We have listed the best forex brokers for beginners in South Africa after comparing 50+ brokers that accept SA traders.

There are so many brokers that accept South African traders. But if you are a beginner, then you must watch out for 3 very important points in a broker: First, the broker must be well regulated. Two, they should have simple & transparent trading fees. Third, their platform should be easy to use.

To save your time, we have compared over 50+ popular forex brokers out there that are well known among beginner traders. We checked their accounts, trading & non-trading fees, minimum deposit, mobile app & other platforms, ease of access to support.

8 Best forex brokers for Beginners in South Africa in 2023

Rated #1 Forex Broker for Beginners

Tickmill is a good forex broker for beginners in South Africa as per our research. The most important points are that they are FSCA regulation, have low fees, zero deposit or withdrawal charges, local instant bank transfer option, wide range of forex trading pairs and decent support.

Tickmill Group was founded in 2014, and they are currently one of the most reputed forex brokers in the world. They offer 2 simple account types for Beginner traders, one with spread + very low commission (Pro account) & Classic account which is spread only. The fees is automatically calculated for each trade on their Metatrader platform.

We consider them a safe broker for South African traders because of Tickmill’s regulation with FSCA & FCA. Both these regulations are top-tier making the broker a low risk for traders depositing funds with Tickmill.

The minimum deposit at Tickmill is a bit higher than other brokers. Their deposit is $100 with Pro account & the same with Classic account. The max. leverage with these accounts is 1:500, and you can trade 62 currency pairs.

Tickmill offers Metatrader 4 platform, which is the most widely used platform in the industry. It is quite beginner friendly. They have support available via English Live chat & emails. Most of these features are excellent if you are a beginner trader.

Rated #2 Forex Broker for Beginners

HotForex is really good when it comes to transparency in their fee structure, we believe there are no hidden charges. Combined with competitive spreads, it is very beginner friendly.

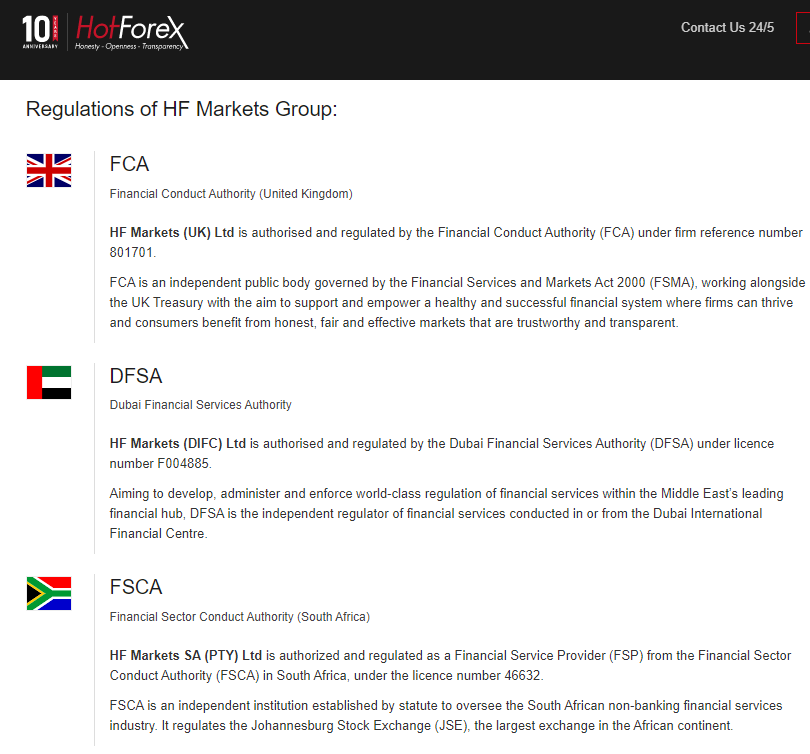

HotForex, setup in 2010, is now a globally reputed broker with presence in more than 200 countries. It is regulated by FSCA of South Africa as well as other reputed authorities like CySEC of Cyprus, FSC of Mauritius, FCA of UK, DFSA of Dubai and FSA of Seychelles. Add to this, the company’s insurance policy and segregation of funds ensure the capital is very safe on their platform.

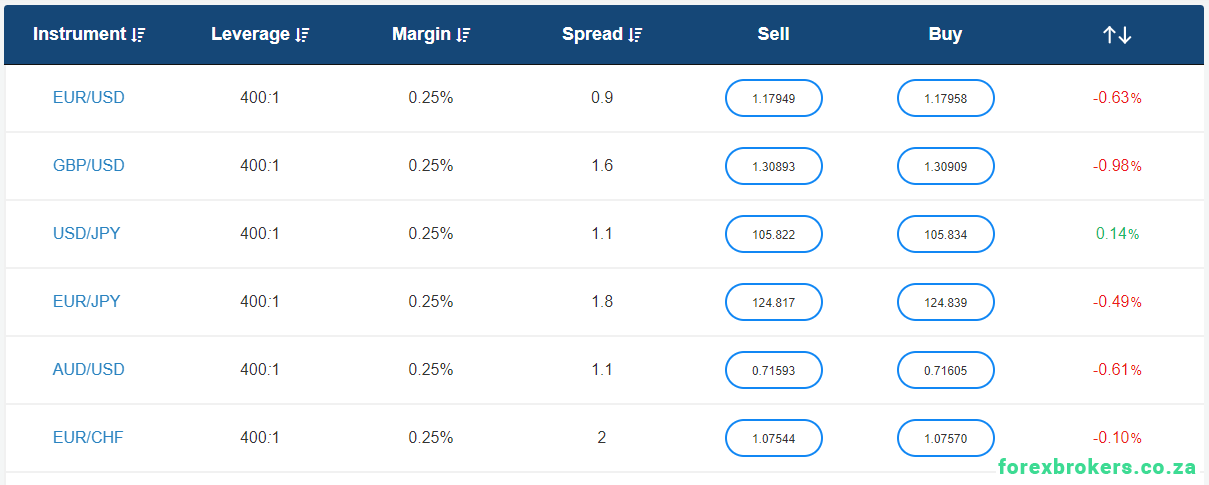

HotForex provides one of the most competitive spreads in the market. For a major pair like EUR/USD, the benchmark spread is around 0.3 pips for a Zero account and 1.3 pips for a Premium or Micro account. Commission of $3 per standard Lot per side is charged by HotForex on Zero accounts. A rollover fee is charged on overnight holdings. There is no Deposit and withdrawal fee.

The minimum deposit is $5 for a Micro account at a benchmark spread of 1.3 Pips, while for a Zero Account, the deposit is $200 with a benchmark spread of 0.3 Pips.

HotForex provides MT4 and MT5 trading platforms. They are available on Desktop (PC and Mac) as well as on mobile (Android and iOS) and a WebTrader.

HotForex offers education resources starting from beginner to seasonal traders in the form of e-courses, video tutorials, webinars, events, How-To Videos.

Rated #3 Forex Broker for Beginners

Overall, XM is very good for beginner traders with their simple fees structure & good trading conditions. They offer a bit of everything from security of funds, competitive pricing, standard trading platforms like MT4 and MT5, and some educational content that teaches the basics required to start.

XM was setup in 2009, since then it has grown to 2.5 million customers with a presence in 196 countries. They claim to have no re-quotes and no rejections policy with a success rate of 99.35% and less than a second execution time. Also, they offers negative balance protection, so the traders are never at risk of losing more than the account balance.

XM is regulated and licensed by some of the globally reputed authorities like the Australian Securities and Investment Commission (ASIC) and Cyprus Securities and Exchange Commission (CySEC).

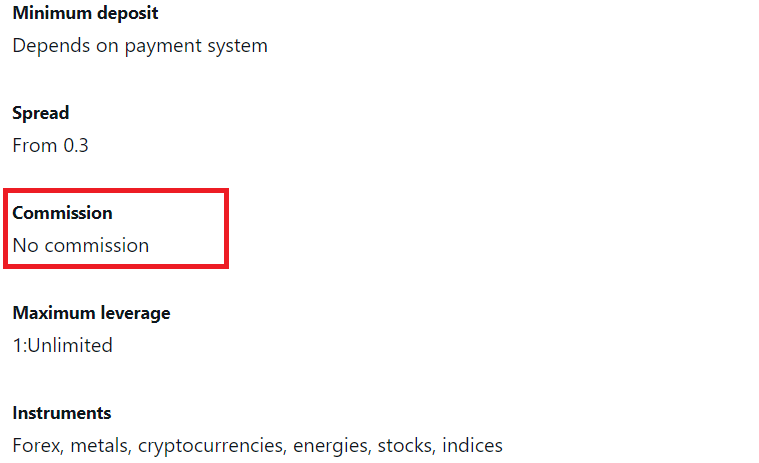

The minimum deposit is $5 for a Micro or Standard account, for which the spread is as low as 1 Pip and zero commission charges. Both these accounts come with flexibility to trade both standard or micro Lots. In “XM Ultra Low Account” the minimum deposit of $50 & has a spread as low as 0.6 Pip with no commission charges. The max. leverage offered is 1:888.

XM offers the MT4 and MT5 (both apps and webtrader) trading platforms only for Windows PC, Mac as well as smartphones and tablets for Android as well as iOS.

Rated #4 Forex Broker for Beginners

Exness is a well regulated forex broker with clear fees structure with all account types. Their lowest spreads are with Pro account, which requires higher deposit but the fees is quite low.

Exness is one of the largest forex broker in terms of traded volume, and their are multi regulated, including with FSCA.

Beginner traders can start with Standard account or Standard Cent account. For both these account types, the minimum deposit is $10 for SA traders, and you can deposit via Bank account.

The typical spreads for major like EUR/USD is 1 pip with the Standard account. This is quite low compared to similar Cent & Micro accounts at other forex brokers. For lower spreads, you can also open Pro account, but that requires a higher minimum deposit.

Traders can trade via MetaTrader 4 & 5 platforms, available across devices. The total range of trading instruments at Exness is also wide, including 100+ currency pairs. The beginner traders should stick to majors, and the low spreads for majors at Exness is a good thing.

The major downside at Exness is their support. The Live chat support is slow & it takes few minutes of hold time on average to connect with a real agent. Their email support also can take a few days sometimes, to reply to queries.

Choosing the right forex broker is an essential component and the foremost step to become successful as a retail trader.

Look for these 3 points as these factors are important to the eventual bottom-line of any trading activity:

#1: Must be regulated by Top Tier Regulators: Understand that the best brokers abide by the regulatory requirements of Top regulators like FSCA, FCA, ASIC.

For example: The regulations page on Hotforex highlights all the market regulators that have regulated them.

A regulated broker is accountable to the authority whose core interests are the safety of retail investors. This ensures the capital deployed on the brokers’ platform is relatively safe from malpractices commonly associated with the industry.

#2: Fees should be simple (no hidden surprises): The best forex brokers that are beginner friendly would have very easy to understand fees model. They would show their spread, deposit/withdrawal charges, inactivity fees publicly on their website.

Brokers have pages on their website where they show their live spread, like this table on Avatrade’s website that shows spread on all currency pairs available on their platform.

The minimum deposit should not be too high.

When considering a forex broker as a new trader, you should prefer a broker that has a simple cost structure. Simply find a broker that charges spreads only (without commissions or extra charges on trades or non-trading).

Most forex brokers have account types which are spreads only. For example, when opening the account, check whether there is any commission involved with that account type. This is what you will find on the broker’s website & account opening pages.

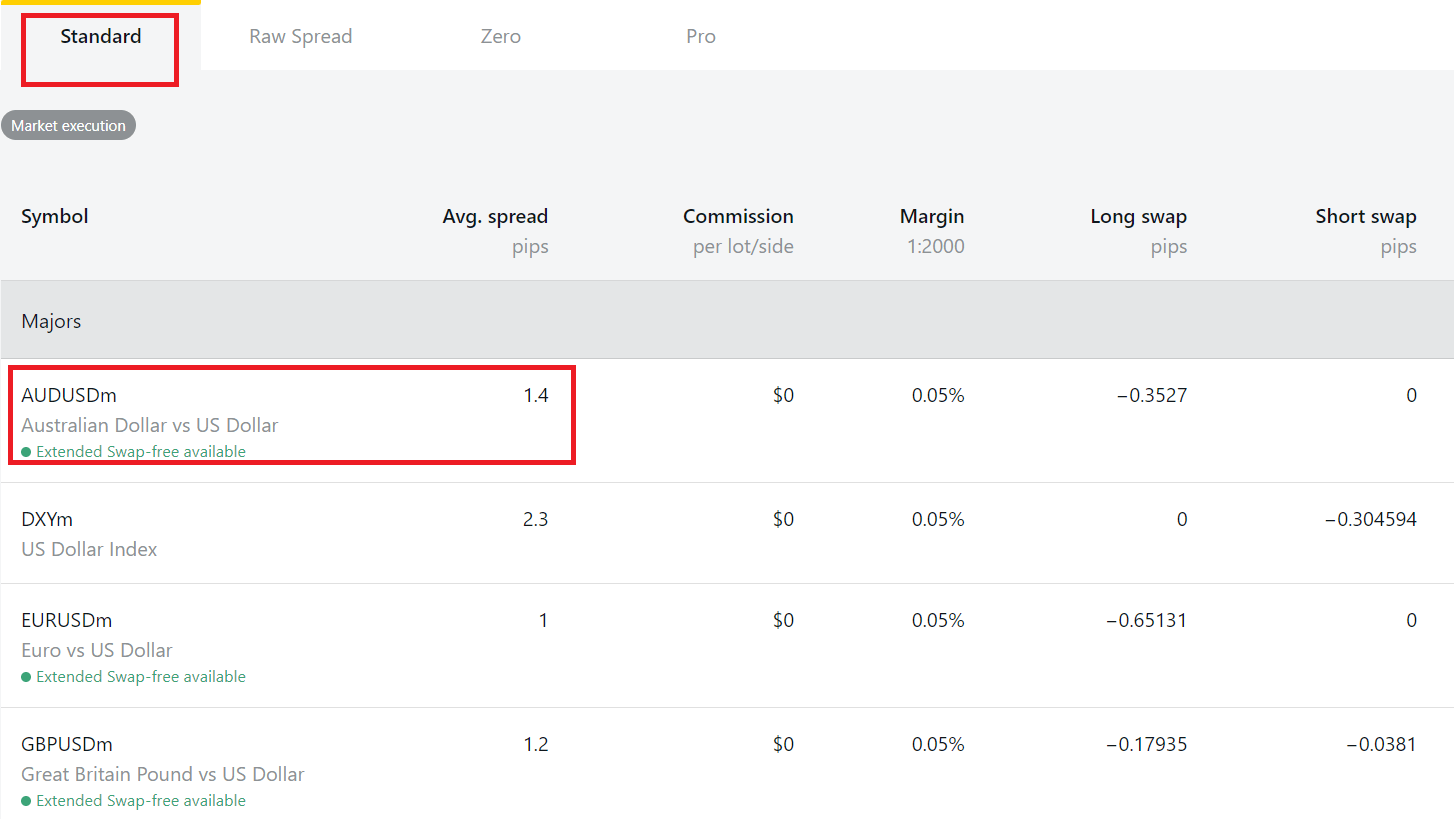

After you have check the commissions, then check the typical/average spreads with the account type you are opening with that broker. We will use Exness to explain this.

The broker will have a page on their website related to trading conditions for their available instruments. There you will find the list of instruments & their ‘typical spreads’.

In the above example, you can see that the typical spreads for AUD/USD is 1.4 pips with ‘Standard Account’ at Exness. Similarly, you can find the spreads charged by different brokers & compare them.

Also, do look for the brokers that offer competitive fees overall. Fee is charged in the form of spreads or commissions, deposit/withdrawals, overnight fee, admin fee etc. While a broker should be transparent with the structure, not many do so. It is important to avoid those that are not transparent with the fee structure.

#3 Easy Web, desktop & Mobile Friendly Platform: Next comes the trading platform and its features. It should be user-friendly and have all the tools for a proper market research. As a beginner, it should not be overwhelming.

Most brokers offer Metatrade 4 platform to traders in South Africa. MT4 and MT5 are probably the most recommended trading platforms out there but some brokers offer their proprietary tools. Other tools like ZuluTrade and cTrader are also popular among certain brand of traders. Demo platforms are offered by most brokers, you can place virtual trades and checkout every platform out there without putting your money.

#4 Education: While you should prioritize to educate yourself on trading concepts from independent resources like our guide on Forex Trading for Beginners in South Africa is a good place to start if you are a beginner, but it is still good if your broker offers Free educational content.

Top brokers offer educational content that suits the beginners’ needs. The content can be in the form of videos, articles, tutorials or webinars etc. Great beginner level education stands-out in our opinion, as knowledge is one of the critical components in any traders’ long-term success.

Forex brokers, or currency trading brokers, facilitate the trading of currencies on their platform by allowing the participants i.e. registered traders to buy and sell currencies. A good broker would quote the best price available for the currency pair from the interbank system (network of banks) and allow the participants to trade – charging a small fee for the service provided.

Beginners can assess the Forex broker based on the below suggestions:

It really depends on the broker and the account type being offered. The minimum account deposit can be as low as $5 or ZAR 76. For a beginner, that should be a good start.

Remember to start by learning the basics of Forex Trading & practicing on demo account for few months before trading with real money. You can also signup with forex brokers that offer no deposit bonus to practice trading in real market conditions.

Forex markets are volatile, and it is common for portfolios to get wiped out within seconds due to currency fluctuations.

Things will get more complicated when the position is taken using leverage. It may improve profits, but it also magnifies any loss. Added to all of this, a retail trader just does not have the information access that a financial institution has.

All these factors make the odds of making consistent profits slim. Having said that, with right knowledge and experience one can learn to navigate the perils associated with Forex & CFD trading.

Tickmill is the #1 FX Broker for Beginners

Visit