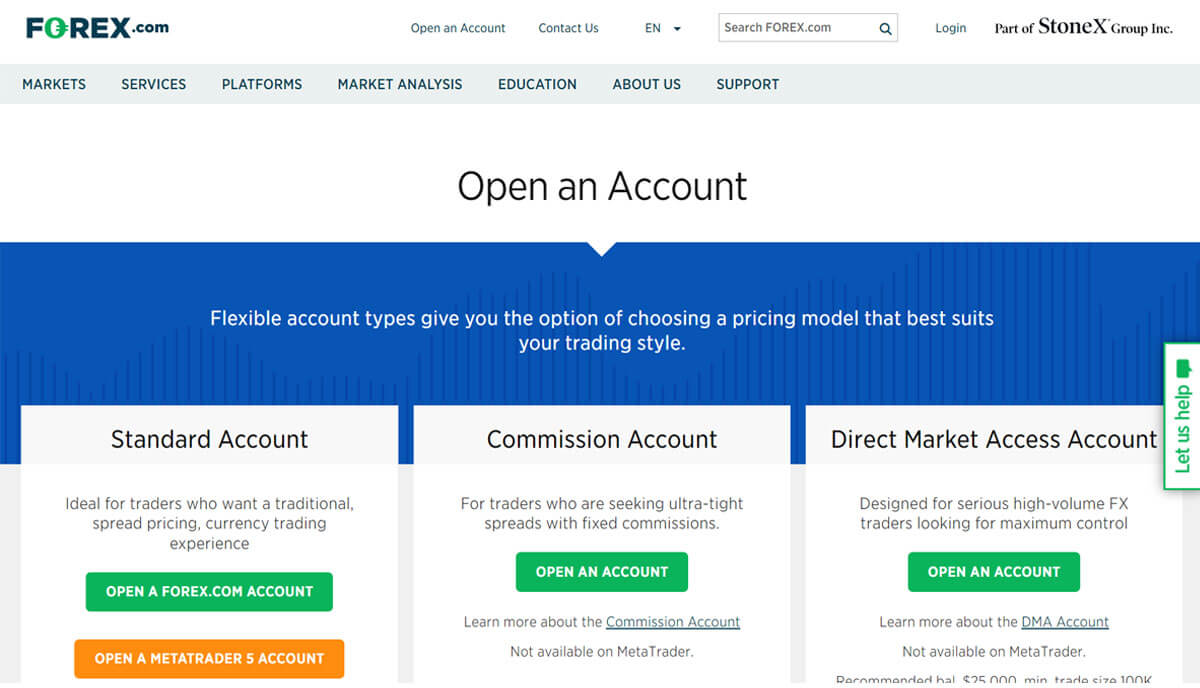

Forex.com allows traders to choose between 3 different account types. Each account type incurs different trading fees from the traders. Further details of each account type have been discussed below.

The minimum deposit required to start trading for Standard and Commission account type is 100 units of the base currency chosen. While the same for the DMA account is 25,000 units of the base currency. Traders can choose between USD, EUR, and GBP as a base currency. The unavailability of ZAR based trading account can be an obstacle for traders in South Africa.

Forex.com provides flexibility to choose the desired and suitable account type. We liked the variation in the account types but the account can only be opened in 3 base currencies excluding ZAR.

Forex.com offers a wide range of trading instruments including CFDs on stocks. Following is the description of all the capital markets at Forex.com.

Overall, the number of trading instruments is fairly attractive to traders in South Africa. Compared to other regulated brokers in South Africa, we found Forex.com to be better than many of the competitors.

Forex.com has limitations for South African traders in terms of deposits and withdrawals. They do not accept ZAR deposits through any of the methods which is a major drawback.

Traders can deposit through debit/credit cards and bank wire transfers at free of any additional cost if the deposit/withdrawal currency is the same as the account base currency. If the currency of the transaction is different from the base account currency, then a currency conversion fee that is 0.5% of the transaction amount is charged from the traders.

The minimum limit for deposit is 1000 units of the base currency. The maximum limit for deposit and withdrawal is $10,000 per day and $50,000 per day respectively for a transaction through cards. No upper limit exists for deposits and withdrawals through bank wire transfer.

The deposits and withdrawals are free from the broker’s side but ZAR is not an acceptable currency at Forex.com which is a major disadvantage of choosing Forex.com in South Africa.

Forex.com does not offer any bonus or referral rewards unlike most the brokers in South Africa.

Although, they do offer the Active Trader Program which can benefit the high volume traders and can marginally reduce the trading cost through rebates.

The minimum trading volume should be worth $25M to avail of the benefits of the Active Trader Program.

Yes, Forex.com is safe and reliable due to multiple regulatory licenses and the listing of the parent company on NASDAQ. Moreover, it allows traders to choose a suitable account type and also grants rebates for high-volume traders.

Traders who wish to trade and transact with ZAR as base currency won’t find the broker useful as it does not accept ZAR deposits. The trading platform is convenient and resourceful while the number of trading instruments is also decent. Although, the unavailability of an FSCA license, no local phone support, and no ZAR account can be major cons for South African traders.

No, Forex.com is not regulated with Financial Sector Conduct Authority (FSCA) in South Africa. But they are regulated with other regulatories like FCA, ASIC, NFA. So we consider them a low risk forex broker.

Unfortunately, Forex.com do not offer ZAR base currency account. You can choose any other currency like USP, GBP as base currency while signup with them.

We consider Forex.com to be a moderate risk forex broker for traders in South Africa as they are not locally regulated with FSCA. But their parent company is regulated under multiple Tier-1 & Tier-2 regulations including FCA (UK), ASIC & IIROC. So, they are relatively a trusted broker compared to brokers that are only regulated by offshore regulations.

The minimum deposit at Forex.com is $100 (1600 ZAR) with Standard live trading account. Forex.com is not accepting ZAR deposit. So traders will be charged currency conversion fees by their bank while making deposit with Forex.com.

"Do you have experience with Forex.com? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.