We tested popular NDD forex brokers for 10+ factors & have listed the best ECN brokers for South Africans that are regulated by FSCA, FCA or ASIC.

While searching for a regulated forex broker, you may have come across the term ‘ECN brokers’. These brokers are generally different in the way they deal with your orders.

Many brokers falsely advertise on their model of execution, so you must exercise caution before you choose a broker.

To understand the difference, forex brokers can be classified into two types based on how they process the orders; Market Makers (Dealing Desk), and NDD brokers (No-dealing desk) which includes ECN brokers, and STP brokers.

Market maker brokers, as the name indicates, create a virtual market for you & act as a counter party to fill your order taking the opposite side of your trade. There may be a conflict of interest with your orders with these brokers.

On the other hand, No Dealing Desks (NDDs) i.e. STP ECN brokers, don’t not take the opposite side of your order, instead they connect you with other market participants. They either charge a small commission per trade or apply a mark-up on the spreads for the revenue.

List of 8 Best ECN brokers in South Africa for 2023

Here we have listed only the ASIC FCA, and FSCA regulated ECN brokers, that have a transparent NDD model and offer STP or ECN type accounts.

Below is our updated list of 8 best ECN brokers in South Africa based on our comparison factors i.e. broker’s regulation, trading commission, trade execution speed & some other factors:

Ranked #1 ECN Broker in South Africa

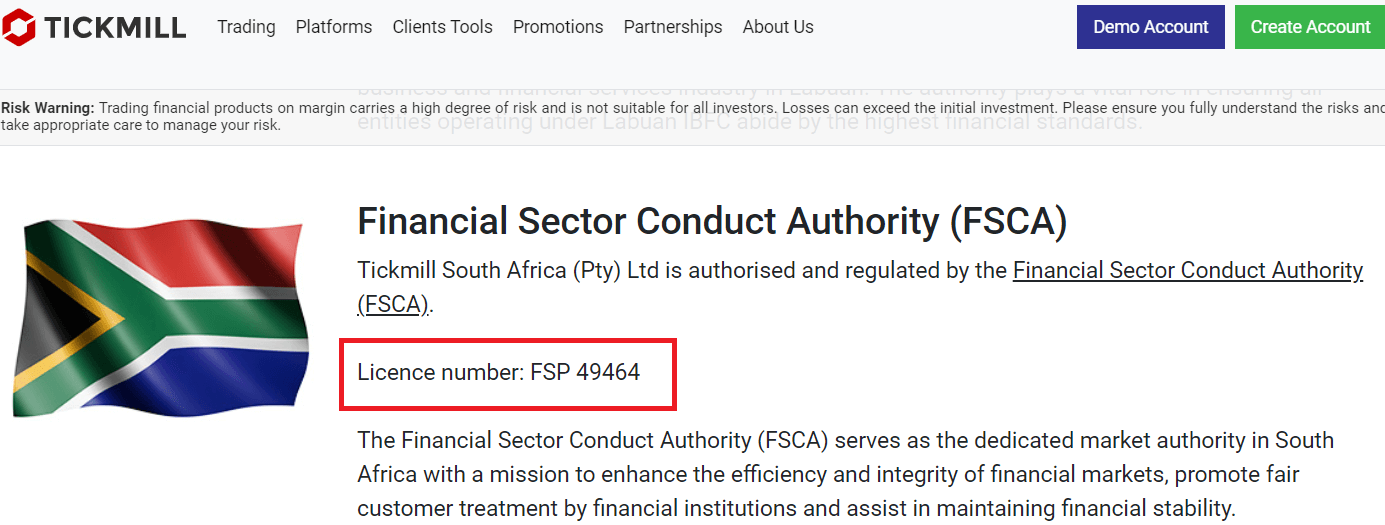

Tickmill is regulated with FCA (Register Number: 717270), FSCA (FSP Number: 49464) & CySEC (Licence number: 278/15). They offer Pro account which is an ECN Type account with NDD execution model.

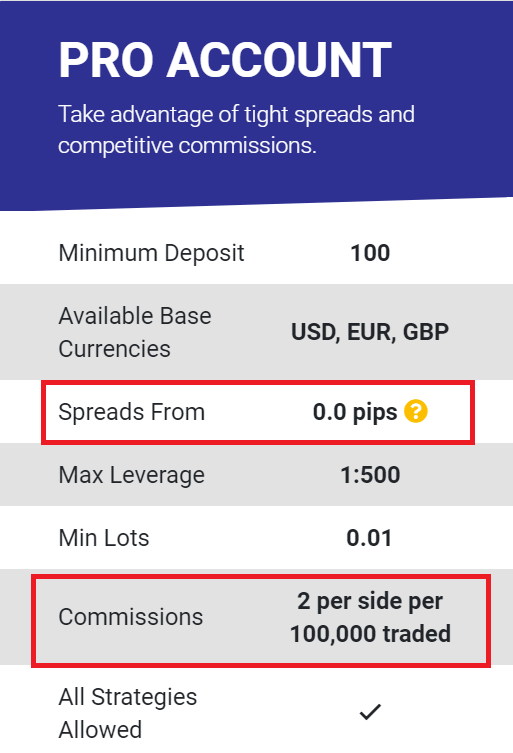

Tickmill offers very competitive fees with their Pro account that has a minimum deposit of $100. In our benchmark, the lowest spread for EUR/USD at Tickmill was 0.2 pips + $4 per Standard lot (i.e. $2 per side).

The execution at Tickmill is quick with no requotes. And they also provide negative balance protection with all their accounts. Moreover, they don’t charge any extra fees for funding.

You can trade on 62 currency pairs, which is higher than most other brokers. But on the negative side, other instruments are quite limited with 16 CFDs on Stock Indices & CFDs on 2 metals.

Tickmill ECN Account Pros

Tickmill ECN Account Cons

Ranked #2 ECN Broker in South Africa

HotForex is a 100% STP broker that is regulated with multiple tier 1 regulators i.e. FSCA (South Africa), FCA (UK) & CySEC (Cyprus). They are a good STP broker if you are looking for a South African regulated broker.

HotForex claims to offer a ‘STP model’ for all the trades placed by its clients, and all the orders are placed directly in the live market. So there is no conflict of interest with the orders that you place with them.

HotForex has one of the lowest spreads with the accounts among the brokers that we have compared. With their Zero Account, the spreads for major pairs like EUR/USD average around 0.3 Pips with a commission of just $3 (per side i.e. $3 to open & $3 to close which makes it $6 per trade) for a standard lot.

Their order execution is also very quick & most of the orders that we placed were completed without any off-quote. Another attractive point, is no deposit and withdrawal fees, so you will get 100% of your amount.

HotForex Pros

HotForex Cons

Ranked #3 ECN Broker in South Africa

Exness is a FSCA regulated broker & they have 3 Professional Accounts. The overall trading fees with these account types is low.

Exness is not really an ECN broker, but they have account types similar to other brokers with commission per lot & Raw spreads.

Exness have their lowest spreads with Pro Accounts. For example, with Zero Account type, the commission per lot for major like EUR/USD is $7 for roundturn per Standard lot & the average spread is 0 pips. With the ‘Pro Account’ there is no commission per lot, but the average spread is low (0.6 for EURUSD, 0.7 for GBPUSD etc.). This fees is lower than most other ECN type brokers.

The typical order execution at Exness is fast & without any delays. Although, during events of fast markets like gap ups or downs, the execution is affected & there is some slippage on limit orders.

Ranked #4 ECN Broker in South Africa

FXTM is a well regulated forex broker & they are also regulated with FSCA in South Africa. So we consider them a low risk broker

FXTM offer as low as 0 pips spread for some currency pairs with their Advantage Account. The commission is dependent on your account’s trading volume, but as an estimate it is 4.88 USD Roundturn for major like EUR/USD. The commission can be lower if your trading volume is high. The spread for EUR/USD with this account is as low as 0 pips.

FXTM does not offer ZAR base currency Accounts but they have local funding options in ZAR, where you can deposit & withdraw via Internet Banking. The amount will be converted into your Account base currency like USD for example.

Ranked #5 ECN Broker in South Africa

IC Markets is an Australian forex & CFD broker that offers Raw spread trading accounts. They are our recommended choice if you are looking for a true ECN type broker that offers low trading fees. The commission is low if you choose cTrader account.

IC Markets is regulated with top-tier regulator ASIC, and they have recently also applied for regulation with FSCA (FSP no. 50715).

The trading fees at IC markets is very low. For ex: for EUR/USD, they offer 0.1 pips spread on average + $7 commission per standard lot ($3.5 per side for open & close of position) with their Raw Spread Account (Metatrader). IC Markets does not charge any other fees for inactivity, funding or withdrawal fees.

They offer market execution model, offering the current market price. The orders with them are filled at the best price without any re-quotes. They don’t offer any negative balance protection though.

IC Markets Pros

IC Markets Cons

Ranked #6 ECN Broker in South Africa

BDSwiss is authorized by CySEC, so we consider them to be a moderately safe forex broker. They are not regulated with FSCA.

BDSwiss offer Raw account which has a spread from 0 pips & the commission is $5/lot for 100,000 units. The minimum deposit required for this account is $5000, which is much higher than other ECN Type brokers. But the overall trading fees is quite competitive with this account type. For example, the typical spread for major like GBP/USD is 0.5 pips on average.

The commission is $5 on all currency pairs including majors & minors, and it is $2 on CFD Indices.

BDSwiss does not offer ZAR Accounts or funding options in ZAR. You can deposit via your card, wire transfer. So the payment methods are not as convenient as some other brokers.

We will explain some of the considerations that you should take note of when choosing an ECN broker. But we will first start by explaining what an ECN broker is. Let’s go.

ECN brokers & STP brokers are the brokers that pass your orders directly in the actual market. These brokers are classified as NDD (No Dealing desk) brokers, since they pass your orders directly into the market rather than trading against you.

The major benefit with ECN brokers is the lower fees per trade, and the fact that your broker is not trading against you. What it means is that there is no conflict of interest with the broker, like in case of market maker brokers who may take the opposite side of your trade & act as liquidity providers.

We have explained below the models of ECN brokers & the STP brokers:

1. STP Brokers: Straight Through Processing (STP) is a technology that do not require a dealing desk. The STP broker typically connects traders with a network of liquidity providers that have access to interbank network. Therefore, they have variable spreads because the orders go through different providers which have their own Bid/Ask spreads.

For every order they get, they search for a counterparty internally among other participants and then look externally with liquidity providers. In this entire process, STP brokers do not assume counter-party positions, instead they connect the pool of participants together. STP execution is done directly in the market and hence no re-quotes. STP brokers earn their revenue through a small mark-up from the spreads quoted by liquidity providers.

2. ECN Brokers: Electronic Communication Network (ECN) broker allow the market participants to trade with each other, unlike STP where the orders are placed with liquidity providers. Your orders are placed in the market & matched against market participants like retail traders, banks, other brokers, financial institutions etc. that bring in liquidity to the forex market. ECN brokers earn their revenue/profits through a small commission per trade instead of mark-ups and spreads.

Let’s face it, the main reasons to choose ECN brokers over Market makers is the lower fees & more transparency.

Market maker brokers (Dealing Desks) are criticized many times for their role in trading malpractices, often taking the opposite side of its own clients’ trades to pocket profits instead of doing its own job of passing orders to a liquidity provider. Sometimes they even manipulate spreads/fees, thereby putting the retail trader at a huge disadvantage. This lack of transparency in their system makes them a poor choice for a retail trader.

In contrast, pure ECN/STP brokers (No dealing desk) have advanced technology which essentially eliminates the role of the middleman by offering a platform that places your orders directly in the real markets, and brings the market participants together. Not just that, ECN brokers allow clients to access real markets, thereby better quotes.

Most brokers these days offer a ‘Hybrid model’ which is usually a combination of both ECN/STP & as market maker. So it is important to check with the broker if they are pure ECN broker or not.

There are few points that you should consider while making choice of your ECN broker. The most important are the regulation & fees.

1) ECN Broker’s Regulation – This is the most important point that you must not ignore. Always choose a broker that is regulated by FSCA in South Africa, or similar top-tier regulations like FCA, ASIC etc. In our list we have only listed the ECN broker that are authorized by 1 or more major regulators.

You check whether the ECN broker is authorized of not by verifying their license number. All forex brokers need to be licensed to operate legally. So, all the licensed ECN brokers will have a page on their website where they list all their regulations.

As a reference, Tickmill which is on our list as a good ECN broker is licensed by FSCA. They have a page under ‘About > Regulations’ on which they have mentioned all the Tickmill Group’s regulations, as well as their license number with each regulator. They have also mentioned their FSP Number, which you can verify from FSCA’s website.

Similarly, you can check the license number of other ECN brokers. Make sure to verify the license number to ensure that it is valid, and the broker is still authorized.

Just because a broker claims to be regulated does not mean that they actually are, as many fake brokers make such false claims. Verify from FSCA’s search that the broker you are dealing with is licensed.

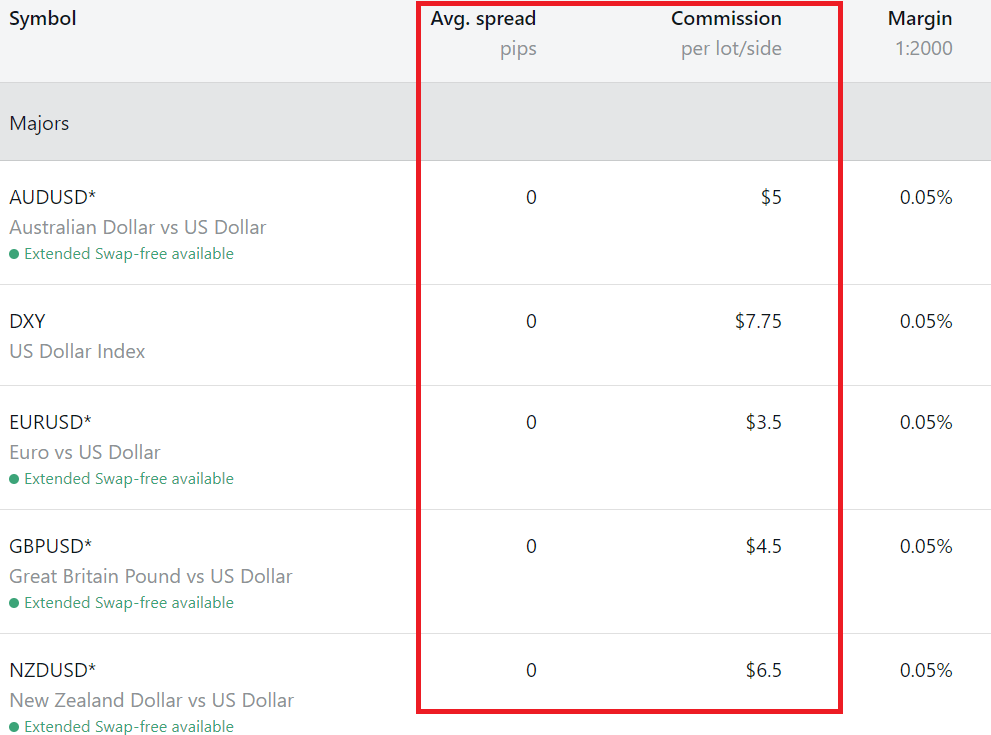

2) ECN Account Commission – One thing that is common with all ECN brokers is low spreads but a commission per lot. So, make sure to check the overall fees with ECN trading account.

Check the spread with ECN account for each instrument that you trade. Then add the commission per standard lot to calculate the overall fees.

For example, if the average EUR/USD commission at an ECN broker is 0.1 pips, and the commission is $7/Standard lot ($3.5 for each side), then the total fees would be $1 + $7 for 1 Standard Lot i.e. $8 in total.

In this example the commission is high, because Tickmill for example has $4/lot commission, and spread from 0 pips.

If the ECN type broker is charging you commissions per lot, it does not necessarily mean that the spreads will be 0. The spreads can still be moderate to high.

You should carefully verify what the spreads + commissions are. Some times, the commission + spread costs can be higher than a normal spread only account.

In the above table from a broker’s website for their Zero Account, the typical spreads are 0. Let’s say that you are only charged the commissions by your broker on EUR/USD trade of $3.5/per lot per side or $7 for roundturn.

This equates to a spread of 0.7 pips (if the spread is 0 at all times, so it can be higher). There are brokers with spread only accounts that have 0.5-0.6 pips spreads on EUR/USD.

So, your trading costs will not necessarily be lower by choosing a commission based account. Look at the total (spreads + commissions), and then compare it with if you only had to pay the spreads.

When comparing, also check the Swap charges for the forex pairs that you want to trade. For example, the Swap EUR/USD Long at Tickmill is -3.54 & 0.39 for Short positions. If you keep your trading order open overnight, then you will be charged the Swap fees.

Also, check the broker’s deposit & withdrawal fees. Some brokers may charge low trading fees, but could have very high non-trading fees for things like deposits, withdrawals, inactivity. Get an idea of the overall fees of the ECN account.

3) Funding & Withdrawals – Another important point that you should take into account is the ease with which you can deposit & withdraw from your trading account. In general, if the broker support EFT then it would be easier to fund & withdraw from your account.

Above all, the most important point to look for is the regulation. If the broker is regulated in SA with FSCA then you can be assured that you will get protection of your funds. Never trade with any unlicensed broker.

4) Overall Trading Conditions – This factor should look at multiple things, including the available platforms (preferably MT4 & MT5), range of trading instruments, available account base currencies, the markets hours, execution speed etc.

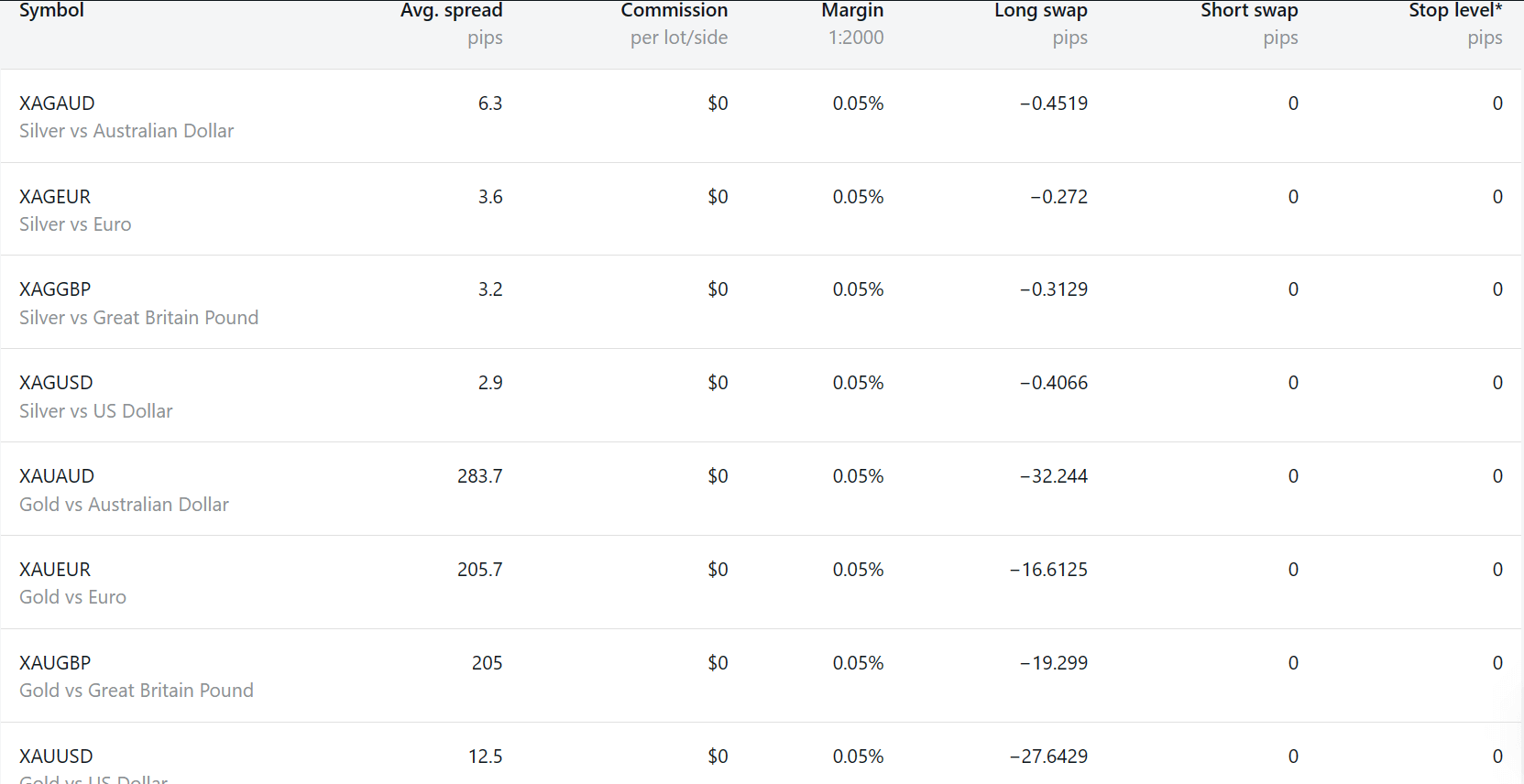

For example, if you were to check the available trading instruments, you should browse through the website of the broker & scan the available currency pairs, and other asset classes as CFDs. Let’s say you mostly trade metals like XAUUSD, and other crosses of Gold, then you should compare the total no. of Gold crosses at each broker, and their exact spreads.

Below is the screenshot from Exness’s website of their typical spreads, commissions & trading conditions for various Gold crosses with Pro account. Their typical spreads for XAU/USD is 12.5, which is moderate.

If the last traded price of XAUUSD is 2000, then 12.5 is around 0.625% of the price. So, the typical fees per trade for this instrument is 0.625%, which is moderate. You should comparatively check the exact trading cost for this instrument with similar Pro accounts at other CFD brokers as well.

| ECN Broker | Regulation(s) | Fees | Leverage | Minimum Deposit | Forex Trading Platform(s) | Start Trading |

|---|---|---|---|---|---|---|

| Tickmill | FCA (UK), ASIC | Pro Account – Spread from 0.2 pips + $4 commission per standard lot | up to 1:500 | $100 | MT4 for web, mobile devices, | get started |

| Hotforex | FSCA (South Africa), FCA, CySEC | Zero Account – Commission of $6 per lot + spread from 0 pips | up to 1:1000 | $200 (for Zero account) | Metatrader 4, MT5. | get started |

| BDSwiss | CySEC, NFA, FSC, FSA | Raw Account – Commission of $5 per lot for forex ($2 for indices) + spread from 0.3 pips | up to 1:500 | $5000 (for Raw account) | Metatrader 4, MT5. | get started |

| FXTM | FSCA, FCA, Cysec | Avdantage Account- Lowest spread from 0 pips + $4.88 commission per standard lot. | 1:1000 | $500 | Multi device MetaTrader 4, MetaTrader 5, Webtrader | get started |

| IC Markets | ASIC, CySEC | Raw Spread Metatrader – Commission of $7 per lot + spread from 0 pips | up to 1:500 | $200 | MT4, MT5 & cTrader. | get started |

| FxPro | FSCA | cTrader account – Floating spread from 0.37 pips + $4.5 USD per trade for standard lot. | 1:500 | $200 | MT4, MT5, cTrader. | get started |

| FP Markets | ASIC (Australia), CySEC | Raw Spread from 0 pips + $3 USD commission per trade | 1:500 | $100 | MetaTrader 4, MetaTrader, Webtraders | get started |

As per our research on comparison of the trading fees, platforms & available instruments the following STP/ECN brokers are the best for traders in South Africa:

ECN & STP brokers offer you direct access to the live market by matching your orders against the other participants in the Forex market.

ECN brokers directly link you to the interbank market participants via their liquidity providers. This is unlike market maker brokers – which create the virtual market & match the traders via their internal order books or take position opposite your trade.

With transparent True ECN brokers there is no conflict of interest & generally the trading fees is also much lower. But, there may be a conflict of interest with market makers as they may be taking position against you, which means that with some broker that follow bad practices, it may be in their benefit that you lose.

You should directly ask the broker about their trading execution model. Most regulated & good brokers will be transparent about it, and also have page on their website for execution policy related terms.

Brokers that offer True ECN access accounts will mostly likely mention it openly. But this does not mean that an ECN broker is the best. Some brokers have hybrid model which can be a mix of STP & ECN, but still be a NDD (No dealing desk) forex broker, and are very transparent with good execution.

FxPro for example is a FSCA regulated NDD forex broker but they don’t have a direct ECN model. So, according to us what should matter most for beginner traders – is the broker is well regulated & does it have quick execution model at lowest possible fees.

There are 10+ FSCA (formerly FSB) regulated forex brokers that also offer ECN type trading accounts. These FSCA regulated brokers have good ECN/STP platforms: Hotforex, ForexTime and Tickmill as per our ranking factors & user reviews.

Hotforex offers lowest fees with their Zero Account. ForexTime offers multiple ECN account types, and some of them have good ECN environment. Tickmil is a NDD broker & has a Pro account which is an ECN type account.

Tickmill is the #1 ECN Broker

Visit