easyMarkets is a regulated forex broker. They are regulated with top-tier regulators i.e. CySec & ASIC. They offer Demo account and live account with minimum deposit of $100. Read our review to check and compare them.

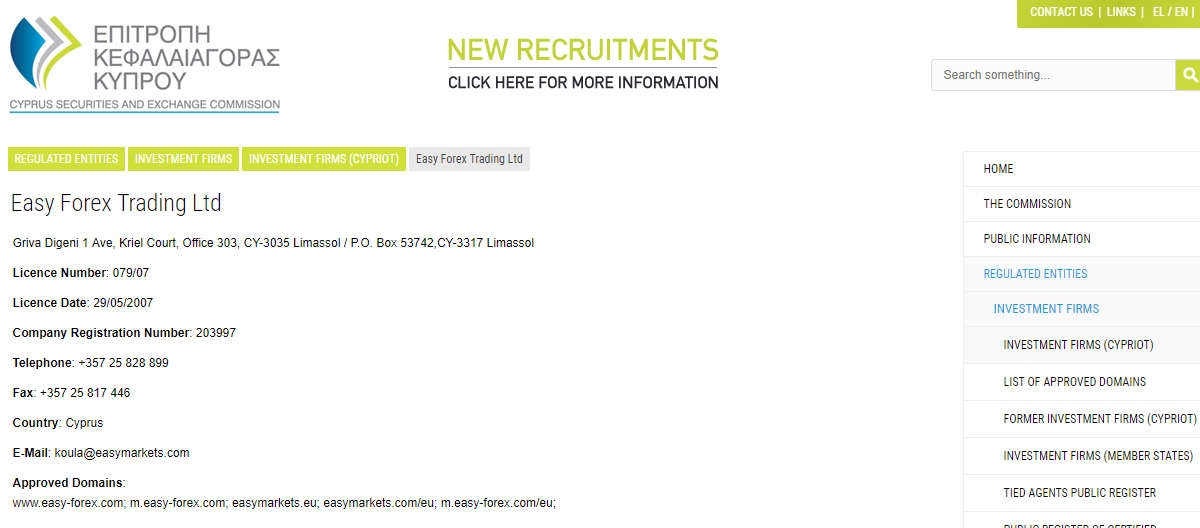

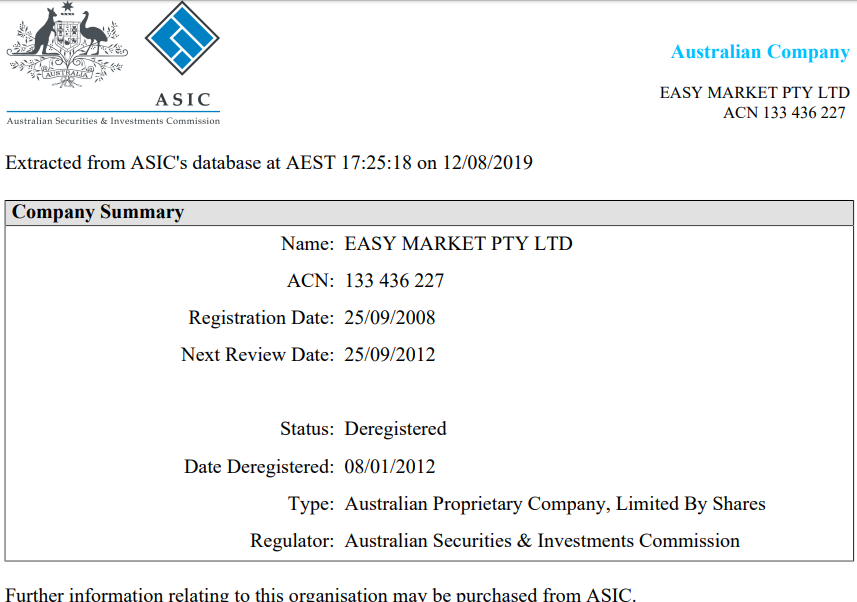

easyMarkets was established in 2001 and is regulated by the Australian Securities and Investments Commission (ASIC) and Cyprus Securities & Exchange Commission (Cysec).

They are also awarded by FX Empire for the best trading platform in 2017.

easyMarkets offer a fixed spread with no commission on trading to their customers. Moreover, there are lots of features available like Freeze rate, Deal Cancellation, and many more.

Read our below review to check and compare with other brokers in South Africa

easyMarkets Pros

easyMarkets Cons

Table of Contents

| 🏦 Broker Name | Blue Capital Markets Group |

| 📅 Year Founded | 2008 |

| 🌐 Website | www.easyMarkets.com |

| Registered Address | Ajeltake Road, Trust Company Complex, MH 96960, Ajeltake Island, Majuro, Marshall Islands |

| 💰 easyMarkets Minimum Deposit | $100 |

| ⚙️ Maximum Leverage | 400:1 |

| ⚖️ Major Regulations | Cyprus Securities Exchange (CySEC), Australian Securities and Investments Commission (ASIC). |

| 🛍️ Trading Instruments | Forex, Commodities, Cryptocurrencies Forex, and market indices |

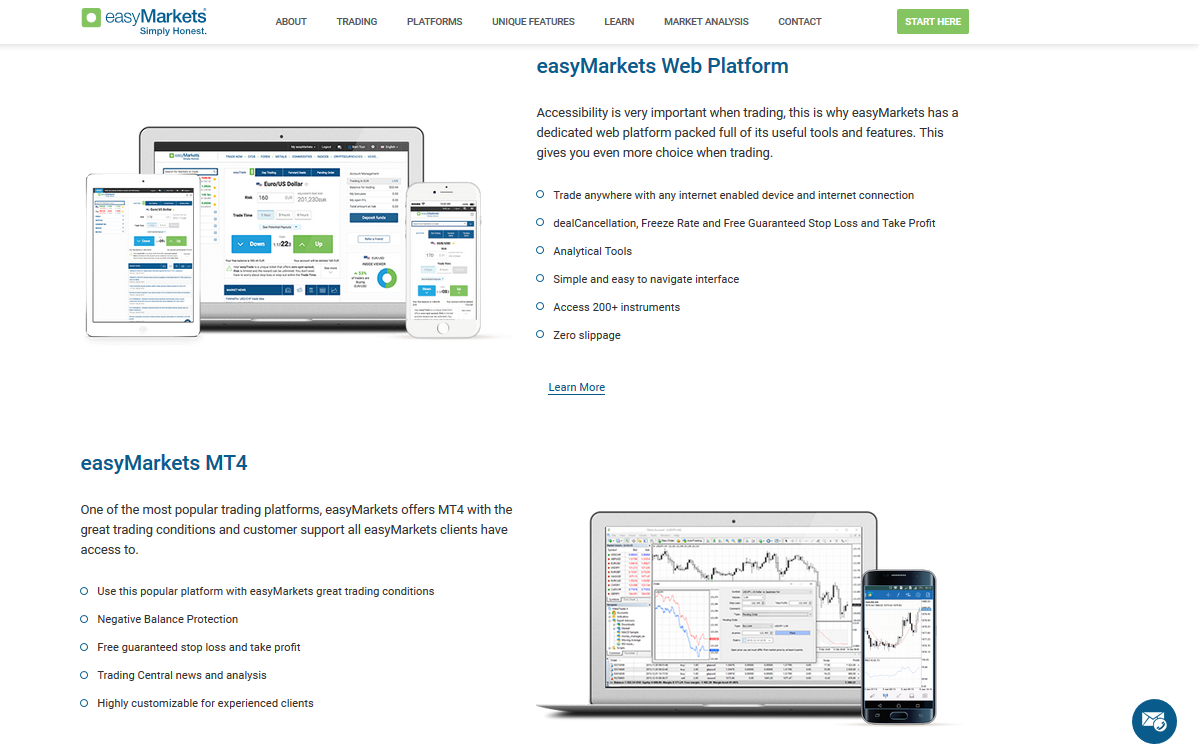

| 📱 Trading Platforms | MT4 (MetaTrader4), easyMarkets Platform |

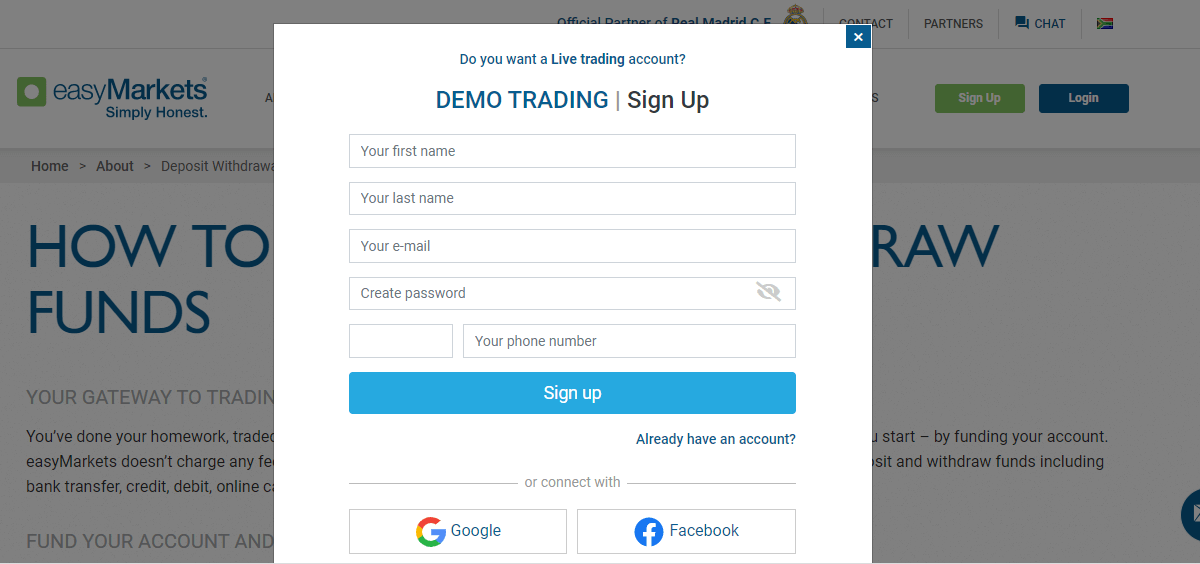

easyMarkets offer demo as well as live trading accounts to their customers. We have explained the features of both the account types below.

Like other brokers in South Africa easyMarkets also offer a demo account to all customers.

Normally who don’t want to take a risk and want to test their trading strategies, can go for the demo account with easyMarkets.

By doing this they can practice implementing their trading strategies without any hassle and without losing their actual money.

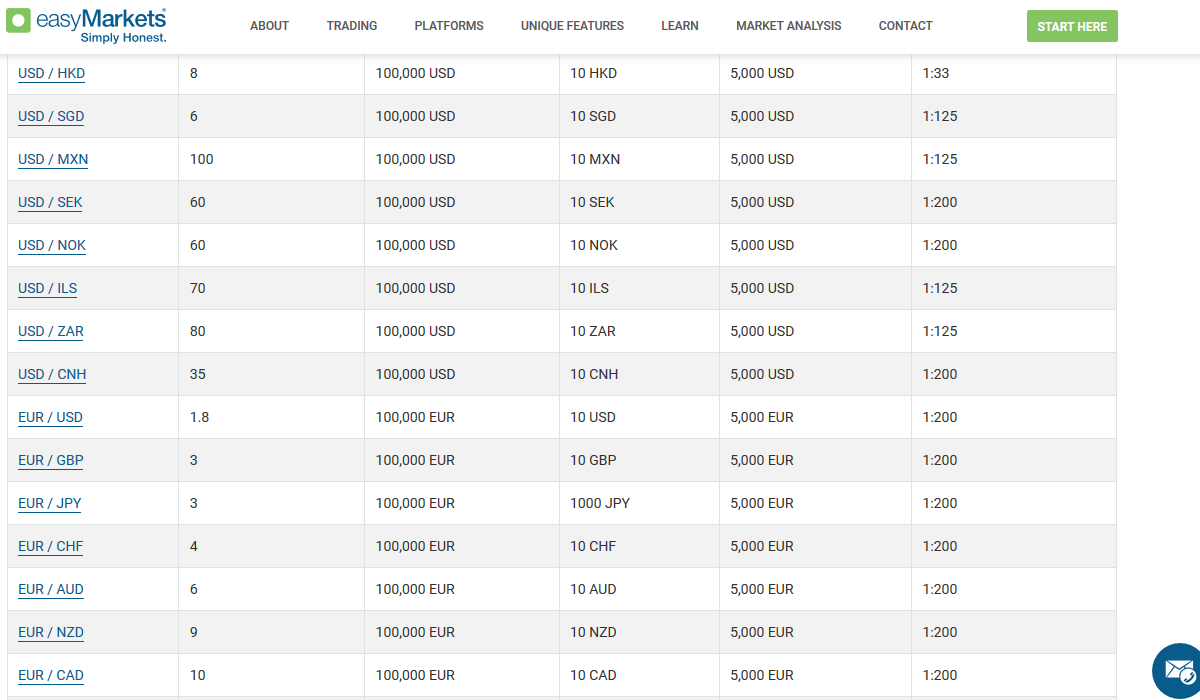

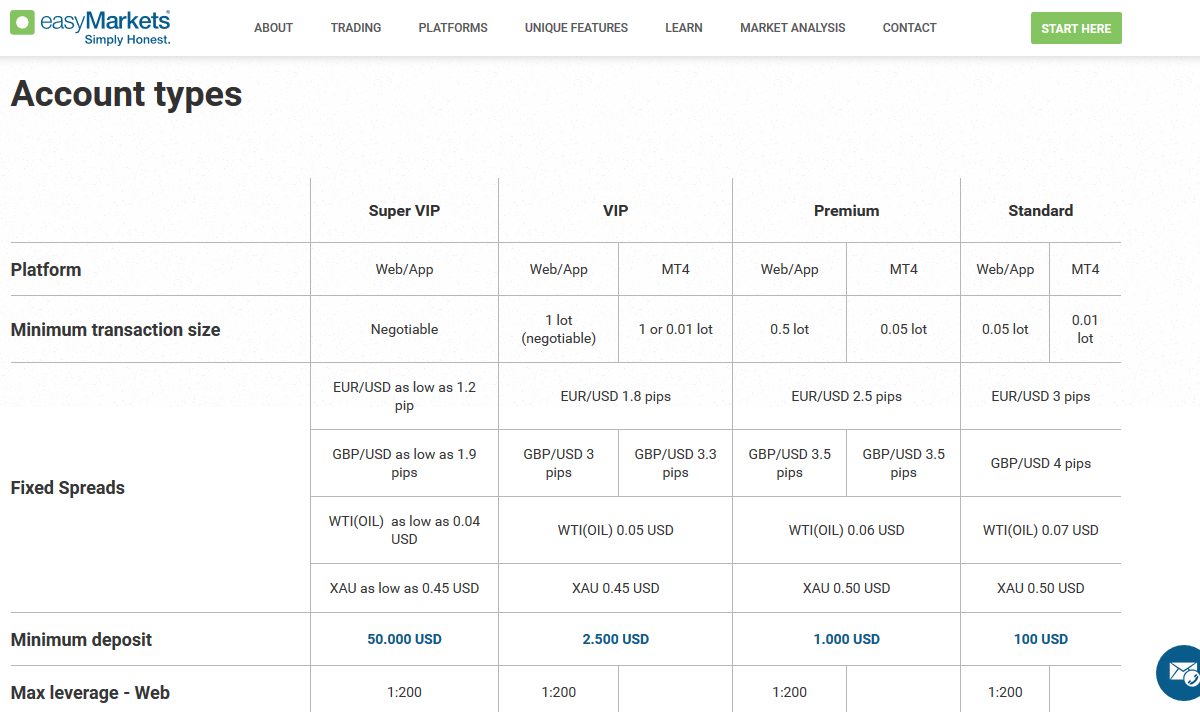

easyMarkets offer 4 types of live trading account. The maximum leverage offered in all live trading accounts is 1:200. Moreover, they are offering a fixed spread in all live trading accounts. A personal manager can also be assigned to traders using any of the live trading accounts.

easyMarkets offer 4 types of live trading account as explained below:

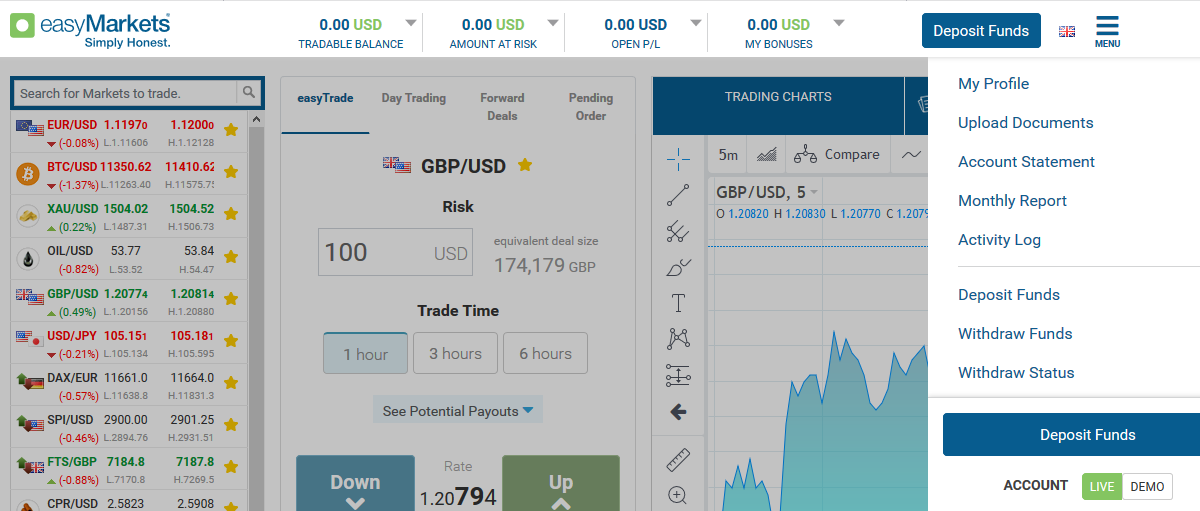

Opening an account with easyMarkets is very easy. You need to follow the below steps to open an account with easyMarkets:

Step 1) Click on START HERE: First of all you need to open the home page of easyMarkets and click on the START HERE button at the top right side of the screen.

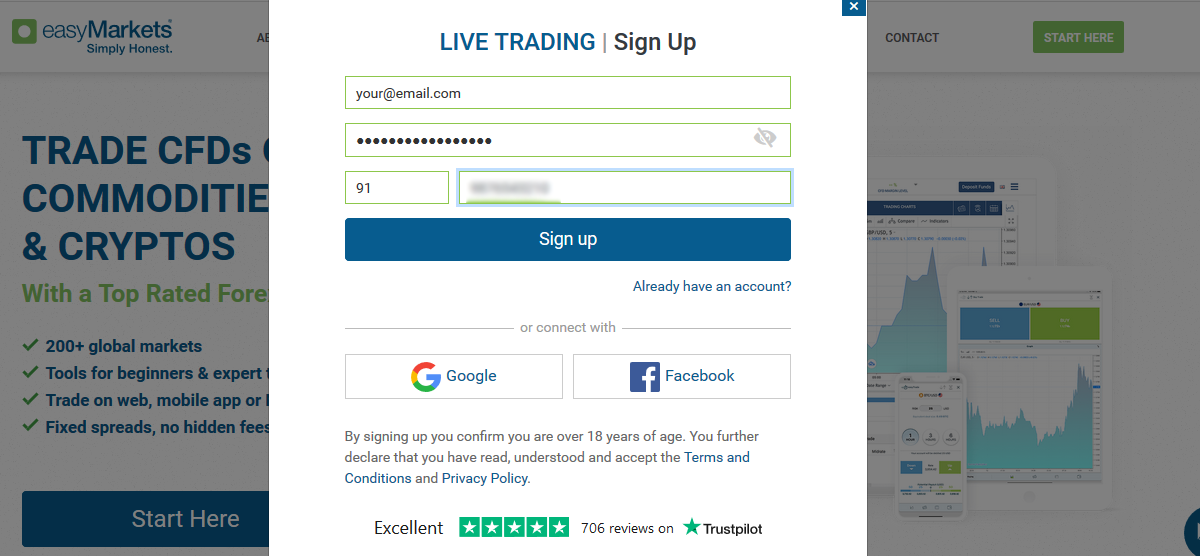

Step 2) Signup using Email: Now you will be redirected to a pop-up where you need to enter your email and password that you want to set as a login password. You can also signup using your Gmail or Facebook account.

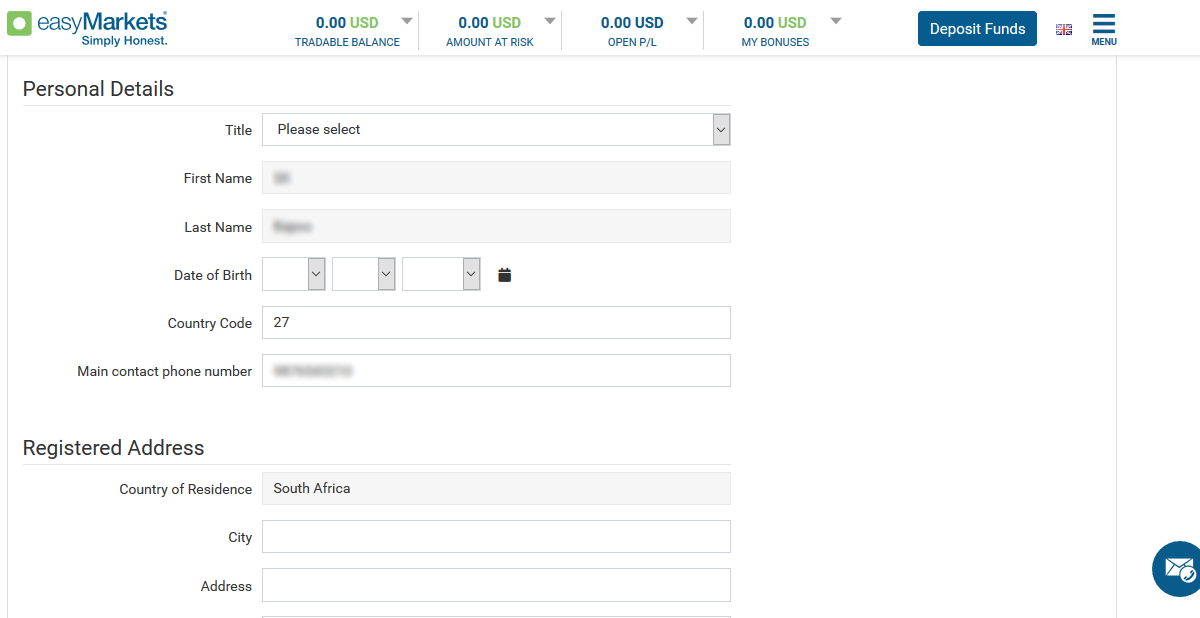

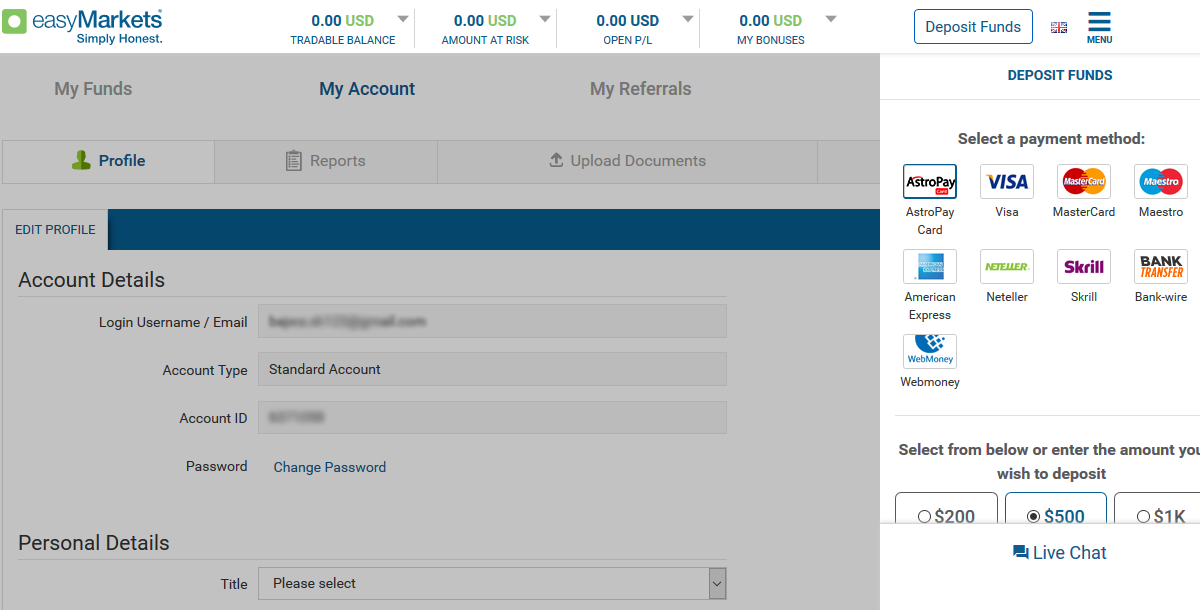

Step 3) Enter Personal Detail: After login into the dashboard, you need to enter your basic and personal information by following the on-screen instructions.

Step 4) Upload Documents to verify: Before you can add your funds with them you need to verify your account. For that, you need to upload your ID proof like Passport, Driving Licence, etc, and Address proof like Postpaid phone bill or Electricity bill.

Step 5) Add funds to start trading: You need to deposit the funds before starting trading with them. You can use your Debit or Credit card, E-Wallets or bank transfer.

Congratulations! Your account has been created and you can now login to the dashboard and start trading.

We have tested and listed Trading platforms which you can check below:

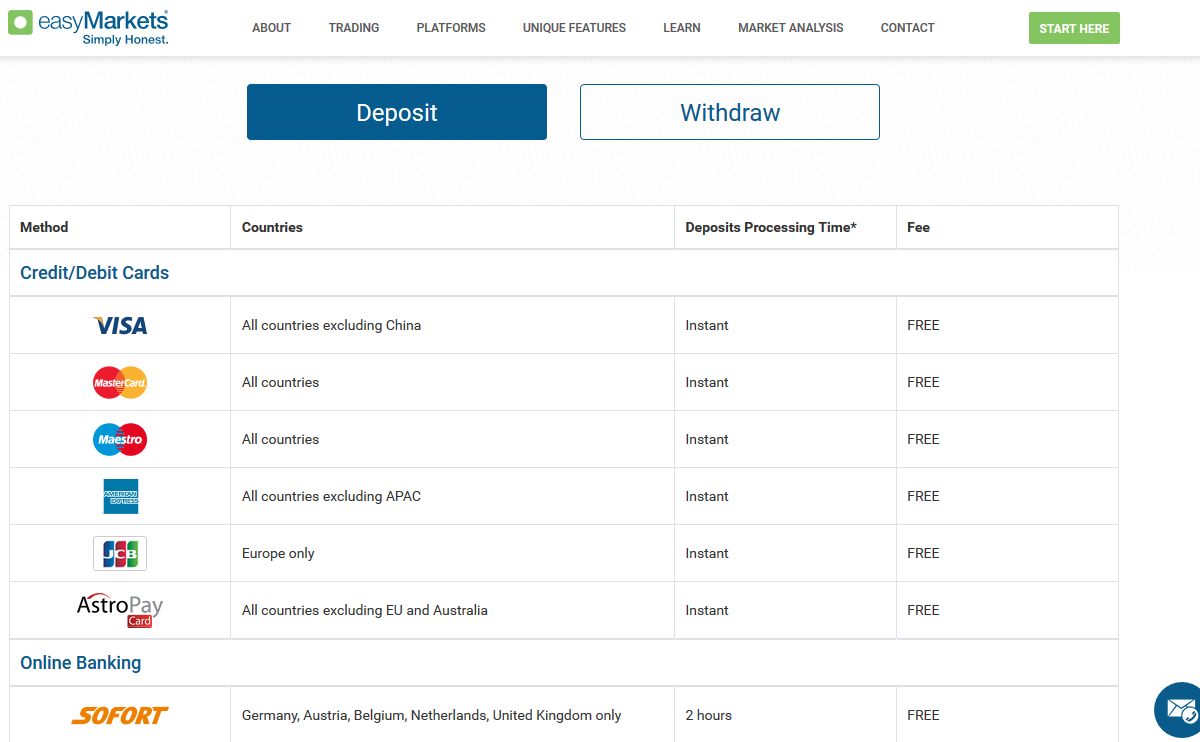

easyMarkets does not charge any fees on deposits and withdrawals. They will cover the fees of deposit and withdrawal but except your bank has an extra charge. You have the below option to fund your account.

They offer a deposit bonus on the first bonus. For any deposit of $100 – $199, they offer a bonus of 30%. And for a deposit of $200 – $1000, they offer a bonus of 50%.

Moreover, for a deposit of $1001 – $5000, they offer a bonus of 40%.

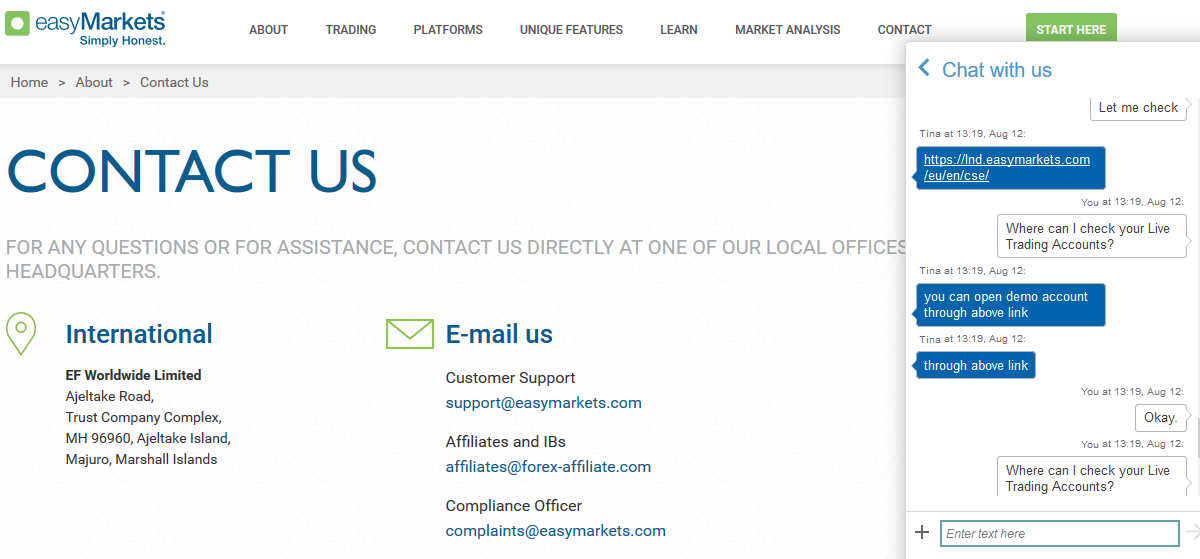

easyMarkets offer customer support 24 hours from Monday to Friday. You can contact them via the below mediums:

If you are looking for a broker with a good past and have some good traders then we recommend you to start with easyMarkets.

Most of the brokers have variable spreads and they also charge high commission on trade. But in the case of easyMarkets, there is no commission on trade with a fixed spread.

Moreover, in the case of a VIP account, the account manager can drop the spread rate for you. In our opinion, this is what makes them different from the other brokers.

easyMarkets offer ZAR account for South African traders. And the minimum deposit for ZAR account is approximately ZAR 1462 which may change and it is not fixed.

The minumim deposit is $100 in Standard Live Trading account. But in case of ZAR base currency the minimum deposit is not fix. Currently the minimum deposit for ZAR account is ZAR 1462.

No. easyMarkets is not regulated with local regulatory Financial Sector Conduct Authority (FSCA. But it is regulated with other regulatories like Cyprus Securities Exchange (CySEC), Australian Securities and Investments Commission (ASIC).

Trader can request for withdrawing by contacting them to support email or can request from the client panel. But before requesting for withdrawal you need to verify your trading account first. Your withdrawal method will depends upon your region or to your deposit method.

"Do you have experience with easyMarkets? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review