Plus500 is a regulated CFD provider. They are also regulated with other top-tier regulators i.e. CySec & FCA in UK & ASIC. They offer good trading environment, with low fees & minimum deposit from $100. Read our full Plus500 review to check and compare them.

Plus500 is a CFD provider that was established in 2008 and now they have more than 320,000 active customers. They offer CFD trading on forex, commodities, cryptocurrencies, and indices etc.

Plus500 is a licensed CFD provider accepting South African traders, and they are also listed on London Stock Exchange, and are regulated with multiple top tier regulators, that makes them a reliable CFD trading platform.

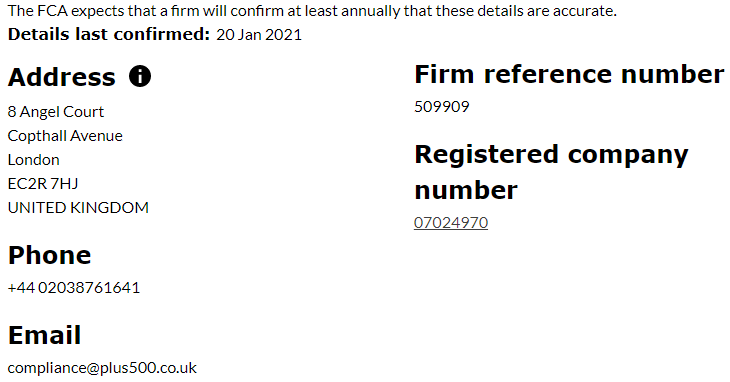

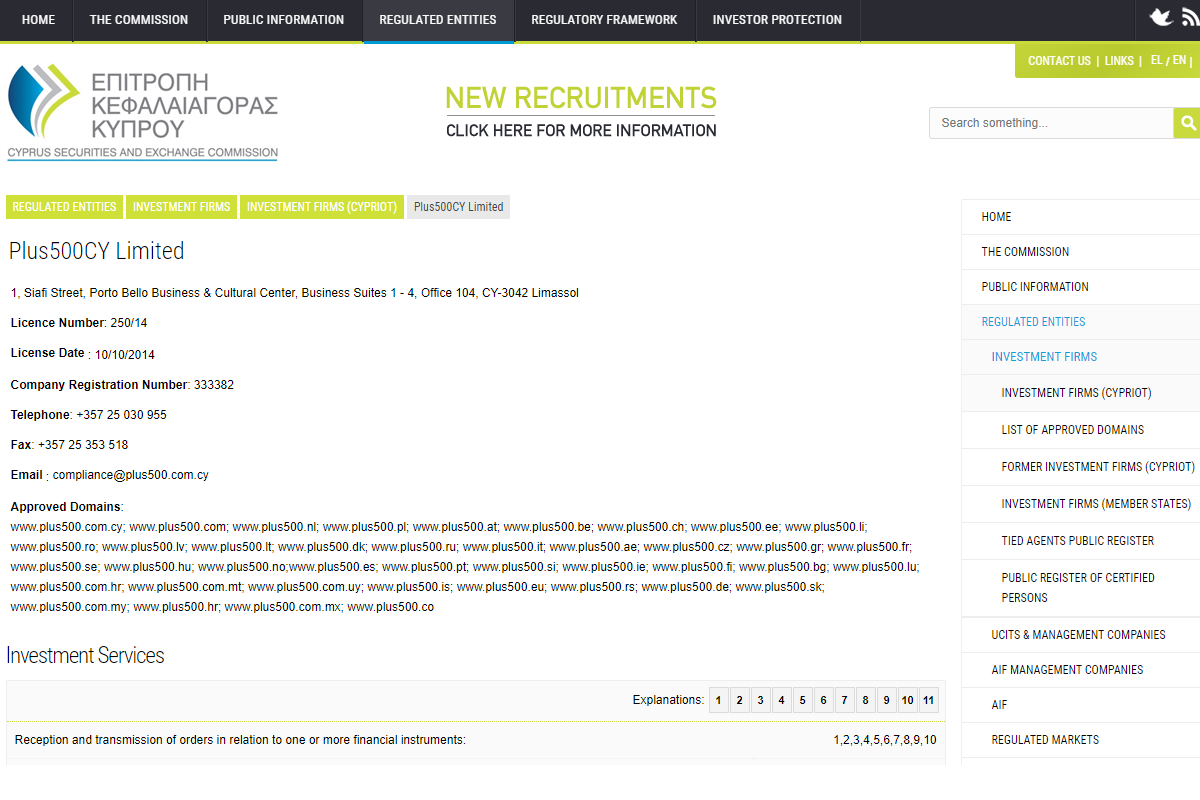

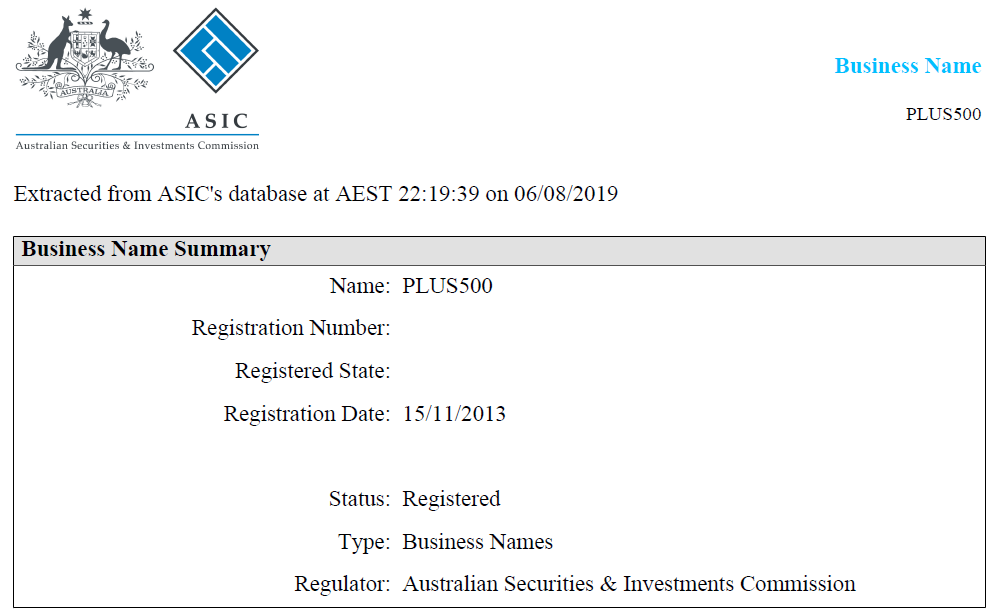

In South Africa, Plus500 has a financial services license from FSCA under company name “Plus500AU Pty Ltd” since 07/02/2017, with FSP under license number 47546. And they are also regulated with global regulators: ASIC (Australia), FSP, CySEC, and FCA (UK).

Plus500AU Pty Ltd. (ACN 153301681) is licensed by: ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Financial Services Provider in South Africa, FSP #47546.

Here’s a transparent look into the Plus500’s regulations, trading fees, bonus, platform(s), customer support & more.

Plus500 Pros

Plus500 Cons

Table of Contents

| 🏦 Broker Name | PLUS500AU (Pty) Ltd |

| 📅 Year Founded | 2008 |

| 🌐 Website | www.plus500.co.za |

| 💰 Plus500 Minimum Deposit | $100 (ZAR 1500) |

| ⚙️ Maximum Leverage | 1:30 |

| 🗺️ Major Regulations | FCA (FRN 509909), CySEC (Licence No. 250/14), ASIC (AFSL N. 417727), FMA – FSP #486026, FSCA – FSP #47546 |

| 🛍️ Trading Instruments | CFDs on Forex, commodities, cryptocurrencies, shares, ETFs & indices |

Plus500 is regulated with several financial market regulators including Australian Securities and Investments Commission (ASIC), UK’s Financial Conduct Authority (FCA). Plus500 is considered a safe forex trading platform for South Africa.

Below are Plus500’s regulations:

For protection of South African investors, Plus500 provides Negative balance protection, which means that your loss cannot exceed your account balance. The funds are held in segregated bank account as per ASIC’s regulations.

Plus500AU Pty Ltd is the company that is authorized by FSCA. This is the company in Australia, and are regulated with ASIC. So, the max. leverage is restricted to 1:30 for forex, which lowers the risk for retail traders.

Also, they offer Guaranteed Stop on CFD trading, so even if the price moves significantly against your position, your order will be closed at guaranteed price without any slippage.

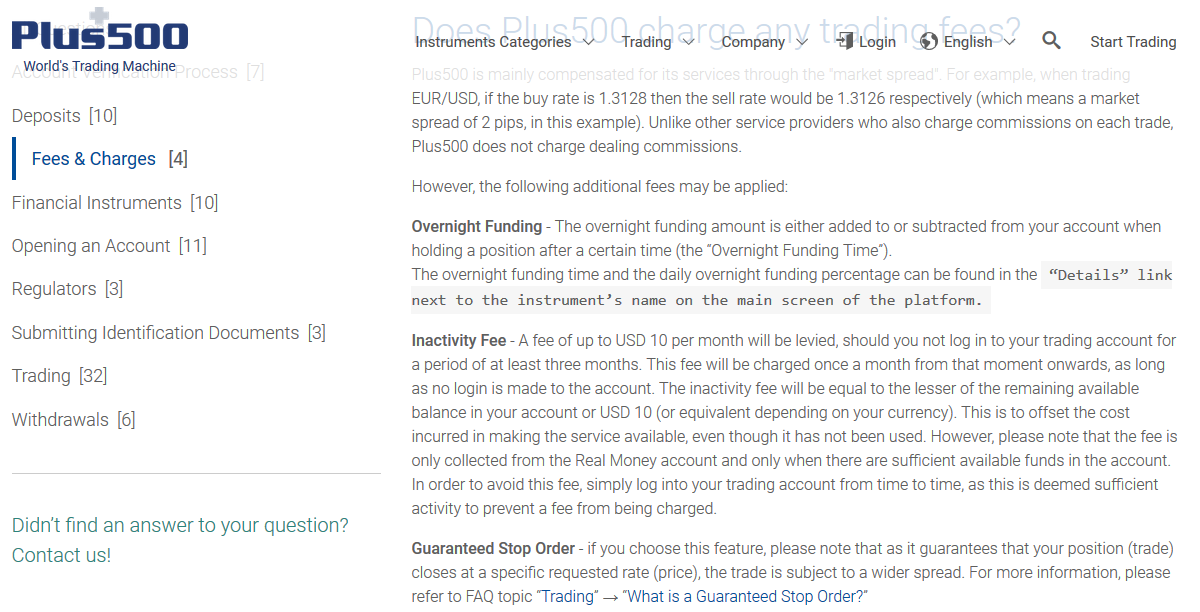

Plus500’s trading fees is low, and they don’t charge any fees on deposits or withdrawals. But they charge some fees for inactivity; if you don’t login to your account.

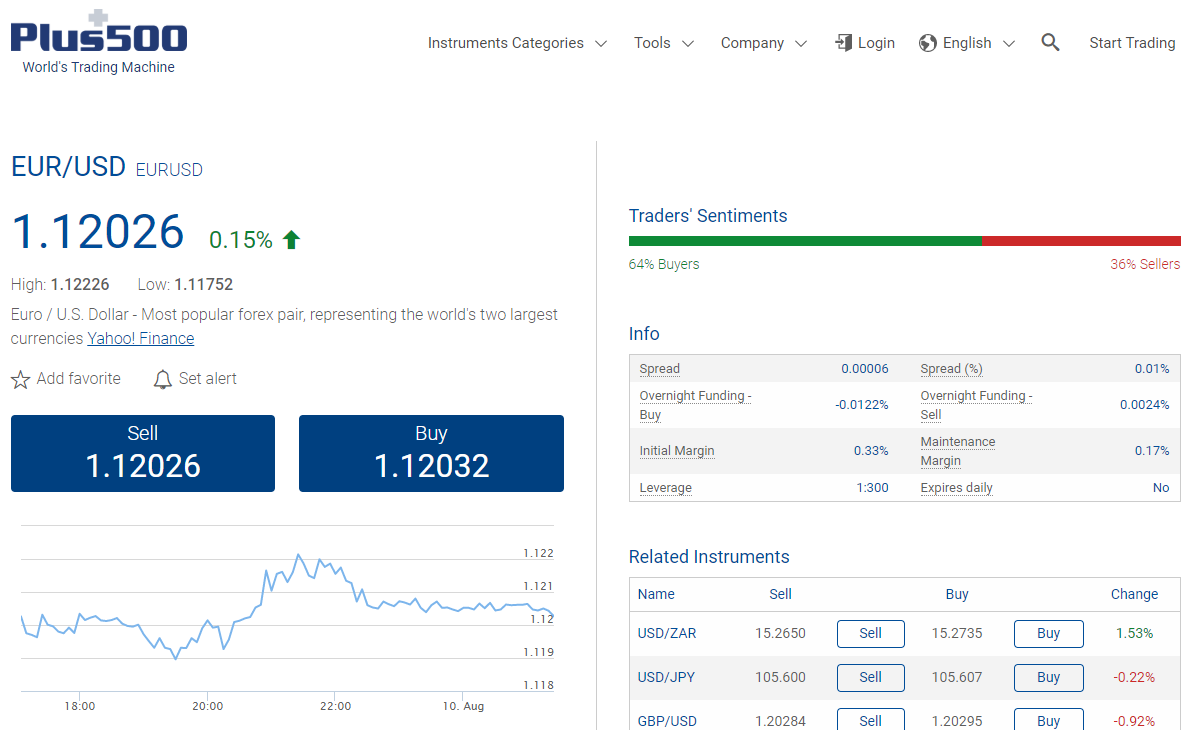

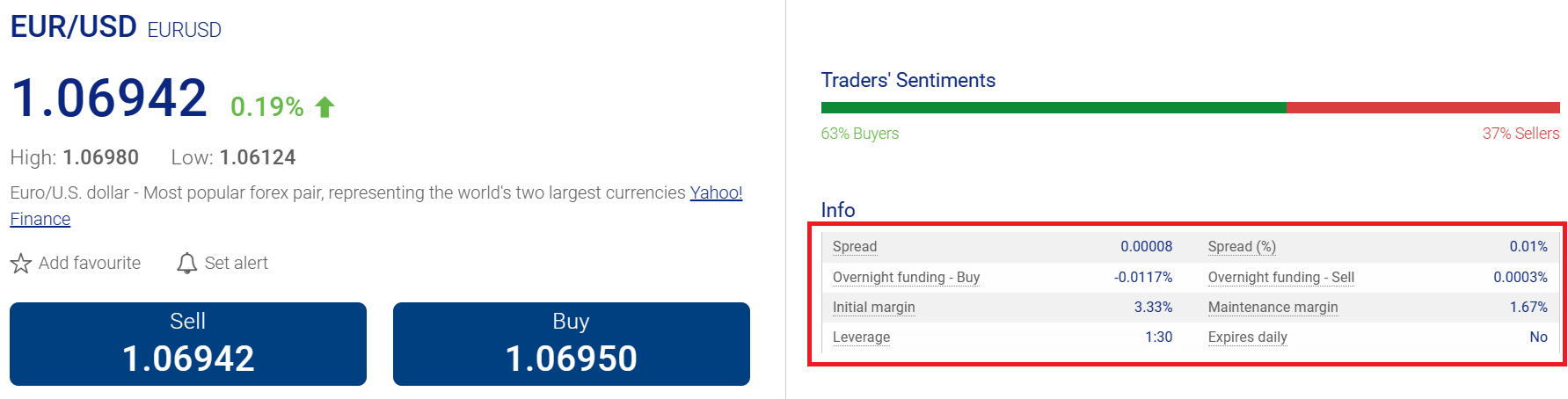

Note: The above screenshot is for reference only. Actual spread on their live platform, would vary as per live market conditions & your trading instrument.

As of the update of this review, their Swap for EUR/USD was is -0.0074% for Long & -0.0039% for Short positions. This is moderate, and similar to Swap at AvaTrade, but higher than Exness.

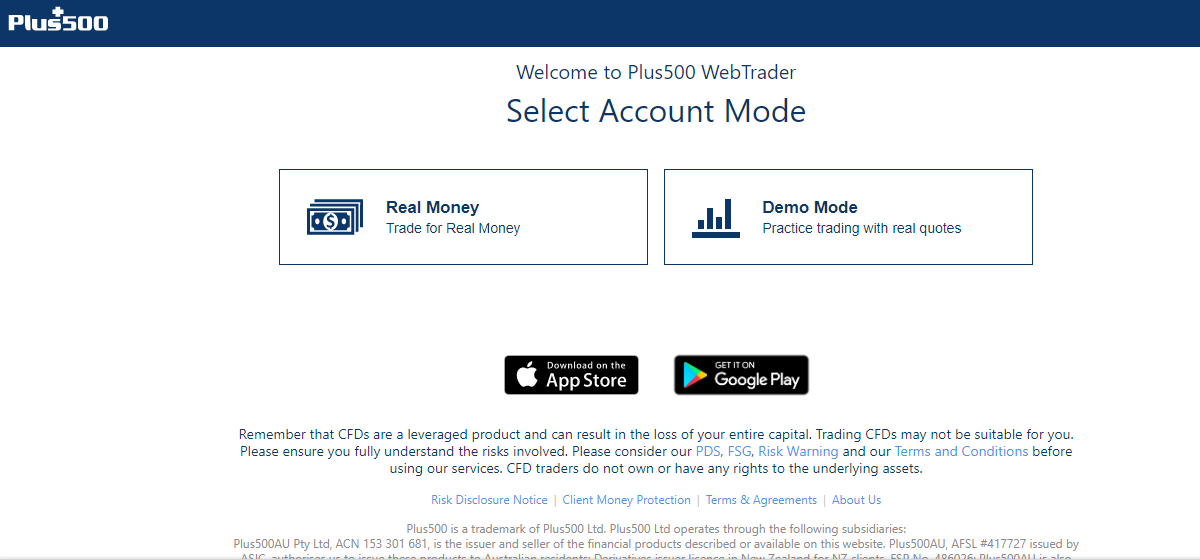

Plus500 offer 2 types of trading accounts, demo & live.

For opening a live trading account, you can start with minimum deposit of $100. While demo account is free, and can be opened without any charges.

Now I am going to explain the features of both trading account of Plus 500:

Demo account is a good feature that is provided by Plus500 for free.

Plus500 demo account is valid for unlimited time, which means you can practice using a demo account until you feel comfortable to start trading using a real amount.

Plus500 does not offer variety of live trading accounts like so many other CFD providers. They have 1 live account with all the features.

You can open the Live account at Plus500 South Africa with a minimum deposit of $100 or R1500. This will give you access to their features like risk management tools, access to economic calendar, availability of all trading instruments at no extra cost.

Live trading Account clients at Plus500 can trade with leverage of up to 1:30.

ZAR Base currency account is available at Plus500. The minimum deposit is ZAR 1500.

There are multiple account currency options including USD, EUR, GBP & ZAR. It is important to note that Plus500 charges up to 0.7% currency conversion charges if you are trading instrument with currency different that your base currency.

For example, if your account currency is in ZAR, and you are trading GBP/USD, you would be charged extra currency conversion fees on your profits & losses. So, it is advised to open account in the currency in which you would actively be trading.

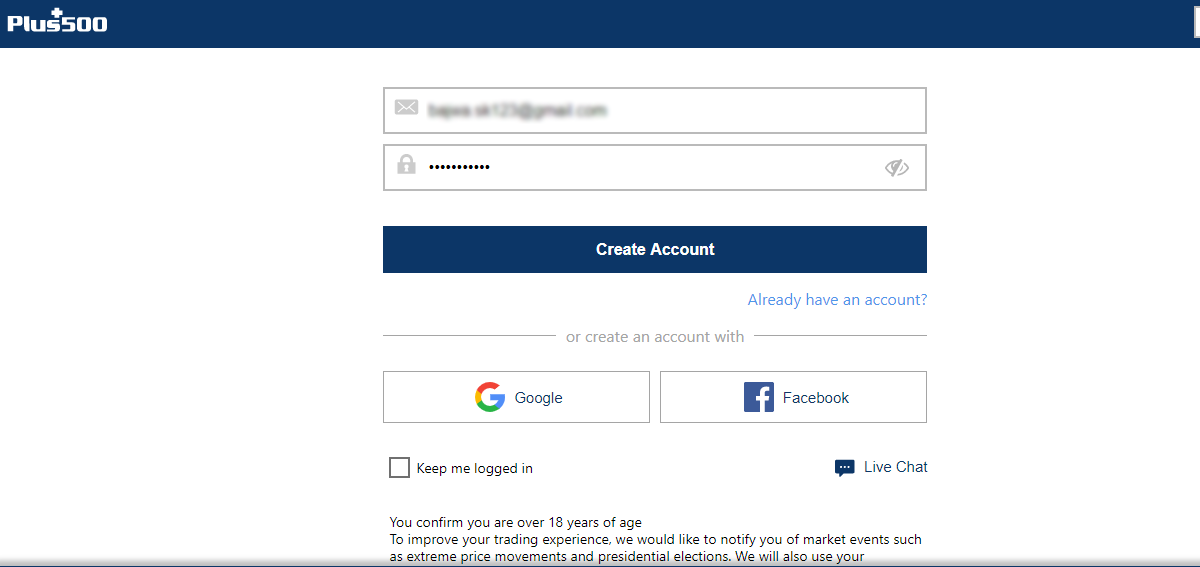

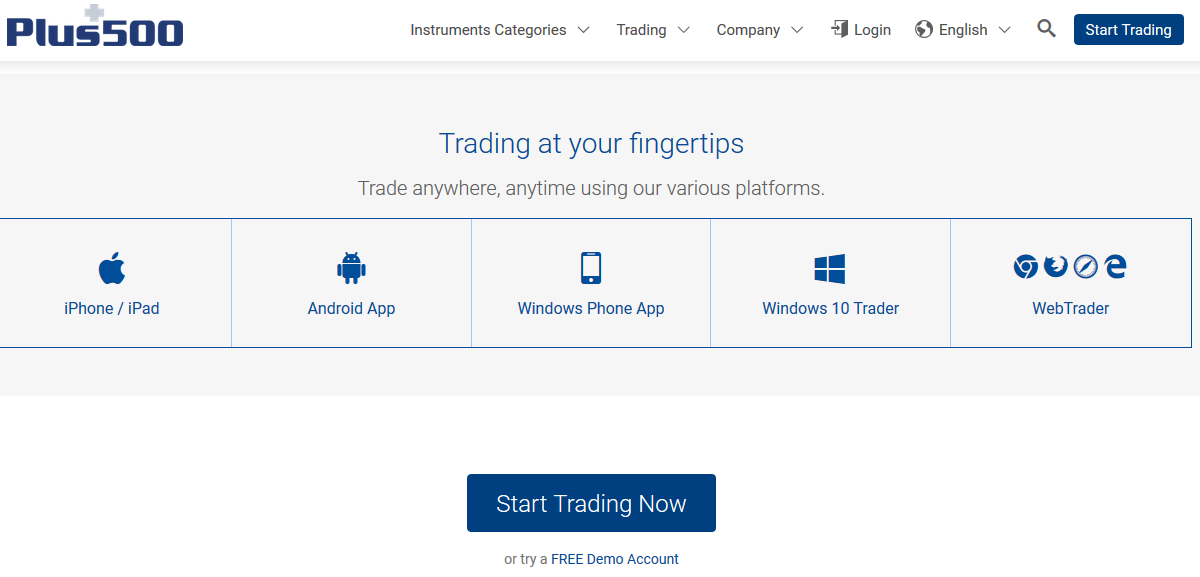

Step 1) Download the Trading software: First of all you need to download the trading software from Plus500 website. After downloading the software you need to install it on your device like PC or Mobile.

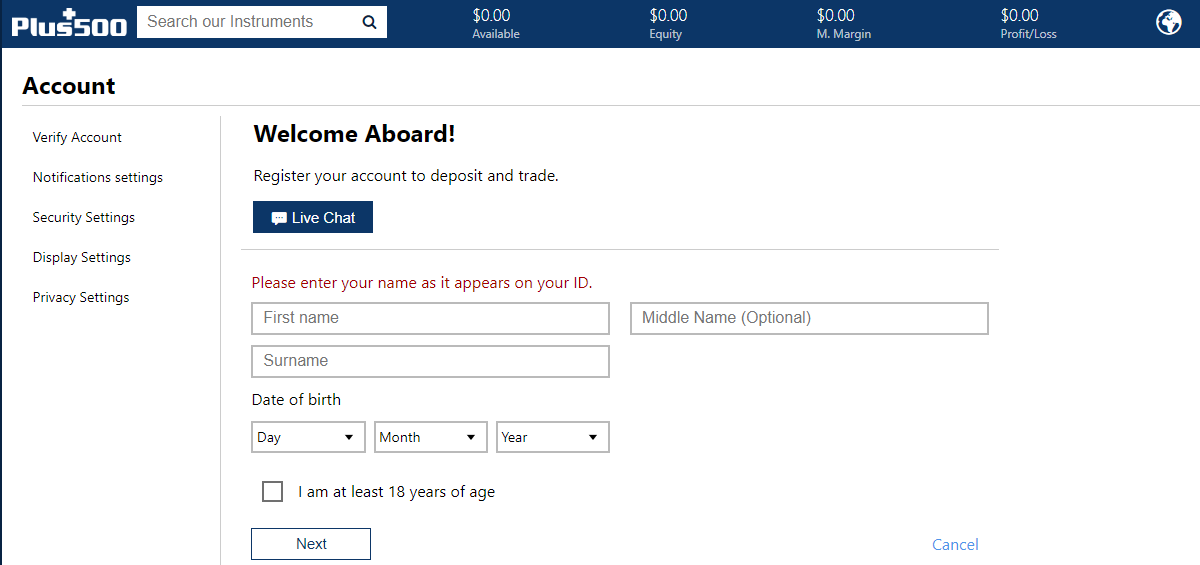

Step 2) Create Account: Now you need to create a real money account with them using the installed software. You can also start with Demo account and then later switch it to real money account when required.

To complete the verification for Live Account, you have to submit some documents (ID, Residence verification). There are also several documents to read and a questionnaire that you need to fill to prove adequecy.

Step 3) Verify the Phone number: Once done with creating the account, you need to verify your active phone number. For this you simply need to click on Verify Phone Number after creating your account with them.

Step 4) Fund Account: After verification, you will receive a notification via email on your registered email. After that you can add funds to your account to start trading.

Congratulations! Your account should be created now after following these steps. You can start your trading using your deposit funds with them. You can also ask for help in case of any issue or query regarding the trading and their trading platform.

The range of asset classes & no. of instruments available at Plus500 are wide. All the asset classes are offered as CFD contracts.

1. 65 Currency Pairs: All the major & minor currency pairs are available at Plus500. These including the majors like EURUSD, GBPUSD, and also minors like USDZAR, USDMXN & crosses like EURGBP. They also offer trading on Dollar Index (DX symbol on their platform).

The max. leverage for currency trading is 1:30 at Plus500. The typical spread on major like EURUSD is 0.8 pips as per their contract specifications. This is low compared to other CFD brokers with similar account types.

The above example is of the contract specification for EURUSD. Similar to this, Plus500 have specification page for each instrument.

2. CFDs on Global Indices Plus500 offers CFD trading on 36 Indices with a max. leverage of 1:20. This includes major global country specific indices like NASDAQ 100, DAX, NIKKEI 225 etc. And they have CFD trading on less known sector specific indices like Crypto 10, NYSE FANG+ Index etc.

Plus500 does not give traders MT4, MT5, cTrader or Tradingview platforms. If you are trading with them, you will have to trade on their own proprietary platform. Their platform is available on all devices, but still it may not be best suited for traders who don’t want to trade on any other platform than Metatrader (just an example).

You will have to get used to using their platform, if you have used standard Metatrader brokers before. Also, your EAs will not work on the Plus500 platform, they don’t have any API for automated trading.

Plus 500 does not charge any fee on deposit and withdrawal with them. But your bank or payment gateway may charge you which you need to confirm it before the transaction.

You can make a deposit with them using any of the below method:

Withdrawal methods are also same as of deposit methods as described below:

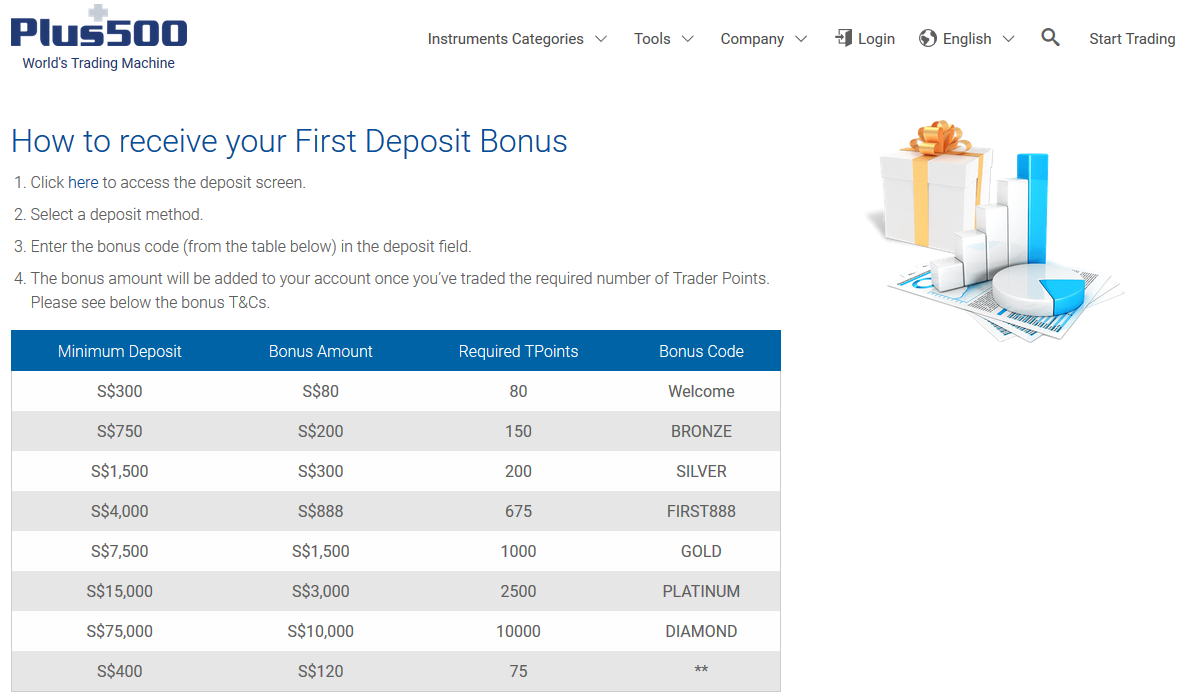

Plus500 has a bonus available for South African customers. The bonus amount depends on your minimum initial deposit.

Note regarding Plus500 bonus: You need to use the bonus code to avail your bonus. You can contact them before making your first deposit and ask the exact bonus amount that you will get in your trading amount.

Can you withdraw the bonus? It can be withdrawn after certain trading volume requirements are met.

Plus500 has good customer support available via live chat, whatsapp and email. They were very quick in responding to our queries.

The support at Plus500 is okay. They could do better by offering local phone no. for support in South Africa.

Yes, Plus500 is a reliable CFD platform. We recommend them for South African traders who are familiar with CFD trading & its risks.

Their trading fees is also quite low in comparison with other platforms, with no fees on deposits or withdrawals.

The minimum deposit of $100 is not very high. Their platform is also quite user friendly & easy to use, with multiple trading instruments available for trading.

The support is also quick & reliable, available 24/7 via chat, emails. Although phone support is not available, but they do have a Whatsapp number.

Overall, trading with them is considered be safe.

Yes, South Africa traders can open ZAR base currency account at Plus500 South Africa. The minimum deposit is R1500.

Yes, Plus500 is a legit CFD trading platform mainly because they are well regulated & they also have a publicly listed entity. This makes them somewhat more reputed than other CFD brokers. Note that this does not mean that they will not have traders who don’t like their platform, it simply means that they are operating legally within the framework set by regulators.

Plus500 has a minimum deposit of $100 for South African traders. In case you are opening ZAR base currency account, then the minimum is ZAR 1500.

Plus500AU is authorized financial services provider in SA (FSP #486026). So, South African traders can safely choose them for CFD trading. Note that CFD trading is risk, and you must be aware of the risks before trading.

Traders can request withdrawal by logging in to Plus500 client panel & go to “Funds Management” > “Withdrawal”. You will find all the withdrawal methods & the time it will take.

"Do you have experience with Plus500? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

My trading account is blocked (19 May 2020) and I cant take any new positions. The only customer support available is email, not Whatsapp or any chats, including Facebook. When you email them, you get a reply from a robot – hence nothing gets sorted out. I think when you keep on loosing money then everything is okay, but once you make a profit, technical issues start appearing out of nowhere and they stop you from trading. I’ve tried about 50 times to make contact without success.