We tested 40+ brokers & then selected the 10 best Forex brokers for South Africans that are regulated with FSCA, FCA or CySEC.

There are over 50+ Forex Brokers that accept South African traders. Most of these brokers claim to offer more or less the same features & trading environment.

So how do you decide which broker is best for you?

At Forexbrokers.co.za, we did the full research for you so that you don’t have to.

10 Best Forex Brokers in South Africa ranked based on our Research & User Reviews

First we narrowed down the list & selected only the regulated & credible brokers that work in the South African market.

Then we signed up with each broker & analyzed multiple factors including: minimum deposit, trading fees (average/typical spread for major instruments, commissions & even fees on deposits/withdrawals), maximum leverage, convenience of trading platform (mobile & desktop), ease of withdrawals, technical support. We even put in consideration the actual user reviews and ratings of real traders.

Now without further waiting…

Here’s our complete list of 10 best performing forex brokers in South Africa. We have compared their Tier-1 & Tier-2 regulations, fees (spread & non-trading fees), time taken during deposits & withdrawals, trading execution time & support offered (last 4 months):

Exness is FSCA & FCA regulated, which are 2 Top Tier regulators, so we consider them to be safe. We like Exness because they have very low spread (even with their Standard Account), higher number of trading instruments, good support & instant withdrawal methods. But the support at Exness is not the best as per our tests.

Exness was founded in 2008 & they are now one of the largest broker globally in terms of daily trading volume, with around 2 Trillion USD trading volume in May, 2022 (as per the latest financial reports on their website). They are a well regulated broker & are regulated by FSCA, FCA, CySEC, so we consider trading with them to be safe for South African traders. Exness ZA (PTY) Ltd is their authorized entity in SA.

Their entity ‘Exness SC (LTD)’ has also been recently approved by FSCA as an ODP.

Their spreads are extremely competitive for forex pairs, and on average it is around 1 pips for EUR/USD (as per the contract specifications on their website), even with their Standard account. The spread is 0.6 pips on average with their Pro account, and it is as low as 0 pips (plus 7 USD commission) with Zero & Raw Spread accounts. Overall, we found Exness to be a broker with one of the lowest spread for Standard accounts, while Tickmill has lower overall fees for commission based account types.

The Swap fees at Exness are moderate. The benchmark for EURUSD is −0.63356 for Long & 0 for Short positions. So there is negative carry if you are Long the EUR against the US Dollar. Their Swap fees are low, but some other brokers in this list have lower charges for overnight positions.

According to us, their fees is lowest with Pro Account if you are looking to trade without any extra commissions per lot. The Swap fees are mostly same with all their account types.

Exness offers the latest MT5 platform as well as MT4 (you can choose), which we consider to be a positive thing. Moreover, they have really good account offerings, including standard accounts & Pro accounts. Their range of CFD instruments include CFDs on 10 metals, 35 cryptos, 3 energies (oil), 100+ stocks & 10 indices.

Their funding & withdrawal methods are quite convenient for South African traders. They have local Internet banking transfer option for deposits & withdrawals, with all major banks supported. Both the deposits & withdrawals are instant with this method. But some users have complained about issues with their withdrawals at Exness & high currency conversion charges for local withdrawals (see our cons below).

Normally, for bank transfers, the deposits are instant to 2 days, but the withdrawals to your local bank account can take upto 5 days. Although many withdrawals are processed within same day or 1-2 days.

The customer support at Exness is fair, we did not find it to be the best because of slow & delayed response time. Exness’s chat support is available 24 hours for 5 days in a week, but it is only available to logged in users. We found their chat support to be friendly, but there were delays (we had to wait for few minutes) while connecting during our test & the support agents were slow in answering our queries. The responses to queries sent to their support email are very slow, and in some tests it took a few days to get a response to our questions. Also, they don’t have a local phone number in South Africa.

Exness Pros

Exness Cons

HF Markets (formerly known as HotForex) is our recommended choice for low cost forex broker in South Africa. We consider them to be safe as they are regulated in South Africa with FSCA (FSP No 46632) since 2016 & with FCA in UK (HF Markets (UK) Limited with Reference number: 801701) since 2019. They offer one of the lowest trading fees among the regulated brokers that we have compared & listed so far.

HotForex, or HF Markets claims to be a 100% STP forex broker in South Africa. They were founded in 2010 & have been regulated by FSCA as HF MARKETS SA (PTY) LTD since 2016.

The SA entity of HFM is not yet an approved ODP under FSCA’s licensing regime.

In terms of trading fees, HFM has the lowest spread with their Zero account & there is no fees on deposits/withdrawals. Their average EUR/USD spread is around 1.3 with Premium account (this would vary according to market conditions), and it is normally around 0.1 pips with Zero account (plus R80 Roundturn commission per lot). The typical spread for CFD like XAU/USD is 0.29 with all account types. HFM SA is solid for low fees.

If you are not an intraday trader, there is an overnight holding cost, which at HFM is moderately high. For example, for EUR/USD, they don’t pay any swap if you are short (meaning long US Dollar against the Euro), but charge -7.4 for long this pair (as per their latest instruments information).

HF Markets gives traders the option of Rand as your base currency for South African traders, this is optional & you can choose USD or EUR base currency as well. They offer 12 trading platforms Including the latest MT5, and the MetaTrader for Android, iPhone and desktop. Their trading instruments on offer are very wide: forex, CFDs on indices, shares, bond & commodities. HFM also offer crypto CFDs.

They also have an attractive 100% deposit bonus for new customers in South Africa and have some great loyalty programs for existing clients.

The funding & withdrawal options at HFM are also very good & at zero fees, and they also offer online bank transfer option via major SA bank accounts for deposit & withdrawals. The deposits via Bank transfer can take 10 minutes, but the withdrawals can take 2 business days. The minimum withdrawal amount is R70 with bank transfer.

In terms of support, they have a quick Live chat support, and they also have a local phone number in South Africa for support.

HFM Pros

HFM Cons

read our HFM review to see detailed comparison of spread, platforms and features.

FxPro Group is a well regulated forex broker, but they are not regulated in SA. FxPro UK Limited are regulated by Top-tier regulator FCA. This makes them a low-risk forex broker. Also, FxPro operates No Dealing Desk model, which means there is no conflict of interest.

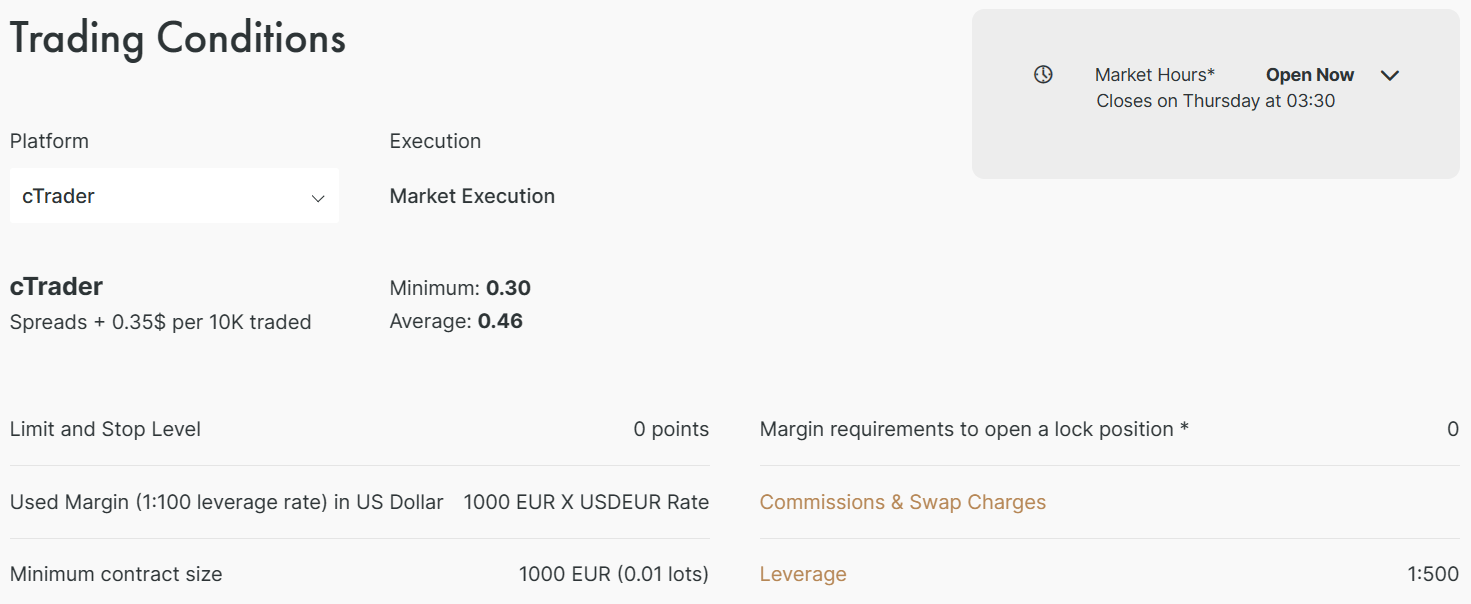

FxPro offers low cost trading with their cTrader account. They charge low spreads with this account type, but there is a commission of $3.5 per 100,000 units. For example, on average, their spread for major like GBP/USD, their spread is 0.55 pips. So, the overall fees for 10,000 units would be $0.9. This is moderate in comparison to most other brokers.

But their fees with MetaTrader based account types is higher than cTrader account. For example, for GBP/USD, the spread is 1.60 pips on average with MT4 floating spread account type.

In terms of accounts, FxPro does offer Rand base currency account option. There is option to choose between MT4, MT5 & cTrader platforms when you open the account. The minimum deposit is $100 or equivalent in local currency if you hold your account in Rand.

FxPro have 70 currency pairs available on their trading platform (which is higher than other forex brokers like HFM). They have CFDs on 12 metals, 3 energies, shares, 28 cryptos & 18 major global indices. You can trade NASDAQ, S&P500 & other major global indices as CFDs at FXPro.

There are multiple funding & withdrawal options for SA traders at FxPro, and there is no extra fees for funding or withdrawals. The important point is that FxPro accepts funding via EFT, bank transfers & also cards (these options are also available during withdrawals). There are also other payment options available.

The live chat support is available & we did not experience much hold time. Their email support is also okay as per our tests. They also have an option to request a callback.

FxPro Pros

FxPro Cons

read our FxPro review to see detailed comparison of spread, platforms and features.

AvaTrade is a European broker that is also regulated with FSCA in South Africa. We recommend them to traders looking to trade forex & CFDs at fixed spread, with a locally regulated broker.

AvaTrade is an European forex broker that was founded in 2006. They are regulated with FSCA since 2015 under the company name ‘Ava Capital Markets Pty Ltd’.

In terms of fees, AvaTrade’s trading fees with their account are lower, than other brokers that we have compared. They offer fixed spread accounts, with EUR/USD spread being 0.9 pips (on average) with Retail account. But their & non-trading charges are high, as they charge an inactivity fees (for non-trading for 3 months) of $50, and an Administration fee of $100 for 12 months of inactivity in an account.

The charges for overnight positions are moderate. For example, for EUR/USD (as per our latest check), their Long Swap is negative 0.0105% & 0% for Short positions on this pair. This is moderate in comparison to other brokers.

AvaTrade offer MT4, MT5 platforms for web & mobile, along with their proprietary platform. Like all the other brokers, they offer Forex, Cryptocurrencies, Stocks & bond trading. The max. leverage they offer for forex trading is 1:400 with most of the major & minor currency pairs & it is lower for other pairs.

Their deposit and withdrawal options include credit cards, wire transfer, and wallets. They also accept local bank transfer deposits. On the plus side, they don’t charge any fees on deposits & withdrawals.

AvaTrade’s customer support is not the best, as their phone & chat support is not available 24/5. It is only available during the company’s business hours. But they do have a local phone number in South Africa.

AvaTrade Pros

AvaTrade Cons

read our in-depth Avatrade review

Tickmill is our 1st rank forex broker for South African traders. Tickmill is a No Dealing Desk (NDD) broker that is regulated by FSCA (FSP no. 49464 & FSP Name Tickmill South Africa Pty Ltd), FCA & CySEC. Since they are regulated by multiple Top Tier Regulators, including in South Africa, so we consider them to be safe.

Tickmill was established in 2014, and we consider them to be a safe broker as they are regulated with multiple top-tier regulators i.e. FSCA, FCA (UK) & CySEC (Cyprus).

Tickmill Ltd. is also an approved ODP.

In terms of fees, Tickmill has an average spread with their Classic Account, starting from 1.6 pips for EUR/USD. But their spread with Raw account is very low from 0.1 pips (Typical spread) for EURUSD + $3 commission per Standard Lot both sides ($6/Standard lot for both sides). Also, Tickmill doesn’t charge any fees on deposits or withdrawals.

South African traders at Tickmill can use Online bank transfer option for funding & withdrawals in Rand. Instant funding is available with online bank transfer, and local bank transfer withdrawals are processed within 24 hours maximum.

Tickmill offers Rand base currency option (including USD, EUR & GBP), and you can select this during opening of your trading account with them. If your account is in different currency like USD, in that case, your funds are converted at the latest exchange rates depending on your account currency.

Tickmill is a Metatrader only forex & CFD broker & they offer MT4, MT5 & Webtrader platforms (their Metatrader platforms are available on multiple devices). They have recently started to offer the latest Metatrader 5. Their forex trading currency pair offering is wide with 62 pairs, but their other trading instruments are limited with just 20 CFDs on Stock Indices (including on VIX), 2 Oil CFDs, 15 Metal CFDs, 12 Crypto CFDs & 4 Bonds.

Tickmill doesn’t have any local phone number in South Africa currently, however their chat support & email support is available from Monday to Friday from 7AM – 10PM (GMT).

Tickmill Pros

Tickmill Cons

read our in-depth Tickmill review for South African tradeers

XM Trading is another popular forex broker with South African traders. But they are not regulated with FSCA, instead their parent company is regulated with foreign regulators ASIC (Australia), CySEC (Cyprus) & IFSC. We like their fast order execution, low spread with Ultra Low Account and zero fees on deposits/withdrawals.

XM Group is a part of Trading Point of Financial Instruments Ltd that was founded in 2009. They are now one of the leading forex broker in terms of daily trading volume. The parent company of XM i.e. ‘Trading Point of Financial Instruments Ltd’ is regulated by CySEC & ASIC (Trading Point of Financial Instruments Pty Ltd since 2015), so we consider them to be moderate risk broker.

Note: SA traders at XM are registered under ‘XM ZA (Pty) Ltd’ which is registered with FSCA, but this entity only acts as the intermediary, and your trades are directed to market maker ‘XM Global Limited’ which is regulated by offshore regulation FSC & the company is registered in Belize. It is important to note this as XM is the market maker on all your trades & XMZA is only their South African entity which is licensed with local regulator.

XM is a market maker broker (so there may be a conflict of interest with the traders), so they are able to offer fast trade execution, with almost zero re-quotes & zero rejection. Their fees with their Ultra Low Account is also low. They have negative balance protection with all their account types.

The minimum deposit at XM is $5 with their 3 account types (Micro, Standard & Ultra Low). The max. leverage is 1:1000 with all these account types. The leverage is lower depending on the instrument.

Their typical spreads with Micro & Standard account types are very high for most CFD instruments. For example, their typical spread for EUR/USD during normal market hours is 1.9 pips with Micro account, and this is quite high. Also, their Swap fees is very high for most of the instruments with both these account types. For example, for EURUSD the Swap fees is -11.21 for Long & 4.39 for Short.

The spread is lower with their Ultra Low trading account (and it is quite competitive). The typical spread is 0.7 pips for EURUSD with this account type, and the Swap charges are also 0 pips for both Long & Short. So the overall fees (including the spread, commission & swap charges) with this account type is low.

XM has both web & mobile trading, available on MT4 & MT5 platforms. Plus, they have wide range of trading instruments including currencies & CFDs on metals, indices & commodities. They also offer choice of ZAR as the trading account’s base currency. Their trading conditions are quite good.

Their support is fast in handling issues during our tests, especially their live chat which also available 24 hours during the week. We tested their live chat during the weekday, and we were connected quickly & got the right responses. Another plus, is that they don’t charge any fees on deposits & withdrawals.

XM Pros

XM Cons

FXTM is licensed with FSCA, FCA & CySEC, so we consider them to be safe. Plus, they offer instant order execution with Micro account & fair support, but their fees is quite high with this account type. We gave them a lower rating because of high spreads.

FXTM was founded in 2011 & it got regulated with South Africa’s FSCA in 2016. We consider them to be safe since they are regulated with multiple top-tier regulators (FCA, CySEC & FSCA) globally. Their parent company ‘Exinity Limited’ is also well regulated.

In terms of safety of funds, we consider FXTM to be quite safe since their are a multi regulated forex broker, including being locally regulated in South Africa.

They offer competitive spread for majors including EUR/USD (0 pips + as low as 0.4 USD commissions per lot) with their ‘Advantage MT5’ account. But the spread is very high with their spread only account types (on average it is 1.9 pips with Micro account & 2.1 pips with Advantage Plus account). So, for traders choosing lower account types at FXTM, the fees is quite high. In terms of their trading fees, we recommend choosing FXTM’s Advantage account.

If you do choose their Spread only account types, the spreads for most of the currency pairs is higher than low cost brokers like Exness & HFM.

The Swap fees at FXTM are moderate. For example, for EUR/USD it is -0.38 for Long & 0.2 for Short positions. The non-trading fees are higher than other brokers. For example, there are extra withdrawals fees with some methods & there is also inactivity fees.

FXTM offer a wide range of trading instruments, 63 major, minor & exotic currency pairs, CFDs on commodities, metals, indices as well as stocks. But they don’t offer CFDs on cryptos. The trading platforms offered by FXTM are MetaTrader 4 & 5, with mobile trading app compatible with Android and iOS.

They have very convenient funding methods including local bank transfer in Rand with zero fees on deposits with this method. But they charge extra fees on some withdrawal methods, like there is 1 USD fees for local bank transfer withdrawals in Rand. But the withdrawals are quick & normally processed in less than 24 hours.

Their customer support is very active, with quick & knowledgeable live chat available 24*5, during our tests. Besides this, they provide free education to new traders in the form of webinars, articles & seminars.

FXTM Pros

FXTM Cons

Octa (formerly OctaFX) is a global forex broker that is regulated with FSCA under FSP no. 51913. Their parent is also licensed under one Top-tier regulation i.e. CySEC with License no. 372/18.

Octa was founded in 2011. We consider them to be moderate risk broker for forex & CFD trading as Octa Group are regulated under FSCA under entity name “Orinoco Capital (Pty) Ltd”, but they are not an approved ODP (they have not applied to be authorized as an ODP as per the recent FSCA listing).

In terms of fees, Octa charges variable spread for every trade. Their typical EUR/USD & GBP/USD spreads are 0.8 pips with their MT4 & MT5 Trading Accounts (as per Octa’s spread data), which is highly competitive when compared with other South African regulated brokers. There is no extra commission per lot with any account, and the only trading fees they charge is the spreads.

They also charge do not charge any inactivity fees or deposit & withdrawal fees. So, their fees overall are very competitive. So, overall, during active trading hours, the charge for trading EUR/USD (major pair) is around 8 USD per Standard Lot on average at Octa.

Octa is mainly a CFD broker. They offer MetaTrader 4 (MT4) & the latest MT5 platforms, and they also have their platforms for forex trading (OctaTrader) & copy trading. Their Metatrader platform has support for desktop, web & mobile. Their number of trading instruments are limited compared to other brokers. For eg. Octa only offers 35 currency pairs for forex trading. But they do offer CFDs on Commodity (Gold), Indices (like NASDAQ), stocks, & Cryptos. Overall, they have multiple asset classes for CFD trading, but there are only 35 currency pairs for forex trading, which is lower than other CFD brokers.

At Octa, only USD account currency option is available to SA traders. But they now offer local Internet Banking option for deposits & withdrawals. For funding & withdrawals in SA at Octa, you can use Ozow and EFT. Also, you can use your Credit/debit card and Cryptos. But they don’t charge any fees on deposits or withdrawals with these methods.

Octa does not have local phone support & office in South Africa. But we found their Live chat support to be quick in answering questions. On average, there was no hold time (first the chat is connected to bot), and we were able to get a resolution to our questions.

Octa Pros

Octa Cons

read our in-depth Octa review to see detailed comparison for their fees, regulations & more.

IC Markets is one of the largest forex broker in terms of daily trading volume. They are well known & are regulated with top-tier regulators including ASIC (Australia) & CySEC. The traders from SA are registered under their offshore regulation.

IC Markets has been operating since 2007, and we consider them safe for traders in SA since they are a reputed broker & are also regulated with multiple regulators. This makes them somewhat low risk broker for traders. They are also authorized by FSCA under license no. 50715 for ‘Derivative instruments’ & ‘Forex investment’ as Intermediary Other.

But note that their legal entity is not ODP approved. We did not find their entity listed under list of ODPs, so it means that they have not applied for the license.

IC Markets offer Raw Spread trading accounts & Standard account. With Raw spread accounts, the spread is as low as 0.1 pips (plus $5-6 commission per Standard Lot depending on your platform, which can be MetaTrader or cTrader) for most CFD instruments. With Standard account too, the spread is competitive, around 0.62 pips on average for EUR/USD are per our benchmark check.

Compared to their MetaTrader account, the fees is lower with their cTrader account. For EURUSD the typical spread with Raw account is 0.2 pips. But the commission if you choose cTrader is $6 per lot, instead of $7/lot with MetaTrader Raw spread account.

Their trading fees is comparatively quite low even with their Standard account. There is no extra commission with Standard Account type at IC Markets. Their Swap fees are competitive but are not the lowest. The exact fees depend on the currency pair that you are trading.

They have minimum/starting deposit requirements of $200 with all their account types. But IC Markets does not have any local funding options in SA like Bank transfer, and they have USD account base currency available (10 base currency account options are available). You have the option to fund your account via wire transfer or online wallets like Skrill, Paypal etc. or via your card

They are a MetaTrader broker, but offer cTrader platform also. Their platforms are available across all devices.

Our experience with their support was good. We found them to be knowledgeable & helpful in answering our questions. But there was some delay in connecting to their Live Chat support & normally it can take a few minutes to connect with a live chat agent. There is no local South African phone number listed on their website for support.

IC Markets Pros

IC Markets Cons

Plus500 is a popular CFD trading platform, that is also listed on London Stock Exchange. They are regulated with top-tier regulators including FCA (UK), ASIC (Australia) & CySEC.

Plus500 was founded in 2008, and we consider them to be safe for South African traders as they are regulated with 2 top-tier regulators & are also a publicly listed company.

Their Australian entity “Plus500AU (Pty) Ltd” is authorized FSP under FSP no. 47546. They have a Category 1 licensed that allowed them to offer ‘Derivative instruments’ as Intermediary. This entity is also an ‘approved’ ODP as per the latest FSCA search.

Plus500 has variable spread which depends on the instrument being traded & the market conditions, but we found it to be very competitive for most CFD instruments. Also, their minimum deposit is not too high at R1500, and they don’t charge any extra fees on deposits or withdrawals.

They don’t have any commission based trading account for Pro traders (who trade on ECN type accounts), and their account is spread only for retail traders. For major like EURUSD, the typical spread is around 0.7-0.8 pips. Note that Plus500 has variable spreads, so it can change according to market conditions.

They offer their proprietary platform on web & mobile. Their platform is easy to use, and very user friendly. But the downside is that it is not available on desktop. Also, popular third party platforms like MetaTrader & cTrader are not available at Plus500.

The max. leverage for trading CFDs is 1:30 for forex & it is lower for other CFD instruments (like CFDs on cryptos, commodities etc. have lower leverage) as per the leverage restrictions with ASIC regulations.

We have found their support to be good in comparison to other brokers, and they are available via live chat, email & whatsapp number. But their education section is quite limited though.

Plus500 Pros

Plus500 Cons

BDSwiss is a European forex & CFD broker. But they are not regulated with FSCA in South Africa.

BDSwiss was founded in 2012 in Zurich, and they are a reputed forex broker. They are regulated by regulators FSC & FSA (license no. SD047), but not with FSCA. So, we consider BDSwiss to be a medium risk broker for SA traders, because they are not locally regulated.

BDSwiss have an average spread of 1.6 pips for EUR/USD with their Classic account. But the spread with Raw Account is very competitive, it is on average 0.3 pips (plus $5 commission per standard lot on Forex). They also offer CFD trading on Gold, popular indices like NASDAQ, and 20 Crypto CFDs at competitive fees.

The overall trading fees at BDSwiss is on the higher side when compared to other brokers. Especially with their starting account types i.e. Classic Account (which have lower deposit requirements), the variable spreads that you will pay for majors is on the higher side typically.

They offer variety of account types with many features including negative balance protection. You can have your trading account funds in four different currencies.

Their minimum deposit is $100 with Classic Account & Premium accounts. But with VIP, Raw accounts, the minimum funding required is $3,000 & $5,000 respectively, which are much higher than other brokers. The overall trading fees is much lower with the Raw & VIP account types, but compared to other brokers which have similar accounts, the deposit requirements are quite high..

BDSwiss have local Internet banking (EFT) option for funding or withdrawals in South Africa. The deposits at BDSwiss are free of any additional charges for all transaction methods. But BDSwiss have some non-trading charges which include Inactivity charges & fees on withdrawals below limits and made via wire transfers & methods other than credit card.

During our research, we found BDSwiss’s support to be good. You can reach them via Live chat, email & phone. But they don’t have a local phone number in South Africa at the moment.

BDSwiss Pros

BDSwiss Cons

read our in-depth BDSwiss review

JustMarkets is a foreign forex broker that accepts traders based in South Africa. They are regulated with FSCA as Just Global Markets (PTY) Ltd, but it only acts as an intermediary & is not the issuer of products.

JustMarkets was founded in 2012 & we consider them a moderate risk forex broker as they are regulated with one tier-2 regulation CySEC.

The overall trading & non-trading charges at JustMarkets are moderately low, and they depend on the account type which you select. For example, the spreads for a major like GBP/USD start from 0.7 pips with the MT4 Standard Account. There are no extra commission charges with this account type. The Swap fees at JustMarkets are higher than some other brokers in our research. For example, for EUR/USD the Swap charges are -4.44 for Long & -0.09 for Short. So you pay this fees for overnight holding.

But they don’t charge any extra fees for deposits & withdrawals made with most of the payment methods. Most importantly, they do accept payments via EFT (the minimum funding amount is $5 or equivalent at the latest exchange rates in Rand), and there are no extra charges with this method. The deposits with this method are instant, but the withdrawals can take 2-3 days.

JustMarkets allows trading on 66 currency pairs, and 100+ CFDs on metals, indices, commodities, stocks & cryptos. You can trade on MetaTrader 4 or the MT5 platforms, as they support both.

JustMarkets does support local base currency, and you can choose to open your trading account in your local currency. This reduces the currency conversion fees at the broker.

JustMarkets broker does not have a local phone number for support in South Africa, but you can request a callback from their contact page. They offer support via Live chat, email, phone, and also through Telegram & other messengers. They also have a dedicated email on their website for any issues related to payments.

JustMarkets Pros

JustMarkets Cons

Regulation matters because it ensures the safety of your funds & protects you in case of any bad practice like fraud or manipulation by the broker. In South Africa, you must check whether the broker is regulated by FSCA or not.

Any good broker will be compliant with major Regulators & will not have complaints (in the past) against them.

If the broker is regulated & registered with more than 1 of these Top-tier Regulatory authorities (without any complaint against them), then we consider them to be safe for trading, and depositing your funds.

But you should not ignore FSCA regulation of the broker. If the forex broker only holds license from foreign regulator (even if from Tier-1 regulator), you should still consider it riskier than a locally regulated broker. This is because you will mot get the same investor protection from regulator of foreign licensed broker in case the broker goes under.

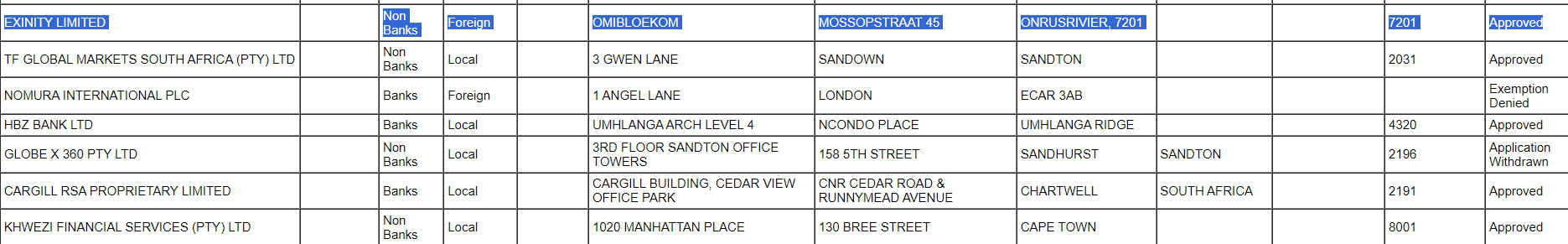

To check if your forex broker is licensed or not, you should search for your broker’s name or their regulation number, on search on Regulator’s (FSCA, FCA or ASIC) websites, as most of them have public search available. Below example is the image of what FSCA’s FAIS Financial Service provider search interface looks like.

Also, if you are searching for approved brokers on FSCA, only checking the “Authorized” status is not enough. Make sure to verify if the broker is approved for offering derivative instruments. You need to ensure that the broker that you are choosing is approved for offering derivatives trading. For example, below is how the “Approved Products” category would look like for a broker regulated for offering Forex & CFD trading.

So next time before choosing any broker, properly do your research, and check if the broker is regulated or not. If the broker claims that it is regulated, then search the name of the broker on the websites of the Regulatory authorities: fsca.co.za (FSCA’s website) & fca.org.uk (FCA’s website) to verify the broker’s claim, and also check if there have been any complaints against the broker in the past.

If the broker that you are about to trade with is not regulated or has a valid complaint against it or has been fined in the past for some bad practice, then its best to stay away from that broker. Also, as another rule, never choose a broker that is not regulated with at-least 1 top regulator i.e. FSCA, FCA. CySEC or ASIC.

The following are the Top-tier Regulators for Forex & CFD trading in various countries. If a forex broker is regulated by more than 1 of these major regulators then it is considered to be a low risk brokerage.

| Regulatory Authority | Country |

|---|---|

| FSCA (Financial Sector Conduct Authority) | South Africa |

| FCA (Financial Conduct Authority) | United Kingdom |

| ASIC (Australian Securities and Investments Commission) | Australia |

| CySEC (Cyprus Securities and Exchange Commission) | Cyprus |

| BaFIN (The Federal Financial Services Authority) | Germany |

| MAS (Monetary Authority of Singapore) | Singapore |

Forex Brokers like HotForex, Exness, Tickmill & FXTM are licensed with at-least 2 top-tier regulators, including with FSCA in South Africa. So these brokers are considered to be low risk.

It is also important to note that some brokers may register their clients under Offshore regulators for lesser compliance. You should avoid such brokers & instead choose forex brokers that are licensed by Top-tier regulations & register your account under a major regulation like FSCA in South Africa.

Always ask your broker about the regulation under which your account will be opened. Most good brokers will transparently answer this question. Also, almost all of the regulated brokers will highlight the name of the “Entity” under which you are registering & their Regulatory Information on the account opening form.

So make sure to verify that your account is opened under a Top-Tier Regulated entity.

Another aspect to consider in the FSCA licensing of the forex broker is whether they are an approved ODP (Over-The-Counter Derivative Provider).

As per FSCA licensing, any broker offering derivatives as the counter-party must be an authorized ODP. But most of the FSCA regulated forex brokers currently have their license status as ‘Applied’ or ‘Application Withdrawn’. Only a few CFD brokers have their license status as ‘Approved’.

For example, Exinity Limited, which operates the brand FXTM is a licensed ODP as per FSCA ODP search page.

Any forex broker that is not an approved or licensed ODP, cannot offer CFDs as the counter-party. Only the approved brokers are authorized to offer derivatives to SA traders.

What does it mean if the broker is a licensed ODP? The license allows the broker to act as the counter party, meaning they can be the issuer of the derivative you are trading. For example, if you are trading EUR/USD, and the broker is an approved ODP, then your broker can act as the market maker of this instrument. So, they are the issuer or seller if you are the buyer, and are taking the opposite side of your trades.

The broker may or may not act as the market maker or issuer of the derivatives you are trading with it, but to do so legally, it has to have ‘approved’ ODP license status.

Some of the brokers like HFM who have large trading volumes are still not licensed ODP. Therefore, they cannot offer CFDs or any derivative instruments as the counter-party. The can only be a non-dealing broker.

When choosing any forex broker, South African traders must carefully check & validate the licenses which are issued by the FSCA to the broker they are choosing. If a broker does not have the required license, but they are still onboarding clients for an unapproved product, then they are not does so legally.

One more question you should ask is for how long has the broker been in business? You must first validate the broker is licensed, that should be a given.

a. Then check if the broker has been in business for 10+ years & have acquired licenses with FSCA (also multiple other Tier-1 Regulators).

b. And they don’t have any warnings of non-compliance against them by regulators in the past. If there is any non-compliance by any broker (or entity), FSCA will publish a warning on their website against that broker.

Both these are generally good indications that the broker is serious about compliance & have proper risk management in place to handle client funds properly.

Whenever you are choosing any broker you cannot ignore the counter party risk. Their reputation & transparency in terms of following legal compliance matters. Because when you are depositing your money with any broker, there is always a risk that broker could be evading the proper legal requirements, maybe they are not separating client funds from Operations which they claim to. Or they may not have proper hedging practices in place to protect themselves against market risks, in which case you could lose your funds if the broker goes bankrupt.

Check that the broker has a reputed management. And for their hedging desk, they have the right people in place to ensure they are isolated from market risk from client positions. This may be too much for new traders to check, but you should still take time to do the due diligence & check on Broker’s website, or ask for this information directly. Questions like how are you hedging your risk, what happens to my funds if your broker goes out of business etc.

In general, our research indicates that brokers that have multiple regulations from 3+ top-tier regulators & have been in business for over 10+ years, they are better at handling adherence to Regulatory compliance & following the risk management practices. But there are outliers also, so always do check if recently the broker has been in the news (or if other traders are pointing out issues) for some bad reasons.

Forex brokers charge fees through their spreads, commissions on trades (in some cases) & rollover (for overnight open positions). Some brokers also charge extra fees during deposits & withdrawals, but don’t actually show it as their fees.

Tracking the fees charged by a broker & then comparing it with other brokers is not easy, but we are here to help you with this.

Here’s a breakdown of the 4 types of fees forex brokers charge:

Another important point to note is that some forex brokers have fixed spread accounts, like AvaTrade. Most brokers have variable or floating spread accounts where the actual spread varies depending on the market conditions, it could be higher or lower than the broker’s ‘typical or average spread’. But the spread at a Fixed spread broker like Avatrade remains the same as what is listed as the typical spread for every instrument on their website.

In some cases, even if the broker claims that that are a fixed spread broker, then that also could be misleading, as it could be dependent on the ‘Trading Hours’. For example, 0.7 pips fixed spreads on majors during active London & NY sessions only. But the spread would be higher during the Asian session or on other pairs.

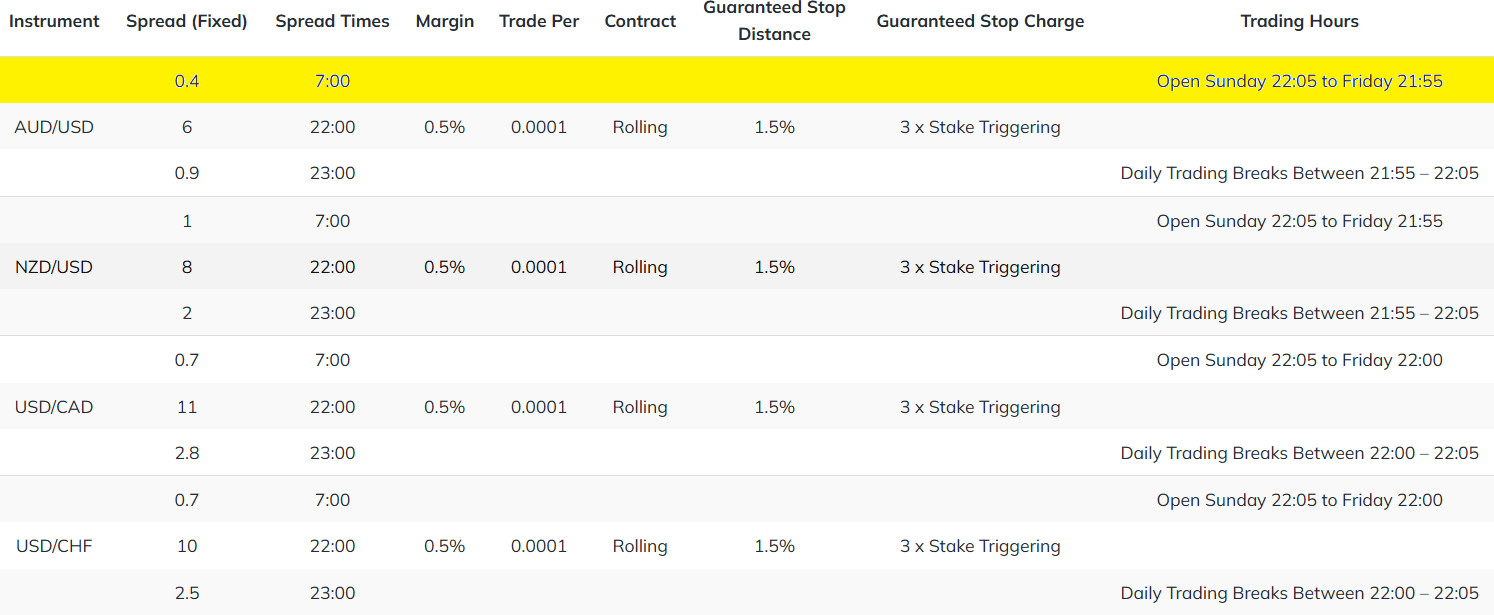

Refer to this screenshot from a fixed broker’s website where they mention their spreads. Notice the highlighted row. See the Fixed spread & spread times columns.

The spreads for AUD/USD in this example is 0.4 pips from 7-22, which is most of the active trading sessions. This is good, because the broker is transparent about the hours under which their fixed spreads are the lowest.

Not all fixed spread forex brokers will mention this clearly. Just because they mention fixed spreads, it does not mean fixed spreads at all trading hours, or even on all instruments.

What you want to check is the exact spreads that you will pay when you place your trades.

For example, some traders place their trades when the market is inactive, like during the Asian session. But most brokers have wider spreads during these trading hours. You will get the lowest spreads during the London & NY sessions.

Before signing up with any forex broker, you should check the broker’s contract specification page as it normally has information on the broker’s spread. Like below is the screenshot from the XM’s forex spread overview page.

This above example highlights the ‘Average spreads’ at XM with their Standard Account. For a major like AUD/USD, their average spread is 1.9 pips with Standard Account. The average spread is normally calculated over a period by the broker. The actual spread during trading this instrument on XM’s platform may be higher or lower because XM is a variable spread broker.

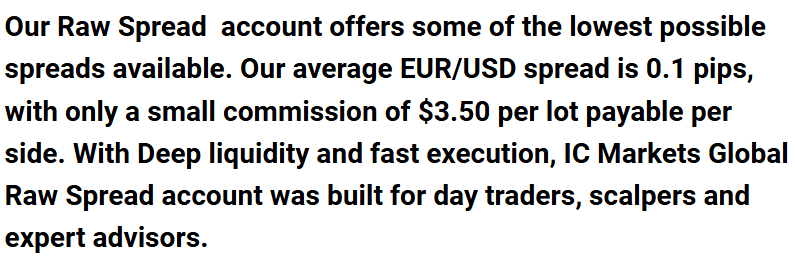

Below terms from FXTM Broker’s website shows the terms of their Advantage account fees.

Forex Brokers normally mention their commission for “each side” of the trade/order. So if the broker mentions that they charge $2 commission per lot per side, then it means that the broker is charging $2 for opening the position & another $2 during closing of the position. The total commission would be $4 with this example.

Also, the commission could vary depending on the CFD instrument. For example: BDSwiss have $5 commission on forex, $2 in CFD indices & 0.15% commission on share CFDs. So you should check the total fees commission for the exact instrument that you want to trade because it is quite possible that the fees for that instrument is lower at another regulated CFD broker.

Let’s take another example. HotForex (HFM) mention their commissions with Zero account in South African Rand as well for traders who have opened account with local currency as their base currency. Their commission is R80 for majors, and R110 for other currency pairs. So, you should also check is the exact commission for currency pairs that you want to trade. As the commission could be higher for that instrument.

Another important point is that if you are a high volume trader, then the fees structure with ECN accounts will be more transparent & have lower trading costs for you.

When you are choosing a ECN account, take the total cost of trading into consideration, not just the commission amount. To give an example, if the commission per lot (100,000 units) is $7 on EURUSD, and the spreads are 0.1 pips ($1 per 100,000 units), you will end up paying $8 per standard lot.

Look at the below screenshot for example from a popular broker’s website. Their ECN type Raw spread account has total cost of trading for EURUSD equivalent to 0.8 pips spreads ($7 roundturn commission + 0.1 pips spreads).

If you consider the above, it really makes no sense to complicate the fees structure because you can simply choose a spread only broker that offers spreads lower than 0.8 pips on EURUSD. Many low cost brokers like TradeNation, Exness, Td365 etc. have spreads lower than 0.8 on EURUSD.

The Swap fees at different brokers are different & this fees can add up if you are holding a position overnight. For example, the Swap fees charged by XM for Long EUR/USD 1 Standard Lot for a trade open for 1 Night is USD -5.05, and it is USD -1.15 for Short Position. For the same conditions the Swap Fees charged by HotForex is USD -4.40 USD for Long & -0.50 USD for Short.

Similarly, at Exness the Swap Long EUR/USD 1 Standard lot is −3.54 USD & you earn 0.97 USD for Swap Short for overnight trade open for 1 night. So, in this example, you would notice that XM is charging the highest fees for this trade with both Swap Long & Short on EUR/USD. You should take this fees into account if you are going to hold your position overnight.

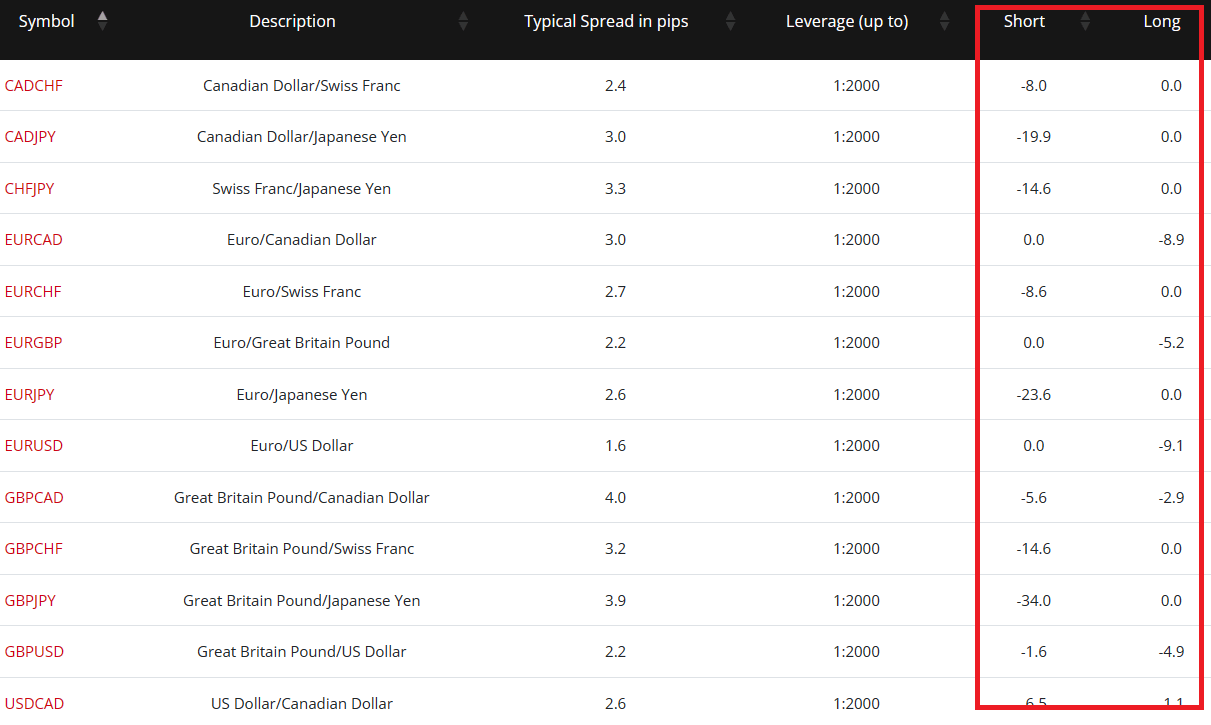

You will see the Swap charges of a broker with the contract specifications of the instruments. For example, HF Markets have listed their Long & Short swaps for each currency pair under their Forex Trading page.

Positive Swap means that your forex broker will pay you for holding that position overnight. This is because of the interest rate differentials. For example, USD/JPY has a negative Swap for Short positions, because of the negative interest rate differentials between the US & Japanese yields.

It is important to note that some forex brokers may not pay you a Swap fees, even for currency pairs that should have a positive carry. For example, generally in the forex market investors are Long USD/JPY for a positive carry. But the retail forex/CFD brokers like HFM, Exness etc. have zero Long Swap for USD/JPY, meaning they don’t pay any interest for holding that position overnight.

Swap is another way in which there can be large differences in the overall fees at different forex brokers. For example, Tickmill has a positive Swap of 10.63 for Long USD/JPY, whereas most other brokers have negative or zero swap for the same position, this makes their charges lower for trading this currency pair in comparison (depending on your position & holding period).

You should use the Swap Calculator on the broker’s website to see the exact Swap that you will have to pay or you will earn for the overnight position for a particular position. This fees would vary depending on the broker & you may earn a positive Swap at some brokers for the same order while another broker may charge you.

These fees could add up if you broker is charging you high Swap Fees & you keep your position open for few nights. So, compare the Swap Long & Swap Short Fees at every broker for the instruments that you want to trade & then decide which broker would be favorable for you.

You will find the deposit & withdrawals charges listed on the broker’s deposit/withdrawal page on their website. This below screenshot of table from Tickmill’s website highlights their deposit & withdrawal commissions. They charge zero commission on all funding & withdrawal methods.

You should also check the fees with deposits & withdrawals via Internet Banking Transfers. Some brokers like Exness & HotForex offer this for free without any extra fees, but some brokers may charge high fees during conversions to your account base currency from Rand if your account’s base currency is not in other currency like USD or EUR.

For example, FXTM charges an inactivity fee of 5 USD per month after 6 months of Inactivity. This fees will be deducted from your account balance.

In general, all forex brokers mention their Inactivity Charges under their Terms (which you agree to during account opening). It is usually calculated from the last day of your trading activity or account use (depending on your broker).

To save your time, we have already calculated & compared the fees of all the brokers for you in our comparison.

In the table below, we have compared the typical spread (in pips) of our 4 top rated forex brokers for their standard accounts (according to the Contract Specification information on their websites):

| Currency Pair | HFM (Premium Account) | XM Trading (Ultra Low Account) | Exness (Standard Account) | FXTM (Micro account) |

|---|---|---|---|---|

| EUR/USD | 1.2 | 0.8 | 1 | 1.9 |

| USD/JPY | 1.7 | 0.8 | 1.2 | 2.2 |

| GBP/USD | 1.7 | 1.0 | 0.5-1.2 | 2 |

| USD/ZAR | 90 | 118 | 116.8 | 139.3 |

| XAU/USD | 29 | 25 | 30 | 45 |

Below Comparison Table Shows the Swap Fees comparison of EUR/USD & GBP/USD (both long & short) at major SA forex brokers.

| Currency Pair | HF Markets | XM Trading | Exness |

|---|---|---|---|

| EUR/USD (Long) | -4.40 USD | -5.1 USD | −3.54 USD |

| EUR/USD (Short) | -0.50 USD | -1.1 USD | 0.97 USD |

| GBP/USD (Short) | -2.30 USD | -3.53 USD | −1.32 USD |

| GBP/USD (Long) | -1.80 USD | -3.83 USD | −1.61 USD |

Note: All 4 brokers compared above have variable spread, so the actual spread may be higher than the value listed in the above comparison table. The actual live spread will fluctuate based on the market conditions. And the actual Swap Fees would also vary, and you should check using the broker’s Swap Calculator.

Based on our comparison of the standard accounts offered by different brokers, typically XM broker & Exness had the lowest spread for most currency pairs, while FXTM generally had the spread on the higher side (with their Micro Account).

Also overall, HotForex has competitive spread for most FX pairs & other CFD instruments like NASDAQ, Gold with Premium account. All 4 brokers listed in above comparison table have variable spread, so the actual spread may be lower or higher than their typical spread for an instrument. The actual spread is based on the Live market conditions.

For ECN brokers, Exness & HotForex are very competitive with their spread. For Example, HotForex has much lower spread (plus $6 commission per 1 lot for forex majors & $8/lot for all other currency pairs) with Zero account, while Exness has spread from 0 pips + USD 7 per lot commission with their ECN type Pro Accounts. FXTM also has really tight spread & low commissions with their MT5 Advantage account. Tickmill too has Pro Account which is an ECN type account with Raw Spread & only $4 commission per 100,000 units (Standard Lot).

When checking the ‘trading fees’ at ECN broker, check the commission charged + any spreads. For example, we checked the fees for EURUSD at FxPro with their cTrader account (commission + spreads).

The typical spread with this account for trading EURUSD is 0.46 pips + the commission is $3.5 per standard lot. If you are trading 100.000 units (1 Standard lot), then your fees will be $8.1 (3.5 + 4.6) for 1 Standard lot, or an equivalent of 0.81 pips spread. This fees overall is moderately low, and other brokers also charge similar fees for similar account types.

Even when checking the fees for ECN type account at any forex broker, calculate the overall cost that you will pay to trade that currency pair. The compare if the fees is lower if you only traded at spread only broker (over commission + spreads), then decide if it makes sense for you in terms of trading charges.

Another factor to consider is if the broker offers quick order execution speed. Fast execution eliminates slippage & re-quotes. Forex brokers either offer market execution or instant execution of orders.

If you are an intraday trader that opens/closes many positions daily, then it should be even more important for you to opt for a broker with the best trade execution speed.

But there is no method to test the execution speed other than actually placing trades on the broker’s live platform. Some brokers will offer good execution on demo but won’t offer the same speed during live trading. So, if you are about to choose a broker then, you should actually their live platform trading conditions with minimum funding & low position size.

During our trading execution tests, 2 brokers, XM Forex with their Ultra Low Account & FXTM with Micro Account had fast order execution (as both these brokers have instant execution account types). The brokers HotForex, Exness & Tickmill also have quick market execution.

It is important to note that during volatile market conditions, you are likely to get requotes at brokers that offer instant execution. This is because the bid & ask prices are volatile & brokers by the nature of their execution model may not be able to fill your order immediately. But market execution brokers (mostly market makers) are able to offer instant fill of your orders without requotes but there is likely to be slippage.

In order to avoid slippage, you should choose you should choose instant execution.

Also, you should test the execution of the exact CFD instruments or currency pairs which you actively trade. For example, if you mostly trade crosses of ZAR (South African Rand) currency pair, then you should check the execution for this exact pair. Many brokers have good execution for majors, but when trading exotic currency pairs, there can be re-quotes or off-quotes.

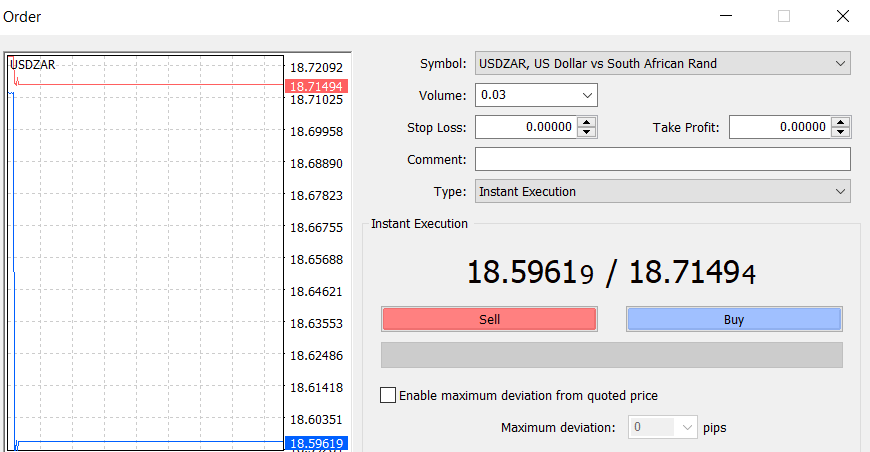

Here is an example of a quote for EUR/ZAR on MetaTrader at a major forex broker. During less trading sessions like Asian session, there are generally issues with execution of orders for some currency pairs & spread widening as well.

This issue is most visible when you trade CFDs on indices at forex brokers. If you notice persistent issues with quotes when trading instruments of your choice, you should switch to a different broker that offers better conditions for your desired markets.

Most of the good brokers have a terms or trading conditions page on their website regarding their execution policy. You should check the broker’s execution policy, and look for terms like market execution, no re-quotes, real-time execution etc. Read the ‘terms’ of the broker or their FAQs page (or directly ask the broker’s support), to understand the type of execution being offered to you.

Also, look for Risk control features your forex broker offers you. These should include ability to restrict/set your trading account’s leverage (to even 1:1), guaranteed stop-loss protection, negative balance protection.

If your forex broker does not offer you these features, it is possible that you would lose more than your equity during unfavorable market conditions where there is slippage & you don’t get your position stopped out at your original stop loss.

Another important point is the margin requirements. Some brokers try to attract clients with high leverage, but suddenly they increase the margin required to keep the position open. If you are trading with really high leverage (which is not advisable to begin with), then a sudden increase in margin by your broker can lead to closing of your position for a loss.

Carefully read the terms of your broker about the margin & leverage. It is best if you can find a broker that keeps it consistent. If it says 1:30, then it should be consistent for the forex instruments covered under those margin conditions.

Adding funds & making withdrawals with a broker should be fast & easy. You would agree, right?

Most brokers transparently show their funding/withdrawal time & methods on their websites. You should always check that first & compare which methods suit you. For example, most traders in SA prefer bank transfer or EFT method, but not all brokers offer local funding & withdrawals in local currency.

Like this page on Tickmill’s website where they transparently show their deposit & withdrawal commissions for various methods.

You should also carefully look into the withdrawal fees, because some brokers offer zero fees on deposits but charge high fees during withdrawals.

Some brokers like Exness, Tickmill, HotForex even offer local bank transfer (Internet Banking) deposit & withdrawal options in South Africa. If you prefer local bank deposits, then we recommend Exness, Tickmill & HotForex. But if you prefer card & other wallet methods, then XM & HotForex are very good as well.

Normally, it is best if your broker offers funding & withdrawals in South African Rand via EFT or Internet Banking. Generally, this method is easiest to use, faster & with lowest fees. For ex. if your broker only offers wire transfer option, then it may be difficult to fund your account, and withdrawals would also be slower & with higher fees as compared to local internet banking.

Overall, we find Tickmill, HotForex, XM & Exness offer the fastest deposits & withdrawals and all 4 brokers charge zero fees on funding & even on withdrawals. FXTM is also quick in processing payments, but they lack in the fees as they charge “Fees/Commission” with most of the withdrawal methods that are suitable for South Africans.

Note that forex brokers can take upto 48 hours to transfer funds to your bank account. Their deposits are mostly instant, but the withdrawals to bank are slower. You will fund the exact time to withdrawal on the broker’s funding/withdrawal pages. For some methods like Skrill, Cryptos, the withdrawals are also processed within 5-10 minutes.

Your account base currency is the currency in which your trading deposits, profits are converted. Eg: If you choose Rand as your base currency then all your account deposits, profits in your account with the broker with be held in South African Rand.

The most popular base currency option is USD, but as per our research trading accounts in local currency are very popular among traders in South Africa.

As per our research, there are a few foreign & local forex brokers that offer ZAR account i.e. with Rand as a base currency option for your trading account. These include popular brokers HFM, Exness, FxPro, XM Broker & Plus500, which you can check in the research linked above.

Brokers will generally display their account base currency options on their Account Types page. Like this page on XM’s website which shows different account currency options:

During the signup & opening of any new account, brokers would generally ask you to select your ‘Account Current’ or ‘Base Currency’. This will be the primary currency of your trading account. Do note that you can open multiple trading accounts from your broker account (at most brokers) & different trading accounts can have different account currencies.

Account currency should be a really important consideration for South African traders, if you are looking to make local deposits and withdrawals in Rand because of the following reasons:

But if your account currency is let’s say USD, then the broker will convert that profit into USD & may charge fees for that conversion.

Almost every broker has multi device platforms including webtrader, desktop application & mobile app; although there are a few exceptions like Plus500 which does not have any desktop version.

According to us, a good mobile trading app would allow you to open your account quickly, be quick to place & close trades, get price alerts, news feed, place orders. We have compared the best forex trading apps for South African traders based on 9 factors, and you should read this research for information on what we checked in the broker’s apps.

But here are the brief factors on how we conducted the check on broker’s platforms.

Moreover, there are some brokers that have their own proprietary web based platforms like Plus500 & Etoro.

You should ask these questions these for starters: Is it available for Android, iOS? What instruments are available in the app & are your desired currency pairs there? Is it fast to use?

It is best to choose a broker that offers support for all devices.

Plus, remember to check the trading app’s negative reviews before you download it. You can check the app’s review from Google’s Play store & iOS App store. In general, a good app will have a lot more positive reviews than negative. Go deep into the negative reviews too to find out if there are any repetitive issues being reported by app’s users.

Another important point to look for in the app is its security. Check if there has been any incident in the past related to broker’s security, like data leaks of their clients data. There have been some brokers which experienced security issues.

The forex broker’s customer support is a really important factor in our comparison. We tracked the support of every broker that we have listed here.

We especially liked XM’s chat support as they are quite responsive & knowledgeable (during our tests). Also, the live chat support at HotForex is responsive. But on the other hand, Exness’s support via live chat is much slower than other brokers.

A good broker would offer 24 hours support during the weekdays via Live Chat, preferably have a local phone number in South Africa & have Email support 24/7 that answers in less than an hour. But not all brokers offer 24/7 support. For ex: Avatrade offers customer support during their business hours only, so there may be high waiting time with them for support related issues. Also, there might be a few minutes of delay while connecting with chat support at some brokers.

We compared the customer support by contacting all the brokers in our review via Live chat & email. Overall, we found XM & HotForex had the best customer support. Both these brokers have quick chat support that is available 24/5, without much hold time. Normally, their replied in under 6 hours for emails sent to their support email.

While some brokers have slower support than others & it can some effort to get support. Like Exness’s email support is very slow in responding to queries, and in most cases you will have to wait for a few minutes to connect to their Live chat support.

Also, during chat with Exness’s support, we noticed that it took few minutes for their support agents to respond to queries. Their email support in some cases did not reply back to our emails, and when they did, it took a few days. On average, we got a response to our email within 1-2 days, but in some cases the responses were much more delayed. That is why we did not like Exness’s support very much.

A good way to test the support is by sending a few emails to the broker’s support email & testing the live chat during business hours. You should perform these tests over a period, so you can have the idea on how responsive their support is.

Another factor that you should consider is the number of CFD trading instruments available on the broker’s platform. Many traders now trade CFDs on metals, commodities, indices etc. Always check beforehand if the instrument that you want to mostly trade is not available at the broker or not.

Most forex brokers have a webpage on their website where they list the range of available instruments & contract specifications for each instrument which can include lot size, typical spreads, lowest spreads etc. Normally, brokers create separate pages for each type of CFD instrument like Forex, metals, indices, commodities etc.

As an example, Forex trading instrument page on HotForex SA’s website has list of all their Forex trading pairs, along with typical spread for each currency pair, and you can also sort the table data.

Other than forex, you should check if the broker offers NASDAQ or NAS100, crypto CFDs, Gold CFDs etc. These are the most commonly traded CFD instruments other than currency pairs, by the traders in South Africa as per our research, but some brokers don’t offer all these instruments. For example, many brokers like FXTM, OctaFX etc. don’t offer Crypto CFDs.

Make sure to always check beforehand if all the trading instruments that you want to trade are provided by the broker. And check what fees the broker charges for the instrument you want to trade. For example, you may want to trade Gold & NASDAQ CFDs mainly, then you should compare the overall fees for these instruments at all the regulated forex CFD brokers.

Another important thing is to compare the overall trading fees for trading each instrument. Some brokers charge high Swap fees for trading CFDs, and this will increase the overall costs if you are a Position Trader. In this case, you should look for a broker that preferably does not charge you Swap fees for overnight positions on CFDs for commodities, stocks etc.

It is important to understand how your forex broker manages their risk, because if they don’t do it properly, there is a risk that it may go bankrupt, and you could lose your funds deposited with them.

Let’s understand it with an example. When you place your trade on let’s say ‘Buy’ GBP/USD for 1 standard lot, the trade is sent to your broker. They would first try to match your orders internally with trades of other clients who have a ‘Sell’ GBP/USD position. If the broker has orders on both sides, that are equal in volume, then the broker would have a neutral position.

The above is an ideal situation which does not happen normally. Often the broker will have more volume & orders on one side, and have an exposure to the markets. For example, assume that at any given moment the broker has 100 lots of buy orders from its clients, but 200 lots of sell orders (this is just an example). In this case, the broker has more sell orders than buy orders.

The broker can either decide to take the risk on their books, and take the opposite side of these trades. This is what market makers do, and the reason for this is because they are aware that retail traders often lose in the long term, and also they have risk assessment internally on when they can be market neutral or directional.

In case of a STP broker, as soon as you place the trades, they send it to their liquidity providers & hedge against any directional risk. This happens before your trade is confirmed, in real-time. Therefore, the broker does not have any market risk on their books.

Why all this is important? Because there have been cases in the past where the brokers have gone out of business. If a broker is a market maker, and they have not offset their risk properly (not hedging it), then there is a risk that during some market event, the broker has to liquidate, unable to match its assets & liabilities.

In an event like above, the client funds may not be protected. If there is no investor protection fund, you could lose your deposits if the broker goes out of business. Therefore, you must ask your broker how they hedge their risk.

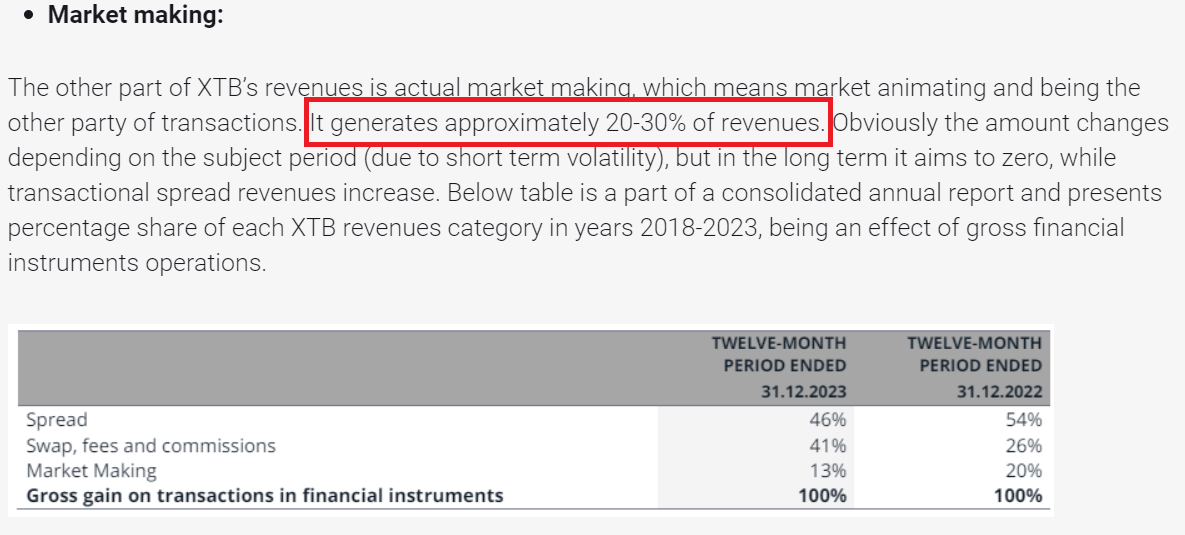

If you are trading via a broker that engages in ‘Market making’ activities, there is conflict of interest. Most brokers will not publicly state this, but they make a big percentage of their income from market making.

What this means in simple words is that the broker made money from clients who lost money on their platforms in that financial year or quarter.

We cannot find this data in public because most brokers keep this information private (they are not required to make their financials public). But XTB, which is a publicly listed company, has made this information public in their Investor presentations, as well as on their FAQs page about revenue sources.

You can clearly see from the screenshot that on an average they make 20-30% of their revenue from market making. This figure can be even higher at other market maker forex brokers. It is in their interest that clients lose their money, which is conflicting the interest of retail traders.

Note that this does not mean that forex brokers always make money from market making. There are periods when they also lose money from this revenue source, but it is very uncommon.

Market maker brokers mostly use practices to encourage you to trade more (even STP brokers do because they make more in commissions when you trade more), as there are high chances that you will lose & deposit more money.

Therefore, you have to very carefully check if the broker is transparent in making it public, or does it try to hide this information.

In some cases, market maker brokers can have lower fees than STP brokers. So, in the situation, you have to consider what your preference is, and are you okay with your broker taking opposite side of your trades. This is totally okay if you are a net winning trader (after paying spreads & commissions).

But still, in general if there are similar brokers, equally well regulated, choose the one with lower pricing structure.

This is not a strict requirement, but it is good to have a broker that offers its API, especially if you are a professional trader. But most CFD brokers don’t offer APIs, some that do, they ask you to contact their support for access to trading API.

Take Pepperstone for example, they don’t directly give you the access to their API, instead they ask you to contact them on an email which appears to be related to their Pro services. And they have strict monthly volume requirements as well.

But some brokers like Capital Com have their API available to all traders by default. With their API you can create new trading accounts, access the market data, open orders & close them. In short, all the basic endpoints you will need in order to trade.

The main benefit of API access is not for non-professional traders. If you are a beginner trader, you won’t really need anything beyond MetaTrader, cTrader or your broker’s simple platform.

But if you are a professional trader, who has built their own platforms for risk controls, and access to traders on your team, you might need a forex broker on the backend that will offer you access to their API, while your own proprietary platform acts as the frontend layer for your trading.

IG Markets, Forex.com, FXCM, Capital Com & Pepperstone as per our research offer their APIs at the moment for forex trading. But none of these brokers are really cheap, they have moderate spreads on most currency pairs. We will continue to update this list, if we find other reputed brokers that offer their API access.

Most brokerage platforms have basic login, passwords checks to login to your account. But this alone is not very secure. If your password is not secure, it is easy for it to be compromised.

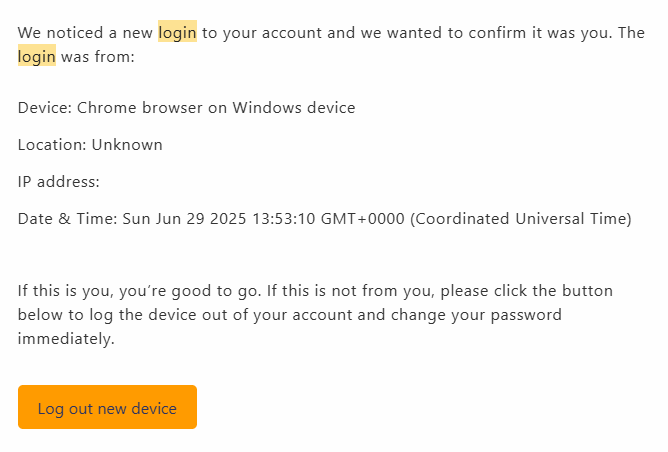

a. You should check if your broker has support for MFA (Multi Factor Authentication), not just during withdrawals, but also for every login.

For example, you will receive an OTP code on your linked phone or the broker will ask you to link an authentication app. If you have MFA enabled, even if someone knows your password, they can’t access your account without the security token sent to your device.

b. You should be able to access to detailed logs of your login activity (for years) including the IP & location, including any failed login attempts.

The login email from your broker will look something like this (IP hidden in the screenshot, but you will see the IP).

This way, if you see any unfamiliar login activity, you can immediately report it & request to block it. These logs should not just be stored on the broker’s platform, these should also be actively sent to your email account.

For example, let’s say that you live in Cape Town, you normally login from your home device & your ISP’s IP location is also the same. But one day you get a notification that there was a login attempt to your brokerage account from London, even though you have not travelled to London. That’s a suspicious login & should be reported/blocked immediately.

Any reputed & secure brokerage platform would not only alert you to this suspicious login activity, but it will allow you to immediately lock your trading account or require you to change your account password. Some brokers may even ask you to verify your identity again.

These checks may seem too much for some traders, but when you have your money in your trading account, these features become even more important.

The fees charged by forex brokers is usually in the form of spreads & commissions.

If the EUR/USD Buy quote is 1.0508, and Sell Quote is 1.0501, the difference of 1 pip is the brokerage charge. It can be higher at some forex brokers, but the lowest we have found is 0.5 pips at Exness.

In this example, if you are trading 1 Standard Lot (100,000 units), then at 1 pip, the broker would make $10 from your trade. If you trade 500 lots in a month, then your broker would in theory make $5000 from your trades, if the only fees they charged you is spreads & commissions.

On a average, as we explained in the ‘how to choose brokers section’ above, forex brokers make 80-90% of their income from spreads, commissions & swap charges. The rest of the income can be from market making activities.

Note that this is an estimation based on the public information made available publicly listed brokers. Moreover, the revenue split depends on the actively traded instruments.

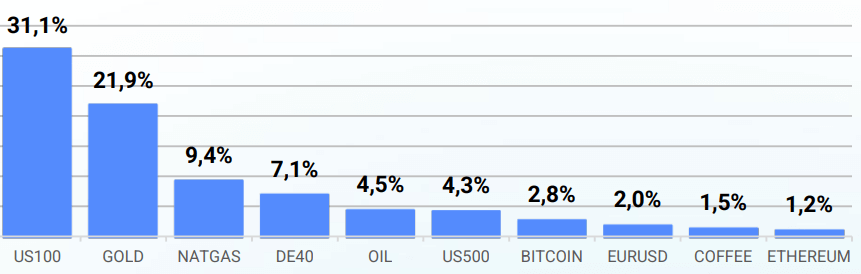

As per the data available at some regulated brokers, they make most of their income from Index & Commodity CFDs. Forex CFDs generate lesser income for brokers as compared to Index CFDs like NAS100, GER30, or Commodity CFDs like XAUUSD. As a percentage, most brokers make less than 10% of their income from Forex CFDs.

Refer to the below example from a broker’s public filing. They made most of their income from non-forex CFDs. These are the most profitable instruments for brokers, because as a percentage of trading volume, the fees is quite high on these CFD markets.

Almost all the brokers who are regulated have very similar products with not much of a different. Therefore, when the conditions are identical (I mean the brokers have similar trade conditions & execution), the broker with lower spreads is charging you lower. Although I want to make it clear that It is not always as straightforward, but it is a reasonable to think that.

The lowest minimum deposit is R16 at some popular forex brokers in SA.

But your deposit should be according to the position sizing you are going to trade. For example, if you are going to trade 1 mini lot (10,000 units) of EUR/USD, then your deposit should be around R15,000 to keep the leverage to 1:10 maximum & manage your risk properly.

Also depending on your account type, the minimum requirements to open the account would be different. It can range even be R7500 or $500 for ECN account types.

I also want to point out that brokers will restrict your leverage during some market conditions. How does this relate to account opening balance you might ask? If for some reason, you see that broker is offering let us say 1:1000 leverage, and you decide that with a very low deposit you could take 1-2 trades at excessive leverage & grow your account.

But this could also backfire because your broker could suddenly reduce its leverage (increase margin required), which would all of a sudden mean that you will have to deposit more money into your trading account in order to keep your position open.

So, just don’t look at the lowest account opening amount that forex brokers advertise, in isolation. Think about it in terms of how much balance you should have in your account to handle the risk you are going to take on your series of trades.

There are many scam & unregulated forex brokers in South Africa. The scam platforms are not even regular broker, but they target general public by promising high returns from forex market.

Note that no licensed platform can promise you returns from any markets. Trading in financial markets has substantial risks which can lead to loss of capital.

For our research, we use multiple metrics to check whether the broker is trusted or a scam. In our criteria, the most important factor is the regulation of broker with FSCA & other tier-1 regulators FCA & ASIC.

Even when dealing with FSCA licensed broker, you should validate the license type that has been acquired by the broker. It must have the proper license that allows it to issue or act as intermediary for CFDs products it is offering.

Exness & Tickmill have trading accounts with low spreads for pro traders with lowest spread of 0.5 pips at Exness with Pro Account without any commission per lot.

Pro traders must consider their cost of trading. For example, if you trade many lots of XAU/USD intraday on Standard Account, but your broker has very high spreads, you would lose out over a period.

Let’s understand with an example. If the spreads for EUR/USD are 1.2 pips instead of 0.5 pips, you are paying $12 per standard lot or 100,000 units. If you are trading 20 lots per day, you will pay USD 240 in commissions to your broker. If the cost was 0.5 pips, you will be paying USD 100 commission.

If you add it over a month, you would have paid the broker almost USD 5000 in commissions, compared to USD 2000 if you were charged 0.5 pips spreads instead or 1.2 pips.

Therefore, you should take into consideration the regulation & the cost of your trading.

No, you need a broker where you can place your orders. The broker will provide you the liquidity to enter & exit your trades when you want.

For retail traders, it is not possible to trade currencies without a forex broker. Note that your broker can be a market maker, meaning they act as the counterparty when you place a trade. Or the broker can be a ECN or STP broker, which will send your order to their pool of liquidity.

There are both market makers & STP brokers in South Africa. You can see the different in the order execution under each broker category.

Some forex brokers have no minimum deposit requirements, which means you can open your trading account with R0.

But you cannot trade without depositing balancing. And the minimum deposit balance depends on the payment method. For example, it can vary from R170 to much higher, depending on the payment gateway, but generally, it is closer to R170 for bank transfer deposits.

The lowest minimum deposit can depend on many factors, and it can even change with time. Here is an example of explanation from a broker’s website where they explain some of the factors.

The most noticeable are the account type & the payment method. When opening your trading account, all the brokers will clearly show you the minimum deposit with that account type. Just go to their account types page for this information.

To sum up, in order to actually start trading with genuine regulated brokers, the lowest minimum deposit as per our research is R170. But you must consider your trading requirements & not just go for a broker with the lowest deposit.

You can open a forex trading account even with R0, because some CFD brokers don’t require you to make any initial deposit. But for real trading on a live account & for placing your trades in the market, you would need funds in your account balance.

No would be our answer to question on whether you ‘should’ trade with R100 at any broker. Brokers will definitely allow you to trade forex with very low balance, because they know you would lose this amount quickly & will have to make a new deposit again.

What you should really need to do is only make a deposit that would allow you to make series of at least 20-30 trades where you follow the same strategy & keep a consistent lot size; meaning you are only trading your edge at any broker.

So, if you are making a deposit of R100, then you should not lose more than R4-5 max. on any one trade hypothetically, and you have to ensure that your broker is offering you a lot size to trade this small (cent account or lower).

Therefore, any deposit you make with your broker should depend on multiple factors like how many trades do you need to place given that you can have series of losses, your average lot size for each trade (and what size does your broker allow). These are only ‘some’ key points (you need to think of other) we think are important for you to answer to yourself before making your deposit at any forex broker.

Don’t deposit your money at any forex broker till you have a proper trading strategy.

There are 2 important points to understand regarding the safety of your funds with any forex broker.

a. Compliance with the SA Regulator: Your funds with the broker are considered safe only if you are trading with a FSCA licensed forex broker that is authorized under Category I license for forex & Derivative instruments.

Some brokers claim to be licensed by FSCA & they offer forex trading product, but in reality they may not have the right license to offer CFD trading. Such brokers should be avoided, because this is a sign of bad practice.