See our comparison of 8 crucial factors including fees, regulations, ease of use, features of the popular forex trading apps for traders in South Africa.

In order to trade forex, you would need access to a trading platform or an app using which you can place & monitor your trades. This trading platform usually also allows you to make informed analysis before entering into trades by viewing charts, news, indicators and other data.

Most forex brokers offer their trading platforms on mobile for both Android & iOS.

These are the Best Forex Trading Apps in South Africa for Beginners based on 12 metrics

Before you start trading currency, you should be aware that large fluctuations can take place in the price of a currency in a very short period of time. Also, the forex market is open 24 hours during weekdays, so you need to be constantly alert to monitor your trades & make informed decisions.

This is where the mobile app by a broker can help.

A good forex trading app will be easy to use, and allow you to have multiple time frames, charting tools, and fast execution. To make this list, we have comprehensively reviewed mobile apps by several brokers that are available in South Africa.

Below we have compared the regulations, fees, features, trading conditions of each trading app in our list:

Ranked #1 Forex Trading App in South Africa

HF Markets’s trading app is available on all devices. We found their app easy to use for charting & managing multiple orders.

HFM is considered to be a safe broker to trade with because it is regulated by the FSCA (FSP No.46632).

Trading App Features – HFM’s trading app is compatible with almost all mobile devices. You can use this app to manage your account through functions like making a deposit, withdrawal, or a transfer.

This app allows you to access analysis features with various types of graphs, timeframes, technical indicators, and the news. You can use their trading calculator to find out risk percentages, position sizers, pivot points, pip values, and so on.

You can use this app to monitor your trades using live quotes on currency, commodities, stocks, and indices. They have a trader’s board where you can get the latest information on currency movers and the volume traded along with live charts on various currency pairs.

Trading Conditions – HFm has ZAR trading account option too, so you can have account with Rand as your base currency to enter into trades. You need to make a minimum deposit of $5 (R70) to open your account, which is a quite nominal. The trading app & account will allow you to trade in a range of markets like 53 forex currency pairs & 1000+ CFDs on commodities, stock CFDs, metals and energy, indices, and bonds. But crypto CFDs are not available at HF Markets.

HFM App Pros

HFM App Cons

Ranked #2 Forex Trading App in South Africa

Tickmill only offers MT4 trading platform for web, mobile & desktop. They are a FSCA regulated forex broker, so we consider it safe to trade on their Metatrader app. Tickmill is also regulated with FCA & CySEC..

Tickmill trading app has spread of as low as 0 pips for major currency pair like EUR/USD with their Pro Account. There is a commission of USD 4 per lot (USD 2 per side for open & closing) with Pro Account

Trading App Features – Tickmill offer MetaTrader 4 trading app with all their account types. But they don’t offer the latest MT5 platform.

Trading Conditions – Traders in South Africa can trade upto 62 currency pairs & 100+ CFDs stock indices, commodities, precious metals & cryptos. They are one of the few brokers that offer Crypto CFDs in SA.

Ranked #3 Forex Trading App in South Africa

Exness offer their Metatrader 4 & 5 trading apps for Android, PC & iOS. Webtrader is also available.

Exness is considered a safe CFD & forex broker as they are regulated with FSCA & FCA. They are licensed with 3 Top-tier regulations.

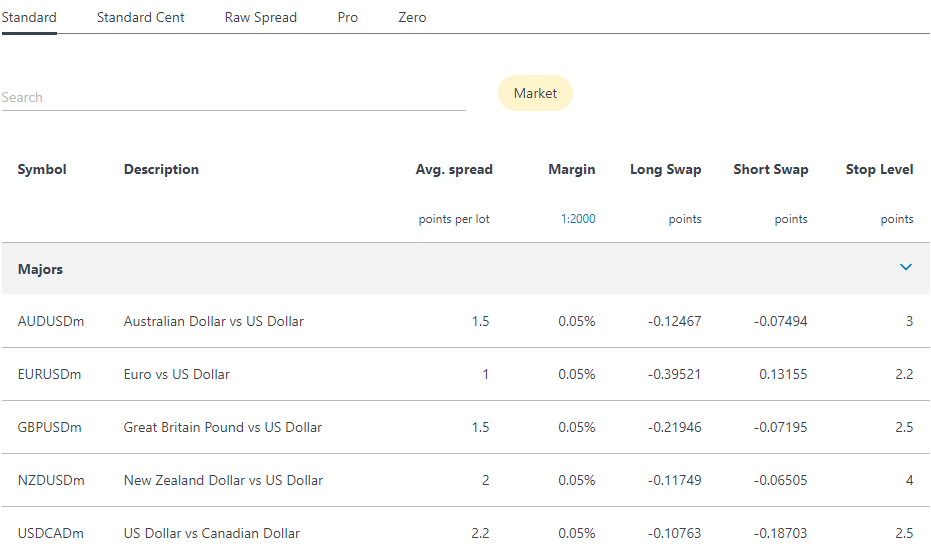

Trading App Features – Exness has a low trading fees for trading currencies & other CFDs compared to other forex trading apps. They only charge spread with their Standard account, there is no other commission per lot. Deposit & withdrawals are free for most methods.

The spread is variable depending on the instrument being traded. For the benchmark, we checked their EURUSD spread, it is on average 1 pip with their Standard account.

The spread is much lower with their Pro accounts, and the requirements for opening Pro Account are also low. For example, the minimum deposit for all Pro Account types is $500, which is low. But the advantage is that the spreads & overall trading fees with these account types is much lower. So, traders should prefer Pro Account over Standard.

Trading Conditions – Exness offers ZAR base currency trading account. They have 107 currency pairs, which is more than most other platforms. And Exness offers trading on 100+ other CFD instruments. One good thing is that they don’t charge overnight fees for these other CFD instruments like there is no Swap fees for CFDs on commodities.

Exness App Pros

Exness App Cons

Ranked #4 Forex Trading App in South Africa

XM Broker offers Metatrade 4 & MT5 platforms for mobile, web & desktop.

XM Trading is considered a low to moderate risk forex broker because they are regulated by 2 Top-tier regulations ASIC & CySEC. Also they are a reputed CFD broker that have been in operation since 2009. But it is important to note that XM is not regulated in SA, and traders are registered under “XM Global” (regulated with FSC).

Trading App Fees – The trading fees at XM with Ultra Low account is low compared to most other brokers. For example, the average spread for XAU/USD CFD is 25 pips, which is lower than Exness, Hotforex, FXTM & other brokers. Similarly the typical spread for EUR/USD is 0.8 pips with Ultra Low account, which is highly competitive. Except from their spread, there is no other fees like commissions per trade. Deposit & withdrawals are free.

Trading Conditions –XM is a spread only broker, they don’t charge any extra commission on trades. XM have ZAR base currency option with all their 3 trading accounts. They offer 57 currency pairs, and 1000+ CFDs on Stocks, Commodities, Precious metals, Equity Indices & Bonds. But they don’t have Crypto CFDs on their app.

Their app us standard MetaTrader app, and it has most of the features that you use in MetaTrader. The app is okay for checking your positions.

XM Trading App Pros

XM Trading App Cons

Ranked #5 CFD Trading app in South Africa

Plus500AU Pty Ltd is authorized to operate in South Africa by the FSCA (FSP No. 47546) & regulated by multiple other top tier regulators including FCA & ASIC. They are also listed on the London Stock Exchange. Hence, they are considered to be a trusted broker to trade CFDs.

Their trading app allows you to view real-time quotes and it is user-friendly once you get the hang of it. You can also use their app to perform your analysis through live charts that are available in different time frames.

Note: Plus500 is a CFD trading platform, that is suitable for experienced traders only.

Trading Conditions – Plus500 offers ZAR trading accounts option. They require a minimum account opening balance of ZAR 1500. You can choose to trade CFDs on any of 71 forex pairs, 1000+ CFDs on stocks, commodities, cryptocurrencies, and more available on Plus500’s platform.

They offer a leverage of 1:300 as well as negative balance protection. You also set guaranteed stop loss for full protection that your stop loss will be fulfilled at your set price without having to pay any extra fees.

Plus500 is a variable spread CFD trading platform, the exact spread depends on the trading instrument and varies according to the market conditions. But, Plus500 does not charge any commission per lot.

They have a responsive customer support team that you can reach through phone, chat, or email. When we tried to contact them through email, they responded within a couple of hours. But their chat support is only available to signed in customers, so it is a bit of a hassle.

Plus500 App Pros

Plus500 App Cons

read our detailed Plus500 review

Ranked #6 Forex Trading App in South Africa

AvaTrade is regulated by multiple Top tier global financial regulators i.e. the FSCA in South Africa and the ASIC. Hence, it is considered to a be safe broker to trade with.

We like the user interface of Avatrade’s trading app, which is quite easy to use and understand. This app provides real-time feed of prices along with social trends. You can use a variety of charts to make an informed analysis. They also have a tutorial features that you can refer on how to use their app.

You can open and manage several MT4 accounts through this app. You can make your deposits and withdrawals through the app itself.

Trading Conditions – To start trading, you need to make a minimum deposit of $100. But on the downside, there is no dedicated ZAR account for South African traders. You can open your trading account in major currencies like USD, EUR, GBP etc.

Their spreads are fixed. For example, their spread for major like EURUSD is 0.9 pips, and this is considered low (although there are brokers with lower spreads of as low as 0.5-0.6 pips overall for the same instrument). Their overall trading fees is still quite competitive.

The Avatrade’s app allows you to trade CFDs on more than 1000 different financial instruments including forex & CFDs on commodities, stocks, cryptocurrencies. The range of CFD trading instruments on their app is good.

AvatradeGo App Pros

AvatradeGo App Cons

read our detailed Avatrade review

Ranked #7 Forex Trading App in South Africa

BDSwiss’s App is available on Android & iOS. Their app allows traders to trade 51 currencies & 100+ CFDs on Commodities, shares, cryptos & indices. The total range of trading instruments is okay.

The average trading fees is moderate with their ‘Classic’ account type. There is no extra commission with this account type. For example, the typical fees is 1.6 pips spread for major like EUR/USD. There is also inactivity fees if the account is not active for a certain period

Trading App Features – Their Androis & iOS apps allow users to place trades, view live currency quotes, view transactions & deposit and withdraw directly from the app. But there are limited charting tools & the app also lacks support for indicators.

Ranked #8 Forex Trading App in South Africa

OctaTrader app is offered by Octa broker on both Android & iOS. This app is free to download if you have an account with Octa.

The trading charge on this app is moderate, starting from a floating spread of 0.6 pips. Other than this, you don’t have to pay any commissions, like other forex apps. All their cost is in the floating spreads.

OctaTrader App Features – You can trade CFDs on 5 asset classes through this app, including 35 currency pairs, Gold & cryptos. Their app gives you the ability to place orders (with single click), manage your trades, set trading alerts, ability to deposit & withdraw from the app itself, view trading logs & there are other features, but we have only listed the ones we found most useful in their app. But the major downside is you can only select USD as your account current (there is no other option).

Before you select a trading app, you need to know what to look for in a good app. Here are the most considerations that matter for us & should go into your decision.

1. Regulation – The first thing that you should check if whether the broker who’s app you are downloading is regulated or not. If you are trading with an unregulated broker, then there is a huge risk that the broker is a scam & would take your money, without any grievance redressal in case of disputes.

A regulated broker can be held liable for the damages in case of any bad practices which are not allowed by the regulators.

Always choose an app of a broker that is regulated by more than one major regulations i.e. FSCA, FCA, ASIC, CySEC & NFA.

If a forex & CFD broker is regulated by more than one of these top-tier regulators, then it is generally a good sign of trust & safety of that broker.

For example, if you are downloading the MetaTrader app of a forex broker that is regulated with FSCA, FCA & ASIC, which are the three major regulators, then we can consider it to be low risk.

You can verify the broker’s regulatory information from the Regulator’s website. For this you need the broker’s license number. All regulated brokers mention their license number on their website.

For example, below is screenshot a from Tickmill’s website (Tickmill Group Licenses & Regulation page), and here they mention Tickmill Group’s licensed with multiple regulators including with the FSCA.

Once you have the broker’s license number, then you can verify it from regulator’s public search (FSCA in this example).

Also, you must make sure to verify that the broker’s license is genuine. Some brokers may claim to be regulated with FSCA while using FSP No. of another broker that is actually licensed.

So you must make sure that the FSP No. of the broker & claim of regulation is actually genuine, and this can be checked by matching the broker’s FSP Name on FSCA’s public search. Also check if the broker is fully authorized to offer the products which they are offering.

2. Order Execution Speed – The speed of your trading app can be the difference between a profit and a loss, since currency fluctuations are high. A fast order execution speed means that your trade is executed at your desired price.

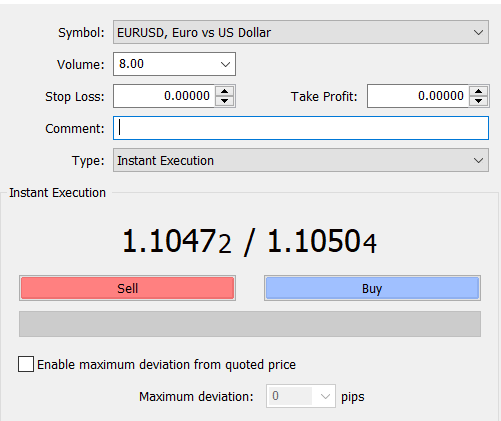

Some forex trading apps offer instant order execution, while others offer market execution. Forex Trading apps that offer instant order execution are usually market markets & there may be a conflict of interest. It is preferred that the broker is a STP broker that offer quick market execution.

For example, HotForex is a STP broker & the average order execution time on their trading app is good. While XM is a market maker broker they have a no re-quotes and no rejection policy.

Generally, the brokers will explain their execution policy & terms, and you should check it properly. For example, HotForex have a policy related to their ‘Trading and Execution Risks’, which highlights points on slippage, widening of spreads, Order Rejection etc.

Here is example of their point on risks related to slippage, which highlights that during volatile market conditions, there is a high risk of slippage, and you order might not fill at the price.

Similarly, other brokers mention their exact policies related to the order execution. The risks are always there, so you should test out the broker’s app, and if there is any issue related to slippage, spread widening, gapping (which is not visible on price at other market feeds), rejected orders, and similar issues, then you should switch to another broker.

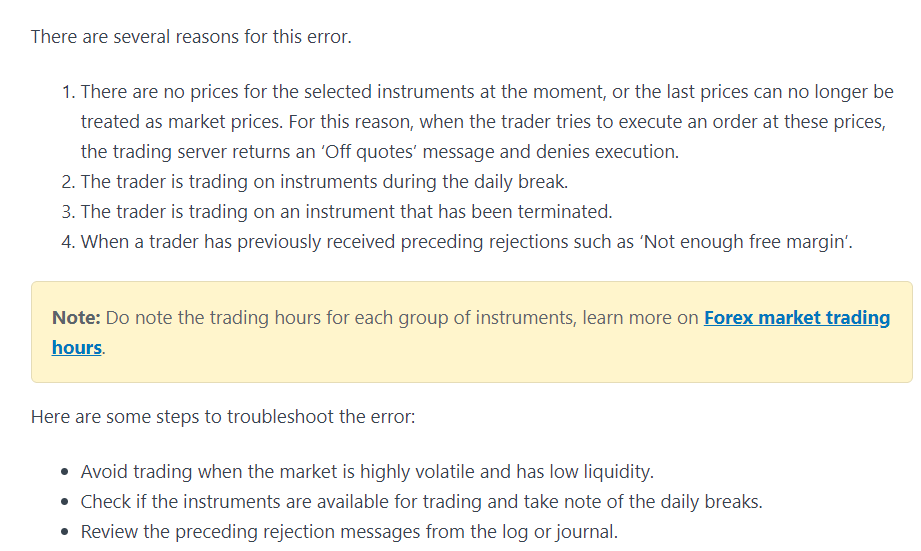

There are also instances where you might get ‘Off Quotes error’ in your app when placing your order. This is usually in case of illiquid markets or where there is no price data available for that symbol.

You might get the offquotes on MetaTrader app of your broker when you are trading CFDs on stocks like AAPL, GOOG etc. Below are the reasons mentioned by Exness for possible Off Quotes on their mobile or PC trading app.

You should avoid trading on an app that has frequent Off Quotes, as you likely will not be filled at the price (both during entries & exits) that you want. This can affect your P&L in trading.

3. Real Time Data and News Feed – Getting real-time price feed & data on your trading app means that you can make an informed decision on the go. Live charts and technical indicators allow you to make quick trading decisions based on real time facts & price.

Generally, most brokers will have instant feed updates of price, but at some times, you will notice that there are differences in price at different brokers, generally during volatile market events. But in such a situation, having a feed from 3rd parties, or multiple brokers like on Tradingview, would give you better indication of the price & tell you if there is something wrong going on with your broker’s app & feed.

If you notice regular occurrences of bad price feed (typically against your orders), then it is a clear red flag.

The trading app should also have a news feed so that you are abreast of the latest market developments.

You will find news feed in trading app at most of the brokers. Many forex brokers offer MetaTrader app, and they have a section for news built in the app.

4. Advanced Charting and Full Functionality – Easy to understand charts are the lifeblood of a financial trader. You need to ensure that your trading app has a variety of charting options. The charting options should include popular technical indicators and a variety of timeframes.

You should download the broker’s trading app & create a demo account. Then check if the tools & indicators that you use are available in the app or not.

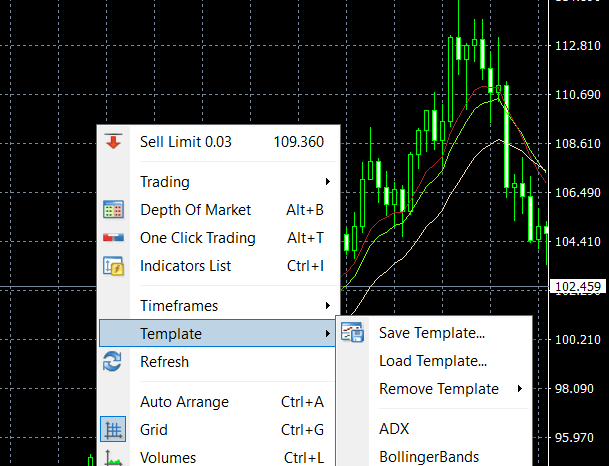

Most MetaTrader based brokers will have wide range of indicators & ability to customize, including Expert Advisors. But for brokers that offer their own proprietary trading apps, you should check if your charting tools & indicators are available or not. And if you can extend the functionality.

Also, the trading app should support basic & important indicators like moving averages (multiple, without any restrictions on max.), RSI. You should be able to use drawing features to draw support resistance, plot trendlines, boxes.

At the very core of the app, you should be able to quickly draw patterns on the app, so it must support all tools like rectangle, brush etc. You should also be able to draw Fibs, with custom settings.

Moreover, the app should allow you to save your templates & layouts. Here is an example of how you can chart your indicators & also save your layouts on MetaTrader 4.

All the forex brokers who offer the MetaTrader app allow these indicators & charting tools. In this example we used the desktop app, but these templates & indicators can also be used on mobile devices.

Moreover, if you prefer to use third-party charting software & app like the Tradingview, then you should check whether your broker supports it in their platforms list. For example, FXCM has support for Trandingview & they allow you to place orders directly from Tradingview’s mobile app, or web browser.

5. Range of Trading Instruments Available – If you’re looking to trade only a few instruments, then you may give this one a skip. However, ensure that the trading instruments you want to trade are available on your trading app at the lowest fees.

For example: Some CFD brokers don’t offer crypto CFD trading instrument like Bitcoin, Ethereum etc. You should check if the broker offers the CFD financial instrument you want to trade.

All Forex Trading apps will list the information regarding their exact number of CFD trading instruments on their website. You will generally find the exact fees & number of instruments under ‘Contract Specifications’ on the broker’s website.

Like Exness has listed all their trading instruments under ‘Contract Specifications’ page.

If you don’t find this information on broker’s website, you can also talk to the broker’s support team & ask for the link to list of all CFD trading instruments available on their app. All reputed apps share this information.

A wider selection of trading instruments means you can analyze multiple assets & trade them if there is a trade opportunity based on your analysis.

6. App Security and Safety – Your trading app needs to be secure. In order to ascertain how safe it is, check out user ratings and reviews. Do not opt for a trading app that is less secure or has lower ratings on Google Play & App store than acceptable standards.

There have been incidents in the past where the data of users have been leaked online due to security vulnerabilities in the broker’s app. For example, the data of FBS broker was leaked in the past due to security issues on their servers.

So, it is important to check if there has been any such incident in the past against the broker. If the broker’s app or their platform had issues like minor bugs reported in the past, or there have been feature requests by the users & the broker has been proactive in resolving such issues, then it is a good sign.

7. Ease of Access – Make sure to check by installing the demo app that a trading app is compatible with your device before opting for it. Always start with a demo account to get used to the platform before trading live.

For example, some forex brokers don’t offer their trading apps on iPhone or iOS, they only have Android apps. Or when they have iOS apps, then it may not be updated regularly due to low number of downloads. So, depending on your device preference, you should choose a regulated broker who’s app is popular on the OS of your choice.

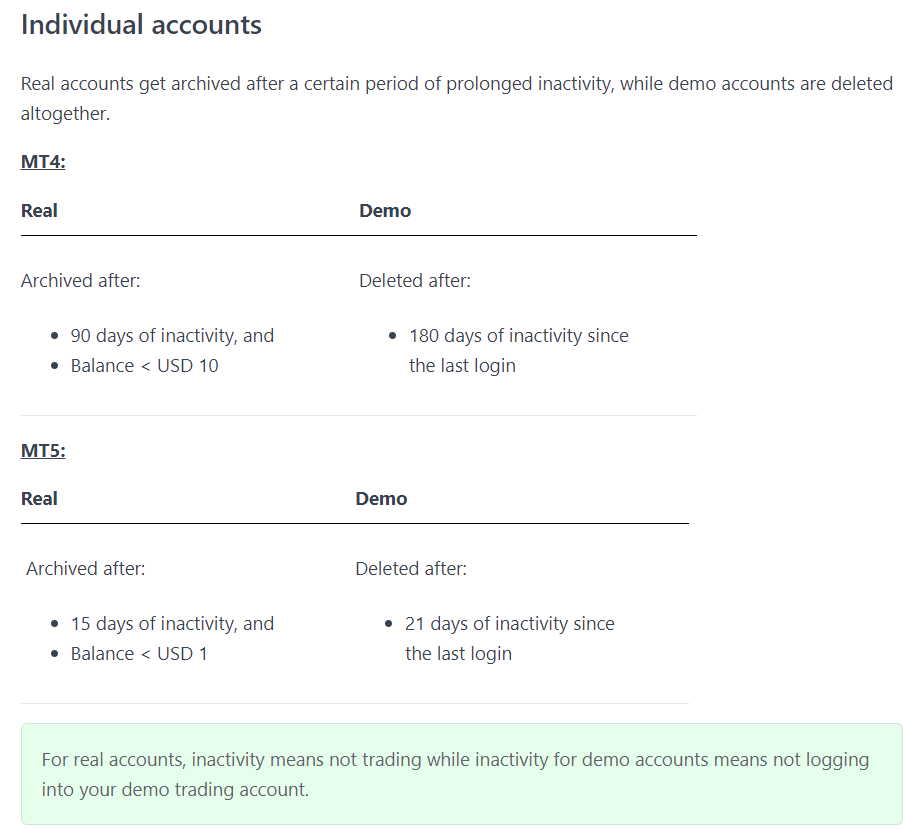

Also, all the good forex & CFD trading apps offer their free demo account which you can use for unlimited period. Some broker offer their demo accounts for limited period if you are inactive, but they generally don’t limit the number of times you can create the account again.

So it is a good idea to first download the app of the broker on your device like Android or iOS, and open a demo account to test it out.

8. How Good is the Customer Support – You never know when the need for quick customer support may arise. You may have an open position which you are unable to close.

At such times, you need the fastest available customer support, preferably from within the app. Only trade with forex brokers who understand the need for good customer service.

Talk to the live chat support before signing up, and also test by sending an email to support. Do you get prompt & helpful responses? Normally as a benchmark, you should receive response within few hours in case of email.

For live chat, there should not be hold time of more than a few seconds. Some forex brokers have few minutes of hold times.

For example, if you are have downloaded Exness’s trading app, and you need support on some issue, then you would have to wait for few days to get response via email as per our tests. And their Live chat normally has a few minutes of hold time & long queues. If you are okay with this, only then you should choose the app of this broker.

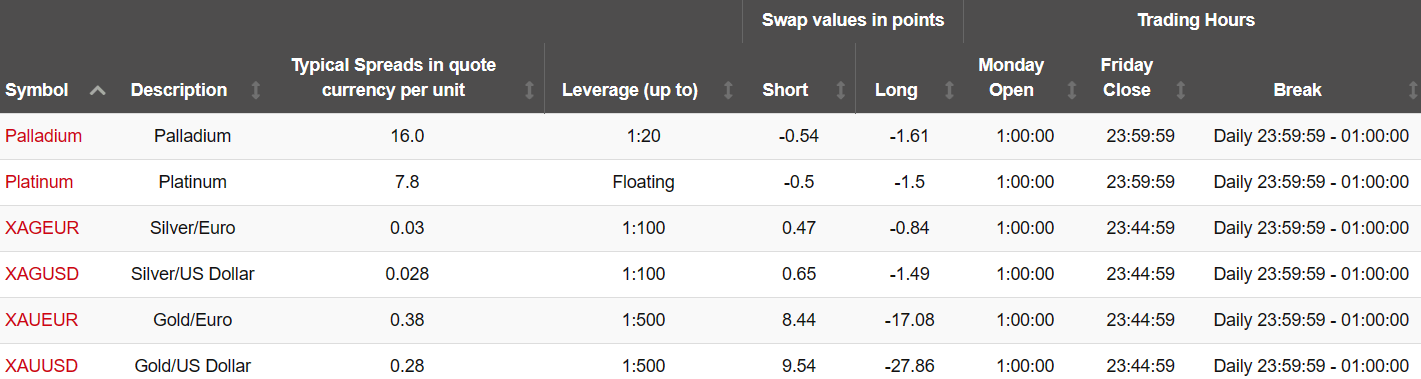

9. Fees on Alternate Trading Instruments – Forex Trading Apps offer multiple trading instruments as CFDs. Other than forex, you should check if the broker offers CFDs on metals, commodities & Indices.

First you should compare the total number of CFD instruments that are available at different apps, because Broker A could have lot more instruments than Broker B. You should also check how much the broker charges for each instrument. For example, maybe you want to trade Gold CFD (XAU/USD), then the broker of your choice in that case should have this instrument at low fees.

As per our research, most of the forex traders in South Africa prefer to trade EURUSD, GBPUSD & CFDs on Gold, and CFDs on major indices. So you should check the exact fees of the CFD instruments at different apps.

Having an idea of the fees for trading alternate instruments would also give you a better idea of the charges that you will pay. This is because many times you won’t always be trading EURUSD or GBP pairs. A forex app can claim to have low fees because they will only show majors, but these apps can still have quite high fees for alternate instruments.

The below screenshot is an example from HFM of the major metal indices available on their app. You should check the typical spreads (can vary for different account types), the Swap charges, Trading hours etc.

During our checks, we found that at some trading apps, you will get Offquote for alternate CFD instruments, even during the mentioned trading hours. You should altogether avoid trading CFDs on those instruments at such a broker because this can cause issues, especially during closing an order.

Let’s say that you were somehow able to open trade on Apple stock via your app, but you want to close it before the earnings report. If your CFD broker shows offquote on the app, this will prevent you from closing your trade, and can cause you losses.

So, if you are more into trading of alternate instruments through CFDs, you should test out different apps, and then select based on your preference for trading conditions, fees & safety of your funds.

10. Availability of Demo Account – With a demo account you can get to practice your strategies & work on them. While most of the forex trading Apps offer demo account, you should check if there are any conditions.

There may be terms where one broker only allows demo for certain time period after which they close it. Or they may close the account in case of inactivity (if you don’t operate the account i.e. place any trades for a few days).

For example, below are the terms at Exness related to archiving of trading account. According to the terms, if you are using MT4 for demo, then your trading account will be deleted after 90 days of inactivity. If you are using MT5 demo account, then the period is 21 days.

Inactivity in this case is if you have not logged in to your demo account for that period (no. of days).

Note that if your demo account is deleted then it does not mean your Brokerage account is also deleted. In case your demo account is deleted, then your can login to your app & create a new demo account.

If the broker allows creating multiple accounts from their app then it is okay, but otherwise it is not friendly.

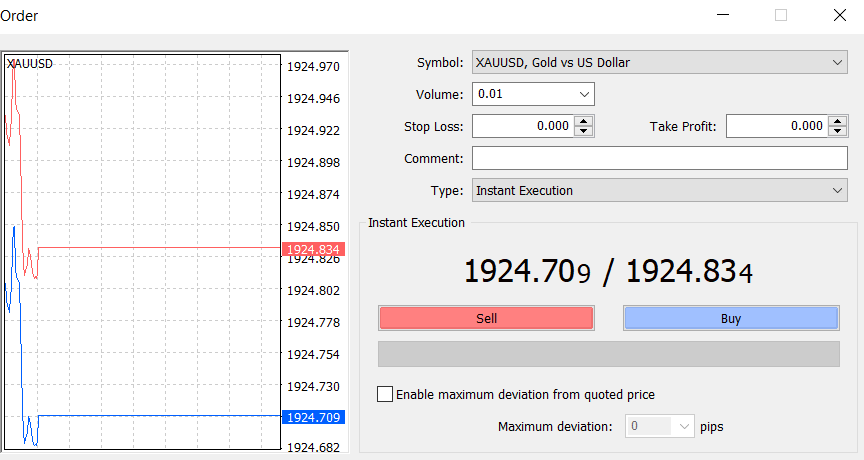

11. Total Cost of Trading – When opening your account with any app, check the total cost to trade. Most CFD trading apps have variable spreads as their main fees.

Depending on which instruments are you trading, your costs can be very high or moderate. For example, if you are trading Gold (XAUUSD) instrument as CFD via the app of your trading broker, they will quote you are Bid/Ask price, which will look like the example below.

You will noticed that the spread is almost 0.14 at this broker, with the account type (this is their lowest spread account). So, if you are trading 1 mini lot on average on Gold, then your spreads cost will be $1.4 per trade on this app. Some other brokers have even higher costs.

Another cost charged by trading apps is the inactivity charges. You will not noticed this easily. Most CFD trading apps will charge you a fixed monthly maintenance cost/charge if your account is dormant (no trading activity in your app for a period of time). You should find out the policy related to inactivity charges by your broker for using their app.

There are other forms of charges as well like charges during withdrawals, conversion of funds in ZAR. You have to carefully look at all these costs, and then decide which trading app has the lowest costs for your trading style.

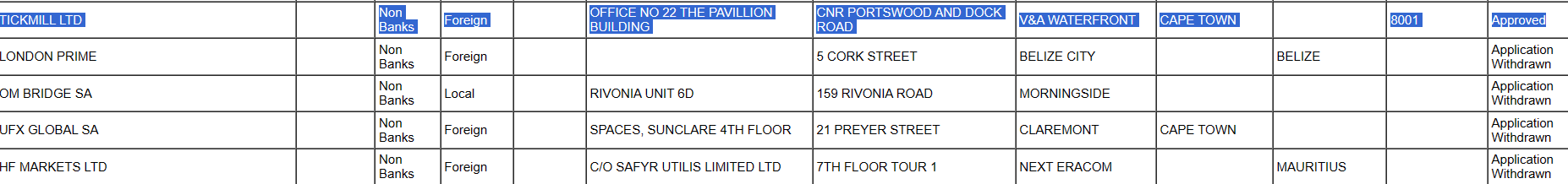

12. ODP License Status – This is related to the regulation of the broker’s entity with FSCA under their OTC Derivative Provider licensing regime.

All the brokers that offer derivatives instruments like CFDs on currencies, other instruments are required to be ‘approved’ under FSCA’s ODP licensing. The brokers are listed as non-bank entities when searched under FSCA ODP list.

When you are choosing a trading app of any broker, check if their entity is licensed to offer you those products. For example, trading apps that offer forex trading are CFD providers. By trading currency pairs through the apps of these brokers, you are trading CFD instruments (speculating on the prices) on a margin.

The entities who offer their forex trading apps in SA are required under FSCA’s new policy to have an approved ODP license. This license can be verified from FSCA’s ODP search.

For example, Tickmill is a licensed ODP with FSCA, and their status shows as ‘approved’. Depending of whether the application of the entity, the status can be declined, pending etc.

Only the forex trading apps of licensed Over-the-Counter Derivative Providers are considered safe for trading. Some forex apps may have a FSP number, but they may not be authorized an an ODP. You must ensure & verify that the trading app you are downloading is by a licensed entity for the safety of your funds.

Trading app allows you to access the financial markets through your mobile device. By using a trading app, you can view the market quotes, place trades on live markets (buy or sell), see your profit & loss etc.

Forex Trading Apps are specifically the apps by forex & CFD brokers. These apps are different from stock trading apps in the sense that you can trade CFDs on the forex market.

Although forex apps have trading available on other instruments too, like stocks, indices, metals & commodities. But these instruments are not directly being bought when you buy or sell. Instead you are speculating for a profit on derivative instruments, on a margin (or leverage) offered by the apps.

Trading via forex apps is very risky for retail investors. Only those who know the risks of CFDs should use these trading apps.

Only the trading apps of FSCA licensed forex & ODP brokers are genuine. Apps by all other brokers are not safe for trading currency derivatives.

Moreover, trading any form of CFD instruments is risky in itself. A trading app being licensed does not mean it is not risky for retail investors, you can still lose your funds if you don’t know how to trade.

You can download the app by a trading broker from Play store on your android device or App store on iOS.

You must only download the app by visiting the link on your broker’s website. After you have signed up for trading account, you will receive an email (on your registered email) from your broker, which would normally include the platform login details & the download links.

For example, if you choose MT4 on your broker, you will receive the login user, password, server id & platform download url on your email. After downloading the platform, let us say on your Windows desktop, you will be able to use these detail to login to your broker’s MT4 platform.

You can use the Forex app to buy & sell currencies from your device. For example, if you are using a mobile phone, you can use your trading app to place buy/sell orders on currency pairs like EUR/USD, or even on metal CFDs like XAU/USD.

Take the below screenshot from desktop app for example at a Metatrader based broker, you can place a Buy or Sell market order with one click. This is because brokers make their money from trade volume, so they make it easier for traders to place more trades easily (which comes with risks for traders).

Most apps are very easy to use & have graphical interface. You will see all the currency pairs which you can trade listed in the app. By clicking the currency pair, you should be able to view its chart.

You can then use drawing tools, indicators to do your analysis. We strong advice not to do any analysis on mobile device, and use a proper interface like desktop or laptop to do your technical or fundamental analysis of your forex trades.

After you have done proper due diligence on what you want to trade, and your order type, then go to your trading app & place the order. Your order can be market order or limit order. Also set the stop loss on your order in the app, which will be your exit price, where you will get out if the trade goes against you.

Your broker will automatically execute your order & stops set through their app. You can also use the app to monitor your historical P&L, learn from it, but some brokers may limit their view to only last few weeks.

In theory you could trade forex via your mobile phone. But in reality, no real trader would, and you should not either.

No professional trader trades any instrument via a phone. The risks are too high with real money (especially for large accounts) to be trading it passively on a phone.

There are so many limitations for someone trading on a phone. We will assume that before taking any trade, a trader will properly analyze the markets, see for different cross currency relations, what other markets are doing as well, check if there is any upcoming news event like NFP or some inflation data that could affect the trade & so on.

You realistically cannot do it on your mobile device.

For example, on your desktop or laptop, you will likely have multiple tabs open in your browser with with different data points you look at daily, but you cannot do that on a small screen, it is just not sustainable to be a consistently profitable trader.

Maybe if you are a position or a swing trader, you can use the mobile device to look at your position. But you would still not use a phone to actually analyze the trade idea, look at different sets of data. You should only think of phone as a medium to access data on the go, but not as your main device for trading.

Even coming up with some trading strategy requires you to go deep into the chart of that instrument (if you are a technical trader), meaning, you have to look at the historical price behavior for at least a few years maybe, and only then can you understand the market behavior. This cannot be done on a phone.

There is no specific forex app that is the ‘best’ for beginner traders. Infact, most forex trading apps are not suited for beginner traders.

This is because more that 90% of retail CFD traders lose money, so in reality, no forex app is suited for beginner traders. And there is a high risk that you will lose your capital that you are depositing.

So, you must understand this risk, and be willing to lose your capital, only then decide on an app to trade with. If as a trader you understand the risks with using any forex trading app, the other considerations come after.

In general, look for an app that has transparent fees structure without any complicated costs. And the platform should be easy to use.

For example, some brokers may charges different fees types (both trading & non-trading) like admin fees, account maintenance charges, currency conversion charges, swap fees, complicated variable spreads.

While this might be okay for a trader with some experience, but if you are a completely beginner trader, all these complicated charges can be a mess. It’s because your overall trading will be impacted by the costs you are paying to the broker.

Assume that your broker charges you variable spreads that all of a sudden spike to 5 pips on EUR/USD ahead of a news. Or the platform freezes when you have an active position in the market.

The point being, you should look for an app that is simple & reliable, and does not overcomplicate stuff for trades.

Regulated MT4 based brokers normally have a simple interface & standard fees structures. For example, Tickmill, Exness etc. have simple fees structures. But Exness does have issues with their Metatrader platform, and its feed sometimes just freezes even during the active sessions.

Overall, there is no best forex app for beginner traders, there is always a risk & tradeoffs you will need to make. But only trade via an app of a broker which is FSCA regulated, this should be non-negotiable.

In the table below, we have compared the 7 best forex trading apps for beginners & experiences traders in South Africa.

| Forex Trading App | Tier 1 & 2 Regulation(s) | Trading Fees (EUR/USD ex.) | Leverage | Minimum Deposit | Availbility | Start Trading |

|---|---|---|---|---|---|---|

| Hotforex Metatrader Apps | FSCA (FSP No.46632), FCA | From 1.2 pips with Premium Account | up to 1:1000 (for Micro), 1:500 (for Premium account) | $5 (R85) | PC, iOS & Android. | get started |

| XM Broker Metatrader apps | ASIC, CySEC | From 0.8 pips with Ultra Low account | 1:888 | $5 (≈R85) | iOS & Android | get started |

| Exness App | FSCA | On average 1 pip with Standard Account | up to 1:2000 | $1 | PC, Android, iOS | get started |

| AvatradeGo | FSCA (FSP No. 47546), ASIC | Fixed spread 0.8 pips | up to 1:300 | $100 (for Retail account) | Android & iOS. | get started |

| Plus500 App | ASIC, FCA, CySEC | Variable | up to 1:300 | R1500 (or $100) | Android, iOS | get started |

| Tickmill | FCA, FSCA, Cysec | From 0 pips + $4 commission per lot with Pro Account. | Variable (1:500 for majors) | $100 | Android, iOS | get started |

| FXTM Trader App | FSCA (FSP No. 46614) | From 2.1 pips with Standard account. | 1:1000 | $5 | Android & iOS. | get started |

As per our research, we have rated these 3 trading apps to be better than other brokers for forex & CFD trading:

Here is a quick checklist of most important factors you should compare in your trading app:

Trading forex online is very risky & most of the forex traders lose money. Major regulators like FCA require CFD brokers to disclose the percentage traders that lose with that broker. Only about 16% to 29% of the Retail traders make money with forex & CFD tradIng, depending on the broker, as these stats vary from broker to broker.

To be profitable with forex trading you need to learn & build a strategy that can give you consistent results, and not lose more than what you make with your trades.

Forex Trading is not a scheme which can make you rich overnight. Avoid any forex app that claims otherwise as it is likely to be a scam.

Yes, you can download the trading apps of two different brokerages simultaneously as long as it fits your requirements.

For example, you can install the app of Exness specifically for trading CFDs on their commodity instruments like Gold. And you can use another trading app for trading G10 or minor or exotic currencies.

There are no restrictions at all from any app. You can install & use as many trading apps you want to on your device, as these will be treated as separate applications on your Android/iOS/Windows device.

Almost all brokers offer their trading apps for Free. The only trading fees that their charge is the spread or commissions for every trade that you make. Some brokers also have extra charges for funding, withdrawals & inactivity.

XM (as low as 0.8 pips spread for EURUSD with Ultra Low trading account), Plus500 (spread from 0.8 pips for major like EURUSD) & Avatrade (fixed spread of 0.9 pips for EURUSD) offer very competitive trading fees starting .

Hotforex has the #1 Forex Trading App

Visit