We researched 30+ FSCA regulated forex brokers in South Africa, here are the best of them that offer CFD & Forex trading at lowest fees.

South Africa’s capital markets which includes forex, CFDs are well regulated. The regulatory body for the financial markets in South Africa is Financial Sector Conduct Authority (FSCA), which was formerly known as Financial Services Board (FSB).

Although it is not mandatory for investors to trade forex & CFD through FSCA regulated brokers, and you can opt to trade with foreign regulated brokers.

But it is advised for South African traders to trade with FSCA regulated forex brokers as this provides a safety for investors by ensuring the safety of funds and protection against any disputes and malpractices by brokers.

The regulation ensures that the investor’s money is not misused in any form by the broker & the provider has to comply with the policies set by the regulator.

List of 8 Best FSCA regulated forex brokers for 2025

To help you find the best regulated forex brokers, we researched all the forex & CFD brokers authorized by FSCA, and then compared their overall trading fees, platforms, number of years since FSCA authorization date, complaints against the broker, their response to customer issues, and some more factors!

Now let’s compare & review all our selected best FSCA forex brokers, one by one..

Here is our detailed research on the features: account opening process, brokerage charges, platforms, funding/withdrawals, available trading instruments, support & more on the selected FSCA regulated forex brokers.

Rated #1 FSCA Regulated Forex Broker

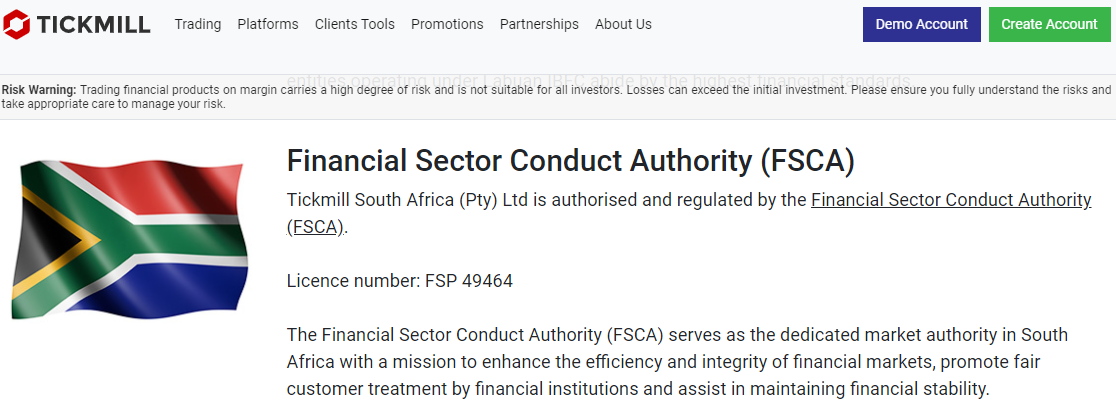

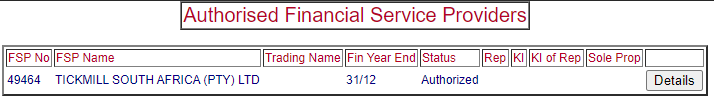

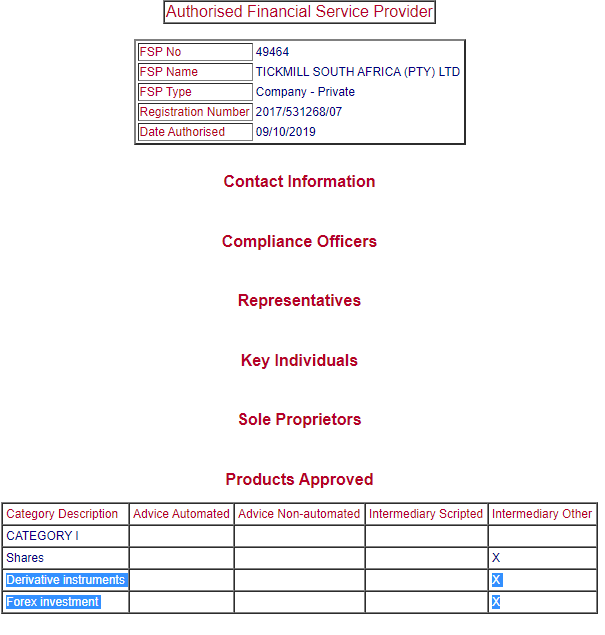

Tickmill is a reputed forex broker that is well regulated globally & has also been authorized by FSCA recently with FSP No. 49464.

Tickmill offers competitive trading fees compared to most other brokers. Their Classic account is spread only account, with spread from 1.6 pips. They also have a Pro account that Raw spread from 0 pips, and $4 commission per Standard Lot. The minimum deposit with both accounts is $100.

Tickmill also does not charge any commissions on deposits or withdrawals. And they accept multiple payment methods including Bank Wire, credit/debit card, Skrill etc.

They are a Metatrader 4 only broker, and their platform is available on PC, Webtrader & mobile apps for Android & iOS. 62 Forex pairs, CFDs on 17 Indices, 2 Metal CFDs & 4 CFDs on Bonds are available for trading on their platform.

Tickmill Pros

Tickmill Cons

also read our detailed Tickmill review

Rated #2 FSCA Regulated Forex Broker

FxPro was authorized by FSCA in 2015 for license of offering ‘Derivative instruments’ as Intermediary Other. They offer trading on multiple asset classes on multiple trading platforms including cTrader, MT4 & MT5.

The overall fees at FxPro is moderate to low depending on your account type. As a benchmark, for major like GBPUSD, their spread is 0.68 on average with cTrader account, plus commission of $3.5 per standard lot. This fees is moderate to low in comparison to other similar brokers.

FxPro allows traders choice between multiple account types, which you can choose based on the platform (MT4, MT5 & cTrader), and the execution method (market or instant). The spreads & commissions for each instrument various depending on the account type.

Besides currencies, there are wide range of asset classes available for trading at FxPro, including CFDs on cryptos & major indices like NASDAQ. You can also open your account with ZAR as your account’s base currency.

Rated #3 FSCA Regulated Forex Broker

HotForex is a FSCA authorized Financial Service Provider since 2016. They are rated best in our research because of their competitive trading fees, easy to use Metatrader platforms & good support.

HotForex has various accounts, for beginner & professional traders. They have Premium account with average spread of 1.2 pips for EUR/USD, with no extra fees. And they have Zero account for high volume traders an average spread of 0.4 pips + $6 per standard lot for EUR/USD.

The minimum deposit required to open a live trading account at HotForex is $5 (ZAR 70), with their Micro account. Plus, the deposit & withdrawals at HotForex are commission free (no fees on funding & withdrawals). Their support is also very quick, available 24/5 via chat, and 24/7 via emails.

MT4 & MT5 platforms are available for all traders. Their options of trading instruments are very wide including – 49 forex pairs, CFDs on metals, indices, 56 shares, 7 commodities & 7 Crypto pairs.

HotForex Pros

HotForex Cons

Rated #4 FSCA Regulated Forex Broker

Exness is an authorized FSP with FSCA since 2020.

Exness is a reputed Forex & CFD broker that is regulated with multiple top-tier regulations. Their average spread & overall fees with Standard account is very competitive, and low compared to other brokers.

Exness offers ZAR account, and USD, EUR base currency options also. They don’t charge any extra fees on deposits or withdrawals. They have option to deposit & withdraw funds in ZAR via Internet Banking tranfer, and there is no extra fees with this method.

MT4 & MT trading platforms are offered by Exness. They offer large number of instruments including 107 currency pairs & CFDs on 100+ instruments

But Exness does not have good customer support. Their live chat support is okay, but for queries sent to their support email it normally takes a few days to get a response. You may have to wait for some time to get a response from their support for issues that take time.

Exness Pros

Exness Cons

also read our Exness review for detailed comparison

Rated #5 FSCA Regulated Forex Broker

Avatrade is regulated with FSCA since November 2015. They are a well regulated broker globally & offer really competitive fixed spread trading account. We recommend them if you are looking to trade with a fixed spread broker.

Avatrade offers standard fixed spread account. Their EURUSD average spread is 0.9, for GBP/USD it is 1.6 pips. Overall for major pairs, their fees is quite fair without any extra commission other than their spread.

The account minimum is $100. Their leverage is limited to 30:1 for retail traders & 400:1 for Professional traders.

Avatrade offers MT4 & MT5 platforms. Their trading instruments available include 55 currency pairs, CFDs on 624 stocks, 17 commodities, 20 Indices, 5 ETFs & 14 cryptocurrencies.

AvaTrade does offer deposit & withdrawals via Bank Transfers in ZAR. But they don’t have ZAR Account base currency option available for Account.

Avatrade Pros

Avatrade Cons

Rated #6 FSCA Regulated Forex Broker

ForexTime has been authorized by FSCA since July 2016. They offer Micro account & ECN type Advantage account.

FXTM is a market maker for their Micro account, but they also offer ECN type ‘Advantage account’ which has spread from 0 pips & low commission based on volume. The minimum deposit at FXTM is $50 for their Micro account & $500 for their Advantage account.

The overall fees at FXTM with Micro account is high compared to other brokers. On average their spread is 1.9 pips with Micro account, which is quite high. But the overall fees (spreads + commission) with their Advantage account is lower, but it is not the lowest, as Tickmill has bit more competitive commission of $4/lot, while FXTM has $4.88/lot commission.

The total brokerage fees with the Micro account would eat a lot of your returns, so if you place a lot of trades intraday, then you should prefer their ECN type account. The total number of forex pairs at FXTM are lower compared to Exness & some other brokers, so you should check if your choice of tradable instruments are available & their exact fees.

The support at FXTM is okay. We found that there is some minutes of hold time while connecting with their live chat support.

FXTM Pros

FXTM Cons

Rated #7 FSCA Regulated CFD Trading platform

Plus500AU Pty Ltd (ACN 153301681) with FSP no. #486026 is an Authorised Financial Services Provider in SA. They are a reputed CFD trading platform that are publicly listed, and also regulated by multiple Top-tier regulatory authorities.

Plus500 offers competitive fees for majors, and their spread is variable. They don’t charge any commission other than their spread, and no fees on deposit or withdrawals.

The minimum deposit is R1500 (you can create ZAR account). The max. leverage is 1:300. They also offer negative balance protection & guaranteed stop loss feature. With Plus500, you can trade CFDs on multiple financial instruments including 60+ Forex pairs, 28 Indices, 22 Commodities & 100+ stocks/shares. Overall their trading conditions are good in comparison with most of the other CFD trading platforms.

Plus500 offer their own proprietary trading platform, they don’t support Metatrader. This is a negative if you prefer trading on MT4 or MT5. Their mobile trading platform app is easy to use.

Plus500 Pros

Plus500 Cons

Rated #8 FSCA Regulated Forex Broker

IFX Brokers has been authorized by FSCA since June 2017. They offer 5 different account types, including Cent, Standard, Premium & VIP accounts.

IFX Brokers offers market execution with all their account types as they only act as an intermediary. The lowest deposit is $10 with Cent & Standard account types, but the spreads are on the higher side with this account type.

Their overall fees is lowest with VIP account, which requires a minimum deposit of $1000. The average commission is from 0.5 pips, and the commission is $6 per 100,000 units. For example, if you are trading 1 mini lot (10,000 units) of EURUSD, and the spread is at 0.6 pips, plus commission of $0.6 roundturn (open & closing a trade). This makes the fees at $1.2 per lot, which is around 1.2 pips for similar account types.

Their trading fees are not the lowest, as other similar forex brokers have lower fees for similar account types.

You can trade on MT4 or MT5 platforms, via your desktop or mobile app. They offer good local support via phone & email.

IFX Brokers Pros

IFX Brokers Cons

FSCA (Financial Sector Conduct Authority) is a market conduct regulator for financial institutions in South Africa that provide financial products and financial services, this includes Banks, insurers and other non banking Financial Institutions.

FSCA was formed on April 1, 2018 after Financial Sector Regulation (FSR) Act of 2017 came into effect. The act applied Twin Peaks model to the financial sector dividing the responsibilities of financial market regulator in two i.e.: Prudent Authority (PA) and Market Conduct Authority (FSCA). This system was based on other developed markets like: Australia, Netherlands, Belgium, New Zealand and the United Kingdom.

Existing non-banking financial market regulator FSB (Financial Service Board) was given the role of Market Conduct Authority giving it right of oversight on both banking & non-banking financial institutions providing financial products & services that are licensed in terms of financial sector laws of RSA including Banks, Insurers & Capital Markets. FSB was renamed to FSCA to assume the Market Conduct Authority’s role, and Reserve Bank was given the duty of Prudent Authority.

In South Africa, all CFDs including Forex Trading are treated as derivatives & non banking financial products and are regulated by FSCA, and all providers are required to be registered under FSCA’s Financial Provider (FSP) List.

The Forex & CFD Brokers authorized by FSCA, are required to have a local office, and have 1 local director. The regulated brokers must also comply with all the FSCA’s guidelines, this ensures the safety of South African investors in case of any bad activity by the regulated broker.

Ever since FSB was restructured from a super-regulator of non banking financial sector and replaced by FSCA in 2018, the additional responsibilities of FSCA has been providing quality finance education to customers, maintaining financial stability of its customers, spreading of information regarding changes in regulation and overseeing the development of South African financial markets.

This ensures fair treatment of customers and maintains high efficiency and integrity of the financial markets.

For brokers, getting regulated by FSCA gives additional benefits. License from FSCA gives credibility to the brokers, hence ensuring bigger market share. Additionally, getting regulated makes it easier to use local bank account for transactions in local currency with ease.

Though trading through offshore or foreign brokers is not restricted currently for traders in South Africa, but still it is advised to trade CFDs or forex via forex brokers regulated by FSCA only.

The reason being that in case the regulated broker commits any fraud or goes bankrupt, the investor’s fund could be restored through the help of local authorities, which would be very difficult or even near to impossible in case the broker is not registered in SA.

Regulation in financial markets is necessary in order to reduce the risk on the trading activities for the participants, consequently reducing the potential losses due to bad trading environment & malpractices by the brokers.

The regulatory body in South Africa is FSCA, which has the responsibility of regulating the financial markets by providing protection to the citizens and the economy from any potential money laundering or fraudulent schemes.

Here are some important considerations:

1. FSCA keeps check on the financial trading activities including: CFDs & Derivatives market to see there are no irregularities or misrepresentation and ensure its smooth functioning so that the financial markets are not adversely affected. FSCA ensures this by regulating the Forex Brokers & Derivatives/CFD Brokers.

2. Additionally, any kind of misconduct by the brokers could be dealt with as per local laws which the investor would be familiar with. FSCA doesn’t issue license to brokers who either do not meet the regulatory requirements or have some shady history.

Hence, FSCA ensures that the investors’ funds are handled with proper care by its regulated brokers. This will safeguard your money from any malpractice or fraudulent procedure, ensure right and fair treatment from brokers and also provide a sense of security from the perspective of legal actions in case of any mistreatment.

3. Apart from regulating the financial markets and protecting it from frauds and misconduct, FSCA also imparts financial education in order to increase awareness amongst investors and brokers with regards to financial regulations and news.

So it is advised for investors to trade forex or CFDs via FSCA regulated forex brokers and one should always check the authenticity of claims of the brokers about their license by verifying it from FSCA’s public search website.

Any entity that wants to offer CFD trading on currencies & other instruments to South African residents has to be authorized by FSCA, which is the financial regulator in SA.

So, a FSCA regulated forex broker is an entity that has been approved by the FSCA, and it can legally onboard traders, and allow them the ability to trade currencies like EUR/USD, GBP/USD etc. through their platform. The regulated broker also has to comply with all the restrictions & capital requirements set in place by the FSCA for investor protection.

In order for a broker to offer forex trading, it has to be first ‘authorized’ under Category I license, for Derivative instruments & forex. Most brokers apply for an ‘intermediary other’, meaning they cannot directly offer any advice to the traders. The broker with this license can only offer a platform for traders to place their trades through based on the decisions made my the trader.

In addition to being authorized as a valid FSP, the broker also has to be an approved ODP. And as per the legal requirements by FSCA, any broker that wants to offer derivative instruments to SA residents (which all forex brokers do, because they offer Contract for Derivatives, which is essentially a contract between a broker & a trader to settle the price difference between the buying & selling price), they must be an approved ODP.

If the forex broker is not an approved ODP, it cannot act as the counter party to your trades. Most CFD brokers are market makers, so they are the counter party, meaning, they are taking the other side of your trade instead of sending it to the interbank FX market.

For example, let’s say you place a Buy order for EUR/USD at 1.0250, the market maker broker with an approved ODP could in theory be taking the opposite side of your trade. And once you close the trade, it will settle the difference between your buying & selling price, regardless of if it was a profit or a loss.

To verify if your broker is regulated by FSCA in South Africa, you should follow these steps:

Step #1: The first step is to find the broker’s FSP number:

The forex brokers that are regulated by FSCA will generally list this information along with their FSP number on their website, either on their homepage, footer of their website or they will have a dedicated page on their website mentioning all of their regulations.

For example: Tickmill South Africa (Pty) Ltd is regulated by FSCA, and they publicly list their FSP number on their website’s footer & regulations page.

Similarly, other regulated CFD brokers like HotForex SA, FXTM & Exness show their FSCA regulation & the exact license number on their website.

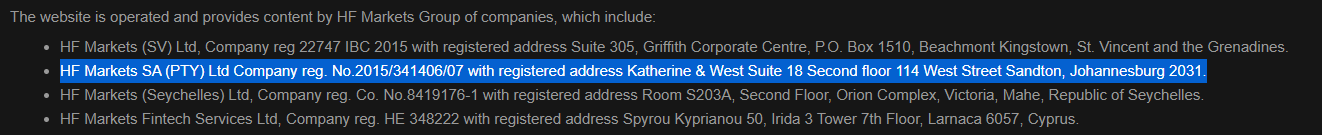

For example, HotForex SA display all their authorized companies under different regulators, along with their license numbers at the bottom section of every page on their website. During signup, you should make sure that you are being registered under FSCA regulation & not under any Offshore regulations.

If you are not able to find the FSP number yourself, it is best to ask your broker’s support team via an email or connect with the Live chat on broker’s website & ask for their FSP number & company name in SA. Any regulated broker would share this information with you.

Note: Some brokers might display fake FSP Number on their website, or might just use the FSP no. of another broker. Such a broker would claim to be regulated, but is actually not. So, you should always verify the FSP number on FSCA’s public search, as explained in the next step.

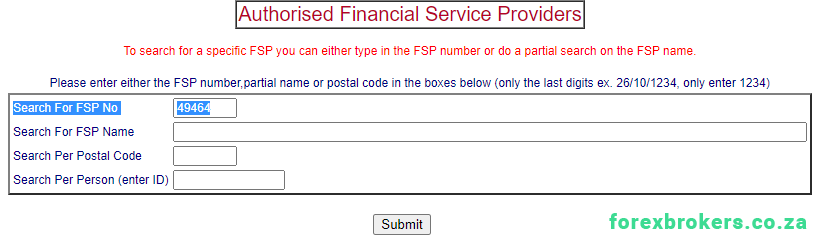

Step #2: Verify the FSP number on FSCA’s public Search

Once you have the broker’s FSP number, the next step is to verify it. FSCA have a public directory for “Search Authorised and Applied FSPs”

On this page, type in the broker’s FSP number under “Search For FSP No” or the company name under “Search For FSP Name”. And then click ‘submit’ button.

On the next page you will see the results. If the broker is authorized by FSCA, then you will see a page that looks something like below (with company name & ‘Authorized’ status). Click the ‘details’ button on the right.

On this page, scroll down to the “Products Approved” section. Check if the broker is authorized to offer ‘Derivative instruments’ under CATEGORY I or not. Also, check all the products for which broker is authorized.

That’s it. So, before opening account with any forex broker & depositing funds, make sure that you verify if the broker is authorized by FSCA to offer the products in SA which it is claiming to.

Also, you must note that some brokers claim that they are a Regulated Financial Service provider in SA even though they are not. They use the FSP No. of other actually authorized providers on their website to claim that they are regulated.

You should protect yourself against such Clone Scam brokers by doing your due diligence & verifying that their FSP No. listed on the website does actually belong to that broker, and your are signing up with actual website of the authorized broker.

For example, if you are signing up with HotForex, then you should visit their authorized website “hotforex.co.za” for SA traders. Scam brokers try to clone the websites of authorized brokers & mislead you to deposit funds in fake accounts. So, you must ensure that the website that you are signing up with is the authorized website.

One way to check this is to check the website with the regulator. Also, you should make sure that your broker/dealer is authorized to offer derivatives trading. Some brokers don’t have the license for offer Forex & Derivatives trading, but they still accept clients for forex trading via their general license.

Also, FSCA issues license of ODP which is Over the Counter Derivative (OTP) Providers. Under this license, only the approved brokers are authorized to offer derivatives. Any other broker who has a pending license cannot act as the counter party to your trades.

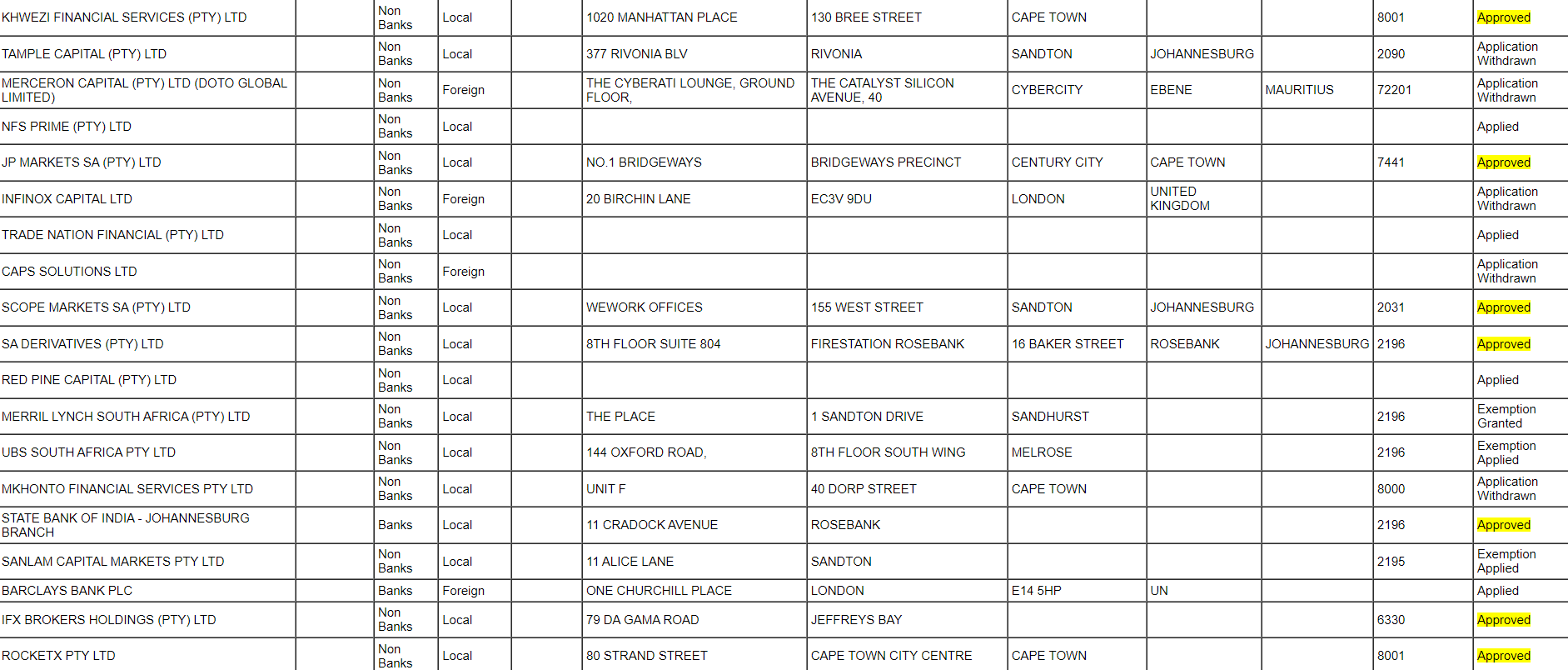

FSCA has published a list of approved, pending & Application Withdrawn status brokers on their website. Only the brokers who have an ‘Approved’ status are licensed as ODP.

Some local brokers like IFX Brokers, Khwezi Trade, Scope Markets etc. have approved licensed for ODP. But HF Markets, Tickmill, Exness & other brokers have their application as either pending or withdrawn.

Any unlicensed broker cannot act as the counter party for your derivative trades. Whenever you are trading any currency pair, or CFDs on index like NASDAQ or metal like Gold, you are trading a derivative instrument.

On your trade, the unlicensed broker cannot act as the counter party to your trades. They can only act as the intermediary to your trades & pass your order, connecting it to other traders.

If you have any doubts then you should contact FSCA to verify the authenticity of the Broker’s license No. & products they can offer. Also, you should verify with them if they are licensed ODP under FSCA. Avoid brokers that don’t give you a clear answer related to their license status & products approved.

Unregulated Forex & CFD brokers are not licensed to offer trading services to traders in South Africa. If you are trading via an unlicensed broker, then there is no investor protection, and the broker can even be a scam broker.

The broker can involve in malpractice & target their client’s stops, or widen the spreads to stop you out of a position. Some scam brokers can even run away with your deposits.

One of the main red flags is if the broker is excessively promoting trading as a lifestyle, and using paid influencers who promote trading as a easy money venture. You should avoid any such broker, because a licensed broker is mostly required by law & regulators to highlight the risks of trading CFDs.

You will find clear warnings on websites of licensed brokers, and some regulators like the FCA in the UK even require their licensed brokers to highlight the percentage of losing traders. But an unlicensed broker would probably not highlight any warnings.

So, you must verify if your broker is authorized by the FSCA to offer the products which they claim. If you are not able to verify the authenticity of their regulation or get proper answers during due diligence, then you should avoid such a broker.

In theory, you can trade forex via unregulated or foreign forex brokers, but you should still not do so.

All the forex brokers who don’t have a licensed to operate in South Africa either are unlicensed anywhere or have an offshore entity that is registered under some third tier regulation.

If you do register with forex broker who operates from aboard, you run the risk of that broker being a scam & running away with your money. Even in a situation where the broker actively manipulates the spreads during active trading sessions, for example during London session, you still would not be able to file a complaint because that broker is not regulated.

There are multiple risks of choosing a foreign licensed broker as well, including limited investor protection & oversight from FSCA under local laws.

All the well known forex & CFD brokers have tried to get a licensed with FSCA, so it is not in your best interest to go for an unknown foreign entity that has no track record.

Here is the comparison table of the FSCA regulated forex brokers in South Africa for 2025. See comparison of FSP number, average spread & minimum deposit.

| FSCA Forex Broker | FSCA FSP No. | Average Spread (EUR/USD) | Leverage | Minimum Deposit | Visit Website |

|---|---|---|---|---|---|

| Tickmill South Africa | 49464 | 1.6 pips with Classic account. 0.1 pips + $4/lot with Pro account. | 1:500 | $100 | Visit Broker |

| Hotforex | 46632 | 1.2 pips with Premium Account | up to 1:1000 | $5 (~R76) | Visit Broker |

| Exness | 51024 | 1 pips with Standard Account | 1:2000 | $1 | Visit Broker |

| Avatrade | 45984 | 0.8 pips | 1:1000 | $100 | Visit Broker |

| FXTM | 46614 | 2.2 pips with Standard accounts | 1:1000 | $10 | Visit Broker |

| Plus500 | 47546 | Variable | 1:300 | R1500 | Visit Broker |

| FXCM South Africa | 46534 | 1.4 pips | 1:400 | $50 | Visit Broker |

| FxPro South Africa | 45052 | 1.56 pips (MT4 Market Execution Account) | 1:30 | $100 | Visit Broker |

According to our research, Hotforex is the overall best FSCA regulated forex broker for South African traders, based on its offering & these 5 key factors:

For more details, read our comprehensive Hotforex review that covers our 9 comparison metrics.

If a forex broker is an authorized Financial Service provider regulated by FSCA, then they will have a registered FSP number.

For ex: One of the FSCA regulated broker in our comparison i.e. Hotforex gives information about its regulation on the footer section where they have mentioned their company name “HF Markets SA (PTY) Ltd”.

You should always look for a Financial Service Provider (FSP) License Number. If the appropriate information is not available on the website, you should ask for the same from the broker. Normally, if the broker is regulated, they will share their FSP number with you.

You just need to enter the FSP number in the above search page. This will show you the regulation status. Look out for the “Authorized” status.

The important consideration here is trading fees without any hidden charges. Plus, other things to consider are the trading instrument, and do you need broker with fixed spread or are you okay with variable spread.

According to us, 3 brokers – Hotforex, Plus500 (CFD platform) & Tickmill offer competitive variable spread with their platforms. None of them any extra fees while making deposits or withdrawals, but all 3 charge some fees if you don’t access your account for few months.

In terms of FSCA regulated forex brokers with fixed spread, Avatrade is the best choice.

Although you can trade forex & CFDs on a forex brokers that is foreign regulated, but you shouldn’t because you risk losing your equity.

Many brokerages that have a license with foreign regulators like FCA, ASIC, CySEC, CMA & other offshore regulations; do allow South African traders to open account with them. But they will not give you any investor protection.

Only FSCA licensed brokers/dealers are authorized to offer CFD instruments like forex legally. All other foreign entities that are offering CFD trading without a local license are high-risk.

HotForex, Exness & Plus500 offer ZAR trading accounts, and there are other brokers too. You can see this list of forex brokers with ZAR accounts if you mostly trader Rand currency pairs & need local deposits/withdrawals without exchange rate losses.

Tickmill is the #1 FSCA regulated FX Broker

Visit